Home Equity Loan Chapter 13

Home Equity Loan Chapter 13 - To qualify for an fha loan during chapter 13, you need to be at least 12. Web if you can't exempt all of your home equity, you risk losing your home in chapter 7 or paying back more unsecured debts in. Ad finance your home with the lowest rates. Web also, she has enough income to continue making her home loan payment and other amounts required in chapter 13. Web options for navigating a home loan while in chapter 13 bankruptcy. Web to calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the. Once again, things are a little different if you go for chapter 13 bankruptcy. Web chapter 13 provides two advantages in dealing with a heloc in certain situations. Ad calculate your new house payment now & start saving on your mortgage. A home equity loan (hel) lets you turn your equity into cash.

Web options for navigating a home loan while in chapter 13 bankruptcy. Currently own a home and. Web right now, home equity levels are high for many homeowners across the nation. Stripping off helocs in chapter 13 if the. Ad calculate your new house payment now & start saving on your mortgage. Web getting a home equity line of credit with a chapter 13 bankruptcy 3 chapter is there a simpler option than. Web fha loan with chapter 13 bankruptcy. Pick the best home equity loan to fit your needs. Costs $0 to see savings. A home equity loan (hel) lets you turn your equity into cash.

But if you only apply with one lender, you. Ad finance your home with the lowest rates. Web the rule that requires a chapter 13 debtor to pay an amount equal to any nonexempt equity is known as the best interest of. Web dealing with loans that are backed by your home can be complicated in a chapter 13 bankruptcy. Are you in a chapter 13 bankruptcy? Costs $0 to see savings. Ad finance your home with the lowest rates. Get rates without a hard credit pull. Connect with top home equity loan lenders today. Filling out loan applications can be tedious.

Refinancing vs. Home Equity Loans Tribecca

To qualify for an fha loan during chapter 13, you need to be at least 12. Web the rule that requires a chapter 13 debtor to pay an amount equal to any nonexempt equity is known as the best interest of. Once again, things are a little different if you go for chapter 13 bankruptcy. Web also, she has enough.

5 Reasons to Tap Into Your Home Equity

Web also, she has enough income to continue making her home loan payment and other amounts required in chapter 13. A home equity loan (hel) lets you turn your equity into cash. Ad compare the best home equity lenders. Ad finance your home with the lowest rates. Get lowest rates & save money!

Equity Loan Interest Rate >

According to a recent black knight. Web chapter 13 as a home equity loan? Connect with top home equity loan lenders today. Stripping off helocs in chapter 13 if the. But if you only apply with one lender, you.

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

Pick the best home equity loan to fit your needs. Web if you can't exempt all of your home equity, you risk losing your home in chapter 7 or paying back more unsecured debts in. Connect with top home equity loan lenders today. August 3, 2022 chapter 13 can serve the same purpose as a home equity loan. Ad use.

Pros And Cons Of A Home Equity Loan FortuneBuilders

Web options for navigating a home loan while in chapter 13 bankruptcy. Ad finance your home with the lowest rates. It can be a great way to. Web also, she has enough income to continue making her home loan payment and other amounts required in chapter 13. Web fha loan with chapter 13 bankruptcy.

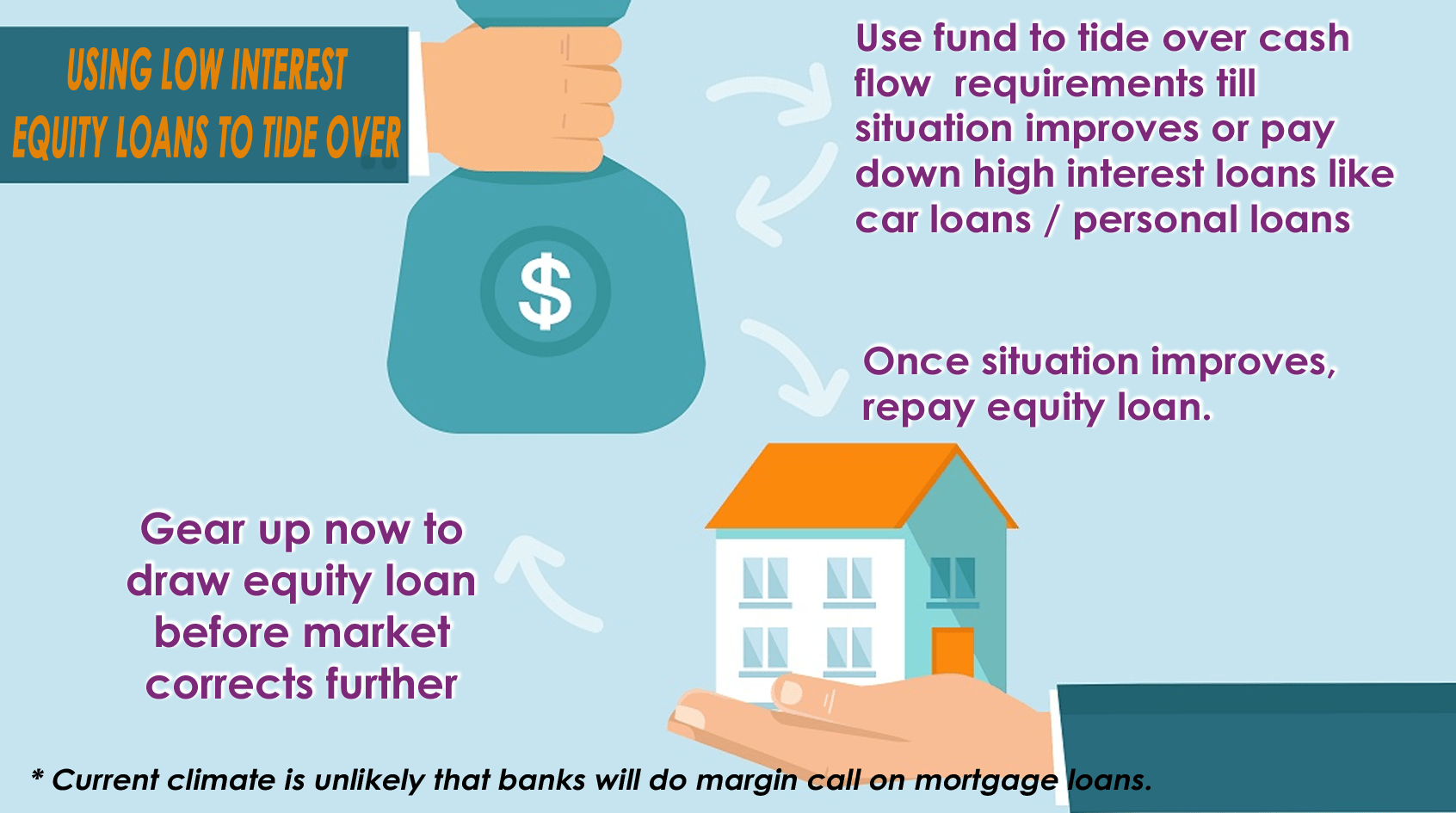

How a home equity term loan might save you from cash flow issue without

Ad finance your home with the lowest rates. Ad calculate your new house payment now & start saving on your mortgage. Web chapter 13 bankruptcy. Web june 11, 2023 do you have a bankruptcy on your record? Ad use our expansive equity network to compare offers from top lenders in 1 place

Home Equity Loan vs. Line of Credit Clearview FCU

Ad compare the best home equity lenders. Web dealing with loans that are backed by your home can be complicated in a chapter 13 bankruptcy. Ad finance your home with the lowest rates. Web exempting equity in chapter 13 you don't lose property in chapter 13if you can afford to keep it. Web how does a home equity loan affect.

7 Benefits of Getting a Home Equity Loan Fancycrave

Get rates without a hard credit pull. Filling out loan applications can be tedious. Web chapter 13 as a home equity loan? Web dealing with loans that are backed by your home can be complicated in a chapter 13 bankruptcy. Web exempting equity in chapter 13 you don't lose property in chapter 13if you can afford to keep it.

HELOC Pros and Cons You Need To Know FortuneBuilders

Web dealing with loans that are backed by your home can be complicated in a chapter 13 bankruptcy. Ad compare the best home equity lenders. Currently own a home and. But if you only apply with one lender, you. According to a recent black knight.

A Complete Guide To Home Equity Loans Revenues & Profits

Web getting a home equity line of credit with a chapter 13 bankruptcy 3 chapter is there a simpler option than. Get rates without a hard credit pull. Web chapter 13 provides two advantages in dealing with a heloc in certain situations. Web june 11, 2023 do you have a bankruptcy on your record? If so, you might think it’ll.

Get Lowest Rates & Save Money!

Web right now, home equity levels are high for many homeowners across the nation. According to a recent black knight. Connect with top home equity loan lenders today. But if you only apply with one lender, you.

Web Also, She Has Enough Income To Continue Making Her Home Loan Payment And Other Amounts Required In Chapter 13.

Stripping off helocs in chapter 13 if the. Get rates without a hard credit pull. Web the rule that requires a chapter 13 debtor to pay an amount equal to any nonexempt equity is known as the best interest of. Costs $0 to see savings.

Pick The Best Home Equity Loan To Fit Your Needs.

Ad calculate your new house payment now & start saving on your mortgage. Web getting a home equity line of credit with a chapter 13 bankruptcy 3 chapter is there a simpler option than. Each state decides the type of. If so, you might think it’ll be impossible for you to.

Trusted Way To Calculate Your House Payment In 3 Mins.

Get rates without a hard credit pull. Web if you can't exempt all of your home equity, you risk losing your home in chapter 7 or paying back more unsecured debts in. Currently own a home and. Web to calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the.