Irs Form 13844

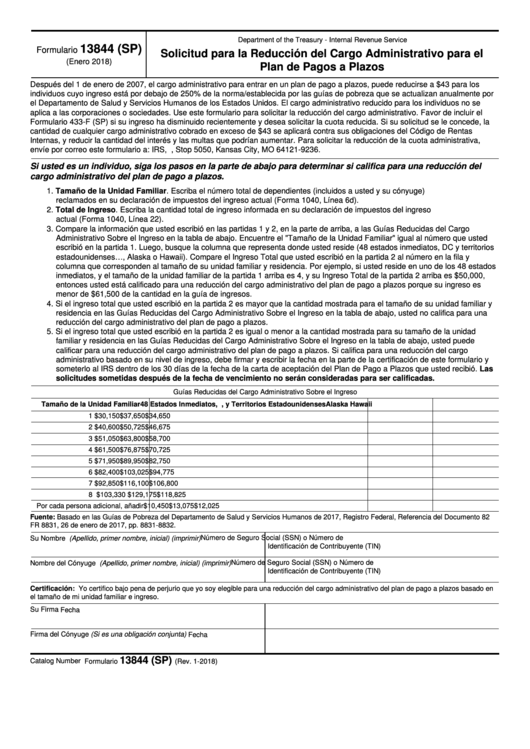

Irs Form 13844 - Irs form 13844, application for reduced user fee for installment agreements , is the tax form that individual taxpayers may use to reduce or eliminate the installment agreement user fee that the irs charges. The irs is working to automate the application process to calculate the appropriate user fees up. Web what is irs form 13844? Web what is irs form 13844? Upload the irs form 13844 application. Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. Affidavit of support under section 213a of the ina. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Instructions for form 941 pdf 13844 (january 2018) application for reduced user fee for installment agreements.

Web what is irs form 13844? The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Edit & sign form 13844 application for reduced user fee from anywhere. To be completed by an attorney or accredited representative (if any). Affidavit of support under section 213a of the ina. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. User fee waivers and reimbursements. Web employer's quarterly federal tax return. Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. Upload the irs form 13844 application.

Web employer's quarterly federal tax return. Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. Form 13844, application for reduced user fee for installment agreements, is used to request the reduction. User fee waivers and reimbursements. Basis for filing affidavit of support Web what is irs form 13844? To be completed by an attorney or accredited representative (if any). The irs is working to automate the application process to calculate the appropriate user fees up. Affidavit of support under section 213a of the ina. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals

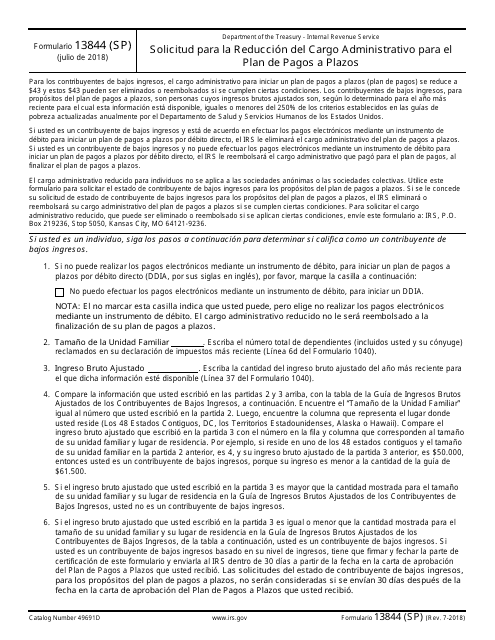

IRS Formulario 13844 (SP) Download Fillable PDF or Fill Online

Basis for filing affidavit of support Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. Affidavit of support under section 213a of the ina. Instructions for form 941 pdf Save your changes and share irs application installment.

Fillable Form 13844 (Sp) Solicitud Para La Reduccion Del Cargo

Save your changes and share irs application installment. Affidavit of support under section 213a of the ina. To be completed by an attorney or accredited representative (if any). User fee waivers and reimbursements. Edit & sign form 13844 application for reduced user fee from anywhere.

IRS Form 13844 Instructions Reduced User Fee Application

Form 13844, application for reduced user fee for installment agreements, is used to request the reduction. To be completed by an attorney or accredited representative (if any). Instructions for form 941 pdf The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Edit & sign form 13844 application for reduced.

Form 13844 Application for Reduced User Fee for Installment

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. The irs is working to automate the application process to calculate the appropriate user fees up. Save your changes and share irs application installment. The user fee for entering into an installment agreement.

Fill irs form 13844 sufficient

Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. Web what is irs form 13844? 13844 (january 2018) application for reduced user fee for installment agreements. The user fee for entering into an installment agreement after january 1,.

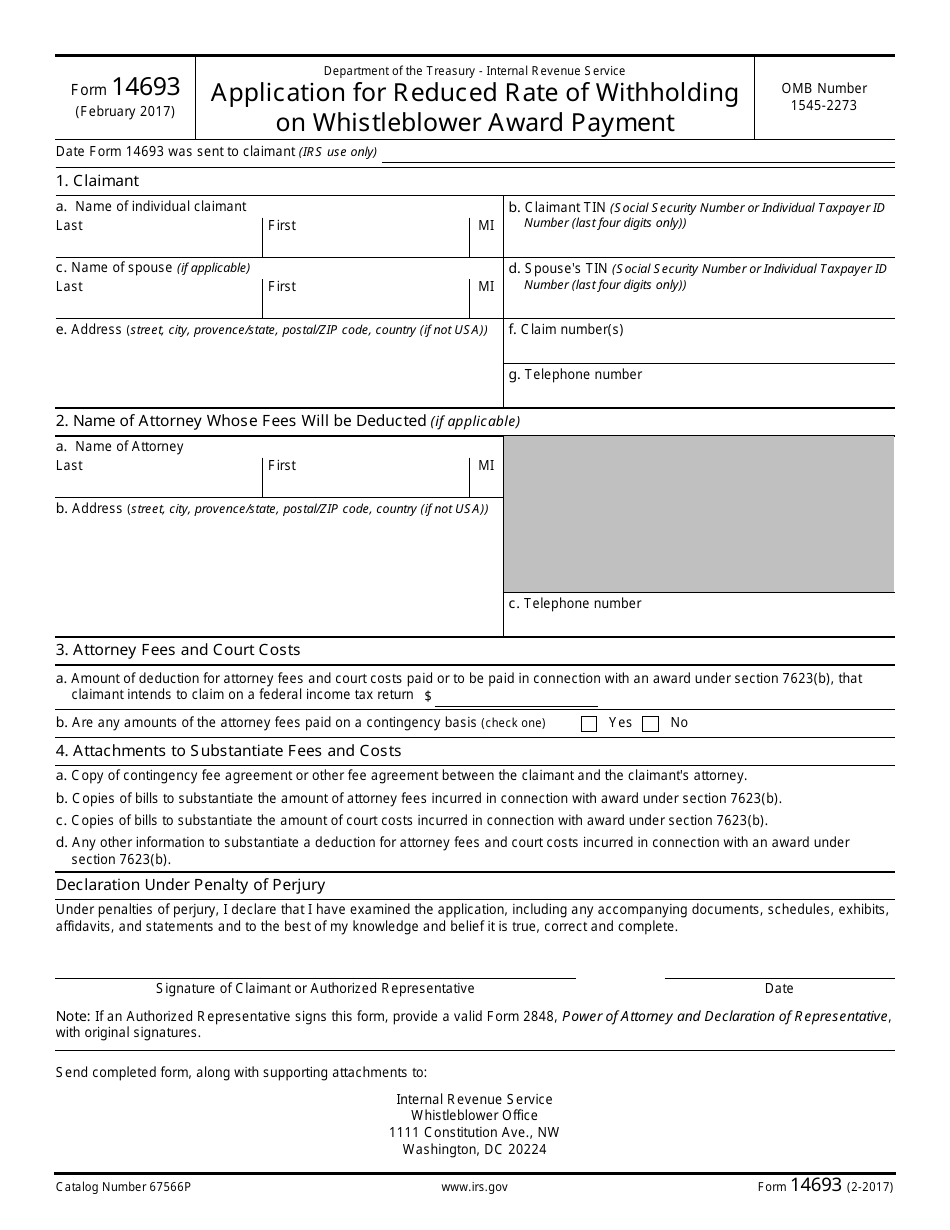

IRS Form 14693 Download Fillable PDF or Fill Online Application for

The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Web we last updated the application for reduced user fee for installment agreements in february 2023, so this is the latest version of form 13844, fully updated for tax year 2022. Irs form 13844, application for reduced user fee for.

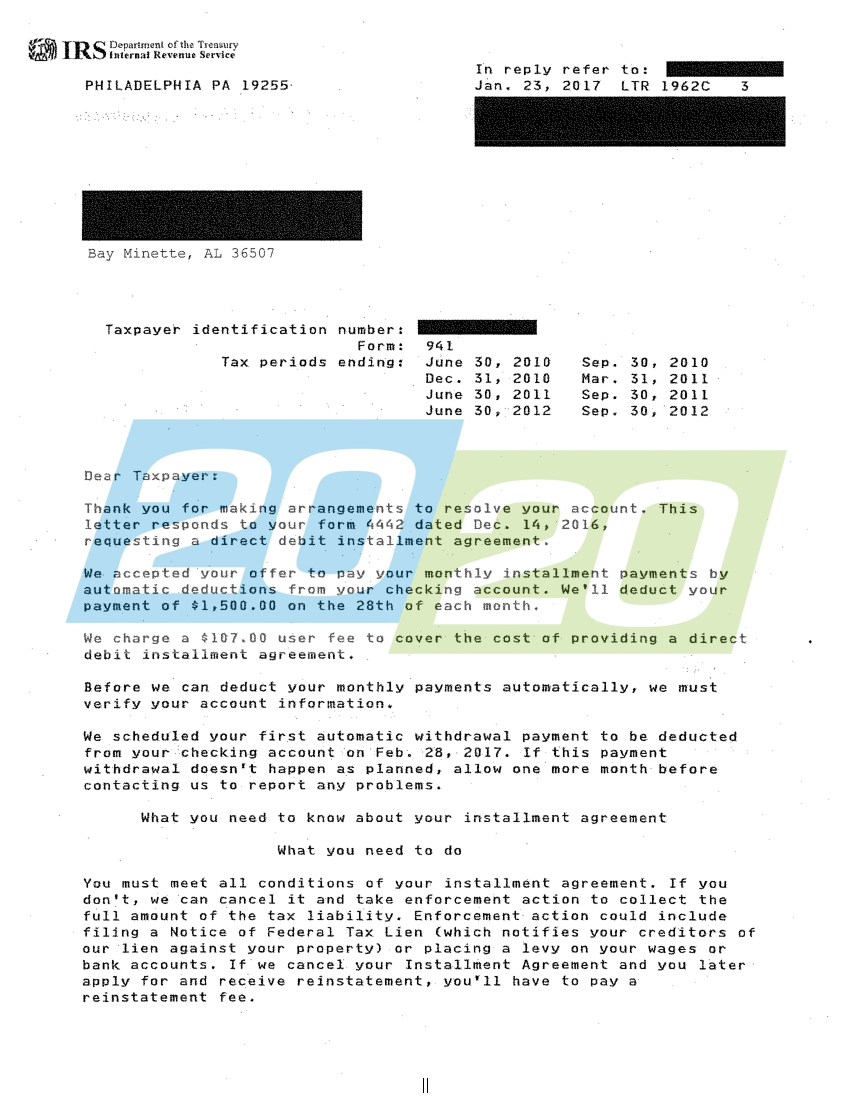

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Save your changes and share irs application installment. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals User fee waivers and reimbursements. The irs is working to automate the application process to calculate the appropriate user fees up. Web employer's quarterly federal tax return.

Fill Free fillable Form 13844 2019 Application Reduced User Fee

Affidavit of support under section 213a of the ina. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Edit & sign form 13844 application for reduced user fee from anywhere. Form 13844, application for reduced user fee for installment agreements, is used to request the reduction. Web we last.

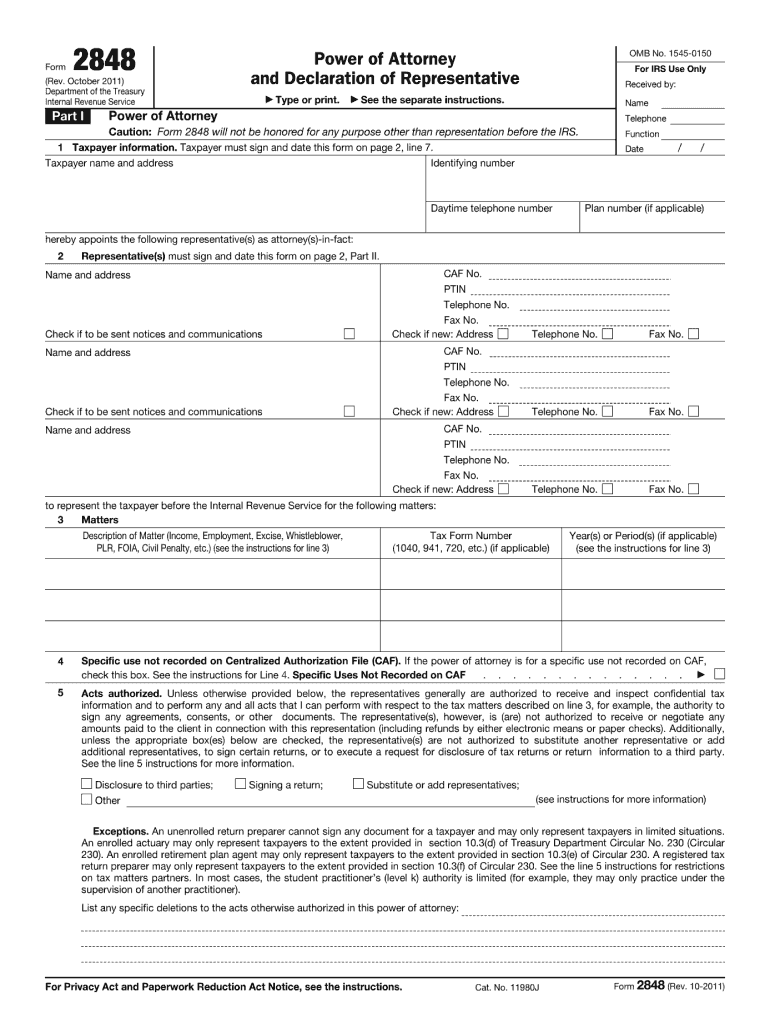

2011 Form IRS 2848 Fill Online, Printable, Fillable, Blank pdfFiller

Irs form 13844, application for reduced user fee for installment agreements , is the tax form that individual taxpayers may use to reduce or eliminate the installment agreement user fee that the irs charges. Save your changes and share irs application installment. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43.

How to Fill Out IRS Form 13844 Pocket Sense

Instructions for form 941 pdf User fee waivers and reimbursements. To be completed by an attorney or accredited representative (if any). Web employer's quarterly federal tax return. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals

13844 (January 2018) Application For Reduced User Fee For Installment Agreements.

Web employer's quarterly federal tax return. User fee waivers and reimbursements. Instructions for form 941 pdf Basis for filing affidavit of support

Affidavit Of Support Under Section 213A Of The Ina.

Save your changes and share irs application installment. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. The user fee for entering into an installment agreement after january 1, 2007 may be reduced to $43 for individuals Edit & sign form 13844 application for reduced user fee from anywhere.

Web What Is Irs Form 13844?

To be completed by an attorney or accredited representative (if any). Web what is irs form 13844? Upload the irs form 13844 application. Irs form 13844, application for reduced user fee for installment agreements , is the tax form that individual taxpayers may use to reduce or eliminate the installment agreement user fee that the irs charges.

Web We Last Updated The Application For Reduced User Fee For Installment Agreements In February 2023, So This Is The Latest Version Of Form 13844, Fully Updated For Tax Year 2022.

The irs is working to automate the application process to calculate the appropriate user fees up. Form 13844, application for reduced user fee for installment agreements, is used to request the reduction.