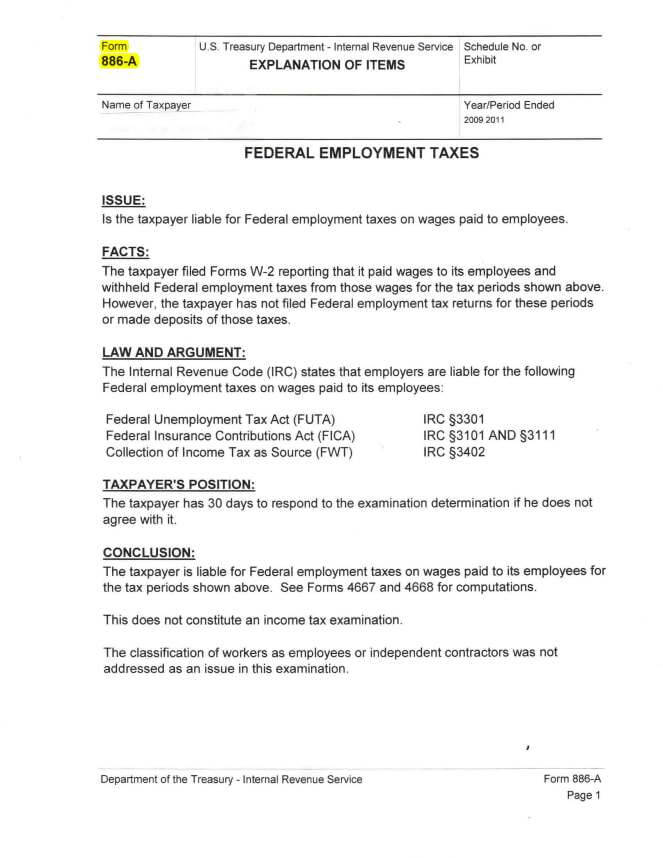

Irs Form 886-A

Irs Form 886-A - Web form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. Supporting documents for dependents taxpayer name. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Locate irs form 886a and click on get form to get started. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions: Web employers that received letter 5005a / form 886a need to take these steps when responding to the irs penalty notice. Make use of the tools we offer to fill out your form. Highlight relevant segments of the documents or blackout sensitive information with tools that signnow gives specifically for that function. Web the best way to modify and esign irs 886a without breaking a sweat. More from h&r block in addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted.

January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions: Web employers that received letter 5005a / form 886a need to take these steps when responding to the irs penalty notice. Make use of the tools we offer to fill out your form. Supporting documents for dependents taxpayer name. This form is extremely important because the irs will want their questions answered by you! Most often, form 886a is used to request information from you during an audit or explain proposed adjustments in an audit. Locate irs form 886a and click on get form to get started. Highlight relevant segments of the documents or blackout sensitive information with tools that signnow gives specifically for that function. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Web form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation.

Most often, form 886a is used to request information from you during an audit or explain proposed adjustments in an audit. Highlight relevant segments of the documents or blackout sensitive information with tools that signnow gives specifically for that function. Locate irs form 886a and click on get form to get started. Web employers that received letter 5005a / form 886a need to take these steps when responding to the irs penalty notice. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. More from h&r block in addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted. Web the best way to modify and esign irs 886a without breaking a sweat. This form is extremely important because the irs will want their questions answered by you! The title of irs form 886a is explanation of items. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions:

Irs Form 886 A Worksheet Ivuyteq

Locate irs form 886a and click on get form to get started. Web the best way to modify and esign irs 886a without breaking a sweat. Web employers that received letter 5005a / form 886a need to take these steps when responding to the irs penalty notice. January 1994) explanations of items schedule number or exhibit name of taxpayer tax.

36 Irs Form 886 A Worksheet support worksheet

More from h&r block in addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted. Make use of the tools we offer to fill out your form. Most often, form 886a is used to request information from you during an audit or.

Audit Form 886A Tax Lawyer Answer & Response to IRS

Web employers that received letter 5005a / form 886a need to take these steps when responding to the irs penalty notice. Supporting documents for dependents taxpayer name. Locate irs form 886a and click on get form to get started. The title of irs form 886a is explanation of items. Since the purpose of form 886a is to explain something, the.

irs form 886a may 2022 Fill Online, Printable, Fillable Blank form

January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions: Most often, form 886a is used to request information from you during an audit or explain proposed adjustments in an audit. Web form 886a, explanation of items explains specific changes to your.

Take W9 Forms 2020 Printable Pdf Calendar Printables Free Blank

Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Highlight relevant segments of the documents or blackout sensitive information with tools that signnow gives specifically for that function. Web employers that received letter 5005a / form 886a need to take these steps when responding to the irs penalty notice. Locate irs.

Irs Form 886 A Worksheet Ivuyteq

Most often, form 886a is used to request information from you during an audit or explain proposed adjustments in an audit. Supporting documents for dependents taxpayer name. Highlight relevant segments of the documents or blackout sensitive information with tools that signnow gives specifically for that function. More from h&r block in addition to sending form 4549 at the end of.

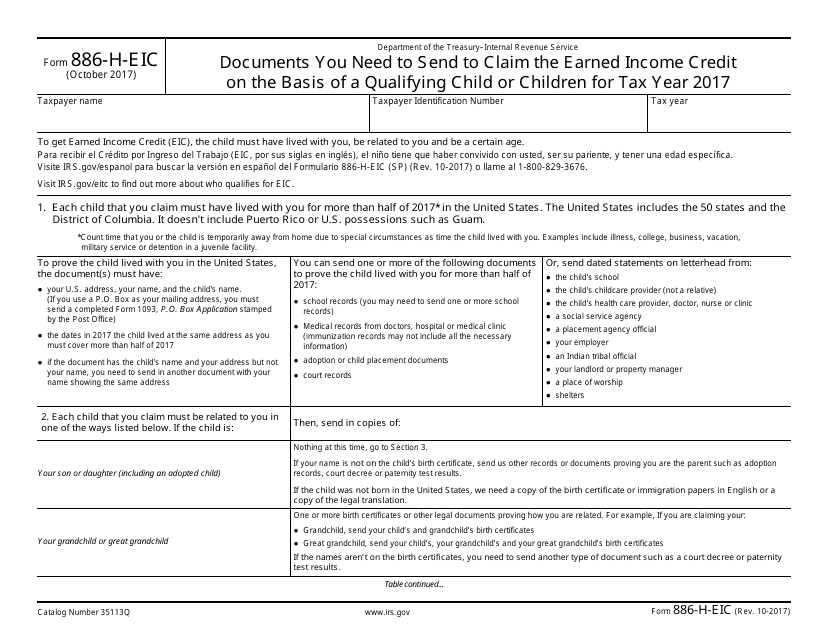

IRS Form 886HEIC Download Fillable PDF or Fill Online Documents You

January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions: Web employers that received letter 5005a / form 886a need to take these steps when responding to the irs penalty notice. More from h&r block in addition to sending form 4549 at.

IRS Form 8868 Download Fillable PDF or Fill Online Application for

Highlight relevant segments of the documents or blackout sensitive information with tools that signnow gives specifically for that function. This form is extremely important because the irs will want their questions answered by you! The title of irs form 886a is explanation of items. Web form 886a, explanation of items explains specific changes to your return and why the irs.

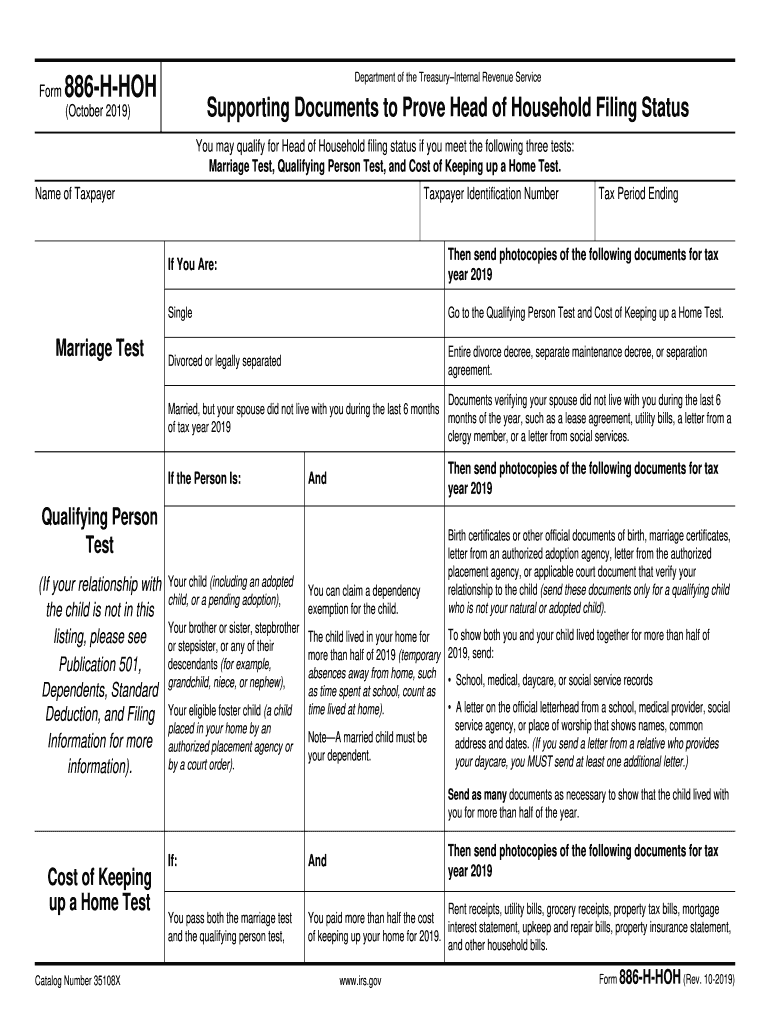

H Hoh Fill Out and Sign Printable PDF Template signNow

More from h&r block in addition to sending form 4549 at the end of an audit, the auditor attaches form 886a to provide an explanation as to why your documentation was not accepted. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following.

Irs Form 886 A Worksheet Escolagersonalvesgui

January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions: Make use of the tools we offer to fill out your form. Locate irs form 886a and click on get form to get started. Web the best way to modify and esign.

Web Form 886A, Explanation Of Items Explains Specific Changes To Your Return And Why The Irs Didn’t Accept Your Documentation.

Make use of the tools we offer to fill out your form. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the appropriate boxes and answer the following questions: Web the best way to modify and esign irs 886a without breaking a sweat. Highlight relevant segments of the documents or blackout sensitive information with tools that signnow gives specifically for that function.

More From H&R Block In Addition To Sending Form 4549 At The End Of An Audit, The Auditor Attaches Form 886A To Provide An Explanation As To Why Your Documentation Was Not Accepted.

Locate irs form 886a and click on get form to get started. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Web employers that received letter 5005a / form 886a need to take these steps when responding to the irs penalty notice. Supporting documents for dependents taxpayer name.

The Title Of Irs Form 886A Is Explanation Of Items.

Most often, form 886a is used to request information from you during an audit or explain proposed adjustments in an audit. This form is extremely important because the irs will want their questions answered by you!