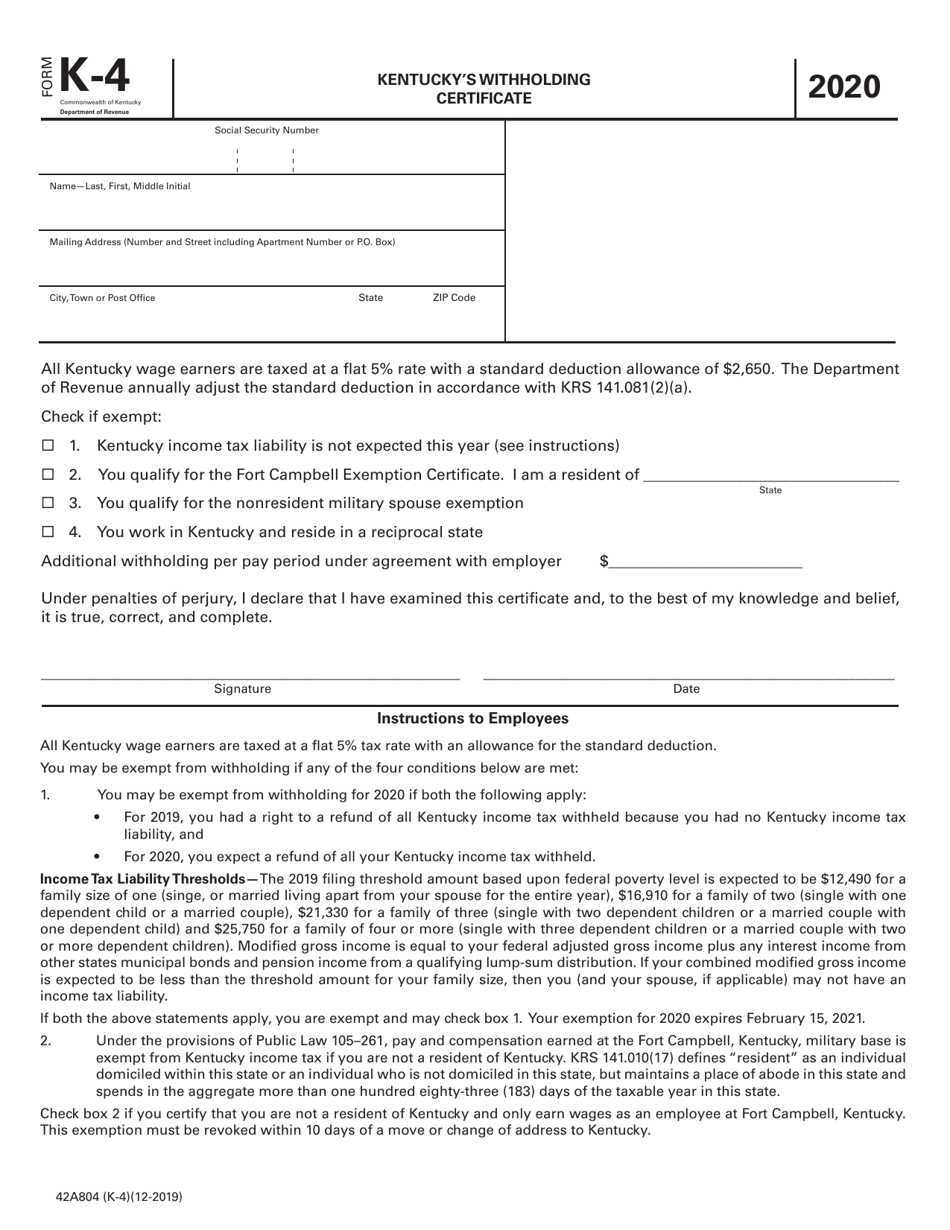

Kentucky K-4 Form

Kentucky K-4 Form - Save or instantly send your ready documents. Sign it in a few clicks. Web download the taxpayer bill of rights. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. (103 kar 18:150) the paper. Pdf (portable document format) is a file format that captures all the. You may be exempt from withholding if any of the. If you meet any of the four exemptions you are exempted from kentucky withholding. Type text, add images, blackout confidential details, add comments, highlights and more. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet.

Sign it in a few clicks. Save or instantly send your ready documents. (103 kar 18:150) the paper. Web check box 4 if you certify you work in kentucky and reside in a reciprocal state. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Web explanation of form fields/questions form: Edit your ky 4 online. Easily fill out pdf blank, edit, and sign them. Edit your kentucky k 4 fillable tax form online.

(103 kar 18:150) the paper. Sign it in a few clicks. Save or instantly send your ready documents. Web check box 4 if you certify you work in kentucky and reside in a reciprocal state. Type text, add images, blackout confidential details, add comments, highlights and more. Pdf (portable document format) is a file format that captures all the. Edit your kentucky k 4 fillable tax form online. Sign it in a few clicks. Edit your ky 4 online. If you meet any of the four exemptions you are exempted from kentucky withholding.

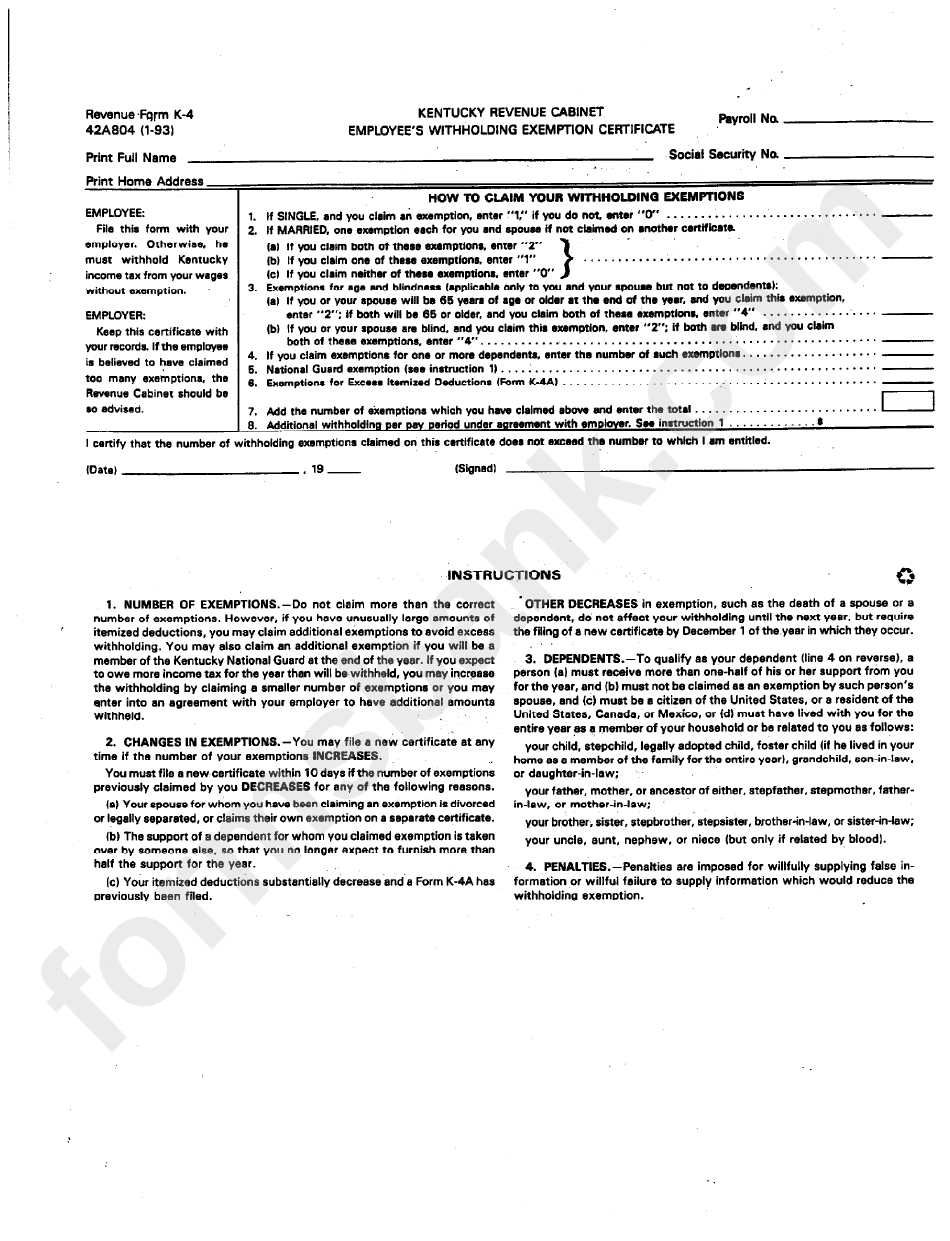

Form K4 (42A804) Download Printable PDF or Fill Online Kentucky's

Save or instantly send your ready documents. Sign it in a few clicks. Edit your ky 4 online. Web explanation of form fields/questions form: If you meet any of the four exemptions you are exempted from kentucky withholding.

Kansas State vs. Kentucky KState pulls a stunner in Sweet 16

Sign it in a few clicks. (103 kar 18:150) the paper. You may be exempt from withholding if any of the. Web check box 4 if you certify you work in kentucky and reside in a reciprocal state. Use get form or simply click on the template preview to open it in the editor.

imperialpricedesign K 4 Form Kentucky

Start completing the fillable fields. Edit your ky 4 online. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Pdf (portable document format) is a file format that captures all the. (103 kar 18:150) the paper.

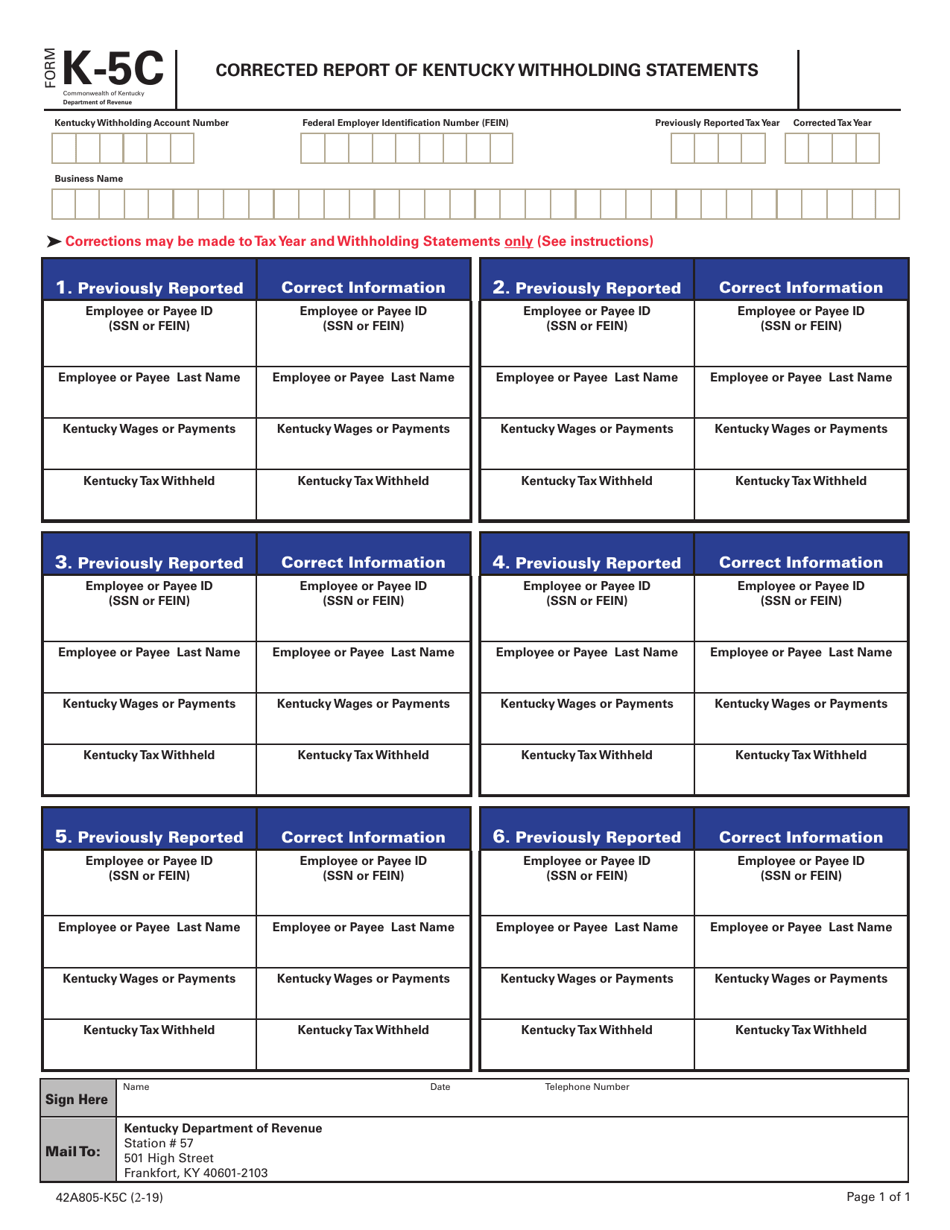

Form K5C Download Fillable PDF or Fill Online Corrected Report of

Pdf (portable document format) is a file format that captures all the. Start completing the fillable fields. Sign it in a few clicks. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Web a kentucky form k 4 is a pdf form that can be filled.

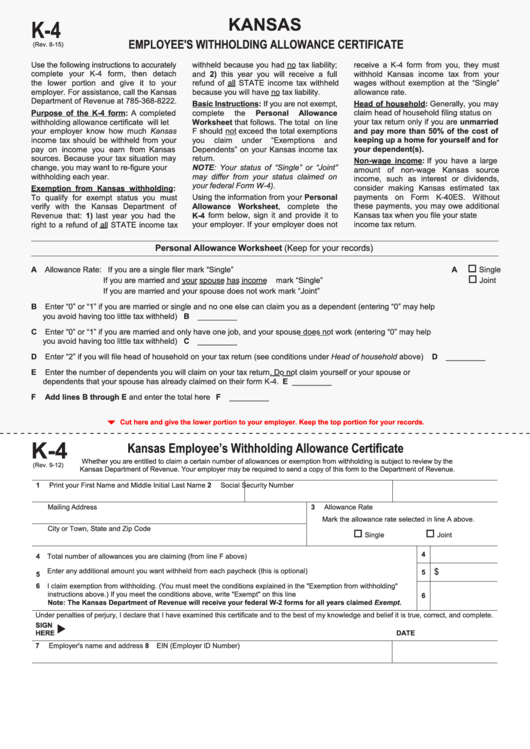

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. You may be exempt from withholding if any of the. Edit your ky 4 online. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Pdf.

Kentucky K4 App

You may be exempt from withholding if any of the. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Save or instantly send your ready documents. Web explanation of form fields/questions form: Pdf (portable document format) is a file format that captures all the.

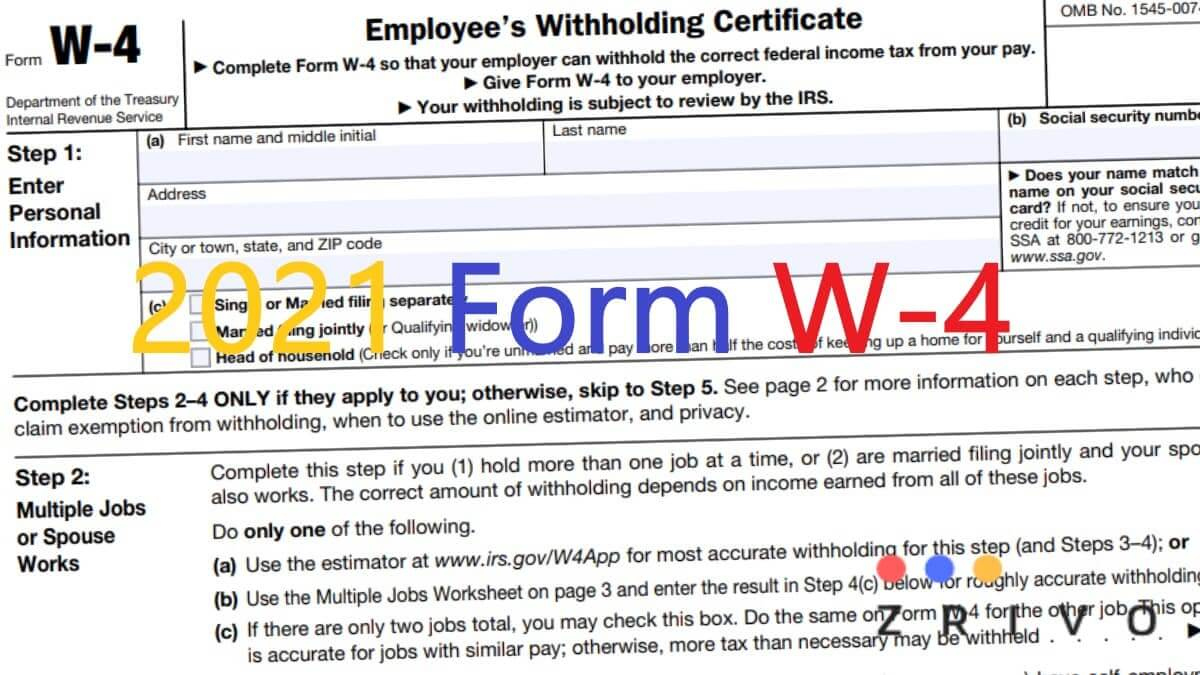

2021 W4 Form Printable State 2022 W4 Form

Web explanation of form fields/questions form: After completing and electronically signing the. Edit your ky 4 online. (103 kar 18:150) the paper. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022.

Fillable Form K4 Employee'S Withholding Exemption Certificate

Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Edit your kentucky k 4 fillable tax form online. Type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your ready documents. (103 kar 18:150) the paper.

Kentucky K4 App

(103 kar 18:150) the paper. Sign it in a few clicks. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web explanation of form fields/questions form: Save or instantly send your ready documents.

Fillable Online ppiinc Form K4E Commonwealth of Kentucky DEPARTMENT OF

Type text, add images, blackout confidential details, add comments, highlights and more. Use get form or simply click on the template preview to open it in the editor. Edit your kentucky k 4 fillable tax form online. Sign it in a few clicks. Edit your ky 4 online.

Save Or Instantly Send Your Ready Documents.

Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Pdf (portable document format) is a file format that captures all the. Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. If you meet any of the four exemptions you are exempted from kentucky withholding.

Sign It In A Few Clicks.

Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Edit your ky 4 online. You may be exempt from withholding if any of the. Easily fill out pdf blank, edit, and sign them.

Sign It In A Few Clicks.

Type text, add images, blackout confidential details, add comments, highlights and more. Use get form or simply click on the template preview to open it in the editor. Type text, add images, blackout confidential details, add comments, highlights and more. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet.

Draw Your Signature, Type It,.

After completing and electronically signing the. (103 kar 18:150) the paper. Web check box 4 if you certify you work in kentucky and reside in a reciprocal state. Start completing the fillable fields.

/cdn.vox-cdn.com/uploads/chorus_image/image/59131619/936740394.jpg.0.jpg)