Georgia Form Dol 4N

Georgia Form Dol 4N - Go to employees or on the fly > state tax & wage forms. Reports with a federal employer identification (fein) or pseudo number instead of the gdol account number. Web to prepare georgia quarterly tax and wage reports: Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by. Web the form is designed to: Click the link to see the form instructions. Web labor commissioner bruce thompson statistics ga unemployment rate: Review and complete the information shown on the data entry screen, making any needed changes. The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely. Complete one or more of these forms separately for each quarterly report that is to be corrected.

Reports with a federal employer identification (fein) or pseudo number instead of the gdol account number. Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by. Click the link to see the form instructions. Select the appropriate filing quarter. Review and complete the information shown on the data entry screen, making any needed changes. Complete one or more of these forms separately for each quarterly report that is to be corrected. Web to apply for a gdol tax account number, complete the online employer tax registration on our website at www.dol.georgia.gov. Web the form is designed to: Web labor commissioner bruce thompson statistics ga unemployment rate: Go to employees or on the fly > state tax & wage forms.

Select the appropriate filing quarter. Reports with a federal employer identification (fein) or pseudo number instead of the gdol account number. Click the link to see the form instructions. Review and complete the information shown on the data entry screen, making any needed changes. The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely. Web to prepare georgia quarterly tax and wage reports: Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by. Web labor commissioner bruce thompson statistics ga unemployment rate: Go to employees or on the fly > state tax & wage forms. $7.25 view more statistics newsroom july 20, 2023 georgia experiencing record.

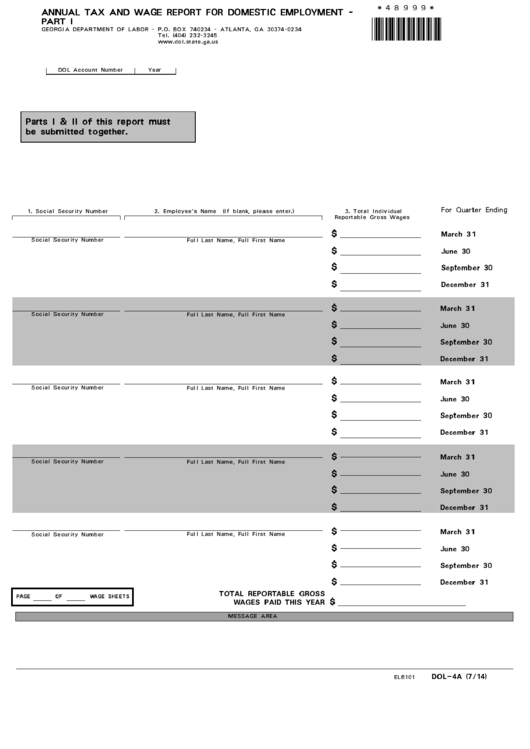

GA DOL4A 20142022 Fill and Sign Printable Template Online US

Click the link to see the form instructions. Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by. The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely. Web labor commissioner bruce thompson statistics.

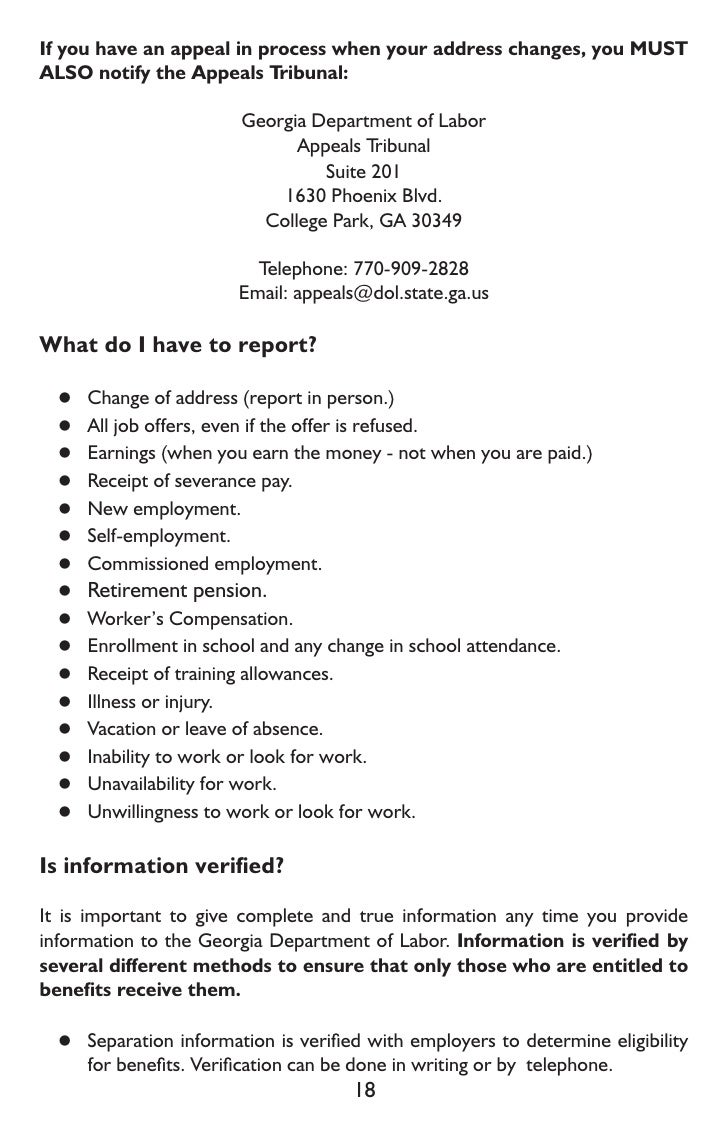

20 Department Of Labor Forms And Templates free to download in PDF

Complete one or more of these forms separately for each quarterly report that is to be corrected. Select the appropriate filing quarter. Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by. Web the form is designed to: Review and complete the information shown on the data.

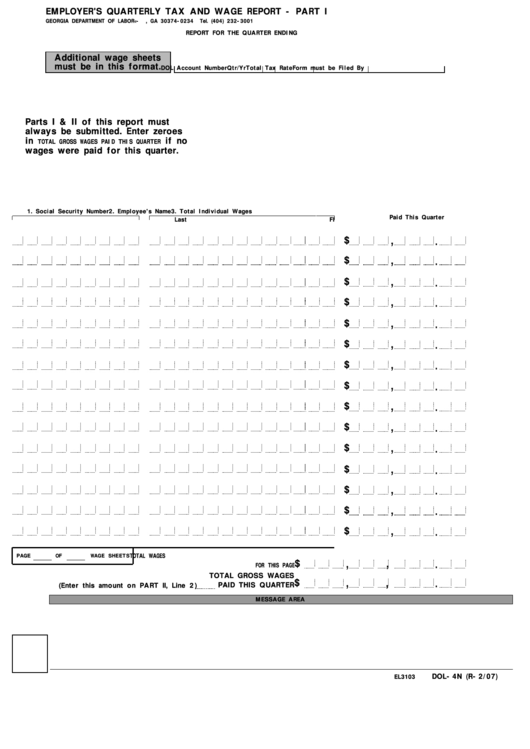

Form Dol4n Employer'S Quarterly Tax And Wage Report State Of

Web to apply for a gdol tax account number, complete the online employer tax registration on our website at www.dol.georgia.gov. Reports with a federal employer identification (fein) or pseudo number instead of the gdol account number. Review and complete the information shown on the data entry screen, making any needed changes. Click the link to see the form instructions. Go.

How to save pdf form with data Australia examples Cognitive Guide

Click the link to see the form instructions. Select the appropriate filing quarter. Web to apply for a gdol tax account number, complete the online employer tax registration on our website at www.dol.georgia.gov. Web labor commissioner bruce thompson statistics ga unemployment rate: The annual report and any payment due must be filed on or before january 31st of the following.

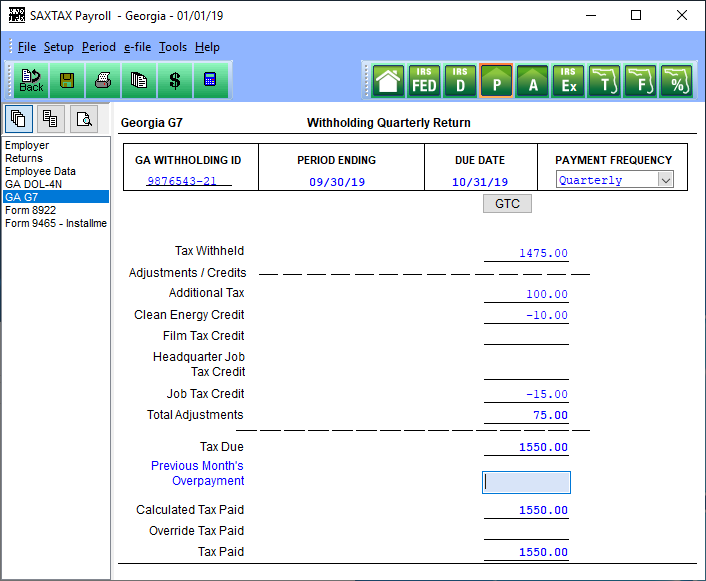

DOL4N Employer’s Tax and Wage Report SAXTAX

$7.25 view more statistics newsroom july 20, 2023 georgia experiencing record. Go to employees or on the fly > state tax & wage forms. Select the appropriate filing quarter. The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely. Year 2000 naswa unemployment insurance code “s” supplemental.

form dol 4 Oker.whyanything.co

Web to prepare georgia quarterly tax and wage reports: $7.25 view more statistics newsroom july 20, 2023 georgia experiencing record. Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by. Reports with a federal employer identification (fein) or pseudo number instead of the gdol account number. Go.

form dol 4 Oker.whyanything.co

Select the appropriate filing quarter. Click the link to see the form instructions. Complete one or more of these forms separately for each quarterly report that is to be corrected. Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by. The annual report and any payment due.

DOL4N Employer’s Tax and Wage Report SAXTAX

Web to apply for a gdol tax account number, complete the online employer tax registration on our website at www.dol.georgia.gov. Web to prepare georgia quarterly tax and wage reports: Reports with a federal employer identification (fein) or pseudo number instead of the gdol account number. $7.25 view more statistics newsroom july 20, 2023 georgia experiencing record. Review and complete the.

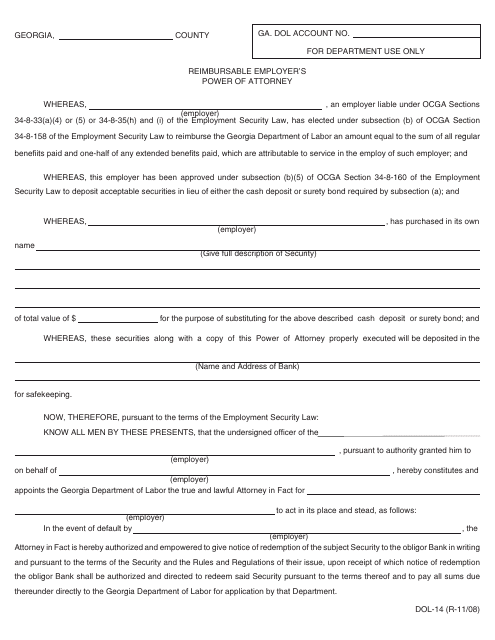

Form DOL14 Download Printable PDF or Fill Online Reimbursable Employer

Review and complete the information shown on the data entry screen, making any needed changes. Web to prepare georgia quarterly tax and wage reports: Complete one or more of these forms separately for each quarterly report that is to be corrected. Web to apply for a gdol tax account number, complete the online employer tax registration on our website at.

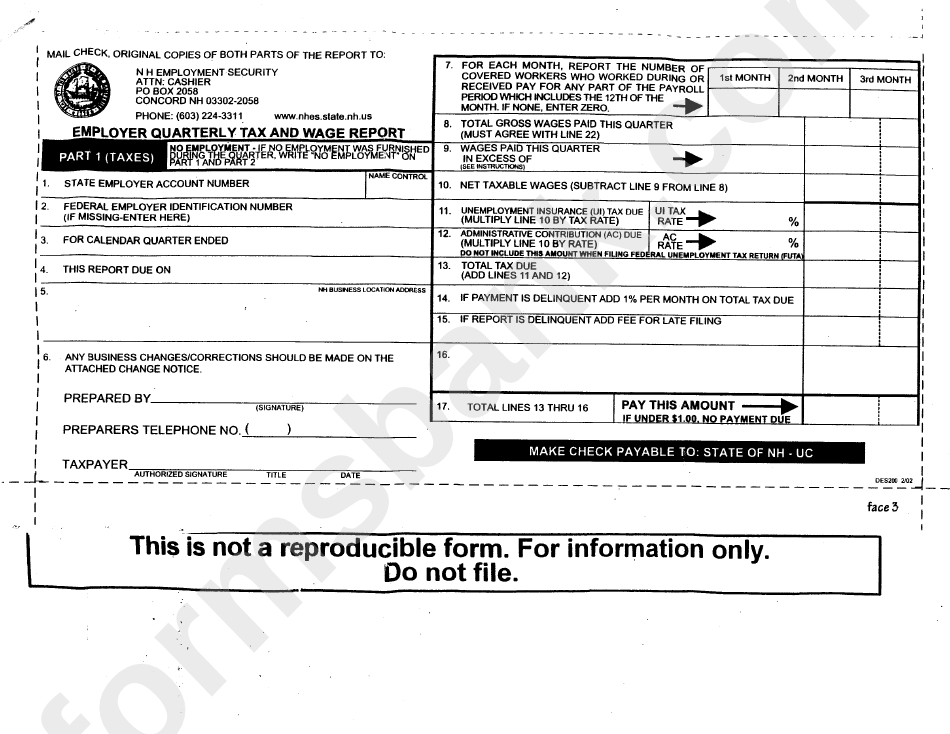

Employer Quarterly Tax And Wage Report Form 2002 printable pdf download

The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely. Web labor commissioner bruce thompson statistics ga unemployment rate: Web to prepare georgia quarterly tax and wage reports: Review and complete the information shown on the data entry screen, making any needed changes. Year 2000 naswa unemployment.

Complete One Or More Of These Forms Separately For Each Quarterly Report That Is To Be Corrected.

Year 2000 naswa unemployment insurance code “s” supplemental record format as defined by the georgia department of labor for direct wage reporting by. Web the form is designed to: Select the appropriate filing quarter. $7.25 view more statistics newsroom july 20, 2023 georgia experiencing record.

Reports With A Federal Employer Identification (Fein) Or Pseudo Number Instead Of The Gdol Account Number.

The annual report and any payment due must be filed on or before january 31st of the following year to be considered timely. Web to prepare georgia quarterly tax and wage reports: Web labor commissioner bruce thompson statistics ga unemployment rate: Click the link to see the form instructions.

Web To Apply For A Gdol Tax Account Number, Complete The Online Employer Tax Registration On Our Website At Www.dol.georgia.gov.

Go to employees or on the fly > state tax & wage forms. Review and complete the information shown on the data entry screen, making any needed changes.

1.jpg)