Instructions Form 944

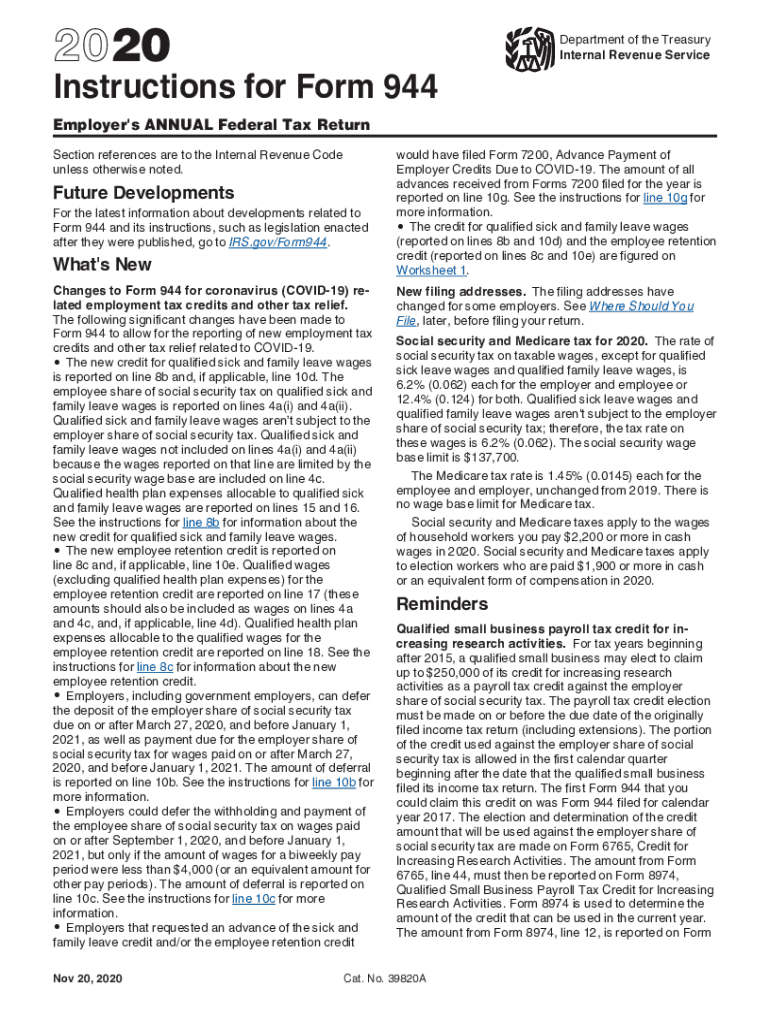

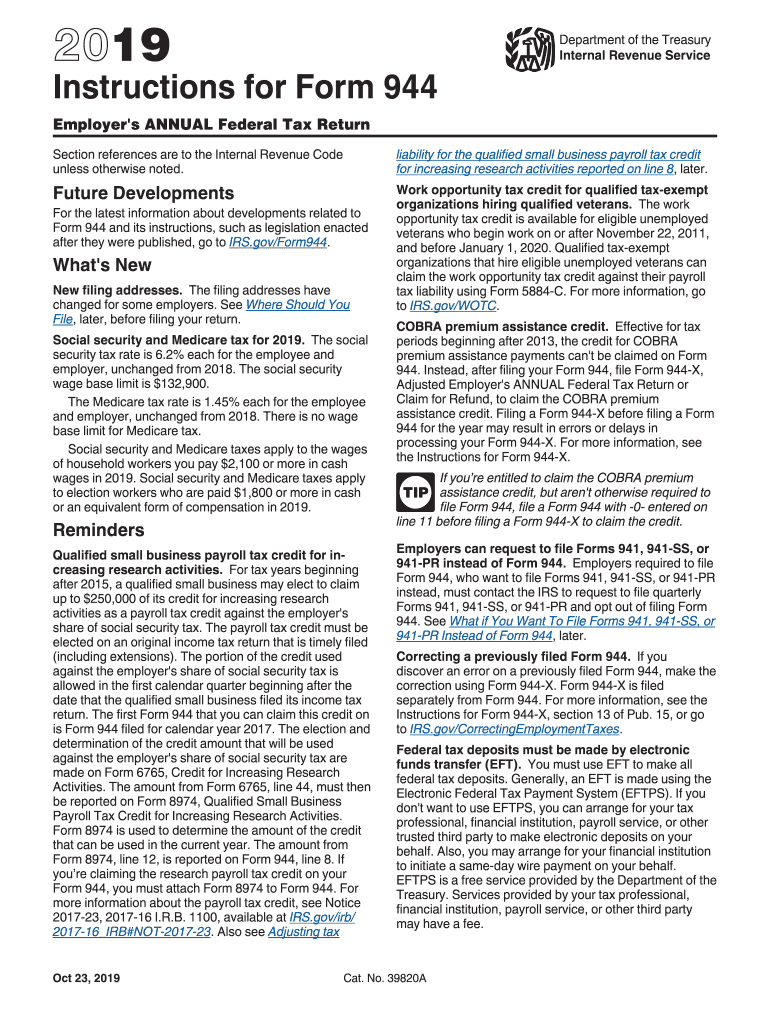

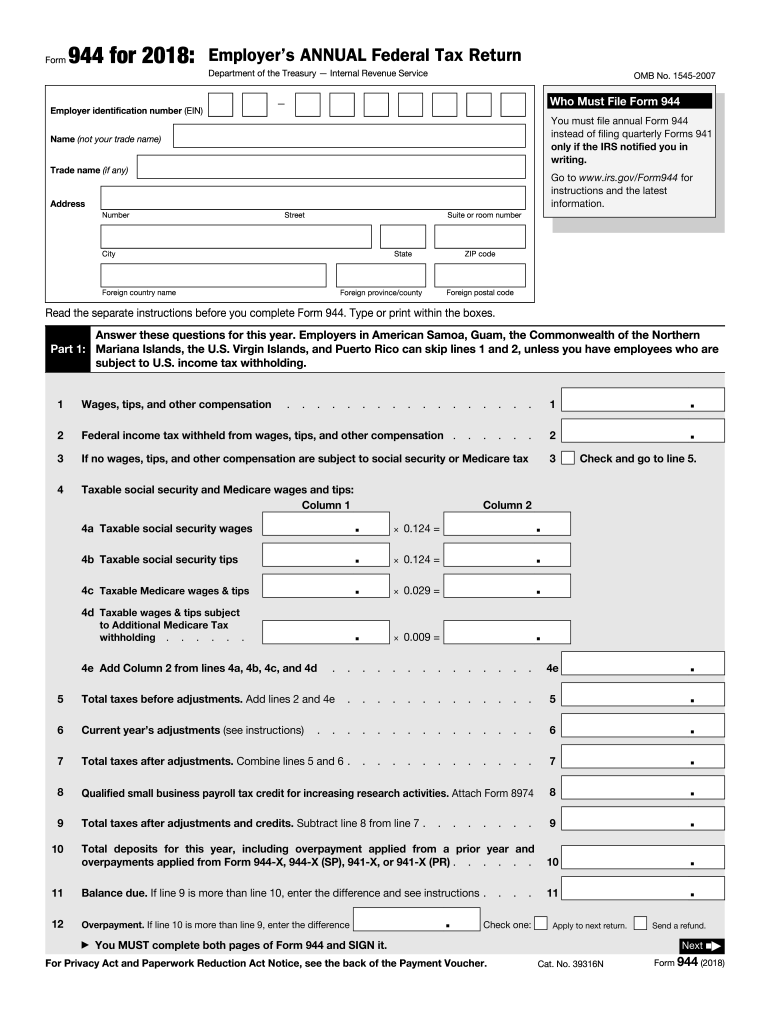

Instructions Form 944 - Small business employers with an. Who must file form 944? Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. For the vast majority of these. Web the irs form 944 takes the place of form 941 if a small business qualifies. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Ad complete irs tax forms online or print government tax documents. Web irs form 944 is an annual filing. Complete, edit or print tax forms instantly. Form 944 is to report the payroll taxes.

The deadline for filing the form is feb. You should always use the latest. The finalized versions of the 2020 form. How should you complete form 944? Try it for free now! November 2009) adjusted employer’s annual federal tax return or claim for refund section references are to. Form 944 is to report the payroll taxes. Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. Web irs form 944 is the employer's annual federal tax return. Get ready for tax season deadlines by completing any required tax forms today.

Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Complete, edit or print tax forms instantly. Web irs form 944 is an annual filing. Ad complete irs tax forms online or print government tax documents. Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. That means employers eligible to file form 944 are only required to complete and submit it once per year. Form 944 is to report the payroll taxes. Get ready for tax season deadlines by completing any required tax forms today. Learn how to fill out the. Web irs form 944:

IRS Form 944 Instructions and Who Needs to File It NerdWallet

Web the irs form 944 takes the place of form 941 if a small business qualifies. For example, these instructions don't discuss who is eligible to claim the credit for qualified sick and family leave wages, the employee. Learn how to fill out the. How should you complete form 944? You should always use the latest.

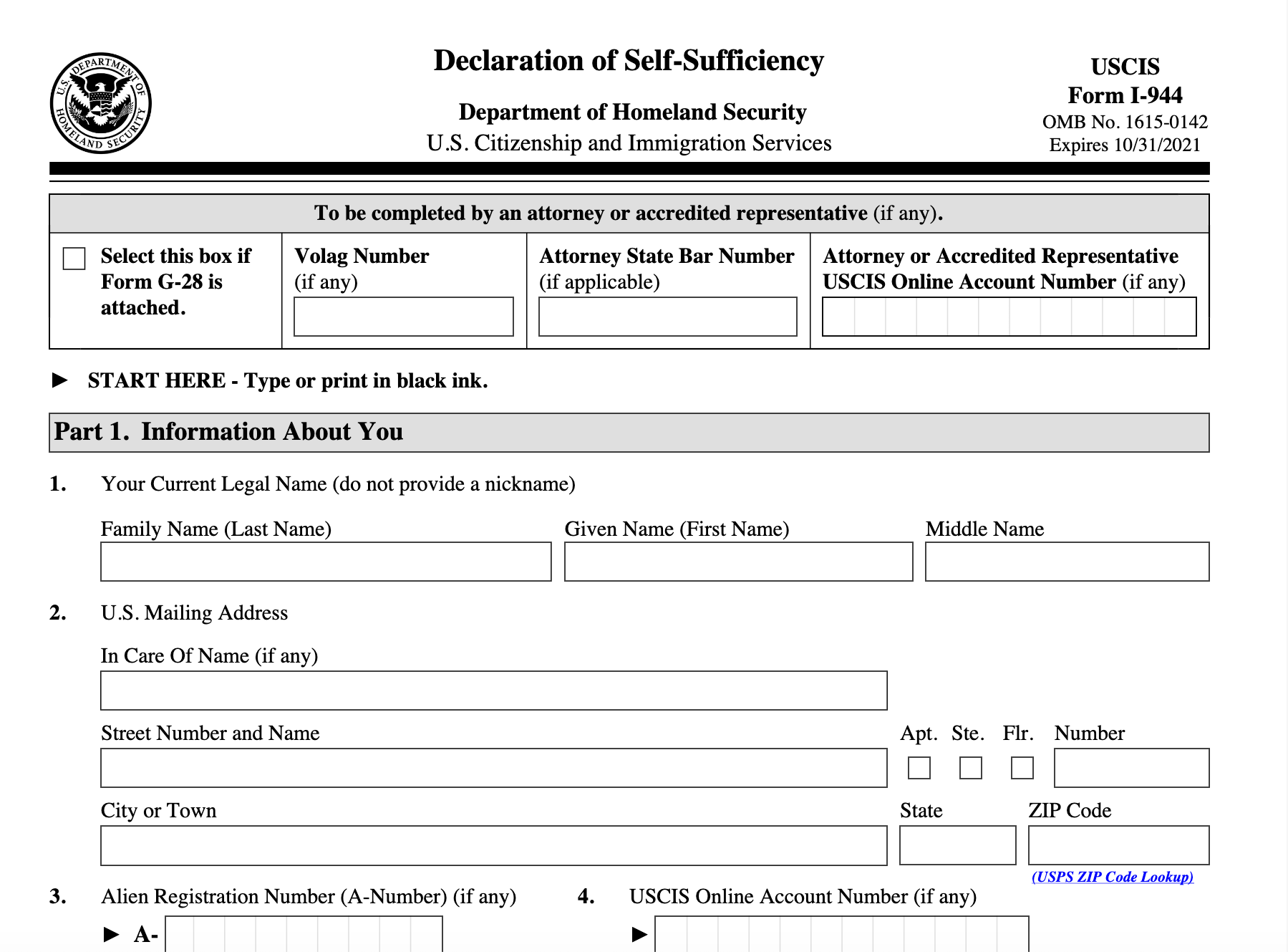

How to Complete Your I944 and Pass the “Public Charge” Test

Form 944 is to report the payroll taxes. The form was introduced by the irs to give smaller employers a break in filing and paying. Web the instructions for form 944. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Web irs form 944:

IRS Form 944 Instructions and Who Needs to File It

How should you complete form 944? Web “form 944,” and “2021” on your check or money order. The deadline for filing the form is feb. Web irs form 944 is an annual filing. If you are a child,.

How To Fill Out Form I944 StepByStep Instructions [2021]

That means employers eligible to file form 944 are only required to complete and submit it once per year. Ad complete irs tax forms online or print government tax documents. The form was introduced by the irs to give smaller employers a break in filing and paying. Form 944 is to report the payroll taxes. Web irs form 944, (employer’s.

What Is Form 944? Plus Instructions

Form 944 is to report the payroll taxes. Web the irs form 944 takes the place of form 941 if a small business qualifies. Ad upload, modify or create forms. If you are a child,. Web irs form 944:

Form 944 2020 Fill Out and Sign Printable PDF Template signNow

Web irs form 944 is an annual filing. Ad upload, modify or create forms. Ad complete irs tax forms online or print government tax documents. Form 944 is to report the payroll taxes. Try it for free now!

Form 944 2019 Fill Out and Sign Printable PDF Template signNow

If you are a child,. Web irs form 944 is the employer's annual federal tax return. Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. Web irs form 944: Learn how to fill out the.

2018 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

How should you complete form 944? November 2009) adjusted employer’s annual federal tax return or claim for refund section references are to. Web the irs form 944 takes the place of form 941 if a small business qualifies. Complete, edit or print tax forms instantly. Web irs form 944:

944 Form 2021 2022 IRS Forms Zrivo

All employers are required to hold their employee’s fica (medicare and social security) and income. Complete, edit or print tax forms instantly. Web “form 944,” and “2021” on your check or money order. Who must file form 944? Web finalized versions of the 2020 form 944 and its instructions are available.

How To Fill Out Form I944 StepByStep Instructions [2021]

Learn how to fill out the. You should always use the latest. Web irs form 944: Web finalized versions of the 2020 form 944 and its instructions are available. November 2009) adjusted employer’s annual federal tax return or claim for refund section references are to.

Try It For Free Now!

All employers are required to hold their employee’s fica (medicare and social security) and income. Form 944 is to report the payroll taxes. Learn how to fill out the. November 2009) adjusted employer’s annual federal tax return or claim for refund section references are to.

Web Irs Form 944 Is An Annual Filing.

Get ready for tax season deadlines by completing any required tax forms today. Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. For example, these instructions don't discuss who is eligible to claim the credit for qualified sick and family leave wages, the employee. Who must file form 944?

Small Business Employers With An.

The deadline for filing the form is feb. Web the irs form 944 takes the place of form 941 if a small business qualifies. The form was introduced by the irs to give smaller employers a break in filing and paying. Web finalized versions of the 2020 form 944 and its instructions are available.

How Should You Complete Form 944?

That means employers eligible to file form 944 are only required to complete and submit it once per year. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. The finalized versions of the 2020 form. Ad complete irs tax forms online or print government tax documents.

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/1-1024x555.png)

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)