How To Fill Out Form 8832

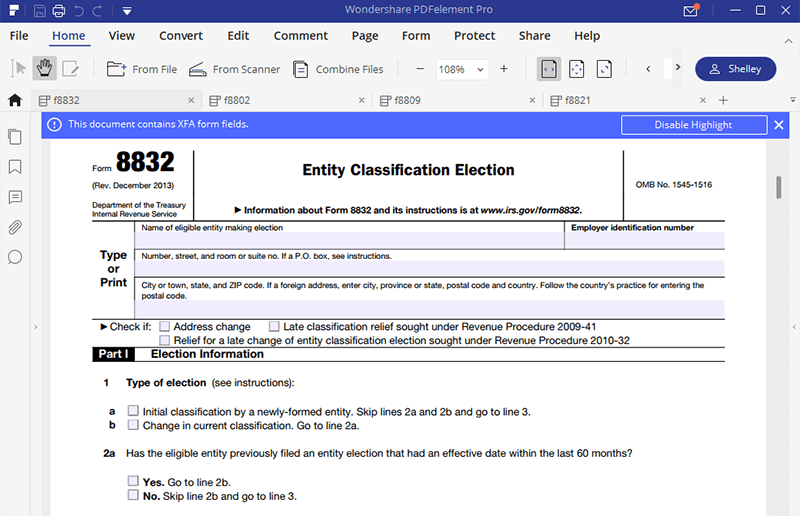

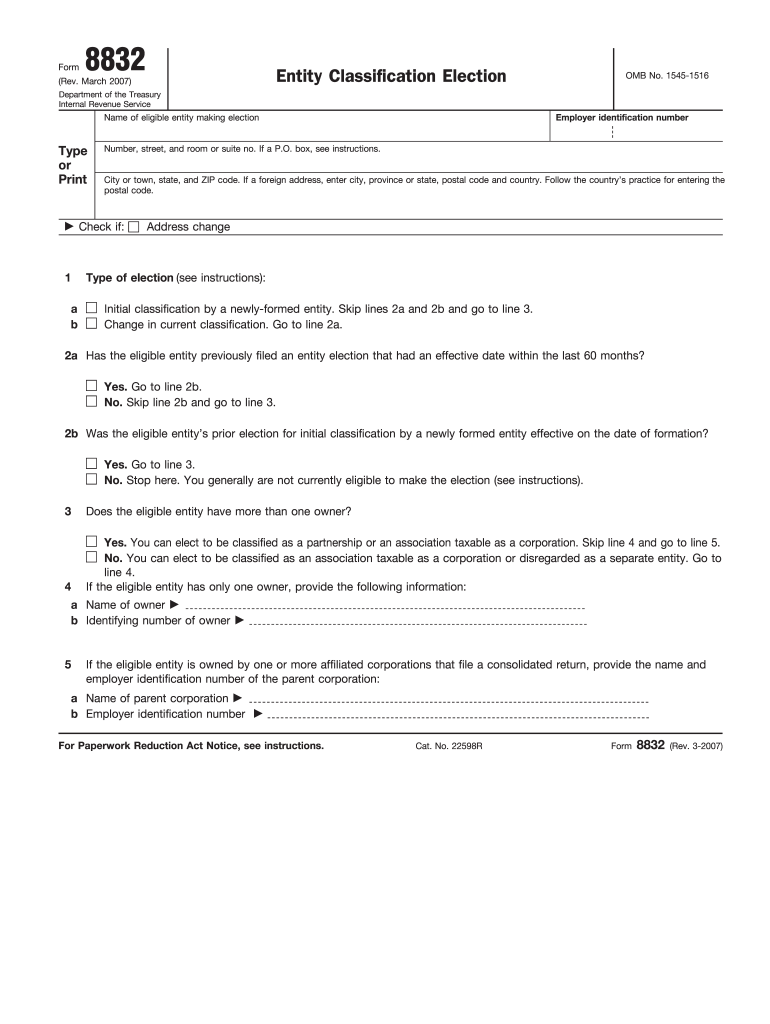

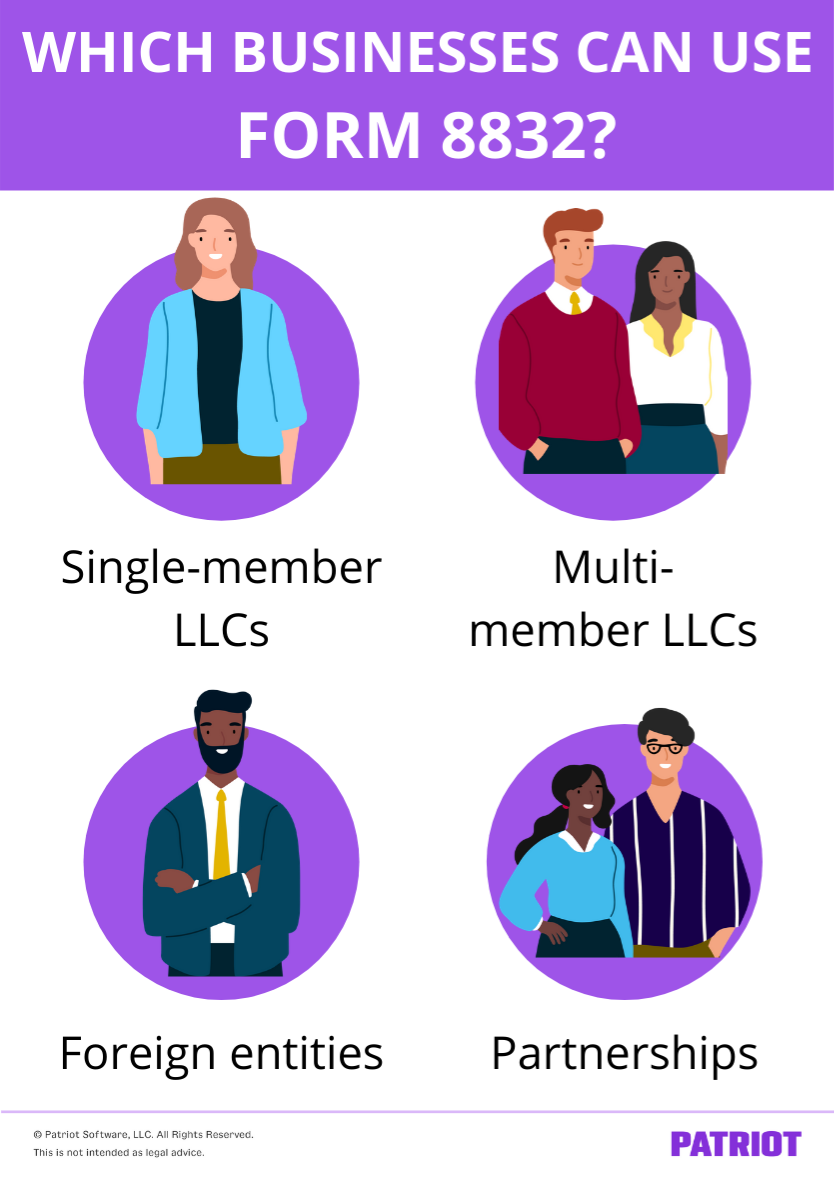

How To Fill Out Form 8832 - Web 6 type of entity (see instructions): Make sure to do the following: Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Form 8832 is divided into two parts: Check here if this is the first time you’re choosing a new tax classification. Put your business name here, not your actual. Choose your type of election. Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). A domestic eligible entity electing to be classified as a partnership. Instructions and pdf download updated:

A domestic eligible entity with a single owner electing to be disregarded as a separate entity. Web we show you everything you need to know to fill out irs form 8832. Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will be classified for federal taxation purposes. Enter your business name and address. Choose your type of election. Web payroll process form 8832 instructions irs form 8832: Name of eligible entity making election: Instructions and pdf download updated: A domestic eligible entity electing to be classified as an association taxable as a corporation.

Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Enter your business name and address. Check here if this is the first time you’re choosing a new tax classification. Name of eligible entity making election: Make sure to do the following: Complete part 1, election information. Part 1 of irs form 8832 asks a series of questions regarding your tax. Web we show you everything you need to know to fill out irs form 8832. Irs form 8832 is used by certain companies to elect how they’d prefer to be classified for federal tax purposes. Web 6 type of entity (see instructions):

Ssurvivor Completed Form 2553 Example

Instructions and pdf download updated: Llcs are formed at the state level. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. A domestic eligible entity electing to be classified as a partnership. Part 1 of irs form 8832 asks a series of questions regarding your tax.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto in 2021 C

Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). Enter your business name and address. Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Check here if this is the first time you’re choosing a.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Web 6 type of entity (see instructions): Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Instructions and pdf download updated: Web we show you everything.

Form 8832 Rev March Fill Out and Sign Printable PDF Template signNow

Web we show you everything you need to know to fill out irs form 8832. Check here if this is the first time you’re choosing a new tax classification. Choose your type of election. Instructions and pdf download updated: Web 6 type of entity (see instructions):

Va form 28 8832 Fill out & sign online DocHub

Web 6 type of entity (see instructions): Complete part 1, election information. Web payroll process form 8832 instructions irs form 8832: Make sure to do the following: Put your business name here, not your actual.

What is Form 8832 and How Do I File it?

Make sure to do the following: Irs form 8832 is used by certain companies to elect how they’d prefer to be classified for federal tax purposes. Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). Web 6 type of entity (see instructions): Web we show you everything you need to.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

Web the first page looks like this: Check here if this is the first time you’re choosing a new tax classification. Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Complete part 1, election information. Enter your business name and address.

What Is IRS Form 8832? Definition, Deadline, & More

Web the first page looks like this: A domestic eligible entity electing to be classified as a partnership. Choose your type of election. Web how to file form 8832 enter your business information. Part 1 of irs form 8832 asks a series of questions regarding your tax.

USING FORM 8832 TO CHANGE THE US TAX CLASSIFICATION OF YOUR COMPANY

Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). A domestic eligible entity with a single owner electing to be disregarded as a separate entity. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web llcs can.

(PDF) Form 8832 Shane Dorn Academia.edu

Put your business name here, not your actual. Irs form 8832 is used by certain companies to elect how they’d prefer to be classified for federal tax purposes. Web the first page looks like this: Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Sandra.

Make Sure To Do The Following:

If you do not yet have an ein, you cannot fill out form 8832. Web we show you everything you need to know to fill out irs form 8832. Web the first page looks like this: A domestic eligible entity electing to be classified as an association taxable as a corporation.

You Can Find Irs Form 8832 On The Irs Website The First Page Of The Form Has.

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web 6 type of entity (see instructions): Complete part 1, election information. Part 1 of irs form 8832 asks a series of questions regarding your tax.

Web In Our Simple Guide, We'll Walk You Through Form 8832 Instructions So You Can Change How Your Organization Will Be Classified For Federal Taxation Purposes.

Sandra akins expert review onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Llcs are formed at the state level. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Web irs form 8832 instructions:

Name Of Eligible Entity Making Election:

Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Web how to file form 8832 enter your business information. Check here if this is the first time you’re choosing a new tax classification. A domestic eligible entity electing to be classified as a partnership.