Irs Deposit Calendar

Irs Deposit Calendar - Web a section on how to use the tax calendars. In general, you must deposit federal income tax and additional medicare tax withheld as well. Web the tax calendar displays tax deposit and filing due dates. A form to be filed or a deposit to be made by a particular date is. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. A table showing the semiweekly deposit due dates for payroll. Web deposit taxes for payments made on saturday, sunday, monday, and/or tuesday by the following friday.

Web the tax calendar displays tax deposit and filing due dates. A form to be filed or a deposit to be made by a particular date is. A table showing the semiweekly deposit due dates for payroll. In general, you must deposit federal income tax and additional medicare tax withheld as well. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. Web deposit taxes for payments made on saturday, sunday, monday, and/or tuesday by the following friday. Web a section on how to use the tax calendars.

Web a section on how to use the tax calendars. Web the tax calendar displays tax deposit and filing due dates. Web deposit taxes for payments made on saturday, sunday, monday, and/or tuesday by the following friday. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. In general, you must deposit federal income tax and additional medicare tax withheld as well. A form to be filed or a deposit to be made by a particular date is. A table showing the semiweekly deposit due dates for payroll.

Direct Deposit Dates For Tax Refund 2019 Tax Walls

Web the tax calendar displays tax deposit and filing due dates. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. A form to be filed or a deposit to be made by a particular date is. In general, you must deposit federal income tax and additional medicare tax withheld.

IRS Refund Deposit Dates 2023 When is the IRS Sending Refunds? Know

Web deposit taxes for payments made on saturday, sunday, monday, and/or tuesday by the following friday. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. Web the tax calendar displays tax deposit and filing due dates. In general, you must deposit federal income tax and additional medicare tax withheld.

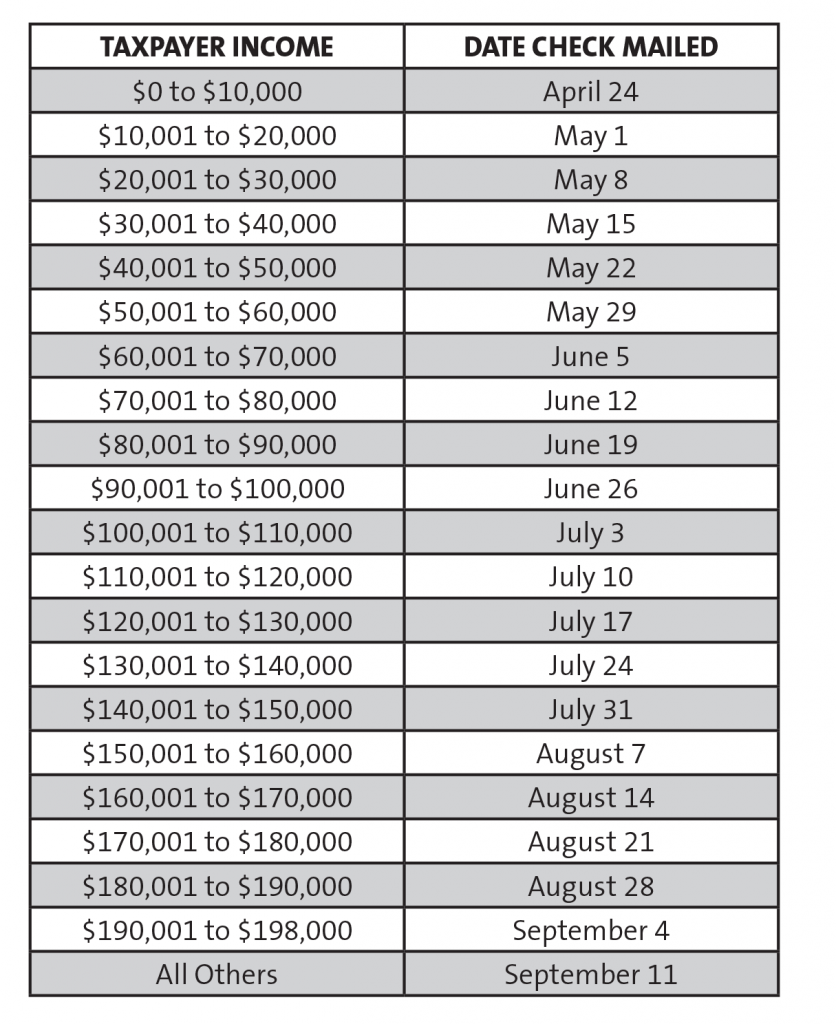

CARES Act Stimulus Payments When Can I Expect to Receive It?

In general, you must deposit federal income tax and additional medicare tax withheld as well. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. Web a section on how to use the tax calendars. A table showing the semiweekly deposit due dates for payroll. A form to be filed.

Irs direct deposit schedule 2022 Get Update News

A table showing the semiweekly deposit due dates for payroll. Web a section on how to use the tax calendars. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. Web deposit taxes for payments made on saturday, sunday, monday, and/or tuesday by the following friday. Web the tax calendar.

Estimated IRS Tax Refund Dates Warner Pearson Vandejen & Consultants

A form to be filed or a deposit to be made by a particular date is. Web the tax calendar displays tax deposit and filing due dates. Web deposit taxes for payments made on saturday, sunday, monday, and/or tuesday by the following friday. In general, you must deposit federal income tax and additional medicare tax withheld as well. A table.

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule

A form to be filed or a deposit to be made by a particular date is. Web a section on how to use the tax calendars. Web the tax calendar displays tax deposit and filing due dates. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. A table showing.

2024 Irs Payment Calendar Cyndi Dorelle

Web deposit taxes for payments made on saturday, sunday, monday, and/or tuesday by the following friday. In general, you must deposit federal income tax and additional medicare tax withheld as well. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. A table showing the semiweekly deposit due dates for.

IRS 941 Deposit Schedules and Tax Liability An Easy Guide Blog

A form to be filed or a deposit to be made by a particular date is. Web a section on how to use the tax calendars. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. Web the tax calendar displays tax deposit and filing due dates. A table showing.

IRS Form 941 Schedule B 2023

In general, you must deposit federal income tax and additional medicare tax withheld as well. Web a section on how to use the tax calendars. Web the tax calendar displays tax deposit and filing due dates. A table showing the semiweekly deposit due dates for payroll. Web deposit taxes for payments made on saturday, sunday, monday, and/or tuesday by the.

Irs Updates On Refunds 2023 Calendar 2023 Get Calender 2023 Update

In general, you must deposit federal income tax and additional medicare tax withheld as well. A form to be filed or a deposit to be made by a particular date is. Web the tax calendar displays tax deposit and filing due dates. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with.

A Table Showing The Semiweekly Deposit Due Dates For Payroll.

A form to be filed or a deposit to be made by a particular date is. Web deposit taxes for payments made on saturday, sunday, monday, and/or tuesday by the following friday. Web a section on how to use the tax calendars. Web the tax calendar displays tax deposit and filing due dates.

Web Go To Your Account Sign In To Make A Tax Deposit Payment Or Schedule Estimated Payments With The Electronic.

In general, you must deposit federal income tax and additional medicare tax withheld as well.