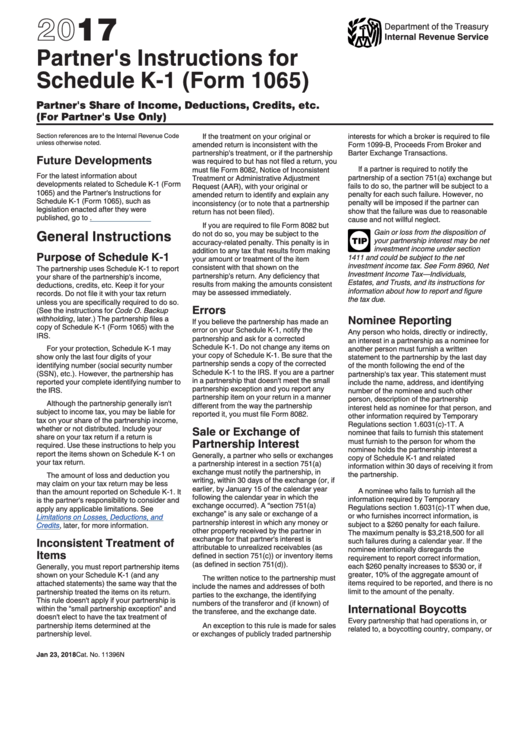

Instructions For K-1 Form 1065

Instructions For K-1 Form 1065 - Form 1065 is used to report the income of. For calendar year 2022, or tax year beginning / / 2022. Web thomson reuters tax & accounting. Ending / / partner’s share of. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. The irs has released draft instructions for the 2019 form 1065 (u.s. Web a 1065 form is the annual us tax return filed by partnerships. 4 digit code used to identify the software developer whose application produced the bar code. Income tax liability with respect. Other deductions, for an individual return in intuit.

Web information about form 1065, u.s. Form 1065 is used to report the income of. 4 digit code used to identify the software developer whose application produced the bar code. Web a 1065 form is the annual us tax return filed by partnerships. This section of the program contains information for part iii of the schedule k. Income tax liability with respect. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Ending / / partner’s share of. Return of partnership income, including recent updates, related forms and instructions on how to file. For calendar year 2022, or tax year beginning / / 2022.

November 1, 2019 · 5 minute read. Income tax liability with respect. The irs has released draft instructions for the 2019 form 1065 (u.s. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. For calendar year 2022, or tax year beginning / / 2022. 4 digit code used to identify the software developer whose application produced the bar code. This section of the program contains information for part iii of the schedule k. Form 1065 is used to report the income of. Other deductions, for an individual return in intuit. Web a 1065 form is the annual us tax return filed by partnerships.

Irs Form 1065 K 1 Instructions Universal Network

Web information about form 1065, u.s. November 1, 2019 · 5 minute read. The irs has released draft instructions for the 2019 form 1065 (u.s. This section of the program contains information for part iii of the schedule k. Department of the treasury internal revenue service.

How to Fill out Schedule K1 (IRS Form 1065) YouTube

Other deductions, for an individual return in intuit. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web a 1065 form is the annual us tax return filed by partnerships. For calendar year 2022, or tax year beginning / / 2022. 4 digit code used to identify the software developer whose application produced.

Form K1 1065 Instructions Ethel Hernandez's Templates

Ending / / partner’s share of. November 1, 2019 · 5 minute read. Web thomson reuters tax & accounting. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Department of the treasury internal revenue service.

Form 8 Box 8 8 Secrets You Will Not Want To Know About Form 8 Box 8

Department of the treasury internal revenue service. For calendar year 2022, or tax year beginning / / 2022. The irs has released draft instructions for the 2019 form 1065 (u.s. Web information about form 1065, u.s. Income tax liability with respect.

Schedule K10 Form 10 Five Awesome Things You Can Learn From Schedule K

4 digit code used to identify the software developer whose application produced the bar code. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Income tax liability with respect. This section of the program contains information for part iii of the schedule k. The irs has released draft instructions for the 2019.

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Web information about form 1065, u.s. Ending / / partner’s share of. Other deductions, for an individual return in intuit. 4 digit code used to identify the software developer whose application produced the bar code.

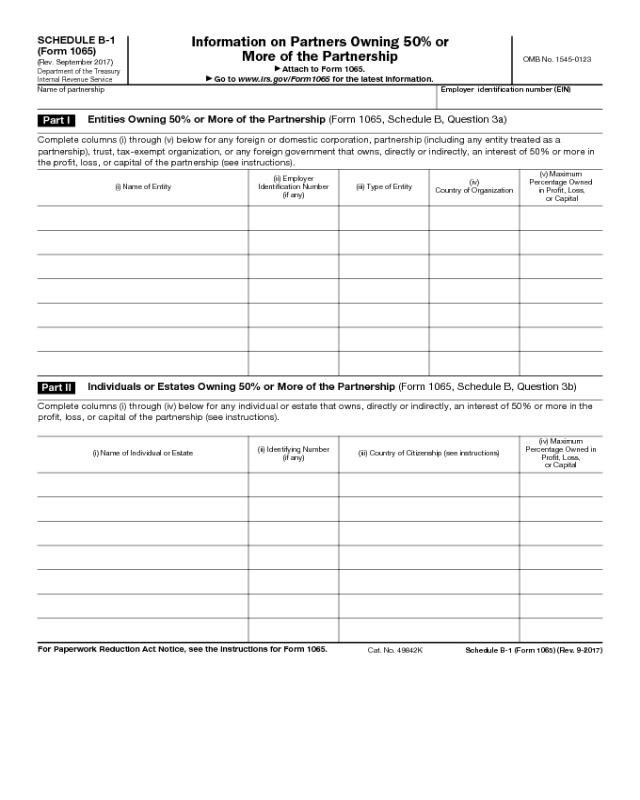

Form 1065 Schedule B1 Edit, Fill, Sign Online Handypdf

For calendar year 2022, or tax year beginning / / 2022. Other deductions, for an individual return in intuit. Form 1065 is used to report the income of. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Return of partnership income, including recent updates, related forms and instructions on how to file.

How to fill out an LLC 1065 IRS Tax form

The new schedules are designed to provide greater clarity for partners on how to compute their u.s. The irs has released draft instructions for the 2019 form 1065 (u.s. This section of the program contains information for part iii of the schedule k. November 1, 2019 · 5 minute read. It is used to report the partnership’s income, gains, losses,.

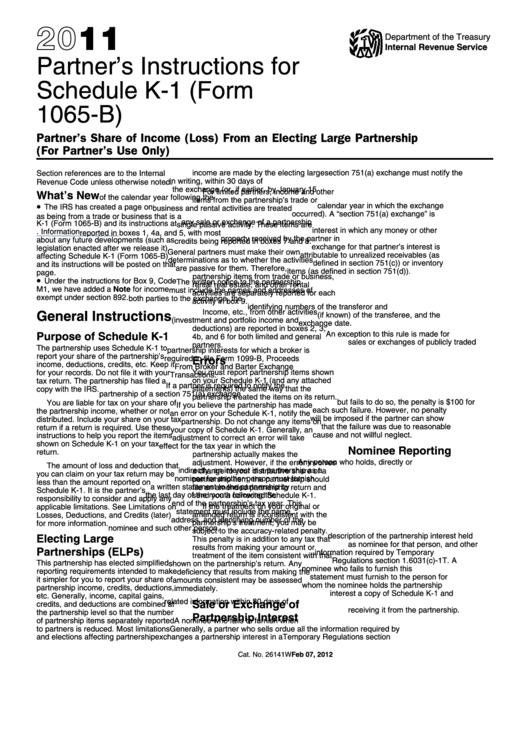

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

This section of the program contains information for part iii of the schedule k. Ending / / partner’s share of. Web information about form 1065, u.s. Form 1065 is used to report the income of. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

4 Digit Code Used To Identify The Software Developer Whose Application Produced The Bar Code.

The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Web thomson reuters tax & accounting. Other deductions, for an individual return in intuit. Department of the treasury internal revenue service.

Web Information About Form 1065, U.s.

The irs has released draft instructions for the 2019 form 1065 (u.s. For calendar year 2022, or tax year beginning / / 2022. Ending / / partner’s share of. November 1, 2019 · 5 minute read.

Income Tax Liability With Respect.

Form 1065 is used to report the income of. Web a 1065 form is the annual us tax return filed by partnerships. This section of the program contains information for part iii of the schedule k. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.