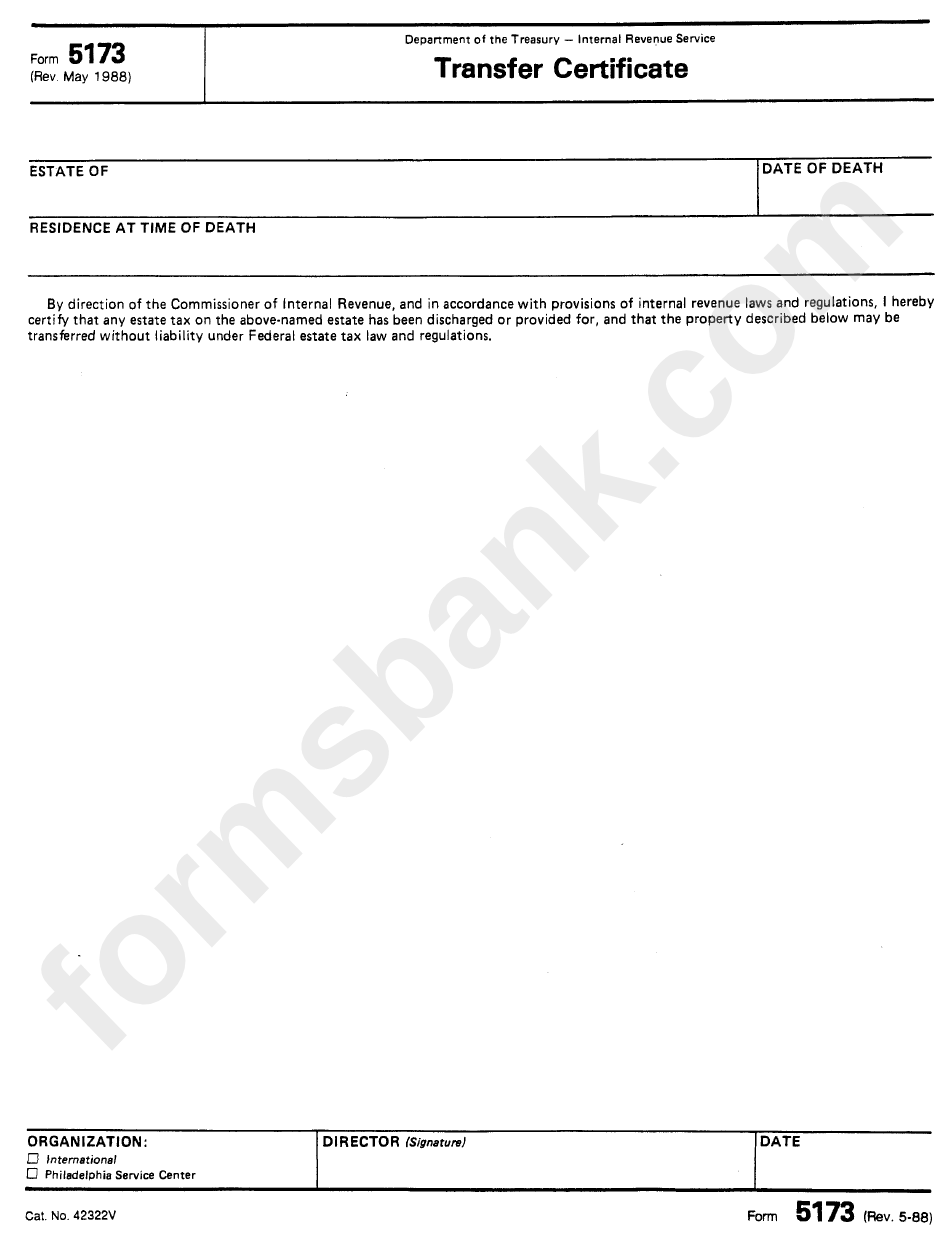

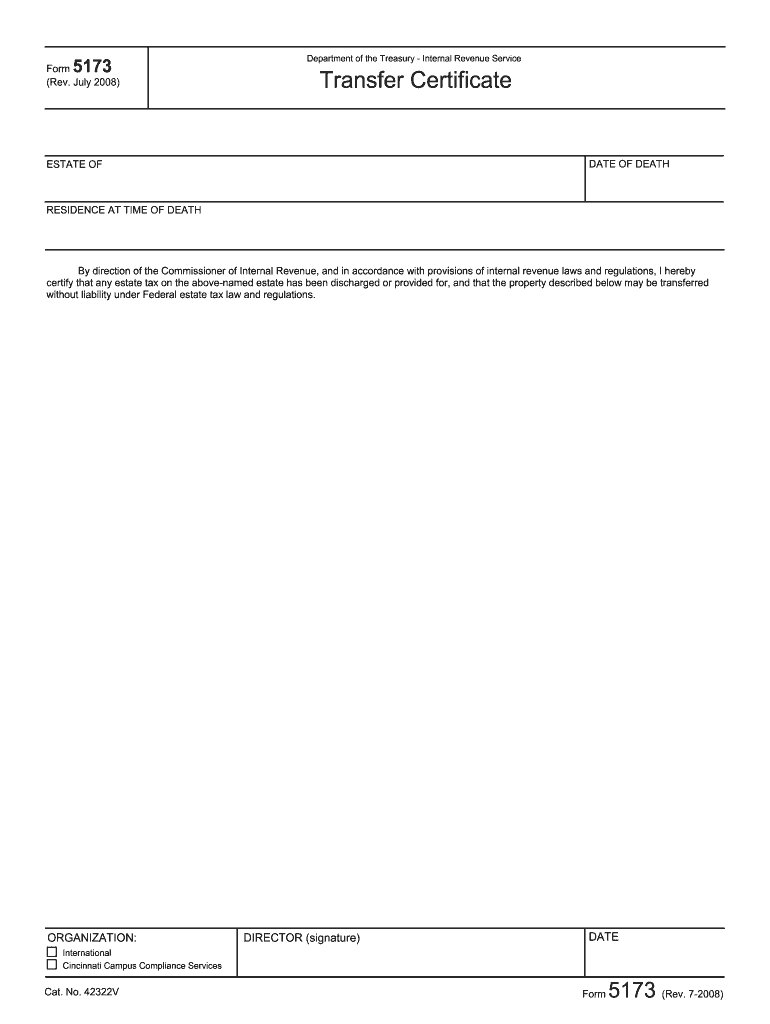

Irs Form 5173

Irs Form 5173 - Irs instructions and specific rules require that the estate tax return must. The following transfer certificate filing requirements apply to the. Web form 5173 is required when a deceased nonresident has u.s. Web transfer certificate (irs form 5173) is received from the internal revenue service. The executor of the person's estate must provide form 5173 to a u.s. It will explain how much you owe and how to pay it. Custodian in order for them to. Web december 10, 2021 purpose (1) this transmits revised irm 4.25.14, estate and gift tax, miscellaneous procedures. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets. Web citizens of the united states use a different tax form (form 706) for estate tax purposes.

Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Material changes (1) the definition to estate. Web what is a form 5173? Form 5713 is used by u.s. Citizens or residents who have brokerage accounts in the united states should be aware that certain investments may. Web tax return year(s) tax return date(s) if the person addressed on this notice is deceased. Executors, surviving joint tenants, trust beneficiaries or other persons legally. Pay the amount you owe by the due date on the notice. The irs will audit the estate tax return and then you will get form 5173. Web form 5173 is required when a deceased nonresident has u.s.

Web transfer certificate (irs form 5173) is received from the internal revenue service. Web form 5173 is required when a deceased nonresident has u.s. Web citizens of the united states use a different tax form (form 706) for estate tax purposes. Web read your notice carefully. Sign it in a few clicks draw your signature, type it,. Citizens or residents who have brokerage accounts in the united states should be aware that certain investments may. Edit your irs form 5173 online type text, add images, blackout confidential details, add comments, highlights and more. Web what is a form 5173? Irs instructions and specific rules require that the estate tax return must. Pay the amount you owe by the due date on the notice.

IRS Form 8038GC Download Fillable PDF or Fill Online Information

Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Web form 5173 is required when a deceased nonresident has u.s. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets. The following transfer.

Form 5173 Transfer Certificate Form Inernal Revenue Service

Web form 5173 is required when a deceased nonresident has u.s. Web transfer certificate (irs form 5173) is received from the internal revenue service. Web tax return year(s) tax return date(s) if the person addressed on this notice is deceased. Sign it in a few clicks draw your signature, type it,. Web what is a form 5173?

IRS 8275 20132021 Fill and Sign Printable Template Online US Legal

Custodian in order for them to. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets. The following transfer certificate filing requirements apply to the. The executor of the person's estate must provide form 5173 to a u.s. What accounts require an irs.

Form 5173 Fill Out and Sign Printable PDF Template signNow

Web what is a form 5173? Sign it in a few clicks draw your signature, type it,. Date of death i already filed a form 1041, income tax return for estates and trusts,. What accounts require an irs federal tax clearance certificate how do i get a tax clearance certificate from the irs? Executors, surviving joint tenants, trust beneficiaries or.

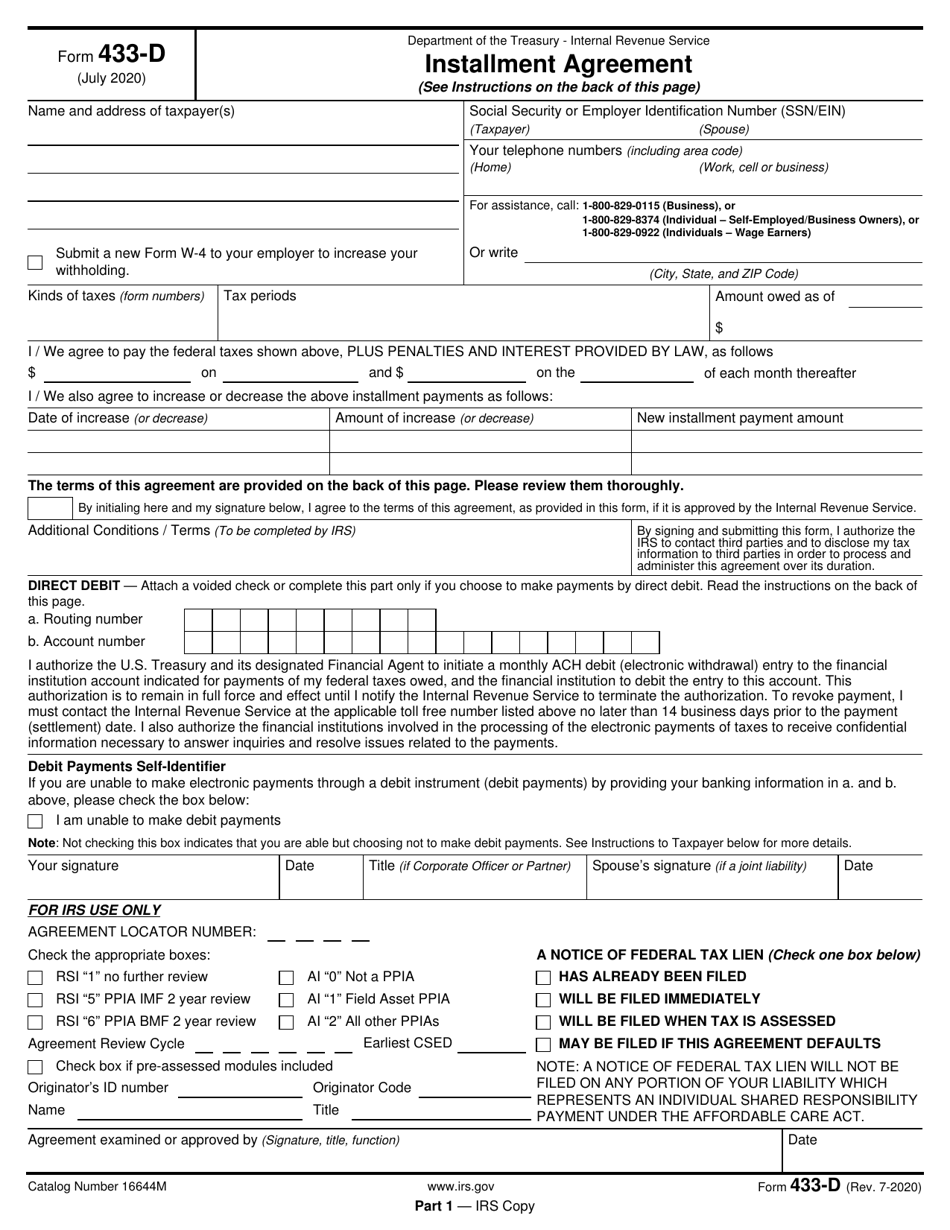

IRS Form 433D Download Fillable PDF or Fill Online Installment

Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. The executor of the person's estate must provide form 5173 to a u.s. Citizens or residents who have brokerage accounts in the united states should be aware that certain investments may. Web in order for you to obtain form 5173 you.

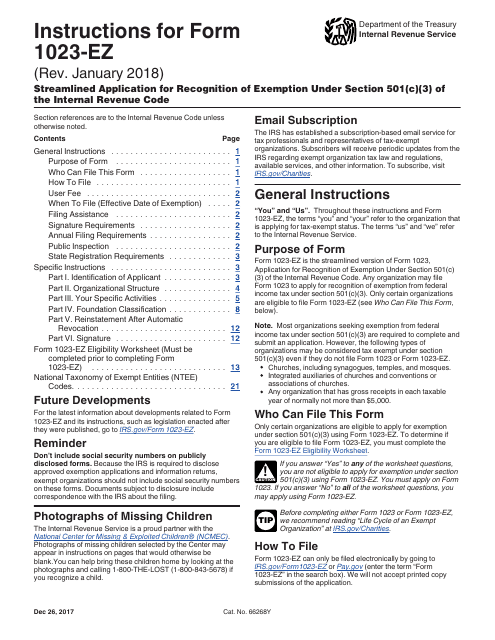

Download Instructions for IRS Form 1023EZ Streamlined Application for

Date of death i already filed a form 1041, income tax return for estates and trusts,. It will explain how much you owe and how to pay it. Web citizens of the united states use a different tax form (form 706) for estate tax purposes. Web form 5173 is required when a deceased nonresident has u.s. Custodian in order for.

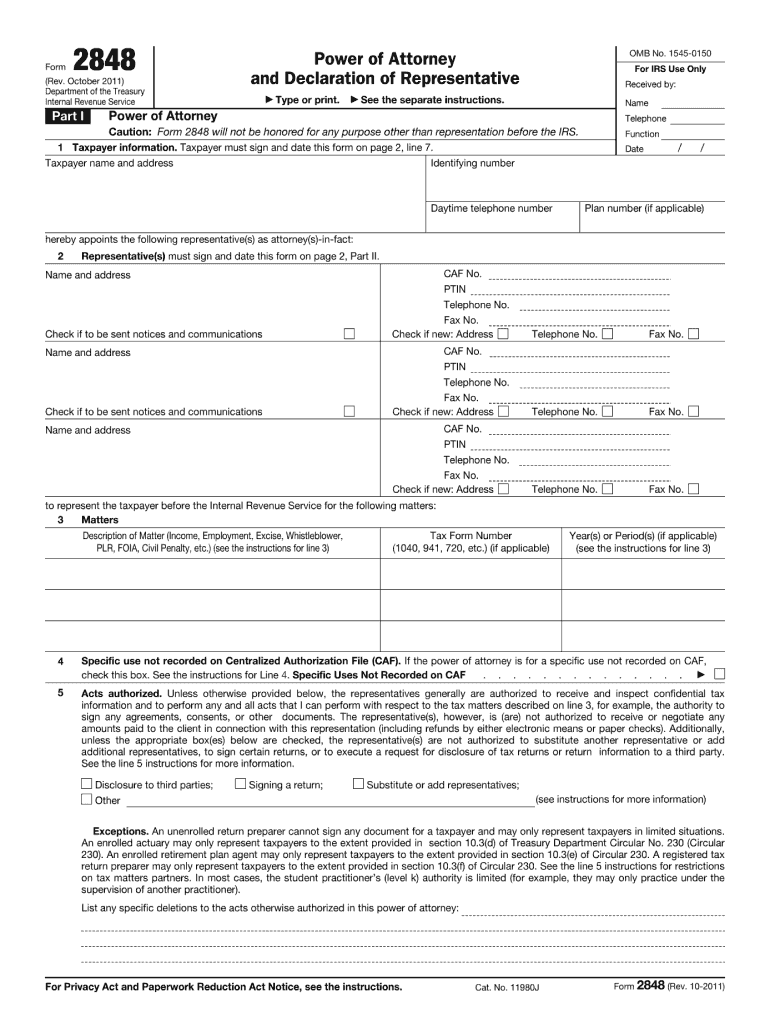

2011 Form IRS 2848 Fill Online, Printable, Fillable, Blank pdfFiller

Irs instructions and specific rules require that the estate tax return must. Web form 5173 is required when a deceased nonresident has u.s. Form 5713 is used by u.s. Edit your irs form 5173 online type text, add images, blackout confidential details, add comments, highlights and more. What accounts require an irs federal tax clearance certificate how do i get.

IRS Tax Forms 836 Free Templates in PDF, Word, Excel Download

It will explain how much you owe and how to pay it. Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Executors, surviving joint tenants, trust beneficiaries or other persons legally. Web form 5173 is required when a deceased nonresident has u.s. Sign it in a few clicks draw your.

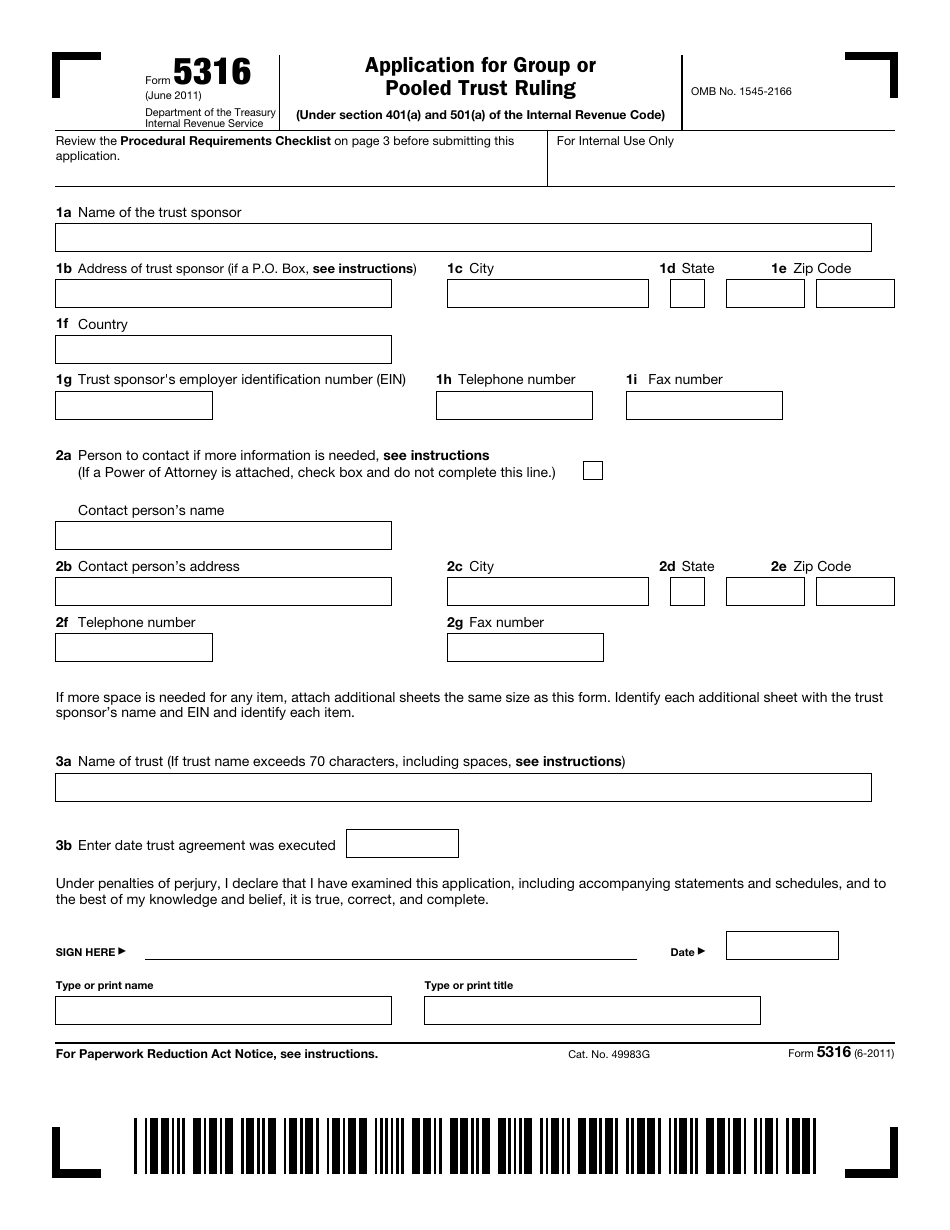

IRS Form 5316 Download Fillable PDF or Fill Online Application for

Web what is a form 5173? Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets. Web transfer certificate (irs form 5173) is received from the internal revenue service. Web in order for you to obtain form 5173 you will need to file.

EDGAR Filing Documents for 000119312516456864

Web form 5173 is required when a deceased nonresident has u.s. Web read your notice carefully. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets. Web transfer certificate (irs form 5173) is received from the internal revenue service. Pay the amount you.

It Will Explain How Much You Owe And How To Pay It.

Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets. Web tax return year(s) tax return date(s) if the person addressed on this notice is deceased. Web read your notice carefully. Web form 5173 is required when a deceased nonresident has u.s.

The Executor Of The Person's Estate Must Provide Form 5173 To A U.s.

Custodian in order for them to. Sign it in a few clicks draw your signature, type it,. Citizens or residents who have brokerage accounts in the united states should be aware that certain investments may. Edit your irs form 5173 online type text, add images, blackout confidential details, add comments, highlights and more.

Web Up To $40 Cash Back Related To Irs Form 5173 Transfer Certificate 1099 Int 2020 9292Voidcorrect Edpayers Name, Street Address, City Or Town, State Or Province,.

Executors, surviving joint tenants, trust beneficiaries or other persons legally. Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Web december 10, 2021 purpose (1) this transmits revised irm 4.25.14, estate and gift tax, miscellaneous procedures. Material changes (1) the definition to estate.

Web Form 5173 Is Required When A Deceased Nonresident Has U.s.

Web what is a form 5173? Irs instructions and specific rules require that the estate tax return must. Pay the amount you owe by the due date on the notice. Web transfer certificate (irs form 5173) is received from the internal revenue service.