Irs Form 1125A

Irs Form 1125A - Knott 7.71k subscribers join subscribe 27 2.3k views 1 year ago for businesses that sell inventory to customers, the. Cost of goods sold appropriate line (irs) form. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Use fill to complete blank online irs pdf forms for free. To access the form, you will need to open a business return on the desktop and then go to add form/display. Web is the form supported in our program? Web the latest versions of irs forms, instructions, and publications. Get ready for tax season deadlines by completing any required tax forms today. Web form 3115 and the instructions for form 3115. View more information about using irs forms, instructions, publications and other item files.

Complete, edit or print tax forms instantly. A small business taxpayer is a taxpayer that (a) has average annual gross receipts of $25 million or less. Web form 3115 and the instructions for form 3115. Certain entities with total receipts. Use fill to complete blank online irs pdf forms for free. Goods and merchandise purchased for the amount you can deduct for the tax. Please use the link below to. How to access the form: To access the form, you will need to open a business return on the desktop and then go to add form/display. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later.

To access the form, you will need to open a business return on the desktop and then go to add form/display. How to access the form: Cost of goods sold appropriate line (irs) form. However, to use the form, a business must meet. Web form 3115 and the instructions for form 3115. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Goods and merchandise purchased for the amount you can deduct for the tax. Web is the form supported in our program? View more information about using irs forms, instructions, publications and other item files. Complete, edit or print tax forms instantly.

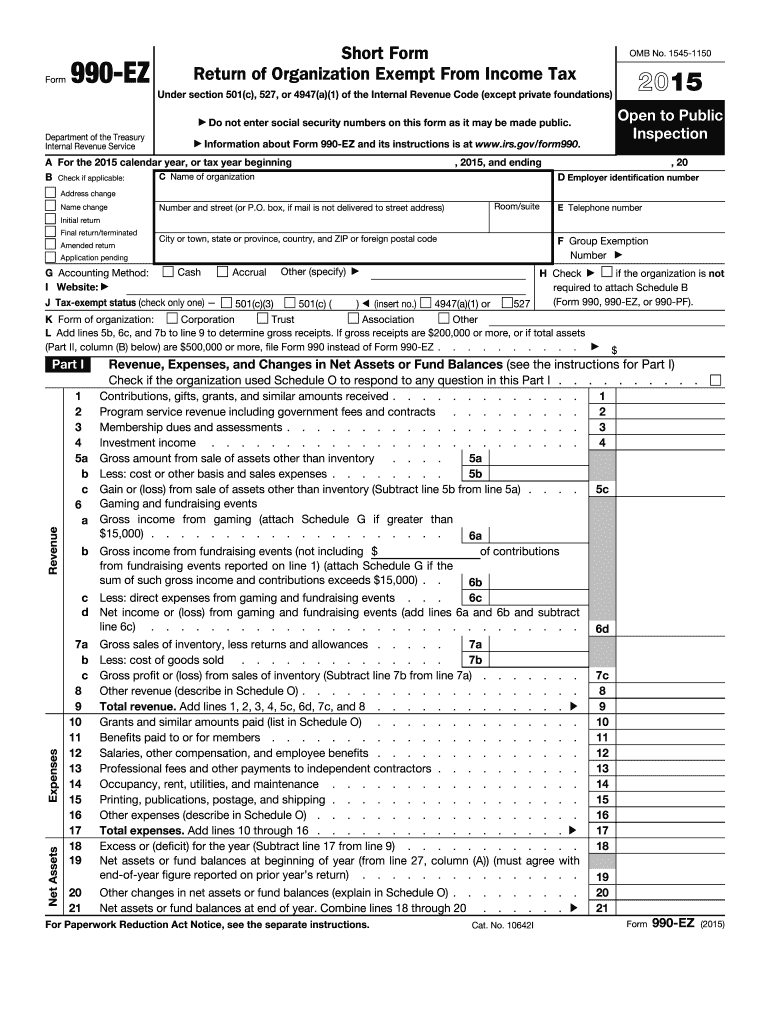

IRS 990EZ 2015 Fill and Sign Printable Template Online US Legal Forms

Web is the form supported in our program? Web the latest versions of irs forms, instructions, and publications. Please use the link below to. A small business taxpayer is a taxpayer that (a) has average annual gross receipts of $25 million or less. View more information about using irs forms, instructions, publications and other item files.

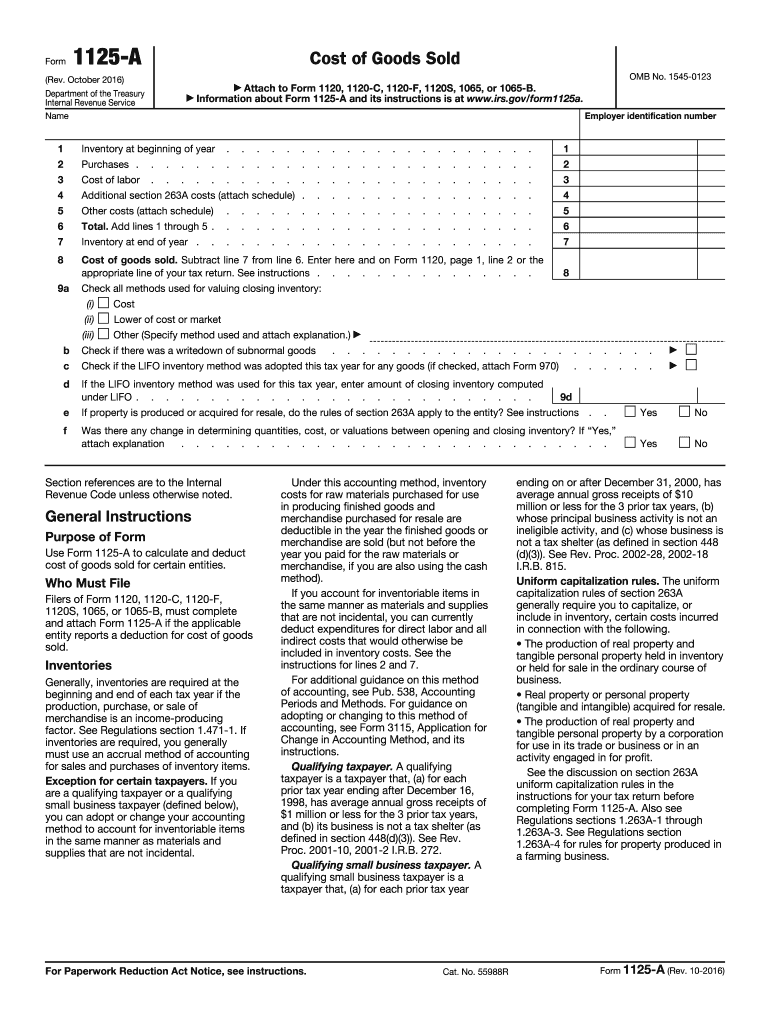

2016 Form IRS 1125A Fill Online, Printable, Fillable, Blank pdfFiller

Use fill to complete blank online irs pdf forms for free. Cost of goods sold appropriate line (irs) form. Ad access irs tax forms. How to access the form: Web the latest versions of irs forms, instructions, and publications.

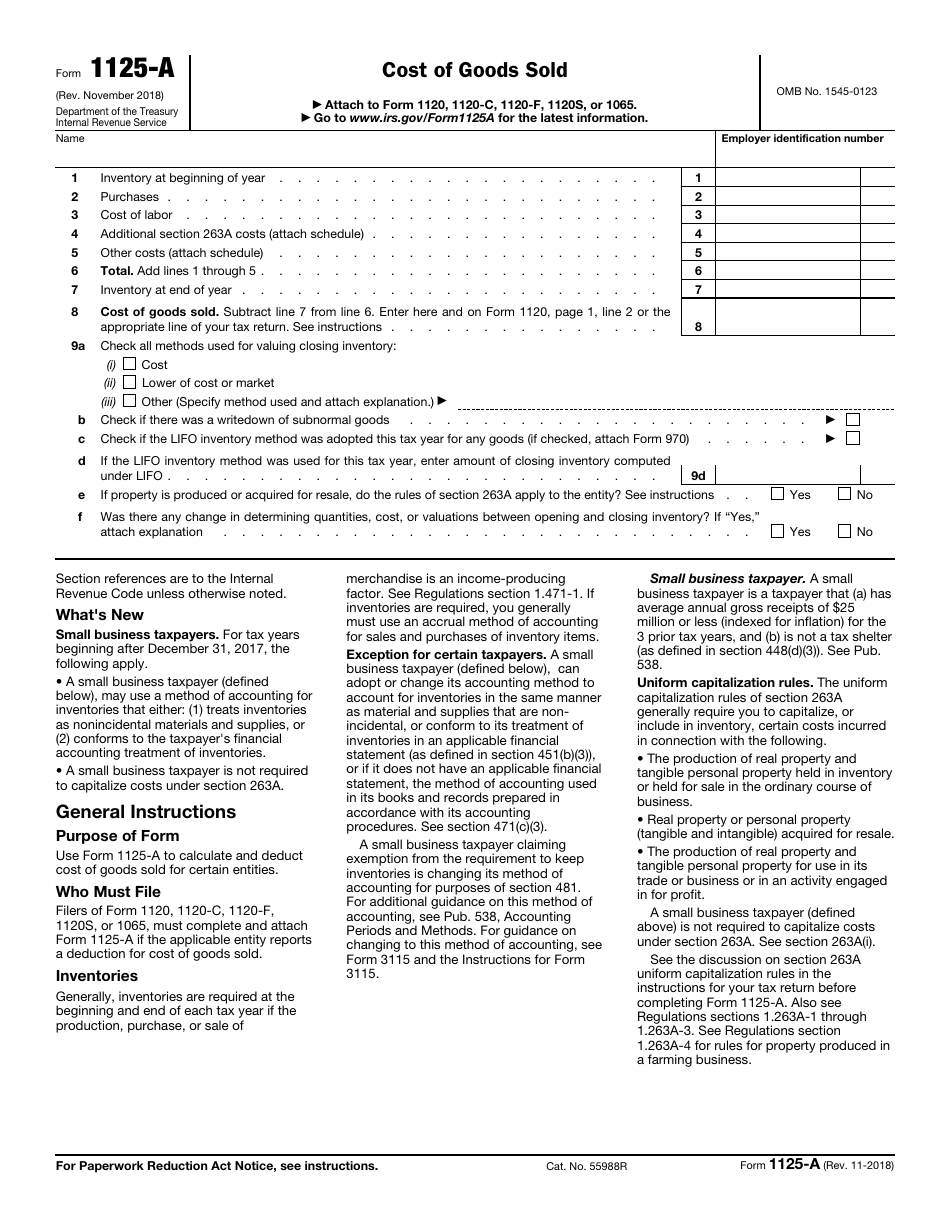

IRS Form 1125A Download Fillable PDF or Fill Online Cost of Goods Sold

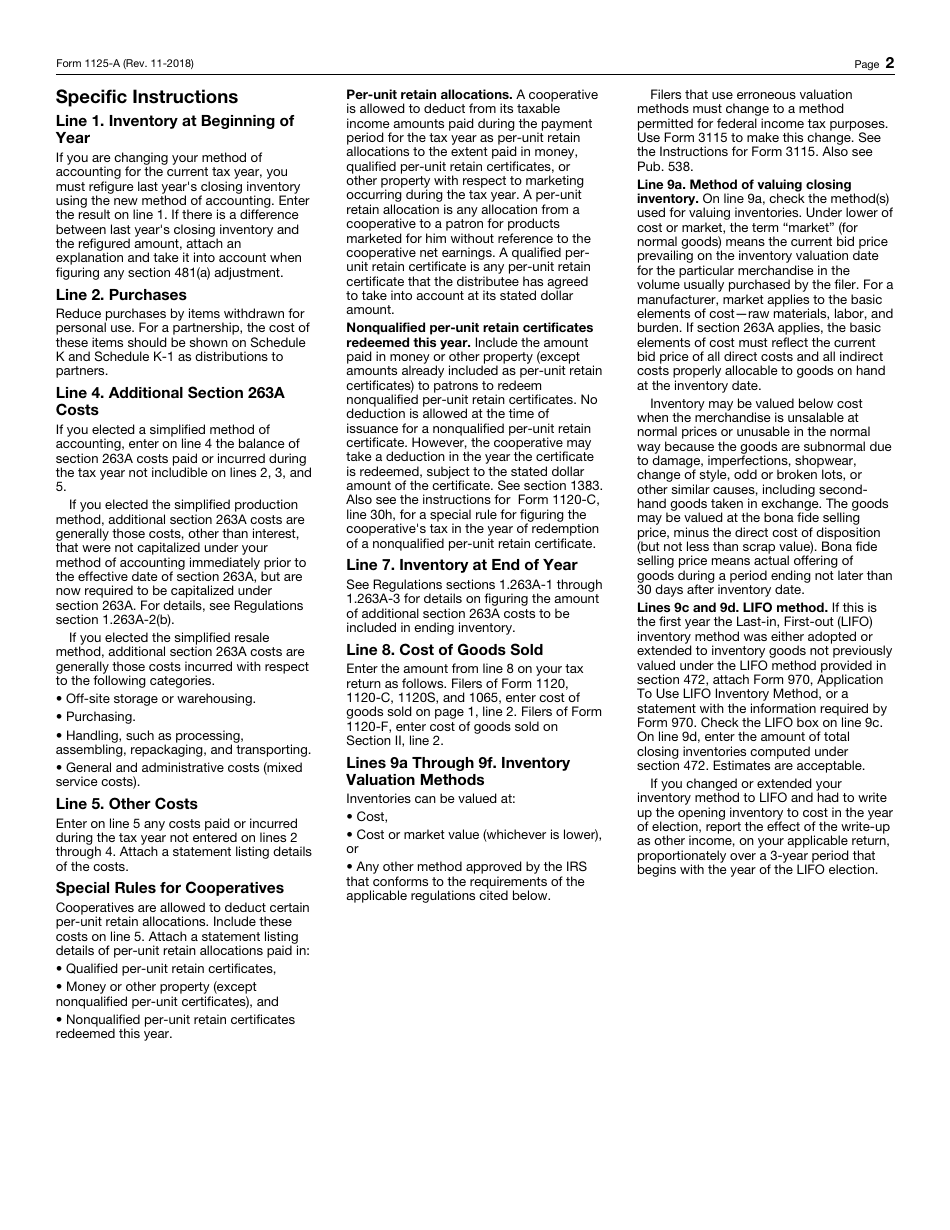

Certain entities with total receipts. Web purpose of formpurchased for use in producing finished merchandise during the tax year on line 2. Please use the link below to. However, to use the form, a business must meet. Cost of goods sold appropriate line (irs) form.

US Internal Revenue Service p9291996 Earned Tax Credit

A small business taxpayer is a taxpayer that (a) has average annual gross receipts of $25 million or less. Please use the link below to. Goods and merchandise purchased for the amount you can deduct for the tax. However, to use the form, a business must meet. Knott 7.71k subscribers join subscribe 27 2.3k views 1 year ago for businesses.

IRS Form 1125A Fill Out, Sign Online and Download Fillable PDF

Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. View more information about using irs forms, instructions, publications and other item files. Use fill to complete blank online irs pdf forms for free. Web form 3115 and the instructions for form.

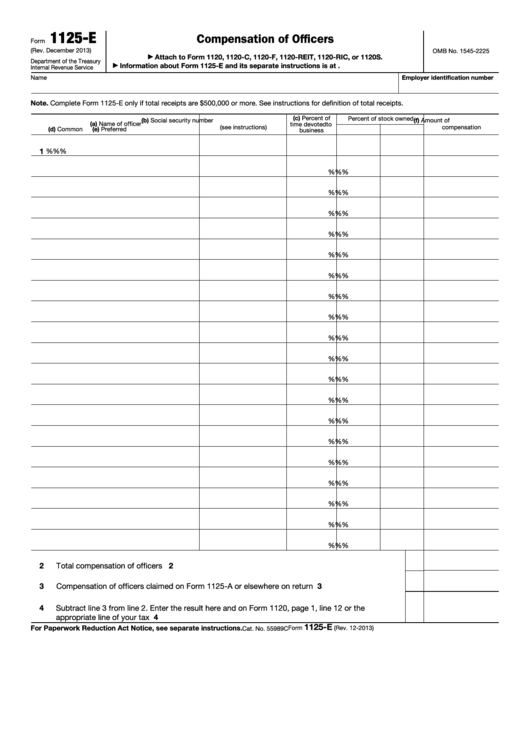

Form 1125E Compensation of Officers (2013) Free Download

Goods and merchandise purchased for the amount you can deduct for the tax. Web purpose of formpurchased for use in producing finished merchandise during the tax year on line 2. Get ready for tax season deadlines by completing any required tax forms today. View more information about using irs forms, instructions, publications and other item files. Ad access irs tax.

Form 10 Attachment Sequence 10 Things To Avoid In Form 10 Attachment

However, to use the form, a business must meet. Ad access irs tax forms. Goods and merchandise purchased for the amount you can deduct for the tax. Get ready for tax season deadlines by completing any required tax forms today. Web form 3115 and the instructions for form 3115.

Form 1120 instructions 2016

Web purpose of formpurchased for use in producing finished merchandise during the tax year on line 2. Web the latest versions of irs forms, instructions, and publications. View more information about using irs forms, instructions, publications and other item files. Web is the form supported in our program? Please use the link below to.

Fillable Form 1125E Compensation Of Officers printable pdf download

Cost of goods sold appropriate line (irs) form. Goods and merchandise purchased for the amount you can deduct for the tax. Web form 3115 and the instructions for form 3115. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Ad access.

A Beginner's Guide to S Corporation Taxes The Blueprint

Knott 7.71k subscribers join subscribe 27 2.3k views 1 year ago for businesses that sell inventory to customers, the. Certain entities with total receipts. Web is the form supported in our program? How to access the form: Use fill to complete blank online irs pdf forms for free.

Ad Access Irs Tax Forms.

Complete, edit or print tax forms instantly. Use fill to complete blank online irs pdf forms for free. View more information about using irs forms, instructions, publications and other item files. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later.

Goods And Merchandise Purchased For The Amount You Can Deduct For The Tax.

Certain entities with total receipts. Web the latest versions of irs forms, instructions, and publications. Web purpose of formpurchased for use in producing finished merchandise during the tax year on line 2. Web form 3115 and the instructions for form 3115.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

How to access the form: To access the form, you will need to open a business return on the desktop and then go to add form/display. However, to use the form, a business must meet. Knott 7.71k subscribers join subscribe 27 2.3k views 1 year ago for businesses that sell inventory to customers, the.

Cost Of Goods Sold Appropriate Line (Irs) Form.

Please use the link below to. Web is the form supported in our program? A small business taxpayer is a taxpayer that (a) has average annual gross receipts of $25 million or less.