Instructions For Form 2848

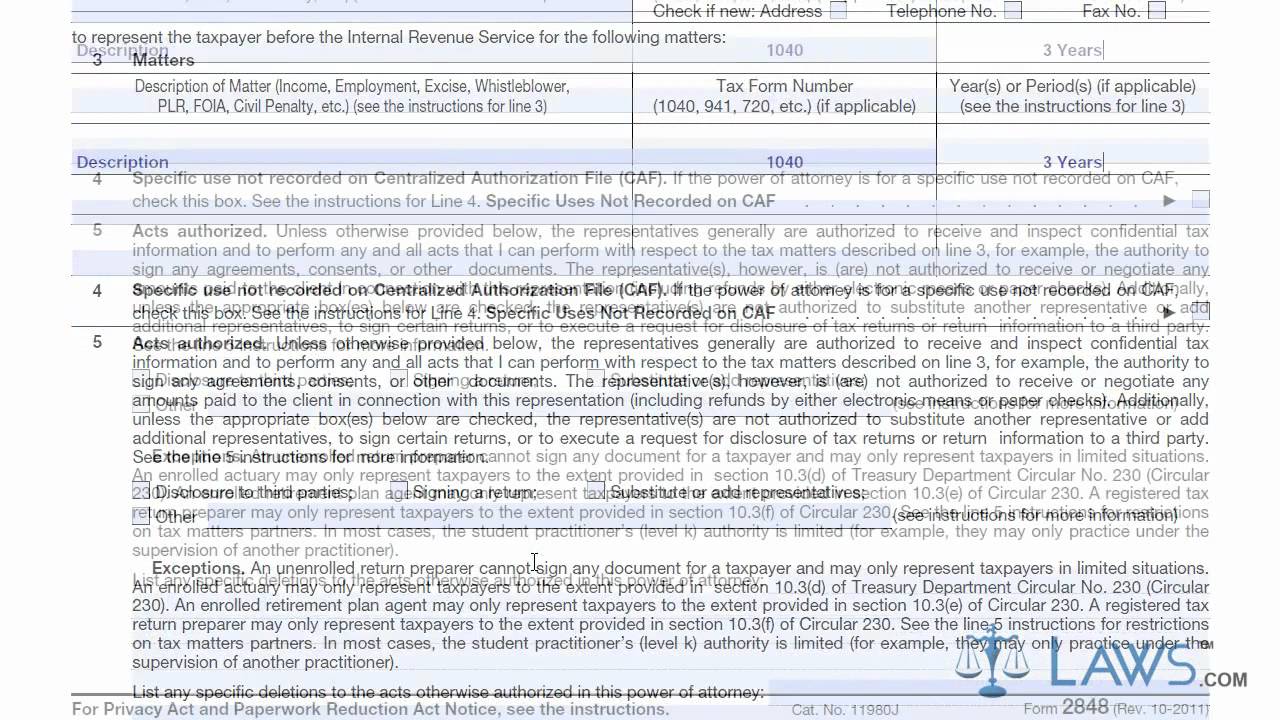

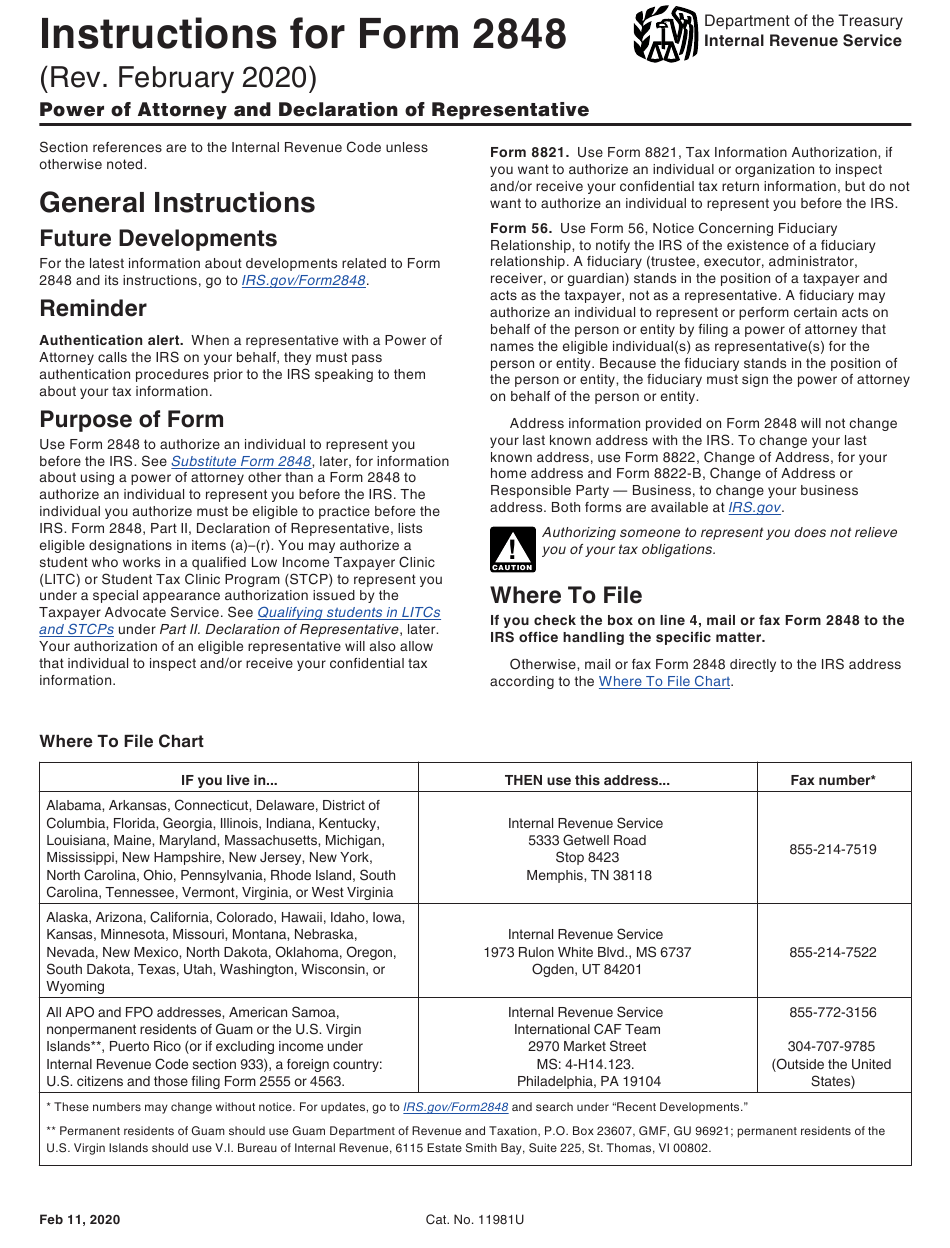

Instructions For Form 2848 - You can learn more about power of attorney in this detailed guide. Web use form 2848 to authorize an individual to represent you before the irs. Web to withdraw as a representative on a form 2848, write “withdraw” across the top of the first page of the form and sign and write the date below this annotation. January 2000) (use with form 2848 revised december 1997.) power of attorney and declaration of representative section references are to the internal revenue code unless otherwise noted. Web instructions for form 2848(rev. And form 941, employer's quarterly federal tax return. Form 2848 will not be honored for any purpose other than representation before the irs. Web a subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720, quarterly federal excise tax return; February 2020) power of attorney and declaration of representative department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web a separate form 2848 should be completed for each taxpayer.

And form 941, employer's quarterly federal tax return. Department of the treasury internal revenue service general instructions purpose of form The individual you authorize must be a person eligible to practice before the irs. Web irs form 2848 is a document provided by the irs that authorizes an individual to appear before them on your behalf. There may be a few reasons why someone would represent on your. Taxpayer identification number(s) daytime telephone number. Form 940, employer's annual federal unemployment (futa) tax return; When completing this section, you need to provide the specific issue(s), the types of forms involved and the year(s) to which this authority applies. January 2000) (use with form 2848 revised december 1997.) power of attorney and declaration of representative section references are to the internal revenue code unless otherwise noted. Web a subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720, quarterly federal excise tax return;

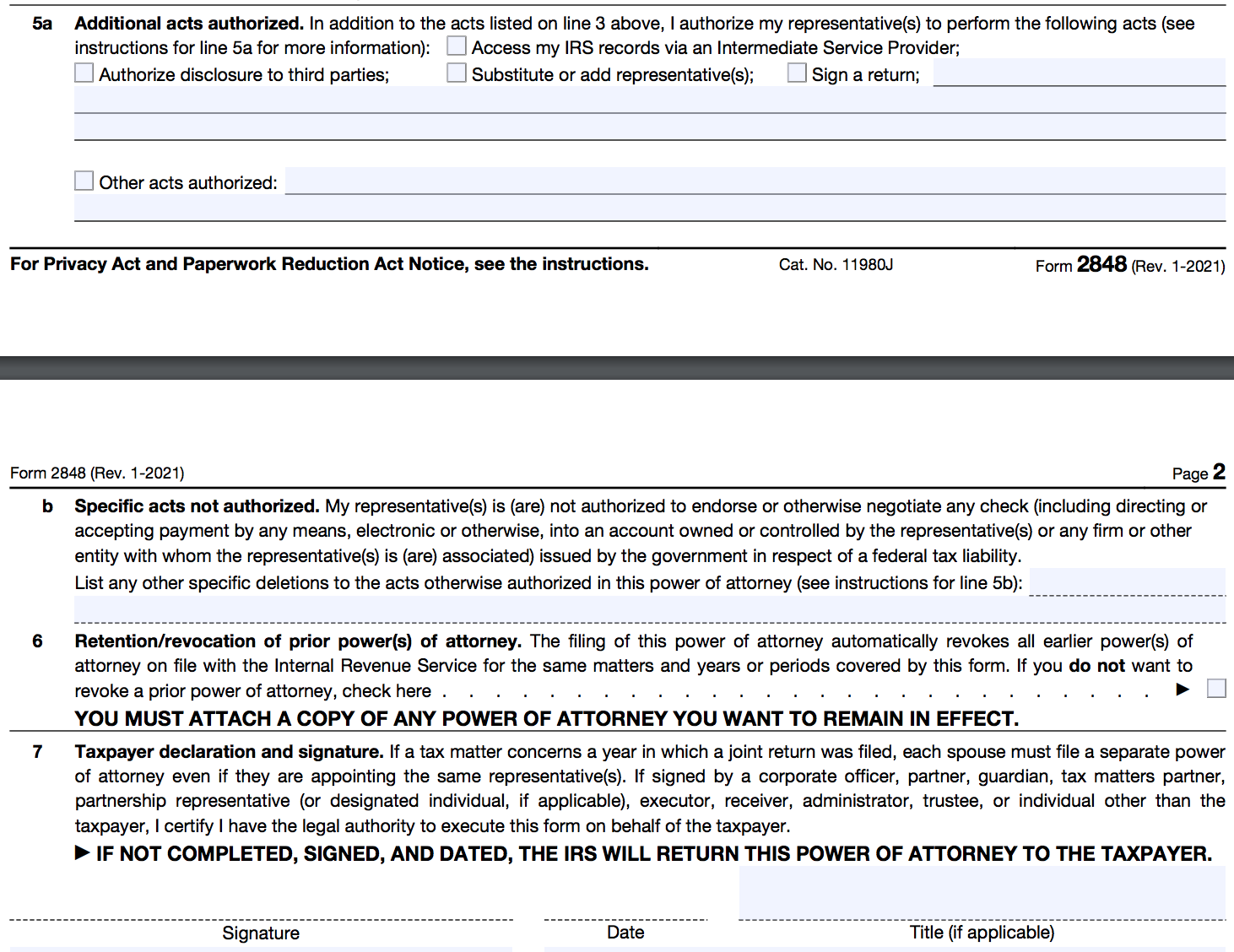

When filing the form, include a copy of your parent’s document that designates you as power of attorney. This form is officially called power of attorney and declaration of representative. Taxpayer must sign and date this form on page 2, line 7. Web irs form 2848 is a document provided by the irs that authorizes an individual to appear before them on your behalf. The individual you authorize must be a person eligible to practice before the irs. Web instructions for form 2848 (rev. Form 940, employer's annual federal unemployment (futa) tax return; Web a subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720, quarterly federal excise tax return; Web a separate form 2848 should be completed for each taxpayer. Web use form 2848 to authorize an individual to represent you before the irs.

Appeal Form Appeals Sample Fill Out and Sign Printable PDF Template

Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Taxpayer identification number(s) daytime telephone number. You can learn more about power of attorney in this detailed guide. Web a separate form 2848 should be completed for each taxpayer. The individual you authorize must be a person.

Nevada Tax Power of Attorney Form Power of Attorney Power of Attorney

And form 941, employer's quarterly federal tax return. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic program (stcp) to represent you under a special appearance authorization. Web irs form 2848 is a document provided by the irs that authorizes an individual to appear before them on your behalf. Web.

Learn How to Fill the Form 2848 Power of Attorney and Declaration of

Web instructions for form 2848(rev. Web to withdraw as a representative on a form 2848, write “withdraw” across the top of the first page of the form and sign and write the date below this annotation. Taxpayer must sign and date this form on page 2, line 7. General instructions future developments for the latest information about developments related to.

Instructions for Form 2848 IRS Tax Lawyer

Web a separate form 2848 should be completed for each taxpayer. The individual you authorize must be a person eligible to practice before the irs. There may be a few reasons why someone would represent on your. Web form 2848 from the internal revenue service (irs) is the form to use if someone will represent on your behalf to the.

Download Instructions For IRS Form 2848 Power Of Attorney Power Of

You can learn more about power of attorney in this detailed guide. This form is officially called power of attorney and declaration of representative. Due to federal laws, the irs is required to keep your taxpayer information confidential, so form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them. Form 940, employer's.

Form 2848 YouTube

When completing this section, you need to provide the specific issue(s), the types of forms involved and the year(s) to which this authority applies. After accessing submit forms 2848 and 8821 online through secure access, choose “revocation/withdrawal of an existing authorization” and follow the instructions provided. February 2020) power of attorney and declaration of representative department of the treasury internal.

[Form 2848 Instructions] How to Fill out Form 2848 EaseUS in 2022

Due to federal laws, the irs is required to keep your taxpayer information confidential, so form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them. Web to withdraw as a representative on a form 2848, write “withdraw” across the top of the first page of the form and sign and write the.

All About IRS Form 2848 SmartAsset

There may be a few reasons why someone would represent on your. Taxpayer identification number(s) daytime telephone number. This form is officially called power of attorney and declaration of representative. Taxpayer must sign and date this form on page 2, line 7. Web to withdraw as a representative on a form 2848, write “withdraw” across the top of the first.

Form 2848 Instructions for IRS Power of Attorney Community Tax

There may be a few reasons why someone would represent on your. Department of the treasury internal revenue service general instructions purpose of form Taxpayer must sign and date this form on page 2, line 7. Taxpayer identification number(s) daytime telephone number. February 2020) power of attorney and declaration of representative department of the treasury internal revenue service section references.

The Tax Times New Draft Instructions For Form 2848 & 8821 Emphasize

Department of the treasury internal revenue service general instructions purpose of form General instructions future developments for the latest information about developments related to form Taxpayer identification number(s) daytime telephone number. Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Taxpayer must sign and date this.

Web To Withdraw As A Representative On A Form 2848, Write “Withdraw” Across The Top Of The First Page Of The Form And Sign And Write The Date Below This Annotation.

This form is officially called power of attorney and declaration of representative. Department of the treasury internal revenue service general instructions purpose of form Web form 2848 from the internal revenue service (irs) is the form to use if someone will represent on your behalf to the irs. Web form 2848 also allows you to define the scope of authority you wish to give your representative, depending on how you fill out line 3 in part i.

Web Irs Form 2848 Is A Document Provided By The Irs That Authorizes An Individual To Appear Before Them On Your Behalf.

Web use form 2848 to authorize an individual to represent you before the irs. General instructions future developments for the latest information about developments related to form Web instructions for form 2848 (rev. Taxpayer must sign and date this form on page 2, line 7.

Web A Subsidiary Must File Its Own Form 2848 For Returns That Must Be Filed Separately From The Consolidated Return, Such As Form 720, Quarterly Federal Excise Tax Return;

Due to federal laws, the irs is required to keep your taxpayer information confidential, so form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them. There may be a few reasons why someone would represent on your. The individual you authorize must be a person eligible to practice before the irs. Form 940, employer's annual federal unemployment (futa) tax return;

Taxpayer Identification Number(S) Daytime Telephone Number.

When completing this section, you need to provide the specific issue(s), the types of forms involved and the year(s) to which this authority applies. January 2000) (use with form 2848 revised december 1997.) power of attorney and declaration of representative section references are to the internal revenue code unless otherwise noted. Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Web a separate form 2848 should be completed for each taxpayer.

![[Form 2848 Instructions] How to Fill out Form 2848 EaseUS in 2022](https://i.pinimg.com/originals/5d/2e/e7/5d2ee7f7d89068e86f739e40ac8cd1e8.png)