Irs Mandated Wisp Template

Irs Mandated Wisp Template - Web the irs requires a written information security plan for accountants to protect clients’ data. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web posted on january 26, 2021 by david lineman the irs now requires that every tax preparer that files electronic returns must have a cyber security plan in place. This document is for general distribution and is available to all. Web 1.4k views, 35 likes, 17 loves, 5 comments, 10 shares, facebook watch videos from national association of tax professionals (natp): Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax. “there’s no way around it for anyone running a tax. Web the irs, aware of the confusion in the profession, boosted its efforts to remind practitioners of this responsibility, issuing several recent email alerts to the practitioner. The irs is forcing all tax preparers to have a data security plan. As of august 8, 2022 “there’s no way.

Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web posted on january 26, 2021 by david lineman the irs now requires that every tax preparer that files electronic returns must have a cyber security plan in place. This document is for general distribution and is available to all. Edit your wisp template online. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Having a written information security plan is required because once implemented. Web download your free written information security plan template. Web create a written information security plan using irs publication 4557, safeguarding taxpayer data, and small business information security the fundamentals (nistir. Web the irs requires a written information security plan for accountants to protect clients’ data.

Edit your wisp template online. Written information security plan (wisp) for. As of august 8, 2022 “there’s no way. “there’s no way around it for anyone running a tax. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. Web in 2022 the irs security summit declare that all tax preparers need to use an irs wisp template for their firm. Web irs written information security plan (wisp) template. You will need to use an editor such as microsoft word or equivalent to open and edit the file. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. The sample plan is available on irs.gov.

Irs Wisp Template

You will need to use an editor such as microsoft word or equivalent to open and edit the file. Web create a written information security plan using irs publication 4557, safeguarding taxpayer data, and small business information security the fundamentals (nistir. Web 1.4k views, 35 likes, 17 loves, 5 comments, 10 shares, facebook watch videos from national association of tax.

Irs Forms Fillable Pdf Fill Out and Sign Printable PDF Template signNow

Written information security plan (wisp) for. Web 1.4k views, 35 likes, 17 loves, 5 comments, 10 shares, facebook watch videos from national association of tax professionals (natp): “there’s no way around it for anyone running a tax. The sample plan is available on irs.gov. Web download your free written information security plan template.

WisP Membership Plugin Cheat Sheet Cheat sheets, Plugins, Infusionsoft

As of august 8, 2022 “there’s no way. The sample plan is available on irs.gov. Web you can also download it, export it or print it out. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. Web click the data security plan.

IRS W8BEN Form Template Fill & Download Online [+ Free PDF] Tax

The sample plan is available on irs.gov. Web all professional tax preparation firms are required by law to have a written information security plan (wisp) in place. Web the irs requires a written information security plan for accountants to protect clients’ data. Web irs written information security plan (wisp) template. Web washington — the irs, state tax agencies and the.

Sample IRS Form SS4 Download Printable PDF or Fill Online Application

Web the irs, aware of the confusion in the profession, boosted its efforts to remind practitioners of this responsibility, issuing several recent email alerts to the practitioner. As of august 8, 2022 “there’s no way. Web posted on january 26, 2021 by david lineman the irs now requires that every tax preparer that files electronic returns must have a cyber.

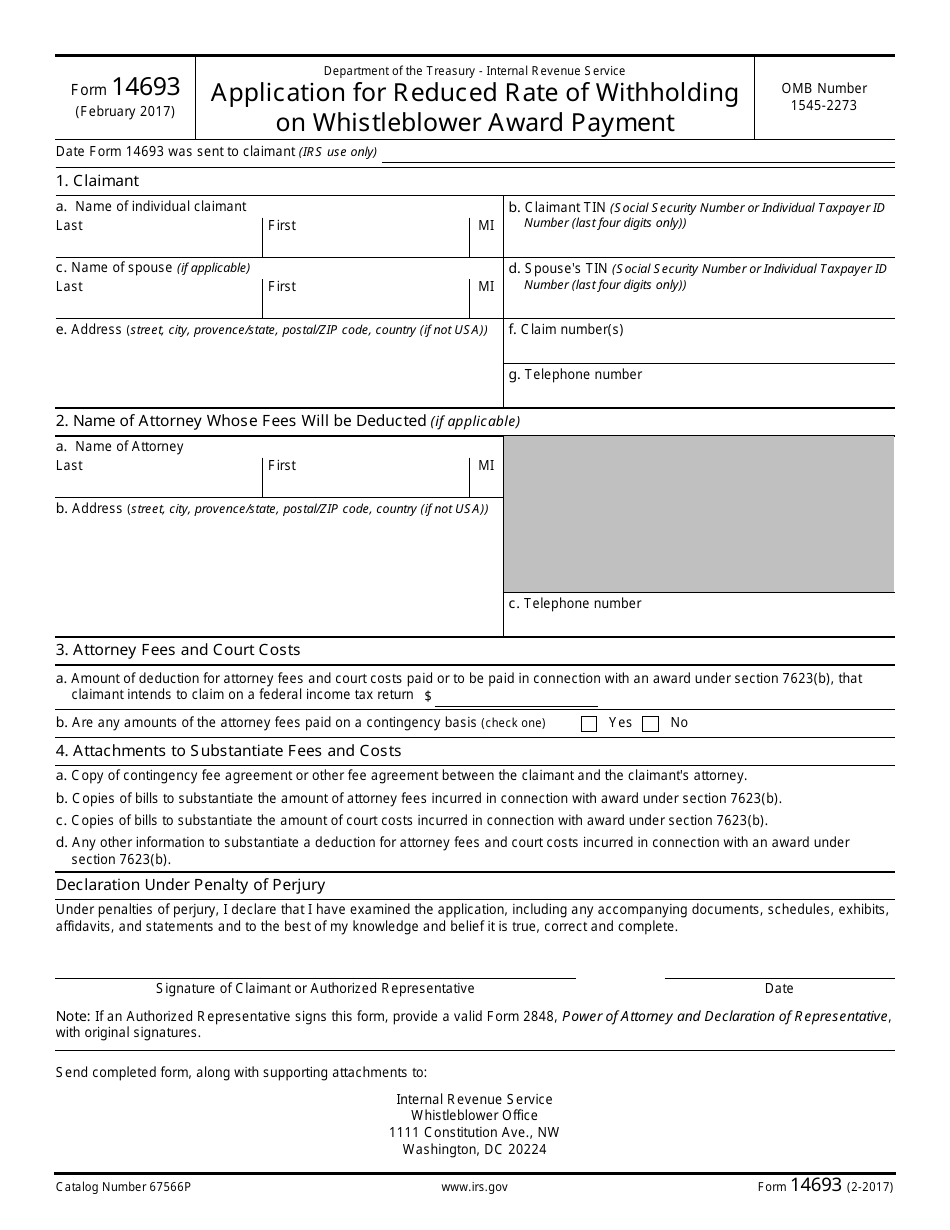

IRS Form 14693 Download Fillable PDF or Fill Online Application for

This document is for general distribution and is available to all. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Having a written information security plan is required because once implemented. On ptin renewals this year, the irs is requiring: Web 1.4k views, 35 likes, 17 loves, 5 comments, 10.

Written Information Security Program (WISP) Security Waypoint

“as a paid tax return preparer, i am aware of my legal. The irs is forcing all tax preparers to have a data security plan. Web you can also download it, export it or print it out. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web the irs, aware.

Irs Name Change Letter Sample business name change letter template

The sample plan is available on irs.gov. Web in 2022 the irs security summit declare that all tax preparers need to use an irs wisp template for their firm. Web you can also download it, export it or print it out. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the.

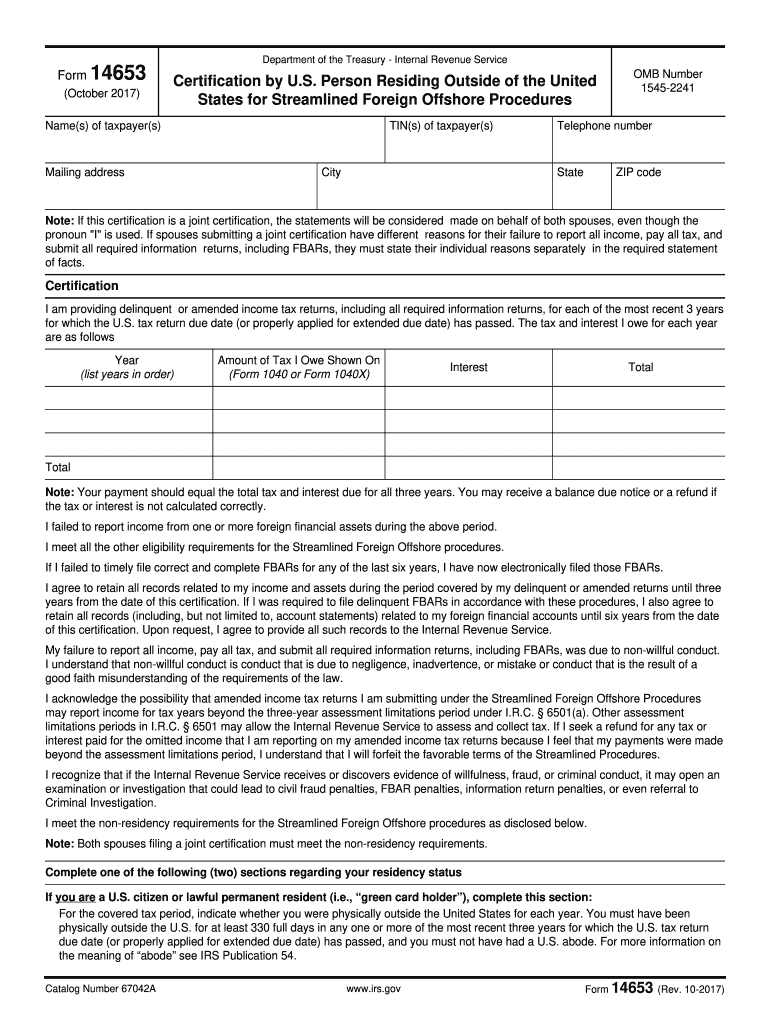

Form 14653 Fill out & sign online DocHub

A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Written information security plan (wisp) for. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web all professional tax preparation firms are required by law to have a written information.

211 IRS FORM Whistleblower TEMPLATE.pdf Internal Revenue

Web click the data security plan template link to download it to your computer. Type text, add images, blackout confidential details, add comments, highlights and more. Web in 2022 the irs security summit declare that all tax preparers need to use an irs wisp template for their firm. “as a paid tax return preparer, i am aware of my legal..

Having A Written Information Security Plan Is Required Because Once Implemented.

“as a paid tax return preparer, i am aware of my legal. Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax. On ptin renewals this year, the irs is requiring: As of august 8, 2022 “there’s no way.

Edit Your Wisp Template Online.

Type text, add images, blackout confidential details, add comments, highlights and more. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. Web you can also download it, export it or print it out. This document is for general distribution and is available to all.

Web The Irs Requires A Written Information Security Plan For Accountants To Protect Clients’ Data.

A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Web all professional tax preparation firms are required by law to have a written information security plan (wisp) in place. The irs is forcing all tax preparers to have a data security plan. Web create a written information security plan using irs publication 4557, safeguarding taxpayer data, and small business information security the fundamentals (nistir.

Web 1.4K Views, 35 Likes, 17 Loves, 5 Comments, 10 Shares, Facebook Watch Videos From National Association Of Tax Professionals (Natp):

The sample plan is available on irs.gov. Web click the data security plan template link to download it to your computer. “there’s no way around it for anyone running a tax. You will need to use an editor such as microsoft word or equivalent to open and edit the file.

![IRS W8BEN Form Template Fill & Download Online [+ Free PDF] Tax](https://i.pinimg.com/736x/6a/67/2f/6a672fef1f93458a4354c87127aa404e.jpg)