Intuit Direct Deposit Form

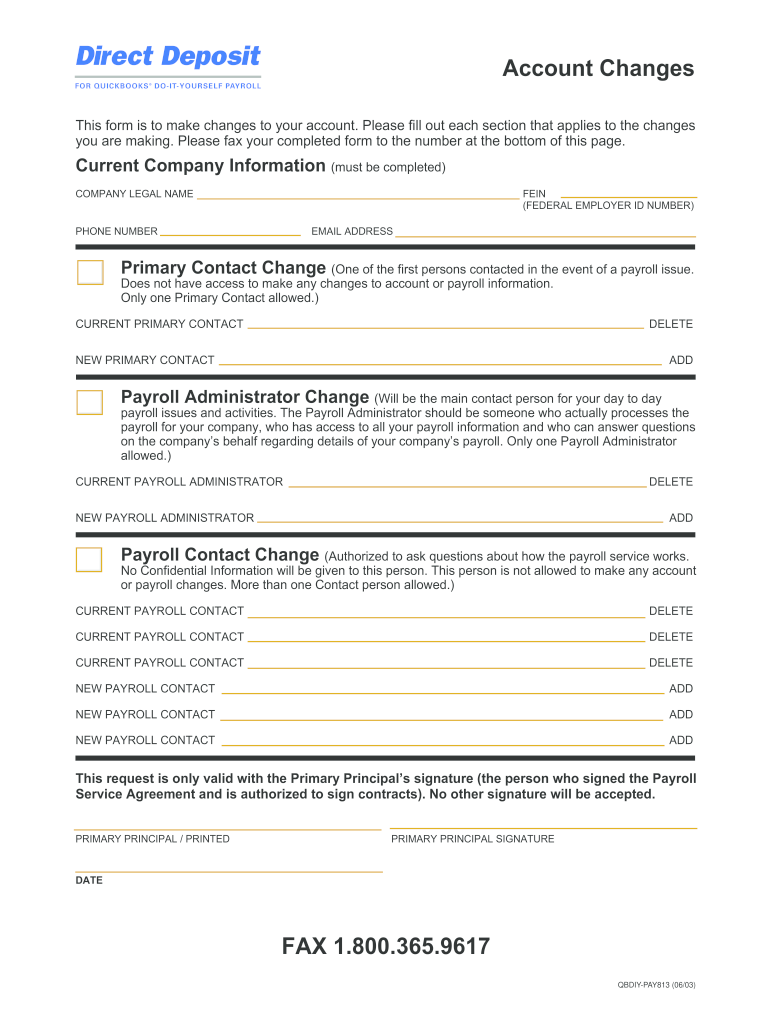

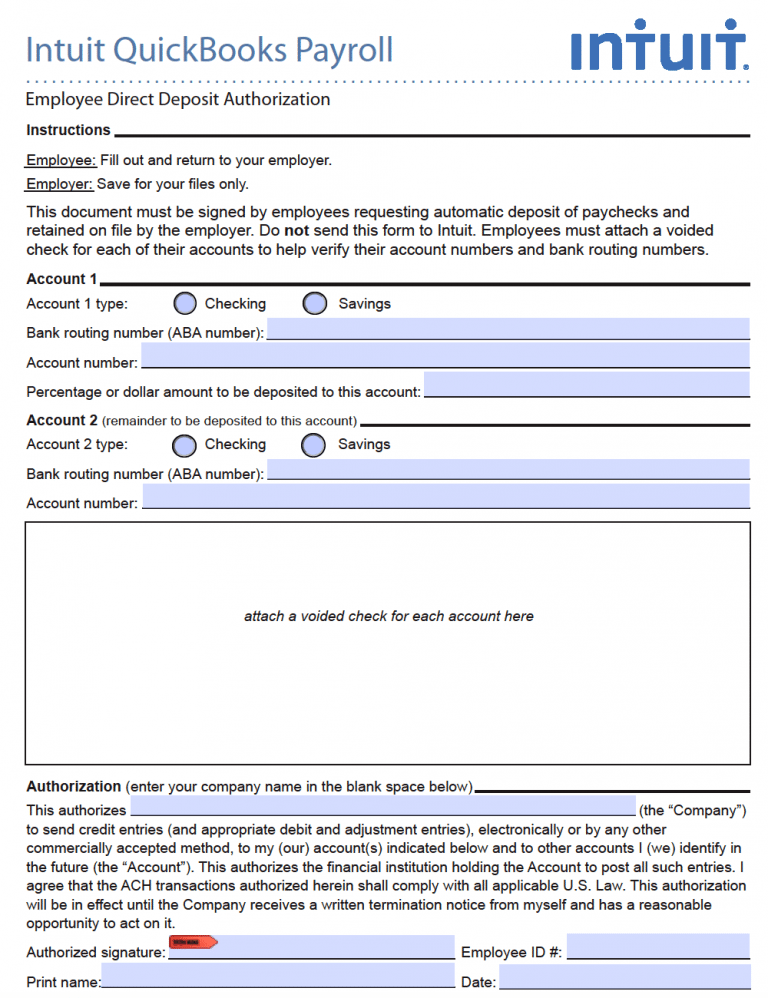

Intuit Direct Deposit Form - Here are some forms commonly printed for new employees (pdf): The first step in setting up direct deposit is to choose a provider. Choose the small pencil icon beside of pay. The intuit (quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. Have your employees fill out, sign, and date a direct deposit authorization form and attach a voided check from the employee’s bank account (not a deposit slip). Upload employee information into payroll system. Account 1 account 1 type: Click the workers tab, then select employees. Ask each employee to fill out, sign, and date the form. In section #5, select direct deposit from the list of options for payment.

(or, choose taxes & forms > employee and contractor setup.) click bank verification under authorization for direct deposit. Upload employee information into payroll system. See set up your company payroll for direct deposit for detailed steps. Pick a direct deposit provider. Here are some forms commonly printed for new employees (pdf): Schedule payroll and direct deposits. Click bank verification next to authorization for direct deposit. Web there are just a few steps to setup direct deposit for your employees. Select filings and click employee setup. The inuit / quickbooks direct deposit authorization allows employees to request direct deposit from their employers.

Web official direct deposit form. The inuit / quickbooks direct deposit authorization allows employees to request direct deposit from their employers. In section #5, select direct deposit from the list of options for payment. Click bank verification next to authorization for direct deposit. Here are some forms commonly printed for new employees (pdf): The form presented and linked below must be completed by the employee and handed into the applicable payroll department to be kept with their files. Select the employee from the list you'd like to enter direct deposit info for. The first step in setting up direct deposit is to choose a provider. Do not send this form to intuit. Web let me get the help you need to get a direct deposit authorization form so your employees can fill it out.

19+ Payment Authorization Forms Free Download Templates Study

Employees must attach a voided check for each of their accounts to help verify their account numbers and bank routing numbers. Have your employees fill out, sign, and date a direct deposit authorization form and attach a voided check from the employee’s bank account (not a deposit slip). Ask each employee to fill out, sign, and date the form. This.

5+ Intuit Direct Deposit Authorization Form Free Download!!

In section #5, select direct deposit from the list of options for payment. Web this document must be signed by employees requesting automatic deposit of paychecks and retained on file by the employer. Here are some forms commonly printed for new employees (pdf): Web official direct deposit form. Click the workers tab, then select employees.

Affiliate Direct Deposit Authorization Fill and Sign Printable

Set up your company payroll for direct deposit. Account 1 account 1 type: Schedule payroll and direct deposits. The inuit / quickbooks direct deposit authorization allows employees to request direct deposit from their employers. Select the employee from the list you'd like to enter direct deposit info for.

Intuit Payroll Direct Deposit Forms Form Resume Examples lV8Ne0r30o

(or, choose taxes & forms > employee and contractor setup.) click bank verification under authorization for direct deposit. The intuit (quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. This feature is only available to quickbooks full service payroll customers. You will need to decide which account.

5 Direct Deposit Form Templates Word Excel Formats

Select filings and click employee setup. See set up your company payroll for direct deposit for detailed steps. Web let me get the help you need to get a direct deposit authorization form so your employees can fill it out. Pick a direct deposit provider. Set up your company payroll for direct deposit.

10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]

Account 1 account 1 type: Web let me get the help you need to get a direct deposit authorization form so your employees can fill it out. Web there are just a few steps to setup direct deposit for your employees. Web this document must be signed by employees requesting automatic deposit of paychecks and retained on file by the.

7+ Quickbooks Direct Deposit Form Free Download [Word, PDF]

Web official direct deposit form. The form presented and linked below must be completed by the employee and handed into the applicable payroll department to be kept with their files. This feature is only available to quickbooks full service payroll customers. Get a direct deposit authorization form. Set up your company payroll for direct deposit.

Intuit Direct Deposit Form Fill Out and Sign Printable PDF Template

Select the employee from the list you'd like to enter direct deposit info for. Web official direct deposit form. You will need to decide which account or accounts you wish your payment to be deposited to then report the information defining the target account (s). Get a direct deposit authorization form. Web there are just a few steps to setup.

Free Intuit / Quickbooks Direct Deposit Authorization Form PDF

On your quickbooks online (qbo), select taxes in the left menu. Set up your company payroll for direct deposit. Select filings and click employee setup. Upload employee information into payroll system. Here are some forms commonly printed for new employees (pdf):

10+ Intuit Direct Deposit Form Word, PDF, Excel Download!

This feature is only available to quickbooks full service payroll customers. See set up your company payroll for direct deposit for detailed steps. Web this document must be signed by employees requesting automatic deposit of paychecks and retained on file by the employer. Select the employee from the list you'd like to enter direct deposit info for. Upload employee information.

(Or, Choose Taxes & Forms > Employee And Contractor Setup.) Click Bank Verification Under Authorization For Direct Deposit.

Schedule payroll and direct deposits. Account 1 account 1 type: Web official direct deposit form. The inuit / quickbooks direct deposit authorization allows employees to request direct deposit from their employers.

The First Step In Setting Up Direct Deposit Is To Choose A Provider.

Do not send this form to intuit. Have your employees fill out, sign, and date a direct deposit authorization form and attach a voided check from the employee’s bank account (not a deposit slip). Web let me get the help you need to get a direct deposit authorization form so your employees can fill it out. Select the employee from the list you'd like to enter direct deposit info for.

This Feature Is Only Available To Quickbooks Full Service Payroll Customers.

Set up your company payroll for direct deposit. The intuit (quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. Select filings and click employee setup. Choose the small pencil icon beside of pay.

Click The Workers Tab, Then Select Employees.

On your quickbooks online (qbo), select taxes in the left menu. In section #5, select direct deposit from the list of options for payment. Employees must attach a voided check for each of their accounts to help verify their account numbers and bank routing numbers. Get a direct deposit authorization form.

![10+ Quickbooks Direct Deposit Form Intuit Direct Deposit [DOWNLOAD]](https://i0.wp.com/www.printabletemplateslab.com/wp-content/uploads/2017/10/5-6.jpg?resize=600%2C730)

![7+ Quickbooks Direct Deposit Form Free Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/09/ddf-1-768x557.png)