How To File Form 1042-S Electronically

How To File Form 1042-S Electronically - Web division online orientation on deped memorandum no. Streamline the 1040 preparation process for your firm & your clients with automation. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web can we efile 1042? Without having secured the taxpayer identification. Why do 89% of americans file their. Source income subject to withholding, were released sept. The first step of filing itr is to collect all the documents related to the process. Source income subject to withholding electronically, both. Source income subject to withholding) is used to report any payments made to foreign persons.

Source income subject to withholding) is used to report any payments made to foreign persons. Why do 89% of americans file their. Upload, modify or create forms. The first step of filing itr is to collect all the documents related to the process. Withholding agents are required to file electronically if there are 250 or more. Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Ad 1099 pro files 10% of all 1099 filings in the united states! Streamline the 1040 preparation process for your firm & your clients with automation. (1) uploading a file in the format required by the irs’s fire (filing information returns electronically) system,.

Learn more about how to simplify your businesses 1099 reporting. Source income subject to withholding electronically, both. Ad 1099 pro files 10% of all 1099 filings in the united states! Web division online orientation on deped memorandum no. Upload, modify or create forms. (1) uploading a file in the format required by the irs’s fire (filing information returns electronically) system,. Streamline the 1040 preparation process for your firm & your clients with automation. Web can we efile 1042? Source income subject to withholding, were released sept. Form 1042 is also required to be filed by a.

1042S Software, 1042S eFile Software & 1042S Reporting

Form 1042 is still required to be sent on paper to the irs service center. Source income subject to withholding) is used to report any payments made to foreign persons. Form 1042 is also required to be filed by a. Income and amounts withheld as described in the. An individual having salary income should collect.

Filling Out The Form 1042s Stock Photo Image of large, paying 63611036

Web a taxpayer can choose to file tax year 2022 form 1042 electronically. Source income subject to withholding, were released sept. Why do 89% of americans file their. Section 6011(e)(2)(a) of the internal revenue. The first step of filing itr is to collect all the documents related to the process.

IRS Form 1042s What It is & 1042s Instructions Tipalti

Ad get ready for tax season deadlines by completing any required tax forms today. Web are you looking for where to file 1042 online? Source income subject to withholding, were released sept. Source income subject to withholding electronically, both. Irs approved tax1099.com allows you to create and submit the 1042.

1042 S Form slideshare

Streamline the 1040 preparation process for your firm & your clients with automation. Web a taxpayer can choose to file tax year 2022 form 1042 electronically. Why do 89% of americans file their. (1) uploading a file in the format required by the irs’s fire (filing information returns electronically) system,. Source income subject to withholding, were released sept.

Form 1042S Efile Diagnostics Ref. 47040 47039 and 47310 Accountants

Web a taxpayer can choose to file tax year 2022 form 1042 electronically. (1) uploading a file in the format required by the irs’s fire (filing information returns electronically) system,. Irs approved tax1099.com allows you to create and submit the 1042. Learn more about how to simplify your businesses 1099 reporting. You will then be able to download and print.

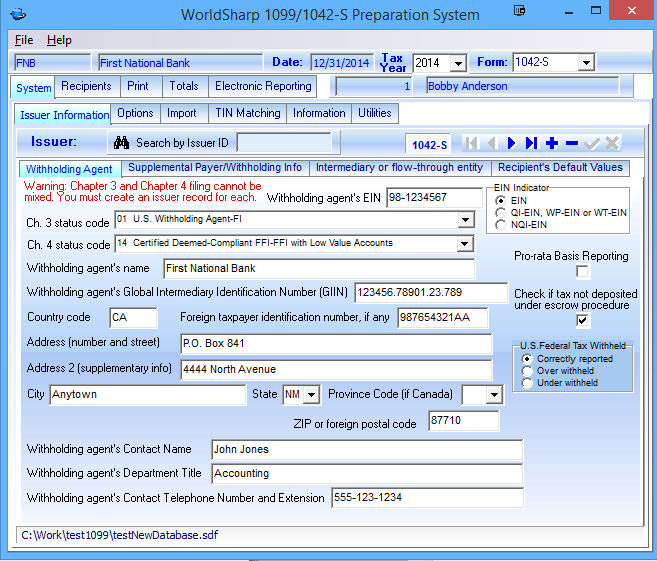

1042S Software WorldSharp 1099/1042S Software features

Section 6011(e)(2)(a) of the internal revenue. Web are you looking for where to file 1042 online? Ad 1099 pro files 10% of all 1099 filings in the united states! Income and amounts withheld as described in the. Web documents needed to file itr;

EFile Form 1042S 1099Prep

Web division online orientation on deped memorandum no. The first step of filing itr is to collect all the documents related to the process. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Irs approved tax1099.com allows you to create and submit the 1042. You will then be able to.

1042 S Form slideshare

Web documents needed to file itr; Learn more about how to simplify your businesses 1099 reporting. Ad 1099 pro files 10% of all 1099 filings in the united states! An individual having salary income should collect. Income and amounts withheld as described in the.

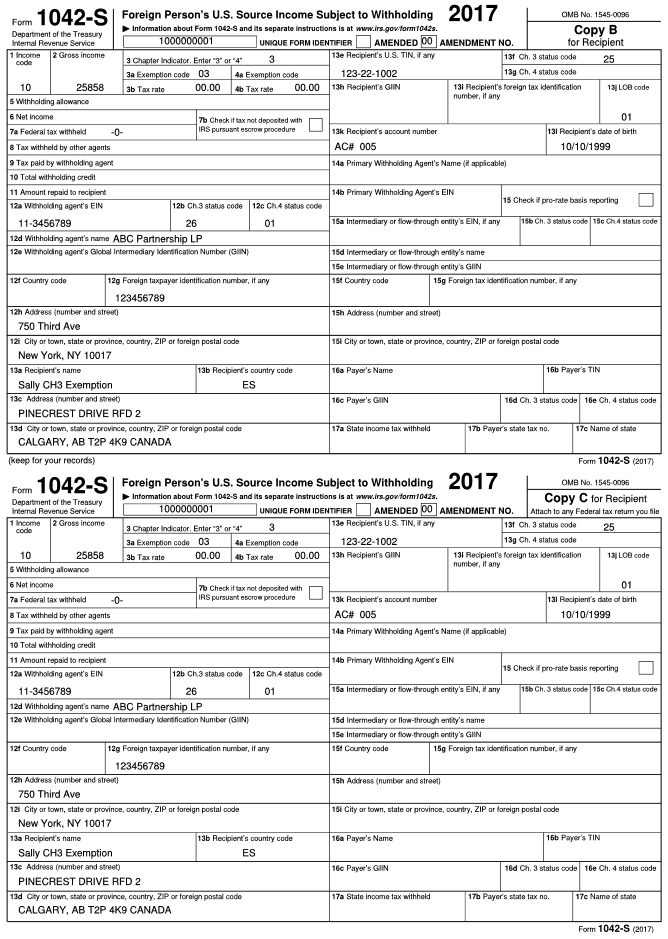

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Streamline the 1040 preparation process for your firm & your clients with automation. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Learn more about how to simplify your businesses 1099 reporting. Source income subject to withholding, were released sept. An individual having salary income should collect.

Form 1042S USEReady

Web a taxpayer can choose to file tax year 2022 form 1042 electronically. Source income subject to withholding electronically, both. Irs approved tax1099.com allows you to create and submit the 1042. Ad 1099 pro files 10% of all 1099 filings in the united states! Source income subject to withholding, were released sept.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Source income subject to withholding electronically, both. Ad 1099 pro files 10% of all 1099 filings in the united states! An individual having salary income should collect.

Web Division Online Orientation On Deped Memorandum No.

Form 1042 is still required to be sent on paper to the irs service center. Income and amounts withheld as described in the. Withholding agents are required to file electronically if there are 250 or more. If a taxpayer prefers to file electronically but needs additional time to become familiar with.

Why Do 89% Of Americans File Their.

Web documents needed to file itr; (1) uploading a file in the format required by the irs’s fire (filing information returns electronically) system,. Irs approved tax1099.com allows you to create and submit the 1042. Upload, modify or create forms.

The First Step Of Filing Itr Is To Collect All The Documents Related To The Process.

Streamline the 1040 preparation process for your firm & your clients with automation. Form 1042 is also required to be filed by a. Source income subject to withholding) is used to report any payments made to foreign persons. You will then be able to download and print the 1042 to mail.