Free Printable 1099 Nec Form

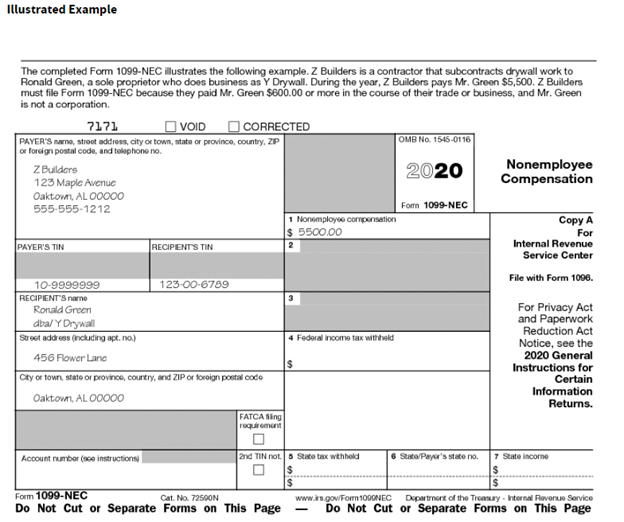

Free Printable 1099 Nec Form - Easily prepare your form 1099 nec in just minutes it’s that easy. Save or instantly send your ready documents. Fill out the nonemployee compensation online and print it out for free. For internal revenue service center. Who gets a 1099 nec; Use fill to complete blank online irs pdf forms for free. Account number (see instructions) 2nd tin not. All copy a forms must be printed on this paper. The payment is made to someone who is not an employee. Both the forms and instructions will be updated as needed.

The payment is made to someone who is not an employee. Easily fill out pdf blank, edit, and sign them. Web step 1 answer a few simple questions to create your document. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Fill out the nonemployee compensation online and print it out for free. Once completed you can sign your fillable form or send for signing. It’s not just a matter of using a color printer loaded with red. Step 2 preview how your document looks and make edits. All copy a forms must be printed on this paper. Save or instantly send your ready documents.

Step 3 download your document instantly. Web instructions for recipient recipient's taxpayer identification number (tin). New box 2 checkbox (payer made direct sales totaling $5,000 or more of consumer products to recipient for resale) removed fatca checkbox. Form1099online is the most reliable and secure way to file your 1099 nec tax returns online. Both the forms and instructions will be updated as needed. Fill out the nonemployee compensation online and print it out for free. Form resized so now it can. The payment is made to someone who is not an employee. These new “continuous use” forms no longer include the tax year. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein).

What the 1099NEC Coming Back Means for your Business Chortek

Web step 1 answer a few simple questions to create your document. Form1099online is the most reliable and secure way to file your 1099 nec tax returns online. Pricing starts as low as $2.75/form. All forms are printable and downloadable. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

Understanding 1099 Form Samples

These new “continuous use” forms no longer include the tax year. Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. Fill in, efile, print, or download forms in pdf format. Web $ city or town, state or province, country, and zip or foreign postal code withheld copy a.

1099NEC Software to Create, Print & EFile IRS Form 1099NEC

Web $ city or town, state or province, country, and zip or foreign postal code withheld copy a for internal revenue service center file with form 1096. Quickbooks will print the year on the forms for you. The payment is made to someone who is not an employee. Fill out the nonemployee compensation online and print it out for free..

How to File Your Taxes if You Received a Form 1099NEC

Pricing starts as low as $2.75/form. Web instructions for recipient recipient's taxpayer identification number (tin). These new “continuous use” forms no longer include the tax year. Who gets a 1099 nec; Web step 1 answer a few simple questions to create your document.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. These new “continuous use” forms no longer include the tax year. Step 3 download your document instantly. Web step 1 answer a few simple questions to create your document. Form resized so now it can.

1099NEC Recipient Copy B Cut Sheet HRdirect

The payment is made to someone who is not an employee. Fill in, efile, print, or download forms in pdf format. These new “continuous use” forms no longer include the tax year. All copy a forms must be printed on this paper. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns.

Form 1099NEC Instructions and Tax Reporting Guide

For internal revenue service center. Form1099online is the most reliable and secure way to file your 1099 nec tax returns online. All copy a forms must be printed on this paper. Fill out the nonemployee compensation online and print it out for free. Step 2 preview how your document looks and make edits.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

All forms are printable and downloadable. • continuous forms printed on carbonless black print paper for clear data transfer between copies Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. New box 2 checkbox (payer made direct sales.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. New box 2 checkbox (payer made direct sales totaling $5,000 or more of consumer products to recipient for resale) removed fatca checkbox. Save or instantly send your ready documents. All forms are printable and downloadable. The payment is made to someone who is not an employee

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Step 2 preview how your document looks and make edits. For copies b,c, and 1, however, feel free to use whatever paper you like. Current general instructions for certain information returns. Account number (see instructions) 2nd tin not. Both the forms and instructions will be updated as needed.

For The Most Recent Version, Go To Irs.gov/Form1099Misc Or Irs.gov/Form1099Nec.

Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web step 1 answer a few simple questions to create your document. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein).

Step 2 Preview How Your Document Looks And Make Edits.

Use fill to complete blank online irs pdf forms for free. Quick & secure online filing. Easily prepare your form 1099 nec in just minutes it’s that easy. These new “continuous use” forms no longer include the tax year.

The Payment Is Made To Someone Who Is Not An Employee

Both the forms and instructions will be updated as needed. For internal revenue service center. Who gets a 1099 nec; Account number (see instructions) 2nd tin not.

Current General Instructions For Certain Information Returns.

All copy a forms must be printed on this paper. Pricing starts as low as $2.75/form. • continuous forms printed on carbonless black print paper for clear data transfer between copies Fill in, efile, print, or download forms in pdf format.