Irs Form 941 Refund Status

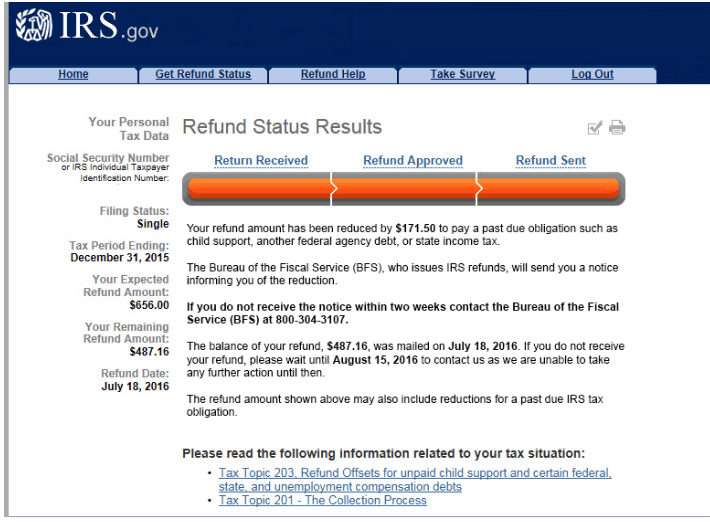

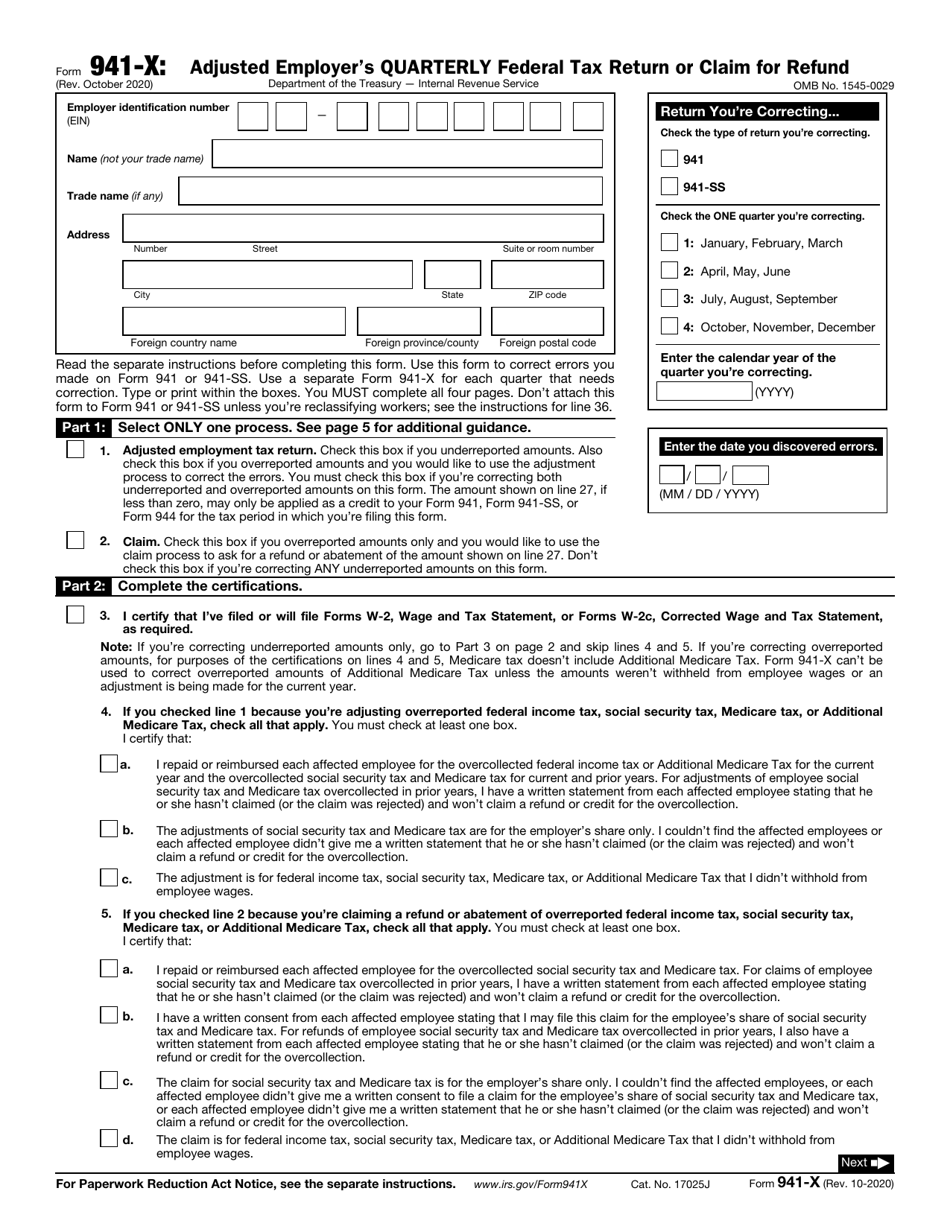

Irs Form 941 Refund Status - Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Web to claim or correct your credit by adjusting your employment tax return, use the adjusted return and instructions that apply to your business or organization and the relevant tax. Web check your amended return status. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Employers engaged in a trade or business who pay compensation form 9465; Type or print within the boxes. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. Web to obtain the refund status of your 2022 tax return, you must enter your social security number, your date of birth, the type of tax and whether it is an amended return. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Request for transcript of tax return.

Web check your amended return status. Type or print within the boxes. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Web november 30, 2021 08:20 am hello! Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an employer id number (ein) check your. Request for transcript of tax return. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Employers engaged in a trade or business who pay compensation form 9465;

Employers engaged in a trade or business who pay compensation form 9465; Those returns are processed in. Type or print within the boxes. Web to obtain the refund status of your 2022 tax return, you must enter your social security number, your date of birth, the type of tax and whether it is an amended return. Web check your amended return status. Request for transcript of tax return. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an employer id number (ein) check your. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty.

mattpencedesign Missouri State Tax Refund Status

Get an identity protection pin (ip pin) pay. You must complete all five pages. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. Those returns are processed in. Type or print within the boxes.

what can i do if i lost my irs refund check Fill Online, Printable

You must complete all five pages. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Get an identity protection pin (ip pin) pay. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web for businesses, corporations, partnerships and.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

You must complete all five pages. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an employer id number (ein) check your. Web check.

IRS Form 941X Download Fillable PDF or Fill Online Adjusted Employer's

Request for transcript of tax return. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Get an identity protection pin (ip pin) pay. Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an.

The IRS just announced the first day to receive federal tax refunds

Web check your federal tax refund status. Web for businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf) accounts. Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround.

IRS Form 941— Tax Filing Basics for Business Owners

However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web for businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf) accounts. Request for transcript of tax return. Web how to file when to file where to file update my information popular.

Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

Those returns are processed in. Web payroll tax returns. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. The request for mail order forms may be used to order one copy or. Web to claim or correct your credit.

How to fill out IRS Form 941 2019 PDF Expert

Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Get an identity protection pin (ip pin) pay. However, if you pay an amount with form 941 that should’ve been.

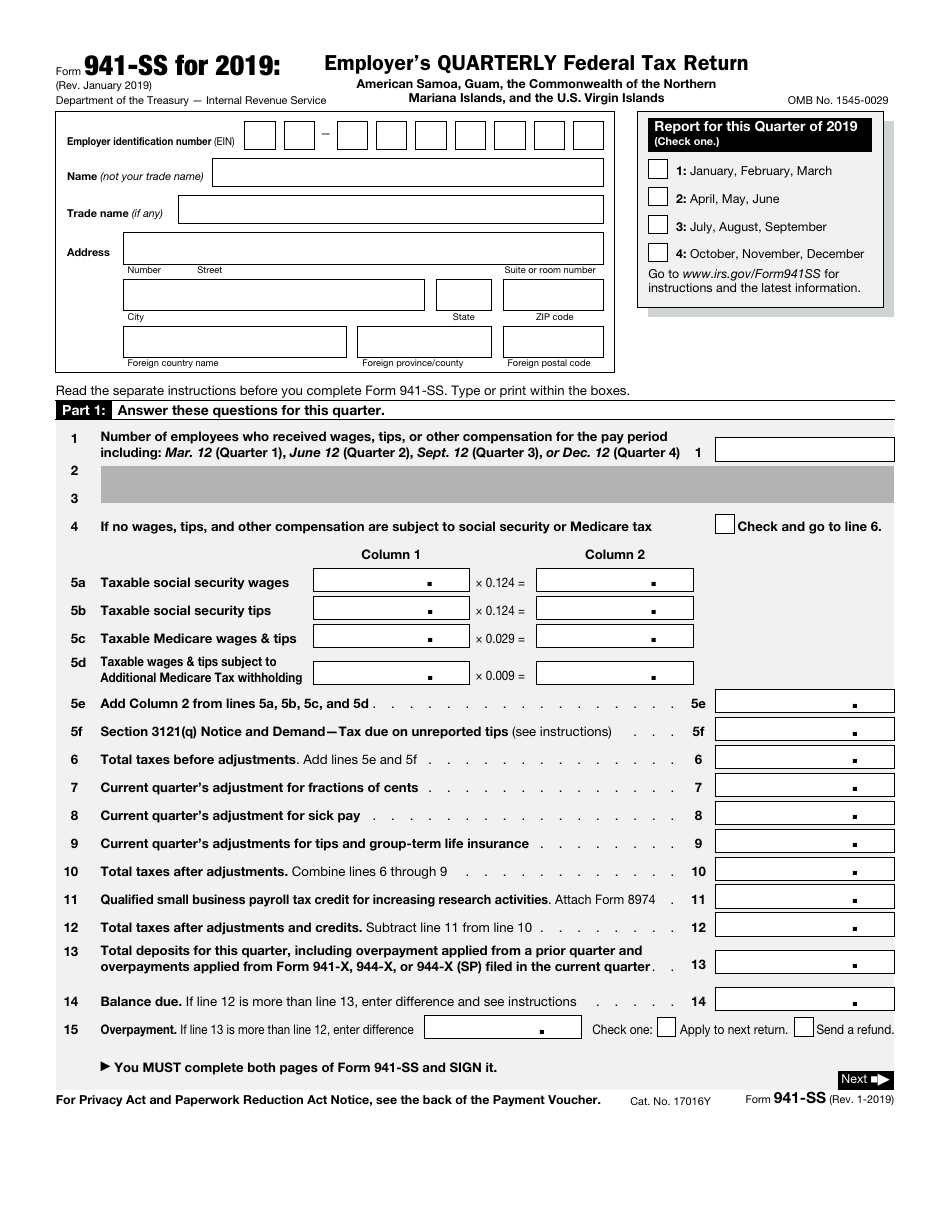

IRS Form 941SS 2019 Fill Out, Sign Online and Download Fillable

Get an identity protection pin (ip pin) pay. Web for businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf) accounts. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Those returns are processed in. Web check your amended return status.

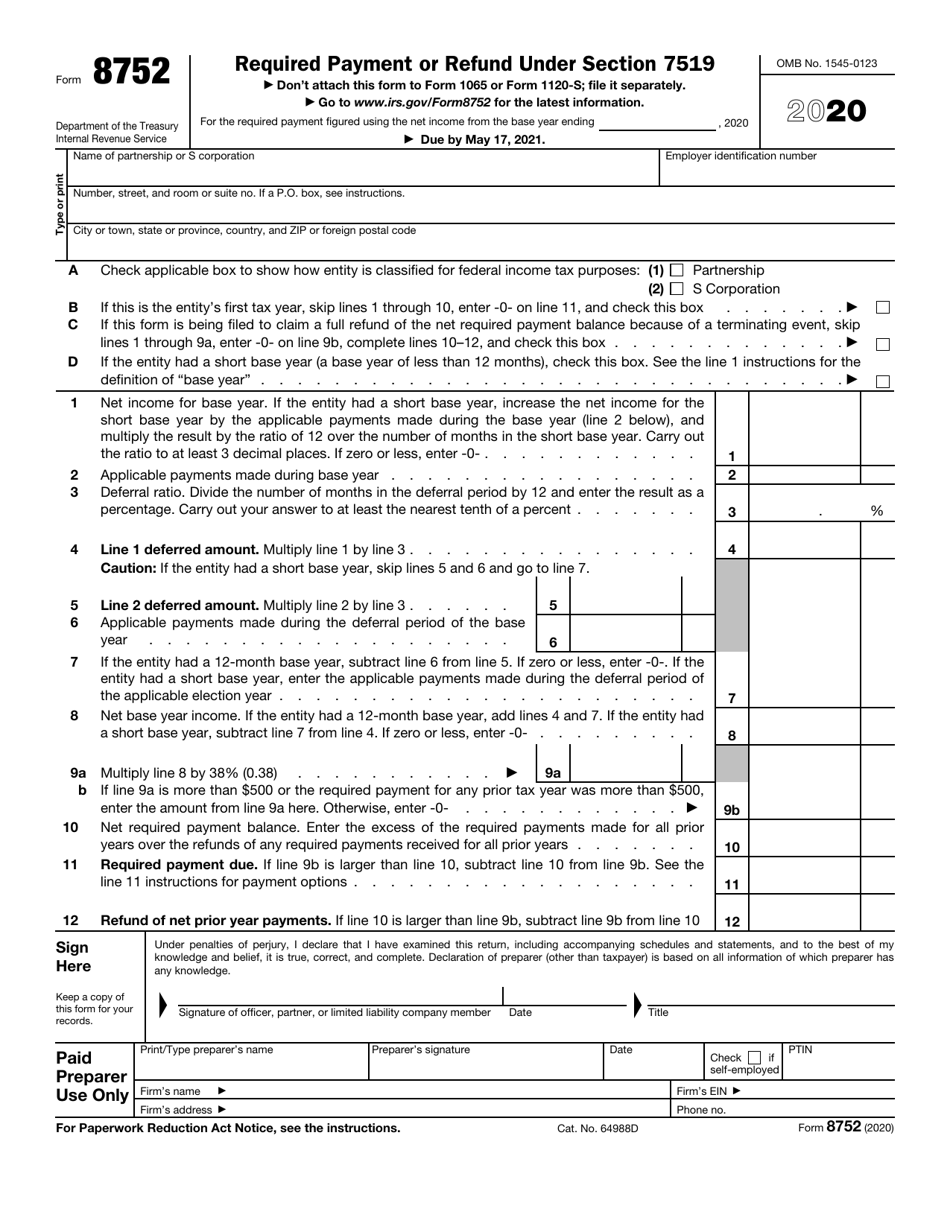

IRS Form 8752 Download Fillable PDF or Fill Online Required Payment or

Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. Web check the status of your income tax refund for recent tax years. Web november 30, 2021 08:20 am hello! Get an identity protection pin (ip pin) pay. As of.

Web Check Your Federal Tax Refund Status.

However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Get an identity protection pin (ip pin) pay. Web how to file when to file where to file update my information popular get your tax record file your taxes for free apply for an employer id number (ein) check your. Web for businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf) accounts.

You Must Complete All Five Pages.

The request for mail order forms may be used to order one copy or. Employers engaged in a trade or business who pay compensation form 9465; Request for transcript of tax return. Web to claim or correct your credit by adjusting your employment tax return, use the adjusted return and instructions that apply to your business or organization and the relevant tax.

As Of July 13, 2023, The Irs Had 266,000 Unprocessed Forms 941, Employer's Quarterly Federal Tax Return.

Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to when a refund from filing your 941 quarterly. Irs2go app check your refund status, make a payment, find free tax preparation assistance,.

Web Payroll Tax Returns.

Web november 30, 2021 08:20 am hello! Web check the status of your income tax refund for recent tax years. Those returns are processed in. Web to obtain the refund status of your 2022 tax return, you must enter your social security number, your date of birth, the type of tax and whether it is an amended return.

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/word-image-1461.png)