Insolvency Worksheet Form 982

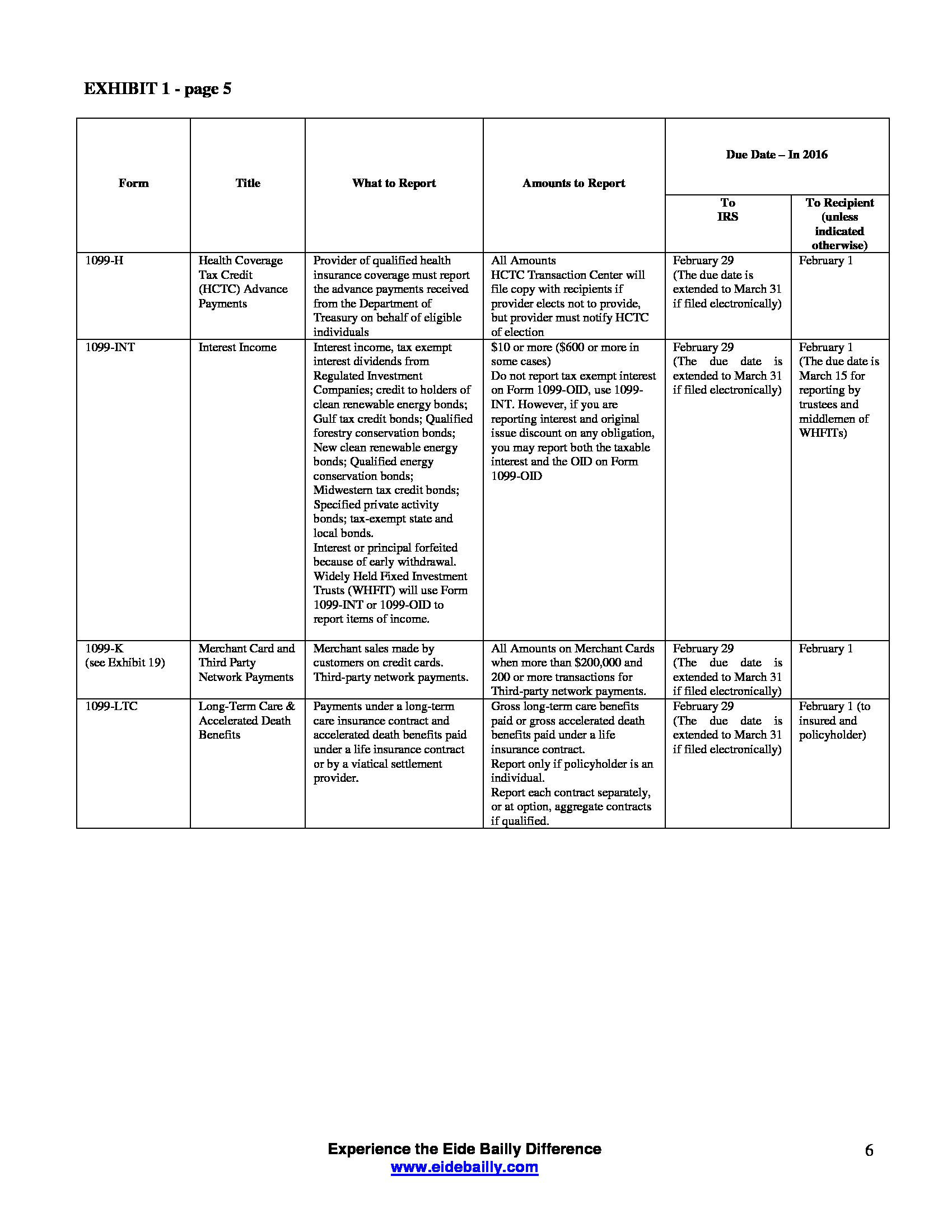

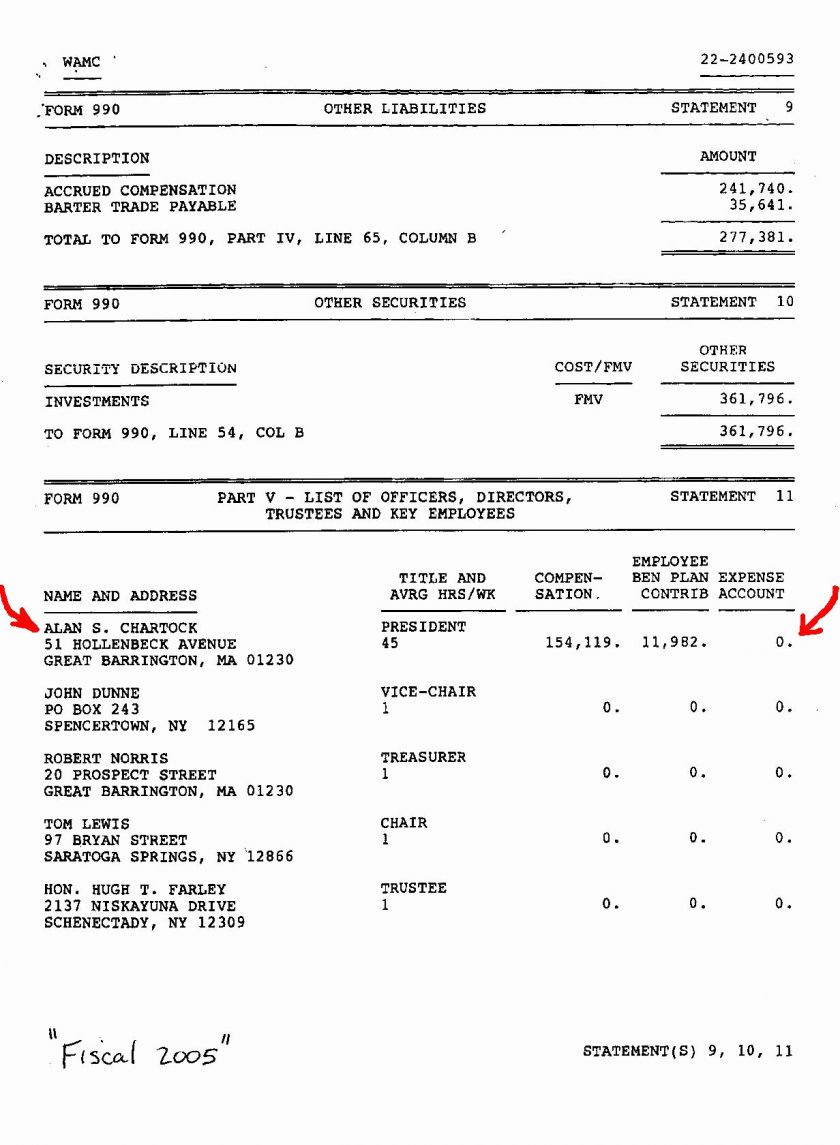

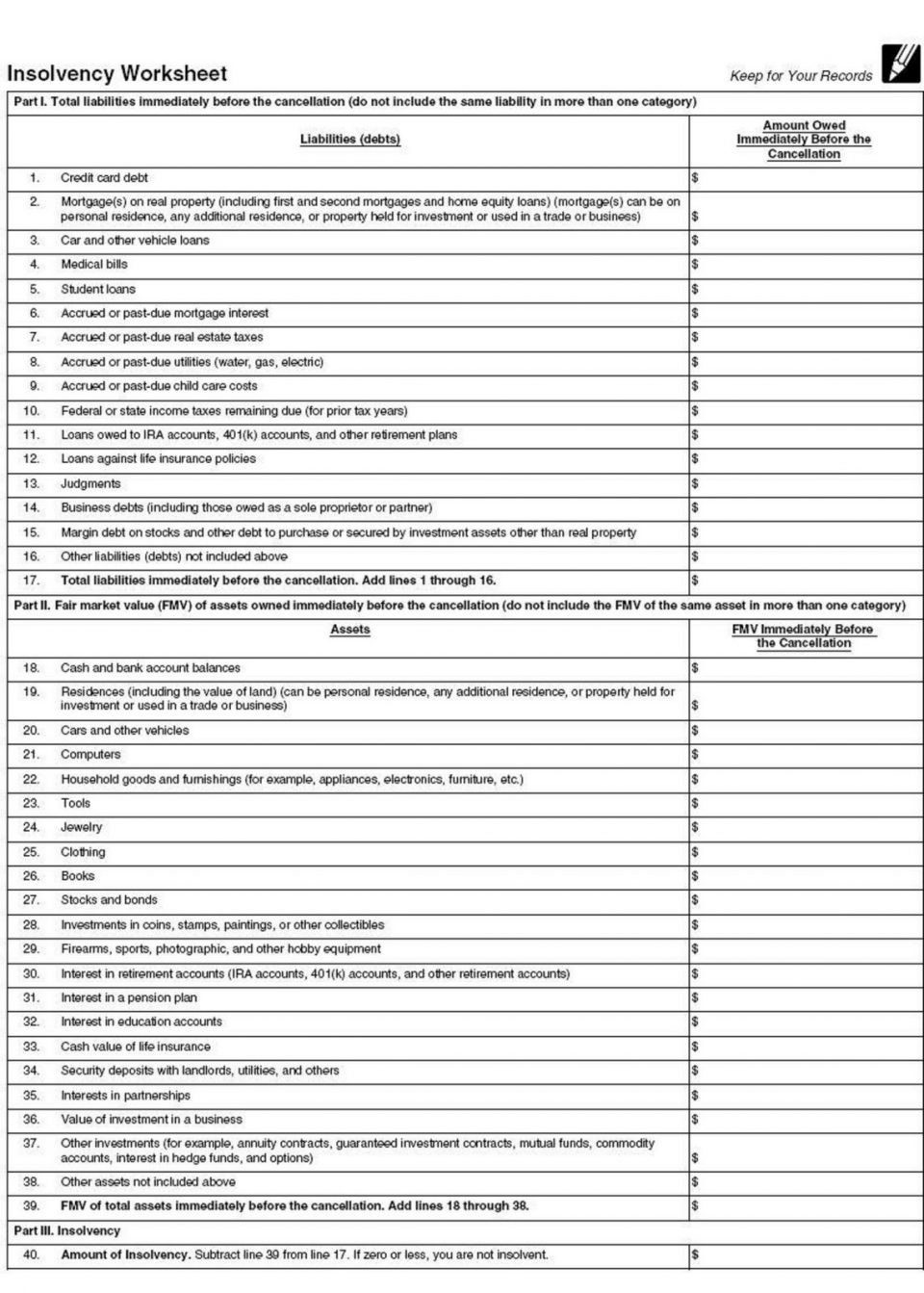

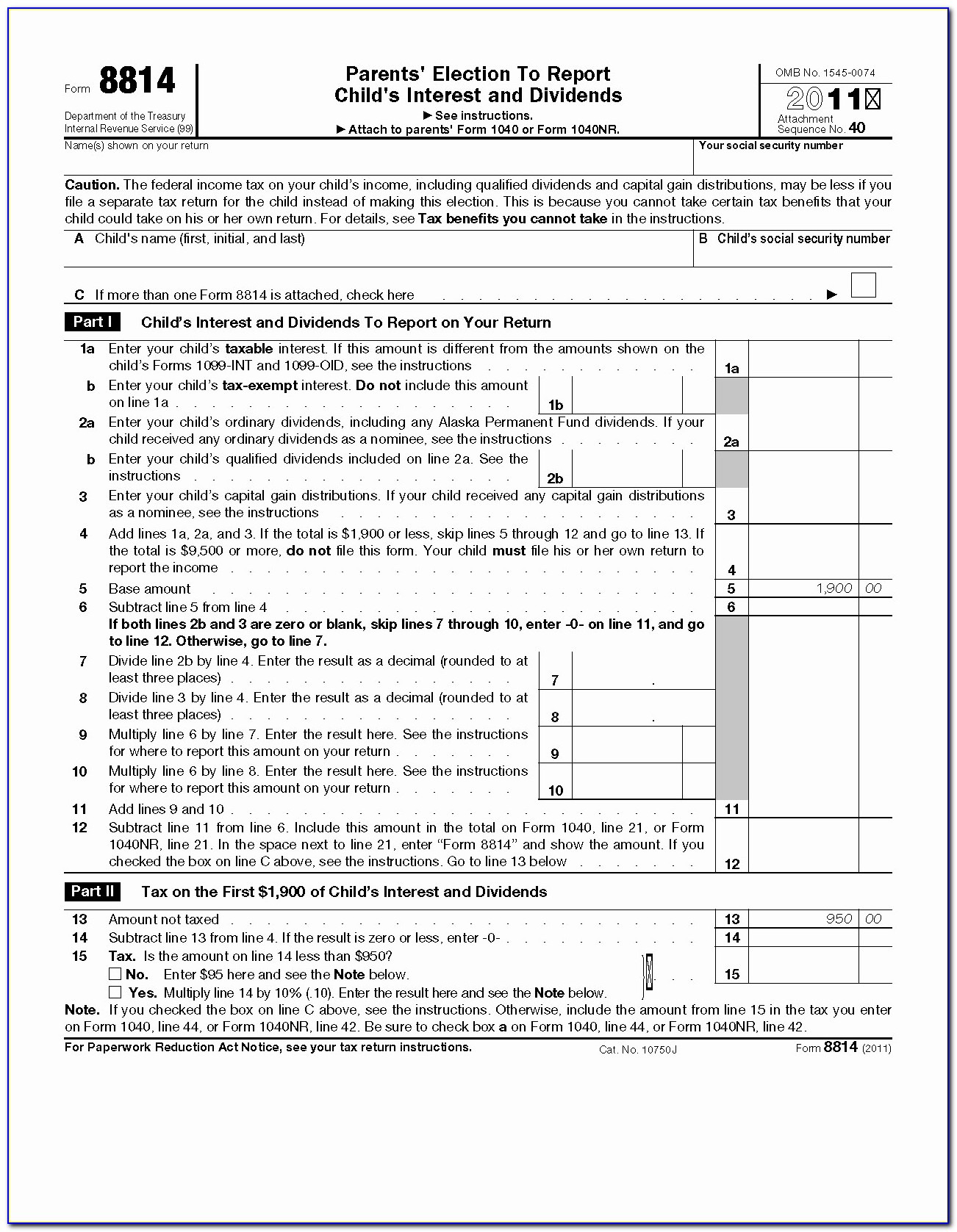

Insolvency Worksheet Form 982 - If you had debt cancelled and are no longer obligated to repay the. This article will assist you with. What is a discharge of indebtedness to the extent insolvent? Go paperless, fill & sign documents electronically. Go to screen 14.1, ss benefits, alimony, miscellaneous inc.; Web instructions for form 982 (rev. Web insolvency determination worksheet determining insolvency is out of scope for the volunteer. December 2021) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and. Check entries on canceled debt worksheet. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related.

December 2021) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and. Check entries on canceled debt worksheet. Ad download or email worksheets & more fillable forms, register and subscribe now! Solved•by intuit•10•updated july 13, 2022. Web create the insolvency worksheet. You must file form 982 to report the. Web purpose of form generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income. Scroll down to the alimony and other income section.;. Go to screen 14.1, ss benefits, alimony, miscellaneous inc.; Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982.

Web instructions for form 982 (rev. If you had debt cancelled and are no longer obligated to repay the. Line 5 of form 982 contains an amount but no statement was created. Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982 to your federal income tax return and check the. Scroll down to the alimony and other income section.;. Web insolvency determination worksheet determining insolvency is out of scope for the volunteer. The amount or level of insolvency is expressed as a negative net worth. Insolvency determination worksheet assets (fmv) homes $ cars. Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982. Web insolvency is a condition in which the fmv of all assets is less than one’s liabilities.

Tax form 982 Insolvency Worksheet Along with 1099 form Utah

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web instructions for form 982 (rev. If you had debt cancelled and are no longer obligated to repay the. Now you are going to fill out irs form 982 (really, really simple!!!) for credit card and other unsecured debts, you only have to deal with part i..

Tax form 982 Insolvency Worksheet

Web create the insolvency worksheet. Web irs publication 4681 (link opens pdf) includes an insolvency worksheet on page 8, which lists the assets you need to value. What is a discharge of indebtedness to the extent insolvent? Open the sch screen (from the link on screen 982. Solved•by intuit•10•updated july 13, 2022.

Tax Form 982 Insolvency Worksheet —

Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982. Scroll down to the alimony and other income section.;. Solved•by intuit•10•updated july 13, 2022. What is a discharge of indebtedness to the extent insolvent? If you had debt cancelled.

Form 982 Insolvency Worksheet

Insolvency determination worksheet assets (fmv) homes $ cars. Web up to $40 cash back fill insolvency canceled debts, edit online. Check entries on canceled debt worksheet. Ad download or email worksheets & more fillable forms, register and subscribe now! You must file form 982 to report the.

Insolvency Worksheet Canceled Debts Fill and Sign Printable Template

Insolvency determination worksheet assets (fmv) homes $ cars. Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982. Scroll down to the alimony and other income section.;. Web up to $40 cash back fill insolvency canceled debts, edit online..

Form 982 Insolvency Worksheet —

Ad download or email worksheets & more fillable forms, register and subscribe now! Web up to $40 cash back fill insolvency canceled debts, edit online. Go paperless, fill & sign documents electronically. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Open the sch screen (from the link on screen 982.

Form 982 Insolvency Worksheet

Insolvency determination worksheet assets (fmv) homes $ cars. According to irs publication 4681: Web irs publication 4681 (link opens pdf) includes an insolvency worksheet on page 8, which lists the assets you need to value. Go paperless, fill & sign documents electronically. Scroll down to the alimony and other income section.;.

Fresh Form 982 For 2016 Insolvency Worksheet Kidz —

According to irs publication 4681: Web irs publication 4681 (link opens pdf) includes an insolvency worksheet on page 8, which lists the assets you need to value. This article will assist you with. Scroll down to the alimony and other income section.;. Web in order to show that the insolvency exception applies and some or all of the canceled debt.

Tax form 982 Insolvency Worksheet

Now you are going to fill out irs form 982 (really, really simple!!!) for credit card and other unsecured debts, you only have to deal with part i. Generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income. Line 5 of form 982 contains an amount but no statement was created. Go.

Solved I need to know about the insolvency exception for 1099c. Do I

Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982. Line 5 of form 982 contains an amount but no statement was created. You must file form 982 to report the. Web purpose of form generally, the amount by.

What Is A Discharge Of Indebtedness To The Extent Insolvent?

Web purpose of form generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income. Web up to $40 cash back fill insolvency canceled debts, edit online. You must file form 982 to report the. Check entries on canceled debt worksheet.

Web Create The Insolvency Worksheet.

Now you are going to fill out irs form 982 (really, really simple!!!) for credit card and other unsecured debts, you only have to deal with part i. Line 5 of form 982 contains an amount but no statement was created. Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982 to your federal income tax return and check the. According to irs publication 4681:

Sign, Fax And Printable From Pc, Ipad, Tablet Or Mobile With Pdffiller Instantly.

Go to screen 14.1, ss benefits, alimony, miscellaneous inc.; Web instructions for form 982 (rev. Web insolvency determination worksheet determining insolvency is out of scope for the volunteer. Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982.

Scroll Down To The Alimony And Other Income Section.;.

Generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income. Solved•by intuit•10•updated july 13, 2022. Open the sch screen (from the link on screen 982. If you had debt cancelled and are no longer obligated to repay the.