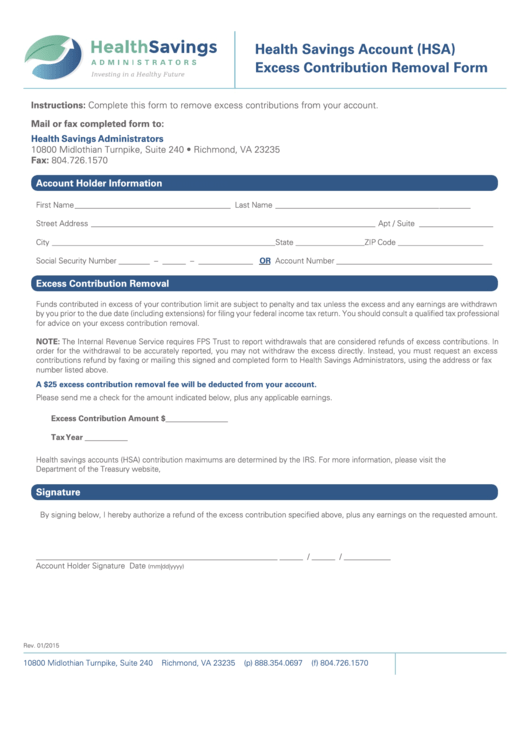

Hsa Excess Contribution Removal Form

Hsa Excess Contribution Removal Form - Return of excess contribution — fidelity health savings account (hsa) use this form to request a return of an excess contribution. Web to remove excess contributions, complete the hsa distribution request form, indicating excess contribution removal as the reason for the distribution request. Web funds will be returned via check to the address on file for your hsa. Web all you have to do is fill out the excess contribution form found on the hsa central consumer portal. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Please choose one of the following: Web if you go over hsa contribution limits for the year, that money is considered an excess contribution — we break down how to handle them. Distributions made after you were disabled. Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Web health savings account excess contribution removal form.

Web funds will be returned via check to the address on file for your hsa. Please choose one of the following: This form is required by the irs to properly report an excess contribution removal. Web if you go over hsa contribution limits for the year, that money is considered an excess contribution — we break down how to handle them. Please use this form to report any excess contribution(s) to hsa cash. Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Return of excess contribution — fidelity health savings account (hsa) use this form to request a return of an excess contribution. Web excess removal form remove funds that exceed your annual contribution limit. Distributions of excess hsa or archer msa contributions.

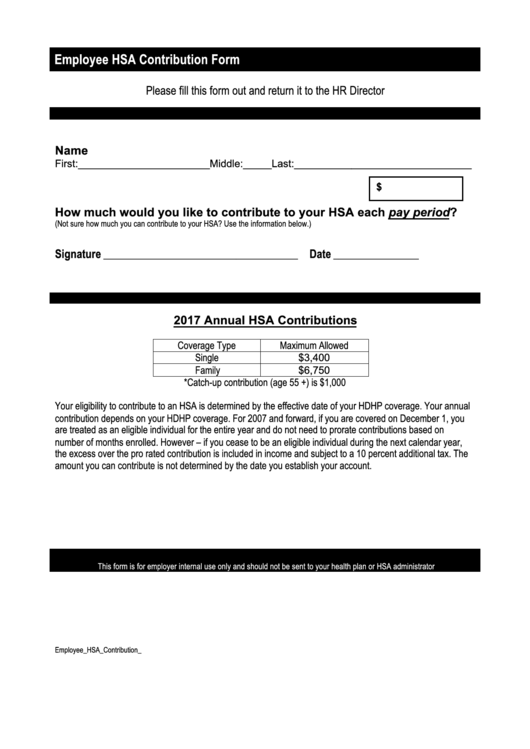

Web to remove excess contributions, complete the hsa distribution request form, indicating excess contribution removal as the reason for the distribution request. Web funds will be returned via check to the address on file for your hsa. Web up to 8% cash back health savings account (hsa) excess contribution removal form form instructions: Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. The form is located under the tools & support section and can be. Hsa contribution maximums are determined by the irs and are no longer based on your deductible. Web health savings account excess contribution removal form. Web apply my excess contribution as my current year’s contribution. Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Web download the hsa contribution form from the member website:

How to Handle Excess Contributions on Form 8889 HSA Edge

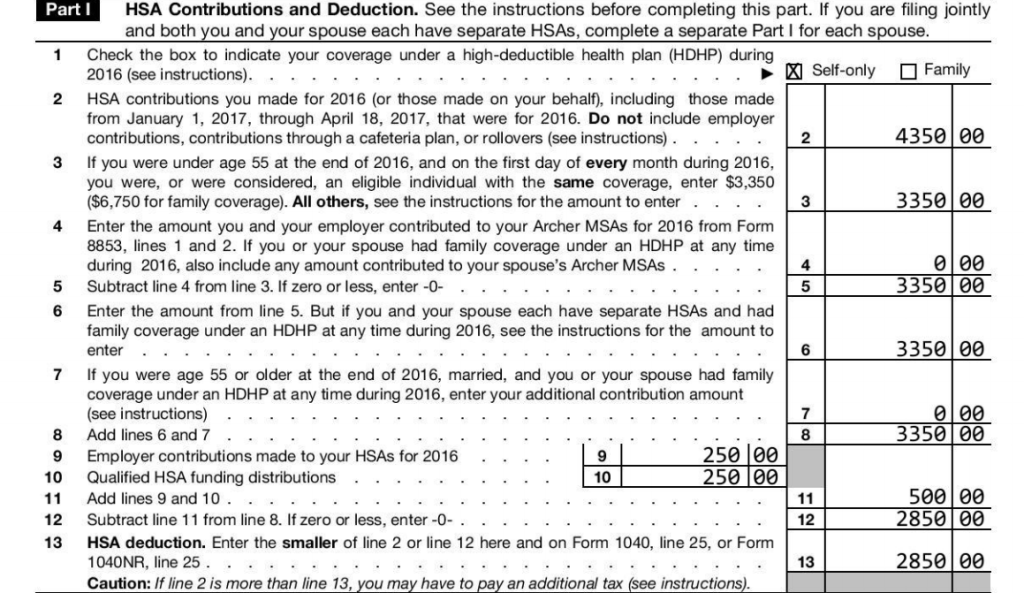

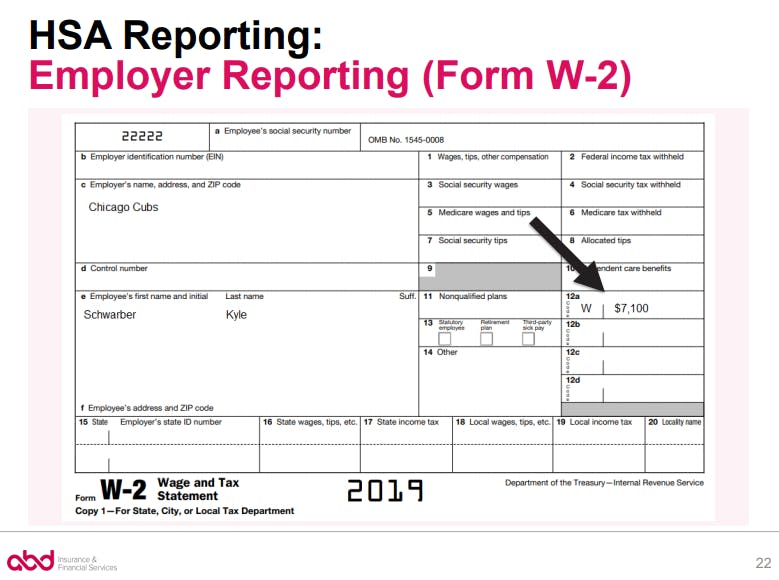

Web health savings account excess contribution removal form. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Web use form 8889 to: Hsa contribution maximums are determined by the irs and are no longer based on your deductible. Web apply my excess contribution as my current year’s contribution.

Employee Hsa Contribution Form printable pdf download

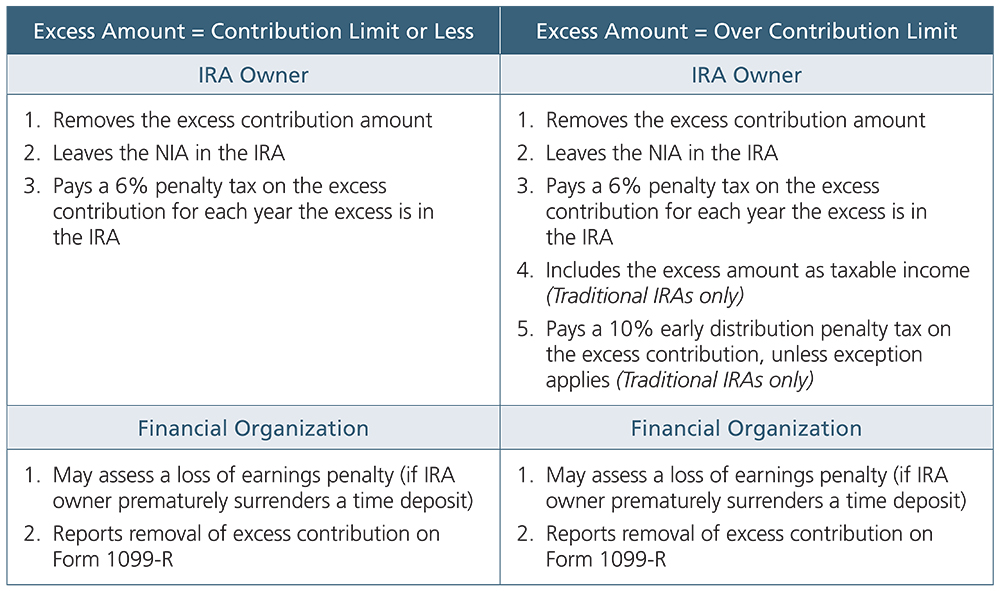

Web treasury regulations provide the requirements for calculating nia, but an excess removal form, such as the ascensus® ira or hsa excess removal. Web however, if you want to avoid the unnecessary expenditure, mail your completed excess contribution removal form to your hsa plan administrator. Hsa contribution maximums are determined by the irs and are no longer based on your.

HSA Form W2 Reporting

This form is required by the irs to properly report an excess contribution removal. Web excess removal form remove funds that exceed your annual contribution limit. Web treasury regulations provide the requirements for calculating nia, but an excess removal form, such as the ascensus® ira or hsa excess removal. Web the contributions for 2022 to your traditional iras, roth iras,.

The Deadline For Correcting IRA Excesses Has Passed—Now What? — Ascensus

Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Complete this form to request. Return of excess contribution — fidelity health savings account (hsa) use this form to request a return of an excess contribution. Please use this form to report.

HSA Excess Contribution—What Is the Penalty and How to Avoid it

Web download the hsa contribution form from the member website: Distributions of excess hsa or archer msa contributions. Web to remove excess contributions, complete the hsa distribution request form, indicating excess contribution removal as the reason for the distribution request. Distributions made after you were disabled. Web instead, you must request an excess contributions refund by faxing or mailing this.

Health Savings Account (Hsa) Excess Contribution Removal Form printable

Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Hsa contribution maximums are determined by the irs and are no longer based on your deductible. Web excess removal form remove funds that exceed your annual contribution limit. Generally, you must pay.

The Deadline For Correcting IRA Excesses Has Passed—Now What? — Ascensus

Web use form 8889 to: Web up to 8% cash back sign in to your account online to download the health savings account (hsa) excess contribution removal form to request an excess contribution refund or a. Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit,.

2020 HSA Contribution Limits and Rules

Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Generally, you must pay a 6% excise tax on excess. Select “tools & support” > “account support & forms.” complete and mail the form along with a check. Hsa contribution maximums are.

HSA Excess Contributions? We have the answers Lively

Web funds will be returned via check to the address on file for your hsa. Web up to 8% cash back sign in to your account online to download the health savings account (hsa) excess contribution removal form to request an excess contribution refund or a. Please choose one of the following: Hsa contribution maximums are determined by the irs.

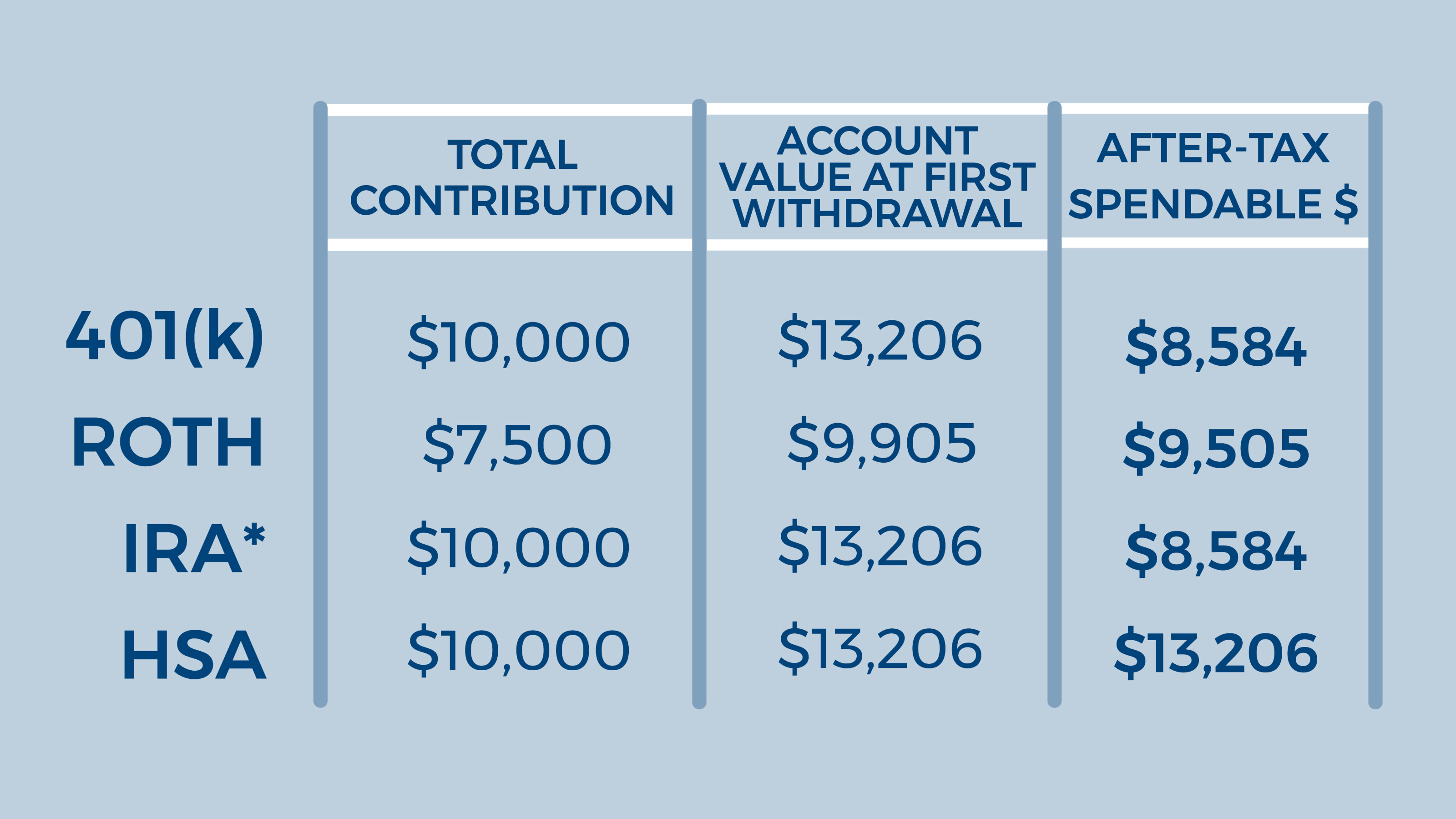

Using an HSA As a Retirement Account AOPA

Web excess removal form remove funds that exceed your annual contribution limit. Please use this form to report any excess contribution(s) to hsa cash. Distributions of excess hsa or archer msa contributions. Web up to 8% cash back excess excess contribution contribution and and deposit deposit correction correction request request form form be sure to consult a tax advisor before..

Web Treasury Regulations Provide The Requirements For Calculating Nia, But An Excess Removal Form, Such As The Ascensus® Ira Or Hsa Excess Removal.

Web all you have to do is fill out the excess contribution form found on the hsa central consumer portal. Web health savings account excess contribution removal form. Please use this form to report any excess contribution(s) to hsa cash. Select “tools & support” > “account support & forms.” complete and mail the form along with a check.

The Form Is Located Under The Tools & Support Section And Can Be.

Web up to 8% cash back health savings account (hsa) excess contribution removal form form instructions: This form is required by the irs to properly report an excess contribution removal. Web instead, you must request an excess contributions refund by faxing or mailing this signed and completed form to hsa bank, using the address or fax number listed above. Distributions of excess hsa or archer msa contributions.

Web However, If You Want To Avoid The Unnecessary Expenditure, Mail Your Completed Excess Contribution Removal Form To Your Hsa Plan Administrator.

(refund of money that was deposited in. Return of excess contribution — fidelity health savings account (hsa) use this form to request a return of an excess contribution. Web excess removal form remove funds that exceed your annual contribution limit. Web use form 8889 to:

Generally, You Must Pay A 6% Excise Tax On Excess.

Web apply my excess contribution as my current year’s contribution. Web funds will be returned via check to the address on file for your hsa. Web up to 8% cash back excess excess contribution contribution and and deposit deposit correction correction request request form form be sure to consult a tax advisor before. Web download the hsa contribution form from the member website: