How To Report Sale Of Residence On Form 1041

How To Report Sale Of Residence On Form 1041 - 2 schedule a charitable deduction. However, the estate gets step up of basis to fmv at the time of death, so there should be no gain to report on the. 1041 (2022) form 1041 (2022) page. Use schedule d to report the following. Web to report a gain or loss from sale on a fiduciary return: Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web how to report sale of decedent's residence on form 1041 The income, deductions, gains, losses, etc. Web instead, a schedule is attached to the form 1041 showing each stock transaction separately and in the same detail as john doe (grantor and owner) will need to report these. On screen income in the income folder, click the statement.

Web 1 best answer tagteam level 15 can this loss be distributed to his beneficiaries? yes, provided the estate was the legal owner of the residence and held. Go to screen 22, dispositions. If it's within 6 months of the date of death, than you can. Web form 1041 is an irs tax return to report income generated by assets held in an estate or trust. Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule. Worksheets are included in publication 523, selling your home, to help you figure the: Web every domestic estate with gross income of $600 or more during a tax year must file a form 1041. Don’t complete for a simple trust or a pooled income fund. Web use the following procedure to report the sale of a personal residence with a section 121 exclusion for an estate/trust. Within the 1041 fiduciary returns, there is not a specific sale of home interview form.

Web use the following procedure to report the sale of a personal residence with a section 121 exclusion for an estate/trust. Web form 1041 is an irs tax return to report income generated by assets held in an estate or trust. On screen income in the income folder, click the statement. Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. If one or more of the beneficiaries of the domestic estate are nonresident aliens,. Web 1 best answer tagteam level 15 can this loss be distributed to his beneficiaries? yes, provided the estate was the legal owner of the residence and held. The income, deductions, gains, losses, etc. Web reporting a sale of home on an individual return in proconnect. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report:

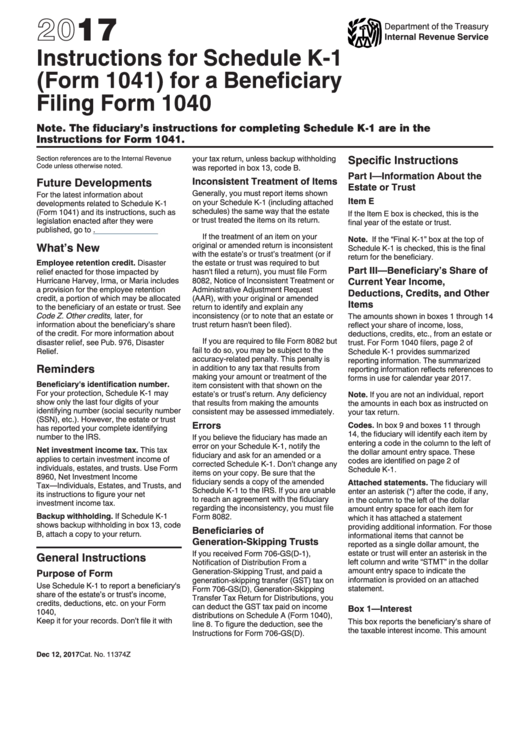

A 2021 Overview of IRS Form 1041 Schedules

Web reporting a sale of home on an individual return in proconnect. Web home how do i enter a sale of home in a 1041 return using interview forms? Of the estate or trust. Worksheets are included in publication 523, selling your home, to help you figure the: The income, deductions, gains, losses, etc.

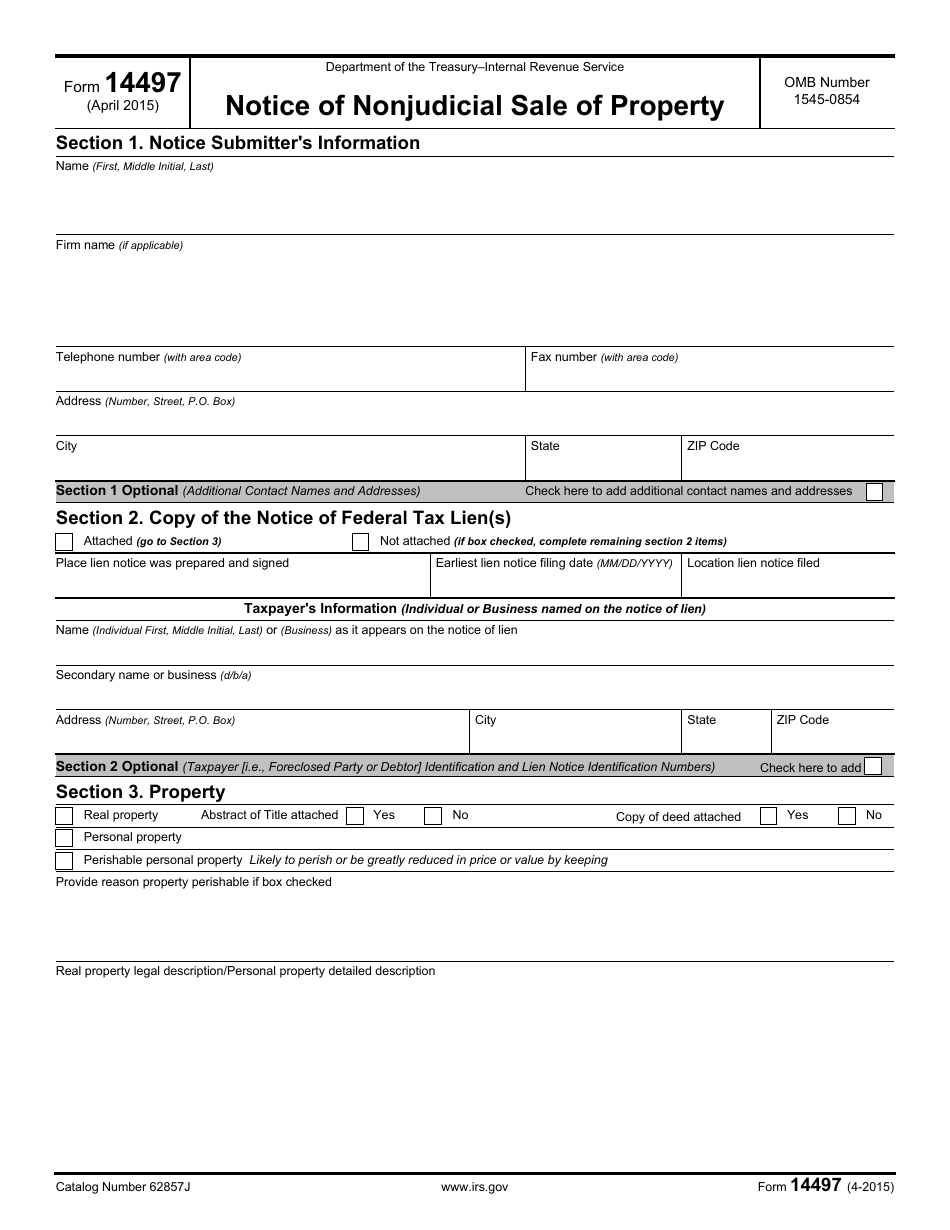

IRS Form 14497 Download Fillable PDF or Fill Online Notice of

Web it is common in an estate to sell the home of the decedent through the probate action. However, the estate gets step up of basis to fmv at the time of death, so there should be no gain to report on the. Web every domestic estate with gross income of $600 or more during a tax year must file.

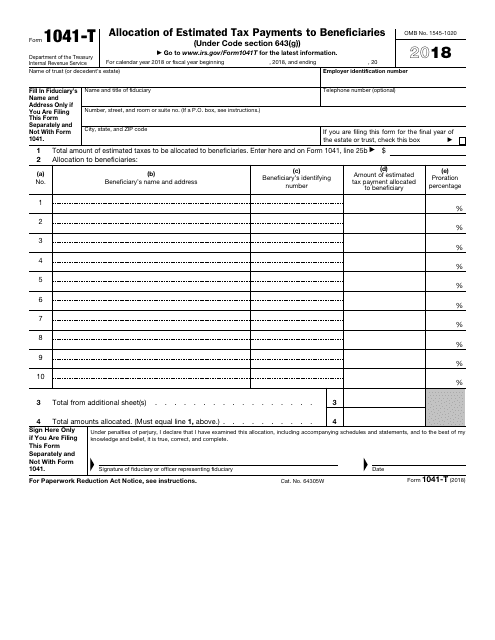

IRS Form 1041T Download Fillable PDF or Fill Online Allocation of

• the overall capital gains and. This article will walk you through entering a sale of home in the. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: If it's within 6 months of the.

20192022 Form IRS 1041N Fill Online, Printable, Fillable, Blank

However, the estate gets step up of basis to fmv at the time of death, so there should be no gain to report on the. Web 1 best answer tagteam level 15 can this loss be distributed to his beneficiaries? yes, provided the estate was the legal owner of the residence and held. Web home how do i enter a.

Top 45 Form 1041 Templates free to download in PDF format

The income, deductions, gains, losses, etc. Form 1041 shows the income, losses, capital. See lines 1a and 8a , later, for more. 1041 (2022) form 1041 (2022) page. Don’t complete for a simple trust or a pooled income fund.

U.S. Tax Return for Estates and Trusts, Form 1041

Web instead, a schedule is attached to the form 1041 showing each stock transaction separately and in the same detail as john doe (grantor and owner) will need to report these. Web reporting a sale of home on an individual return in proconnect. Within the 1041 fiduciary returns, there is not a specific sale of home interview form. This article.

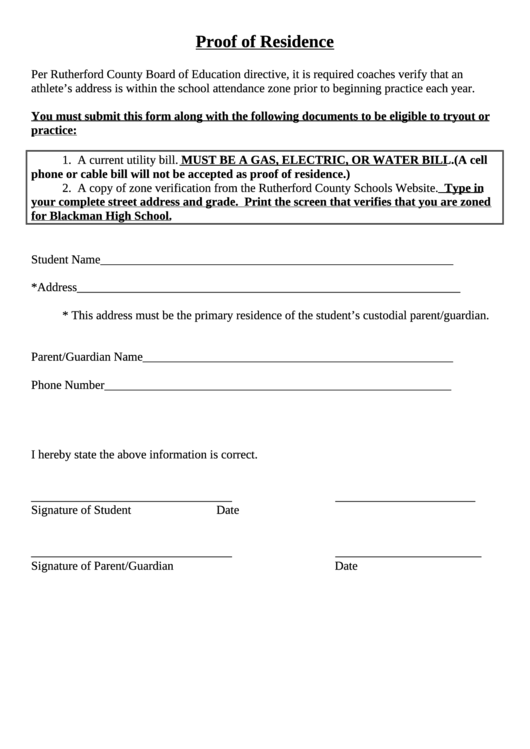

Proof Of Residence Form printable pdf download

• the overall capital gains and. Select the income, then dispositions, then the schedule d/4797/etc section. Web form 1041 is an irs tax return to report income generated by assets held in an estate or trust. Web assuming no family member lived in it, and it's just being sold in the estate to distribute, then you'd need to report the.

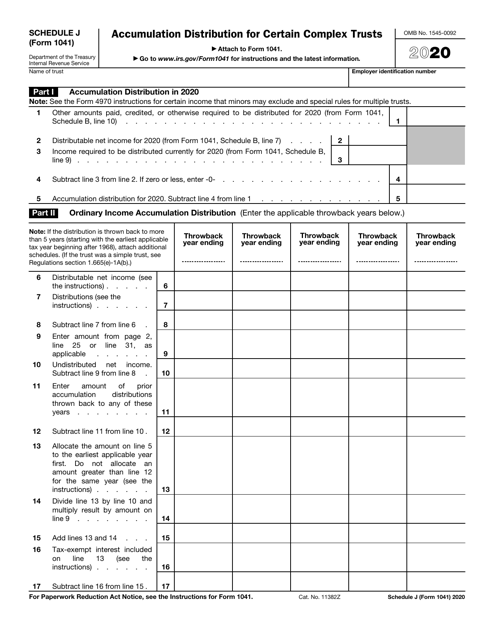

IRS Form 1041 Schedule J Download Fillable PDF or Fill Online

Web if you determine that section 121 is eligible for your fiduciary return, you must manually enter the exclusion using one of two methods: Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule. If it's within 6 months of the date of death, than you can..

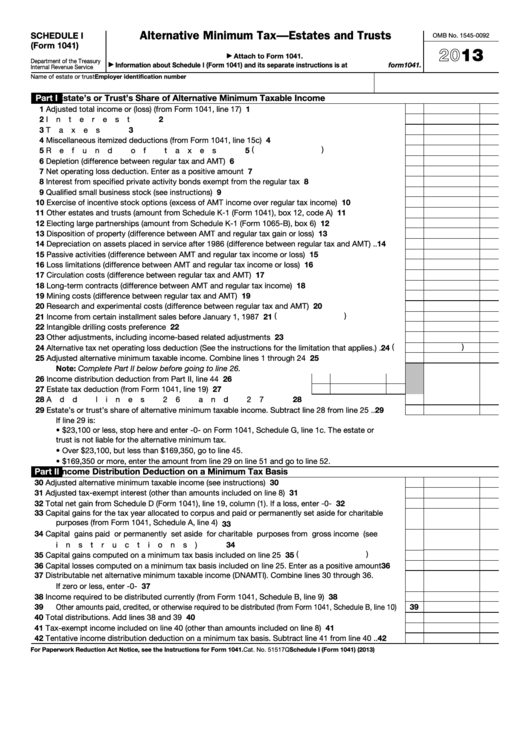

Fillable Schedule I (Form 1041) Alternative Minimum TaxEstates And

See lines 1a and 8a , later, for more. If one or more of the beneficiaries of the domestic estate are nonresident aliens,. Web use the following procedure to report the sale of a personal residence with a section 121 exclusion for an estate/trust. Of the estate or trust. However, the estate gets step up of basis to fmv at.

IRS Form 1041 Reporting an Tax Return for a Deceased Taxpayer

Web to report a gain or loss from sale on a fiduciary return: Go to screen 22, dispositions. He passed away in 2019 at which time the living trust became an. On screen income in the income folder, click the statement. Web home how do i enter a sale of home in a 1041 return using interview forms?

Web Every Domestic Estate With Gross Income Of $600 Or More During A Tax Year Must File A Form 1041.

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. He passed away in 2019 at which time the living trust became an. Don’t complete for a simple trust or a pooled income fund. Go to screen 22, dispositions.

Web To Report A Gain Or Loss From Sale On A Fiduciary Return:

Web home how do i enter a sale of home in a 1041 return using interview forms? Web you cannot deduct a loss from the sale of your main home. 1041 (2022) form 1041 (2022) page. Web instead, a schedule is attached to the form 1041 showing each stock transaction separately and in the same detail as john doe (grantor and owner) will need to report these.

Form 1041 Shows The Income, Losses, Capital.

See lines 1a and 8a , later, for more. Worksheets are included in publication 523, selling your home, to help you figure the: Web to report a gain or loss from sale on a fiduciary return: Of the estate or trust.

• The Overall Capital Gains And.

The income, deductions, gains, losses, etc. Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule. Web how to report sale of decedent's residence on form 1041 Web form 1041 is an irs tax return to report income generated by assets held in an estate or trust.