Heavy Highway Use Tax Form 2290 Instructions

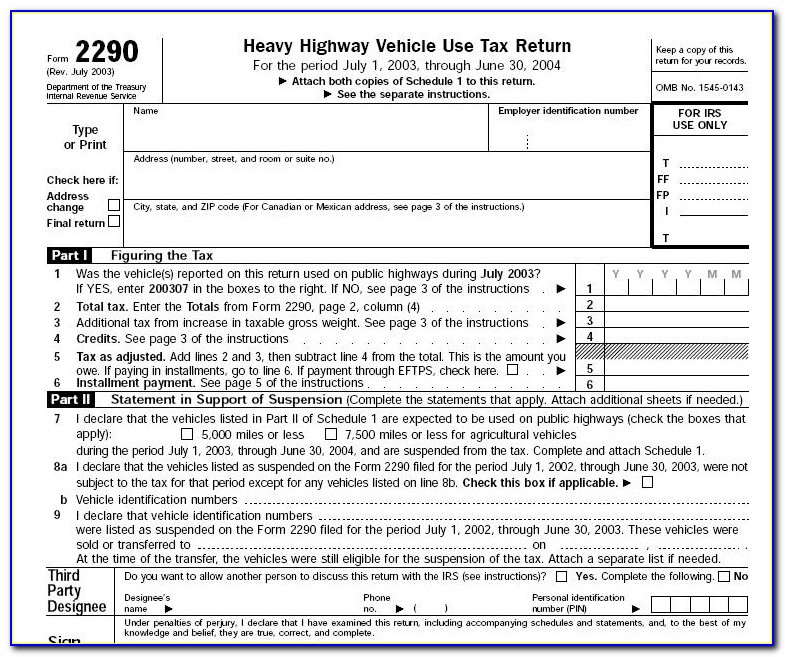

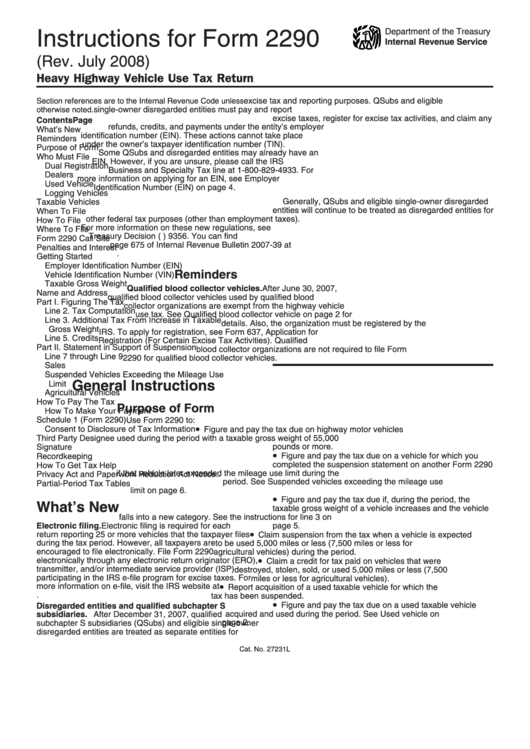

Heavy Highway Use Tax Form 2290 Instructions - Complete and file two copies of schedule 1, schedule of. Easy, fast, secure & free to try. Web this 2290 form instructions guide will walk you through each section and provides detailed instructions for filing the 2290 heavy vehicle use tax with the irs. With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Essentially, hvut is the federal program, and form 2290 is the tax return used. Web is form 2290 for trucking? Web general instructions purpose of form use form 2290 for the following actions. Web payment methods to pay 2290 heavy vehicle use tax. Web tax form 2290 for 2023 is used to calculate and pay the federal taxes associated with these heavy vehicles, ensuring that the owners contribute their fair share towards maintaining. Web hvut is the heavy vehicle use tax (hvut) collected annually on heavy vehicles with gross weight of 55,000 pounds or more, operating on public highways.

Do your truck tax online & have it efiled to the irs! Essentially, hvut is the federal program, and form 2290 is the tax return used. This return is filed to calculate and pay the heavy. Address change amended return check this box if reporting (a) additional tax from an increase in taxable gross. Complete and file two copies of schedule 1, schedule of. Web irs form 2290, heavy highway vehicle use tax return, is used to figure and pay taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more. With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web 1 day agothe tax is payable to the irs on form 2290, heavy highway vehicle use tax return. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is. Truck tax is a very important tax if you.

Easy, fast, secure & free to try. Web general instructions purpose of form use form 2290 for the following actions. Web this 2290 form instructions guide will walk you through each section and provides detailed instructions for filing the 2290 heavy vehicle use tax with the irs. With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Address change amended return check this box if reporting (a) additional tax from an increase in taxable gross. Taxact ® supports the individual tax return, but does not support the heavy highway use tax return on form 2290 heavy highway. Web home federal tax forms form 2290 2023 form 2290 and instructions heavy highway vehicle use tax return heavy highway vehicle use tax return. Truck tax is a very important tax if you. Do your truck tax online & have it efiled to the irs! Web is form 2290 for trucking?

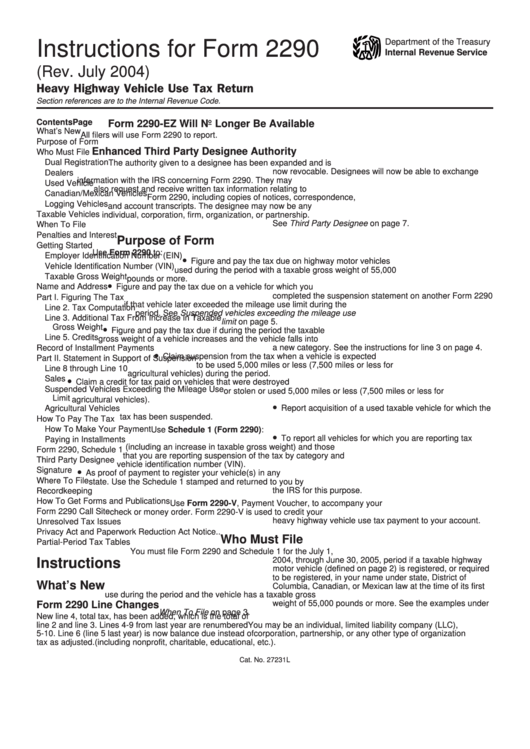

Instructions For Form 2290 Heavy Highway Vehicle Use Tax Return

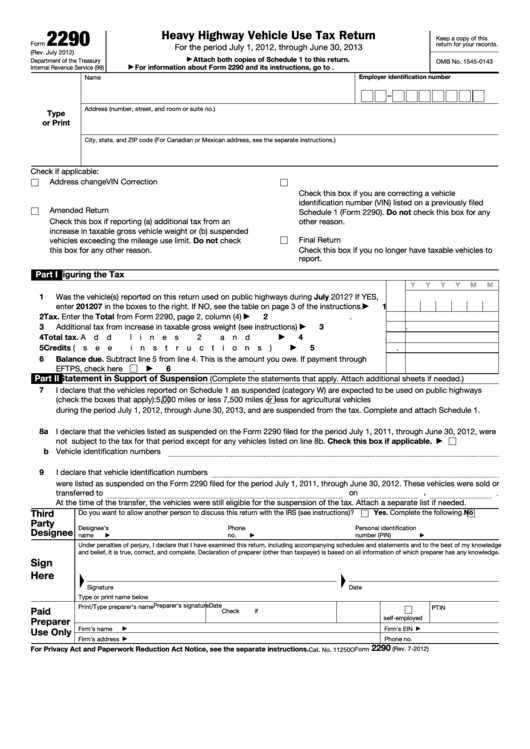

Web heavy highway vehicle use tax return check if applicable: Essentially, hvut is the federal program, and form 2290 is the tax return used. I declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2019, through june 30, 2020, were not subject to. Truck tax is a very important tax if you..

Fill Free fillable Heavy Highway Vehicle Use Tax Return 2018 Form

Web complete and attach schedule 1. Web first, file the form 2290 and pay the heavy highway vehicle use tax for each taxable vehicle weighing over 55,000 pounds or more. Web heavy highway vehicle use tax return check if applicable: Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending.

2290 heavy use tax 3451892290 heavy use tax 2020

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Address change amended return check this box if reporting (a) additional tax from an increase in taxable gross. Web tax form 2290 for 2023 is used to calculate and pay the federal taxes associated with these heavy vehicles, ensuring that the owners contribute their fair.

How To Handle Overpaid Highway Heavy Vehicle Use Tax Form 2290?

Form 2290 is a heavy vehicle use tax return filed with the irs on an annual basis. With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Ad file your truck tax & get schedule 1 in minutes. Web tax form 2290 for 2023 is used to calculate and pay the federal taxes.

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is. Complete and file two copies of schedule 1, schedule of. Web payment methods to pay 2290 heavy vehicle use tax. Web general instructions purpose of form use.

Heavy Vehicle Use Tax Form 2290 Schedule 1 Form Resume Examples

Address change amended return check this box if reporting (a) additional tax from an increase in taxable gross. Web general instructions purpose of form use form 2290 for the following actions. This return is filed to calculate and pay the heavy. Truck tax is a very important tax if you. Web first, file the form 2290 and pay the heavy.

How to file your own IRS 2290 highway use tax. Step by step

Taxact ® supports the individual tax return, but does not support the heavy highway use tax return on form 2290 heavy highway. July 2012) department of the treasury internal revenue service (99) heavy highway vehicle use tax return for the period july 1, 2012, through june 30, 2013. Web first, file the form 2290 and pay the heavy highway vehicle.

Instructions For Form 2290 Heavy Highway Vehicle Use Tax Return

Keller ® applications designed specifically for the commercial motor vehicle market. I declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2019, through june 30, 2020, were not subject to. Easy, fast, secure & free to try. Web complete and attach schedule 1. Web home federal tax forms form 2290 2023 form.

Heavy Vehicle Use Tax Form 2290 Schedule 1 Form Resume Examples

Web payment methods to pay 2290 heavy vehicle use tax. • figure and pay the tax due on highway motor vehicles used during the period with a taxable. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Form 2290 is a heavy vehicle use tax return filed with the irs on an annual basis..

Instructions For Form 2290 Heavy Highway Vehicle Use Tax Return

Web first, file the form 2290 and pay the heavy highway vehicle use tax for each taxable vehicle weighing over 55,000 pounds or more. Web 1 day agothe tax is payable to the irs on form 2290, heavy highway vehicle use tax return. Web tax form 2290 for 2023 is used to calculate and pay the federal taxes associated with.

Truck Tax Is A Very Important Tax If You.

Complete and file two copies of schedule 1, schedule of. This tax form goes by many names like hvut (heavy vehicle use tax), heavy highway tax, truck tax, etc. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Keller ® applications designed specifically for the commercial motor vehicle market.

Ad File Your Truck Tax & Get Schedule 1 In Minutes.

Web home federal tax forms form 2290 2023 form 2290 and instructions heavy highway vehicle use tax return heavy highway vehicle use tax return. Web hvut is the heavy vehicle use tax (hvut) collected annually on heavy vehicles with gross weight of 55,000 pounds or more, operating on public highways. Web 1 day agothe tax is payable to the irs on form 2290, heavy highway vehicle use tax return. Do your truck tax online & have it efiled to the irs!

With 2290 Online, You Can File Your Heavy Vehicle Use Tax Form In Just 3 Easy Steps.

Web first, file the form 2290 and pay the heavy highway vehicle use tax for each taxable vehicle weighing over 55,000 pounds or more. With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Form 2290 is a heavy vehicle use tax return filed with the irs on an annual basis. I declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2019, through june 30, 2020, were not subject to.

Web Tax Form 2290 For 2023 Is Used To Calculate And Pay The Federal Taxes Associated With These Heavy Vehicles, Ensuring That The Owners Contribute Their Fair Share Towards Maintaining.

Web is form 2290 for trucking? Web this 2290 form instructions guide will walk you through each section and provides detailed instructions for filing the 2290 heavy vehicle use tax with the irs. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is. • figure and pay the tax due on highway motor vehicles used during the period with a taxable.