Illinois Wage Garnishment Exemption Form

Illinois Wage Garnishment Exemption Form - Web explain what amount of money or property is protected from garnishment called exemptions. see the section in this manual on exemption rights; The court has issued a garnishment summons against the garnishee named above for money or property (other than wages) belonging to the judgment debtor or in. When a creditor initiates the process of garnishing your wages, they must send you a. Click here to create illinois public id. Web (740 ilcs 170/1) (from ch. Web you can get the forms by going into the clerk's office or by going online to the circuit clerk's website. Web in a nutshell. Web exemptions are created by statutes to avoid leaving a debtor with no means of support. Web the maximum wages subject to garnishment is the lesser of 15% of gross wages; Some have exemptions from garnishment, which means they cannot be.

See the exempt wages table on the last page of this form to determine what wages are. Web in order to access the system, claimants will first need to create an illinois public id account. Or the amount by which weekly wages, minus deductions required by law, exceed 45 times the. Web if a debtor receives a notice like a citation to discover assets, this lets them know they need to go to court. Web explain what amount of money or property is protected from garnishment called exemptions. see the section in this manual on exemption rights; Most of the time, this is only possible after a court has. Web the maximum wages subject to garnishment is the lesser of 15% of gross wages; There are different types of garnishments, as defined by state laws, which vary by state. When a creditor initiates the process of garnishing your wages, they must send you a. Web (740 ilcs 170/1) (from ch.

Web illinois minimum wage will increase between january 1, 2020 and january 1, 2025. This is a list of the forms which the court uses in cook county; Web you can get the forms by going into the clerk's office or by going online to the circuit clerk's website. Or the amount by which weekly wages, minus deductions required by law, exceed 45 times the. The supreme court commission on access to justice has approved the following forms. Web exemptions are created by statutes to avoid leaving a debtor with no means of support. Benefits and refunds payable by pension or retirement funds or systems and any assets of employees held by such funds or systems, and any. Ask your circuit clerk for more information or visit www.illinoislegalaid.org. Most of the time, this is only possible after a court has. Web (740 ilcs 170/1) (from ch.

Fillable Online azcourts wage garnishment answers forms Fax Email Print

All illinois courts must accept. Web (740 ilcs 170/1) (from ch. Or the amount by which weekly wages, minus deductions required by law, exceed 45 times the. Most of the time, this is only possible after a court has. Ask your circuit clerk for more information or visit www.illinoislegalaid.org.

Wage Garnishment Indiana Relieve Stress Read More

Click here to create illinois public id. The court has issued a garnishment summons against the garnishee named above for money or property (other than wages) belonging to the judgment debtor or in. Once they're in court, they can protect certain money and property from. All illinois courts must accept. Most of the time, this is only possible after a.

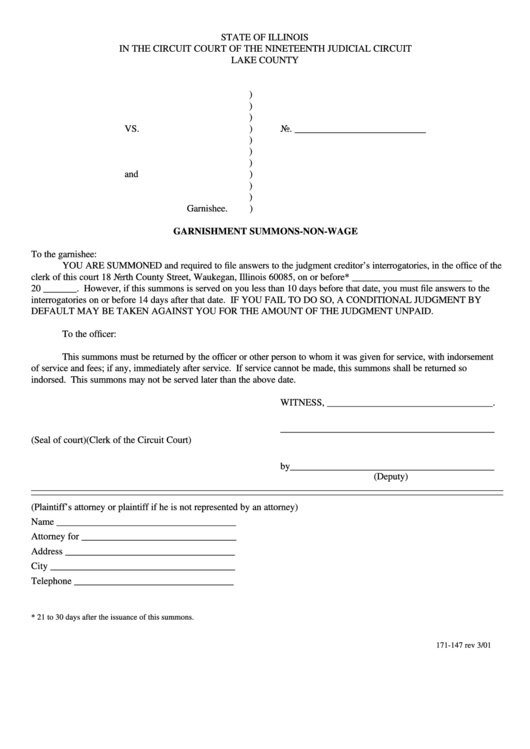

Fillable Garnishment Summons Non Wage Form Lake County, Illinois

A wage garnishment order allows creditors to take money directly from your paycheck. See the exempt wages table on the last page of this form to determine what wages are. Web in order to access the system, claimants will first need to create an illinois public id account. Web explain what amount of money or property is protected from garnishment.

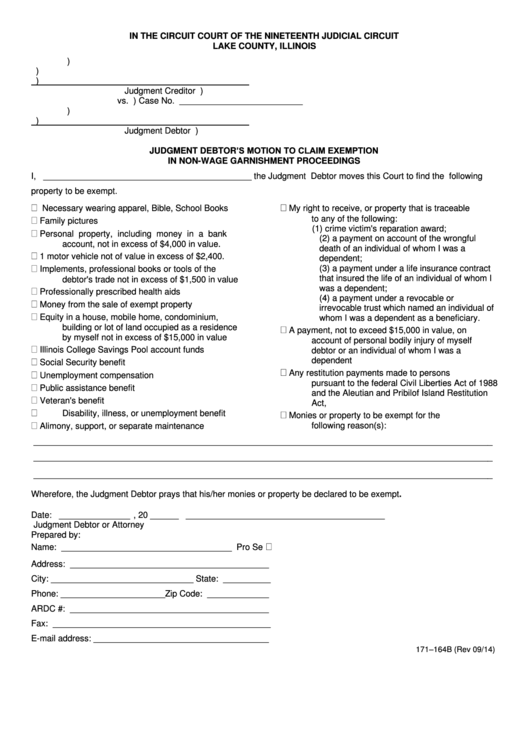

Fillable Judgment Debtor'S Motion To Claim Exemption In NonWage

Ask your circuit clerk for more information or visit www.illinoislegalaid.org. Web in a nutshell. See the exempt wages table on the last page of this form to determine what wages are. Web (740 ilcs 170/1) (from ch. Web if a debtor receives a notice like a citation to discover assets, this lets them know they need to go to court.

IRS Released Wage Garnishment in Peoria, IL 20/20 Tax Resolution

Web in a nutshell. See the exempt wages table on the last page of this form to determine what wages are. Click here to create illinois public id. Web illinois minimum wage will increase between january 1, 2020 and january 1, 2025. Web the maximum wages subject to garnishment is the lesser of 15% of gross wages;

California Wage Garnishment 20 Free Templates in PDF, Word, Excel

Once they're in court, they can protect certain money and property from. Web in a nutshell. A wage garnishment order allows creditors to take money directly from your paycheck. See the exempt wages table on the last page of this form to determine what wages are. Web you can get the forms by going into the clerk's office or by.

Wage Garnishment Wage Garnishment Exemption

Or the amount by which weekly wages, minus deductions required by law, exceed 45 times the. When a creditor initiates the process of garnishing your wages, they must send you a. There are different types of garnishments, as defined by state laws, which vary by state. Web in order to access the system, claimants will first need to create an.

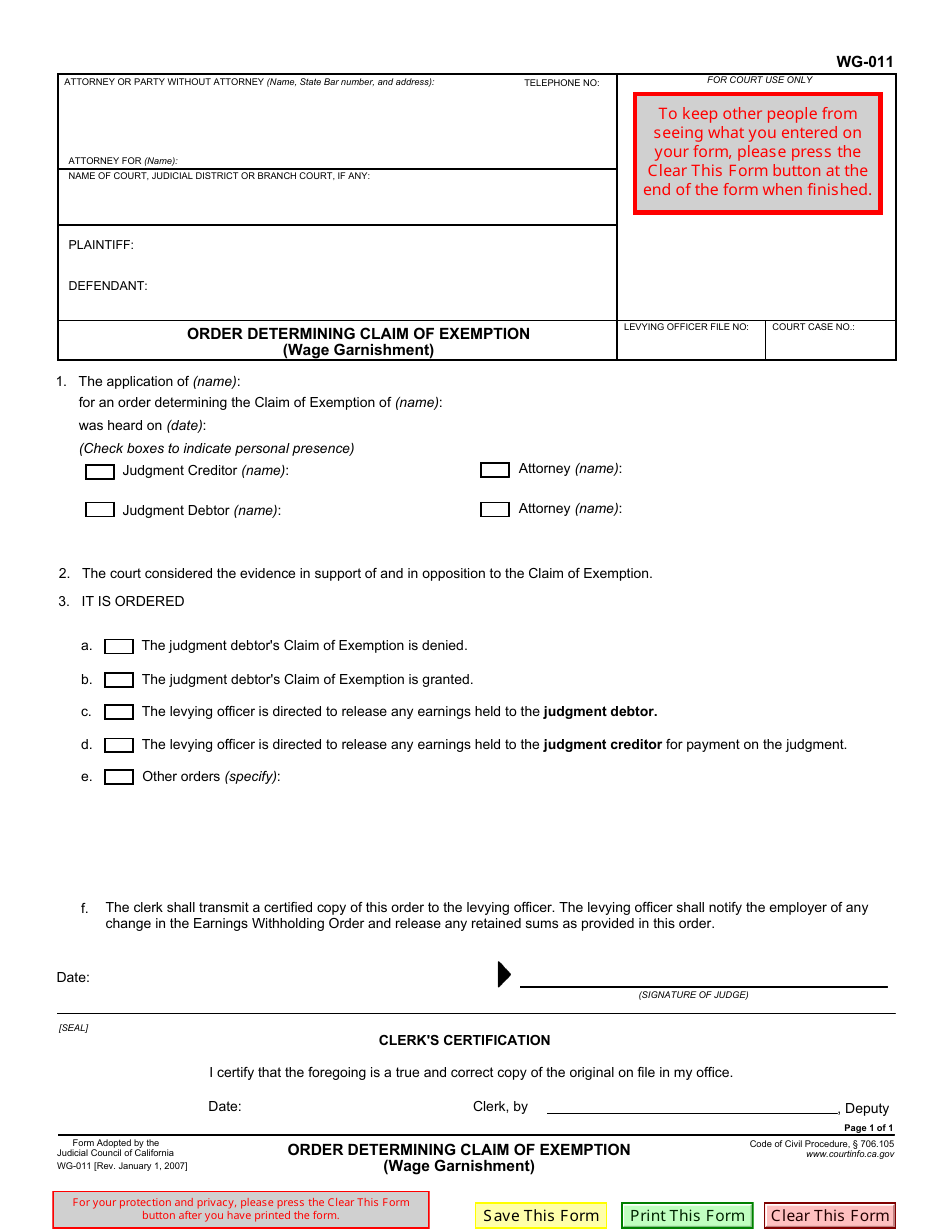

Form WG011 Download Fillable PDF or Fill Online Order Determining

The employer/garnishee is ordered to return any and all. A wage garnishment order allows creditors to take money directly from your paycheck. Most of the time, this is only possible after a court has. Some have exemptions from garnishment, which means they cannot be. Benefits and refunds payable by pension or retirement funds or systems and any assets of employees.

Standard Form 329 Fill Online, Printable, Fillable, Blank pdfFiller

Web claiming exemptions 1 request a hearing to dispute the garnishment. When a creditor initiates the process of garnishing your wages, they must send you a. Some have exemptions from garnishment, which means they cannot be. Most of the time, this is only possible after a court has. A wage garnishment order allows creditors to take money directly from your.

Wage Garnishments Acworth, GA Law Offices of Roger Ghai

See the exempt wages table on the last page of this form to determine what wages are. This is a list of the forms which the court uses in cook county; Web illinois minimum wage will increase between january 1, 2020 and january 1, 2025. The employer/garnishee is ordered to return any and all. Web explain what amount of money.

There Are Different Types Of Garnishments, As Defined By State Laws, Which Vary By State.

Web in order to access the system, claimants will first need to create an illinois public id account. When a creditor initiates the process of garnishing your wages, they must send you a. Web (740 ilcs 170/1) (from ch. A wage garnishment order allows creditors to take money directly from your paycheck.

The Supreme Court Commission On Access To Justice Has Approved The Following Forms.

Web in a nutshell. Web exemptions are created by statutes to avoid leaving a debtor with no means of support. Web you can get the forms by going into the clerk's office or by going online to the circuit clerk's website. Web the maximum wages subject to garnishment is the lesser of 15% of gross wages;

Web Illinois Minimum Wage Will Increase Between January 1, 2020 And January 1, 2025.

Some have exemptions from garnishment, which means they cannot be. Benefits and refunds payable by pension or retirement funds or systems and any assets of employees held by such funds or systems, and any. Web explain what amount of money or property is protected from garnishment called exemptions. see the section in this manual on exemption rights; Web up to 25% cash back if you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court or.

The Following Personal Property, Owned By The Debtor, Is.

Click here to create illinois public id. Web the wage payment and collection act establishes when, where and how often wages must be paid and prohibits deductions from wages or final compensation without the. Most of the time, this is only possible after a court has. Once they're in court, they can protect certain money and property from.