Ky Form 740-Es 2023

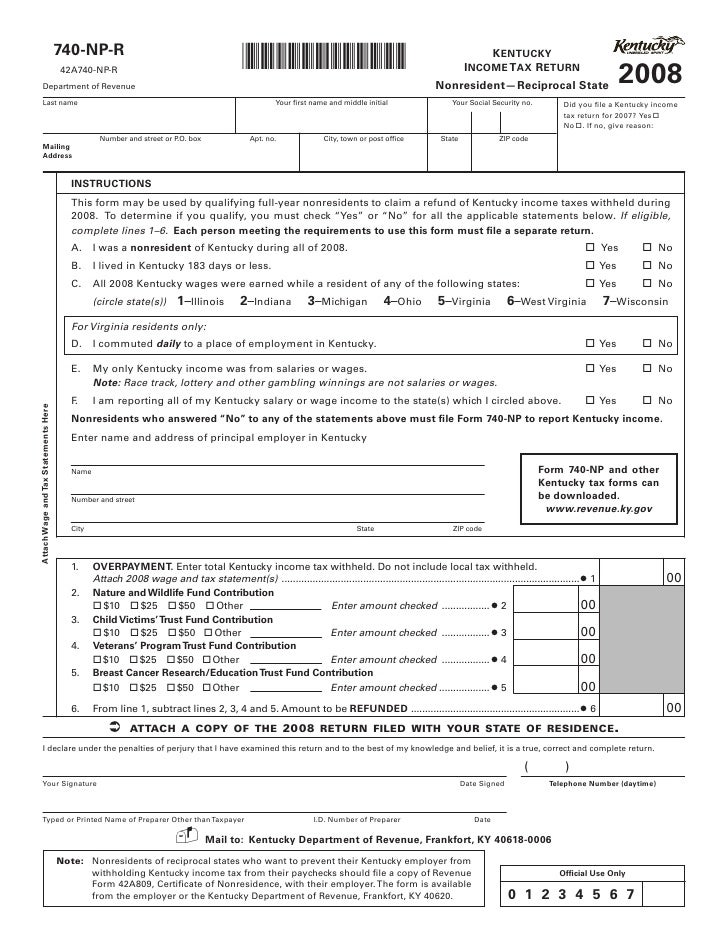

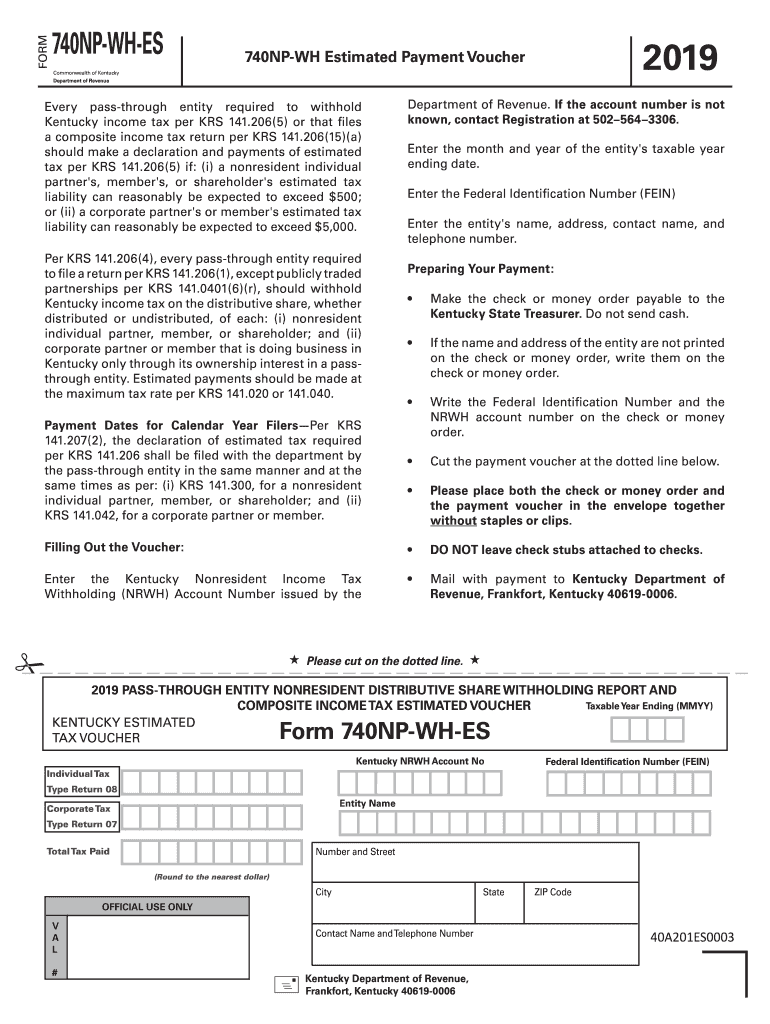

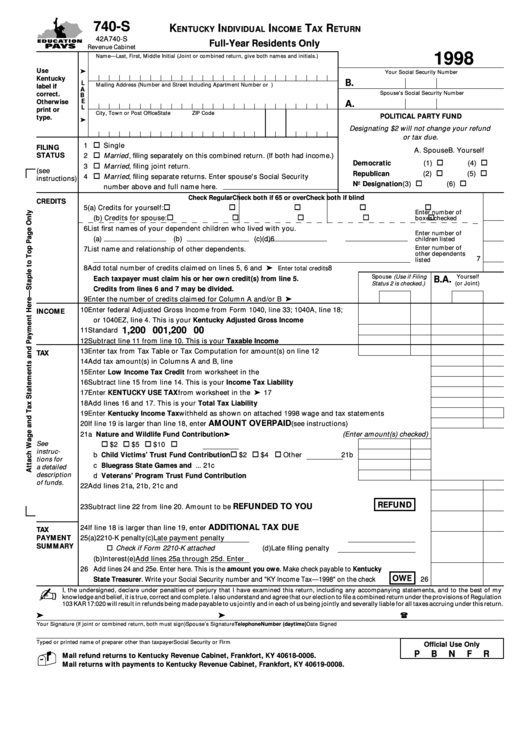

Ky Form 740-Es 2023 - Web enter the kentucky nonresident income tax withholding (nrwh) account number issued by the department of revenue. Web this form may be used by both individuals and corporations requesting an income tax refund. Web download the taxpayer bill of rights. This form is for income earned in tax year 2022, with tax returns due in april. The kentucky tax form 740 is the individual income tax return. If the account number is not known, contact registration. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Easily fill out pdf blank, edit, and sign them. Click on the sign tool and. Indicate the date to the document using the date function.

Web enter the kentucky nonresident income tax withholding (nrwh) account number issued by the department of revenue. Web download the taxpayer bill of rights. The kentucky tax form 740 is the individual income tax return. Web income for 2022 or 2023 is from farming or fishing, you can do one of the following: • pay all of your estimated tax by january 16, 2024. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Indicate the date to the document using the date function. Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. Web follow the simple instructions below: Web fill out each fillable area.

If the account number is not known, contact registration. Save or instantly send your ready documents. Web form 740 is the kentucky income tax return for use by all taxpayers. Web enter the kentucky nonresident income tax withholding (nrwh) account number issued by the department of revenue. When completing this form, the following. Our service gives you a wide selection. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Easily fill out pdf blank, edit, and sign them. / fein spouse's social security no. This form is for income earned in tax year 2022, with tax returns due in april.

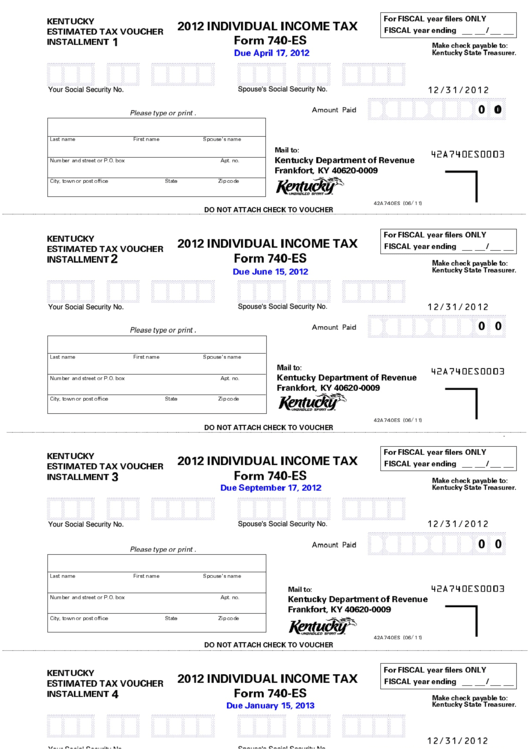

Fillable Form 740Es Individual Tax Estimated Tax Voucher

Web form 740 is the kentucky income tax return for use by all taxpayers. Click on the sign tool and. Web income for 2022 or 2023 is from farming or fishing, you can do one of the following: Easily fill out pdf blank, edit, and sign them. Web enter the kentucky nonresident income tax withholding (nrwh) account number issued by.

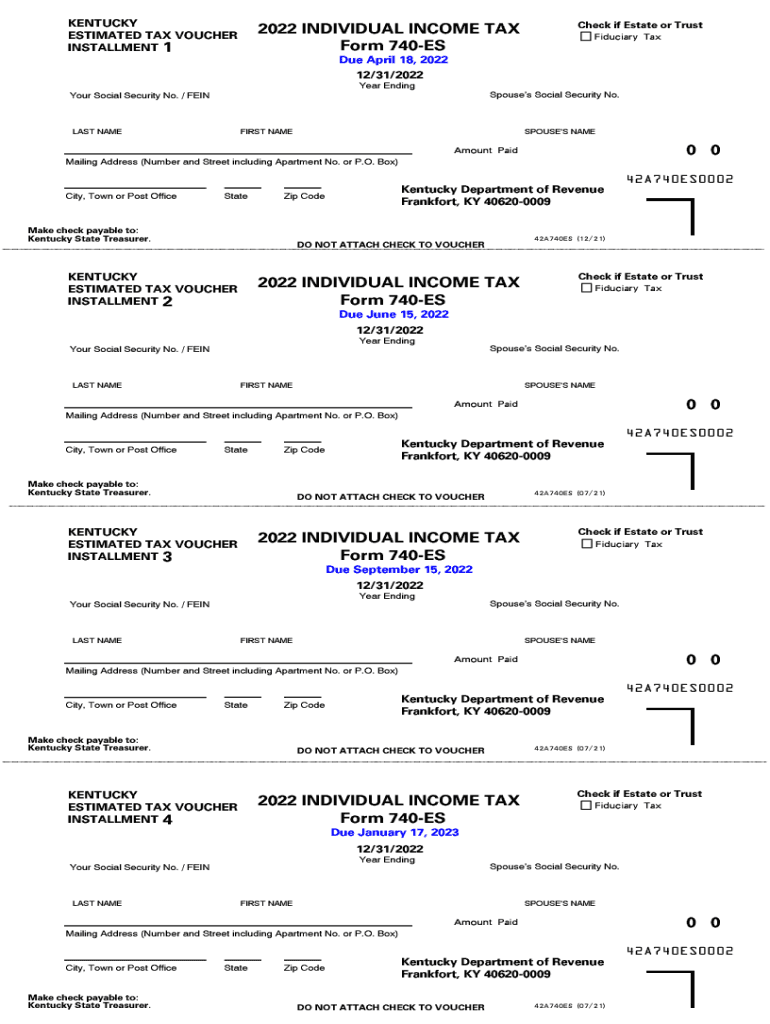

Kentucky 740 Es 2023 Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april. Web form 740 is the kentucky income tax return for use by all taxpayers. This form is for income earned in tax year 2022, with tax returns due in april. Web up to $40 cash back the deadline to file ky 740 in 2023.

2013 Form KY DoR 740NPWHES Fill Online, Printable, Fillable, Blank

Web download the taxpayer bill of rights. Web fill out each fillable area. Click on the sign tool and. Web we last updated kentucky form 740 from the department of revenue in february 2023. • pay all of your estimated tax by january 16, 2024.

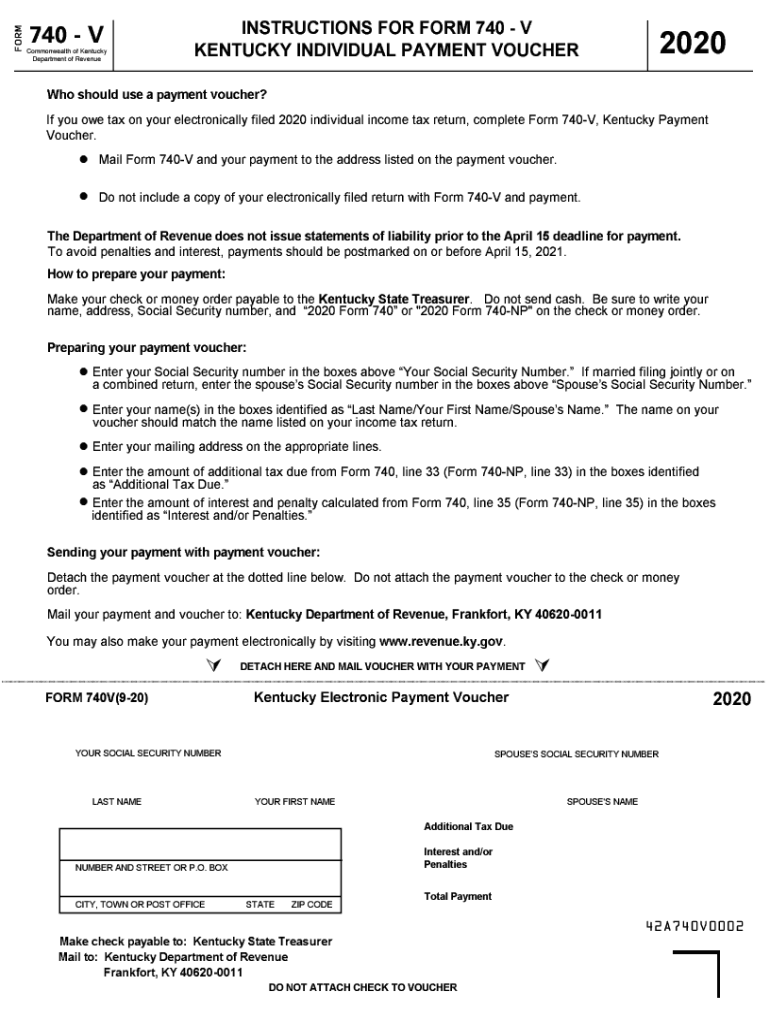

KY 740V 20202022 Fill out Tax Template Online US Legal Forms

Show sources > form 740 is a kentucky individual income tax form. When completing this form, the following. Our service gives you a wide selection. Web income for 2022 or 2023 is from farming or fishing, you can do one of the following: Click on the sign tool and.

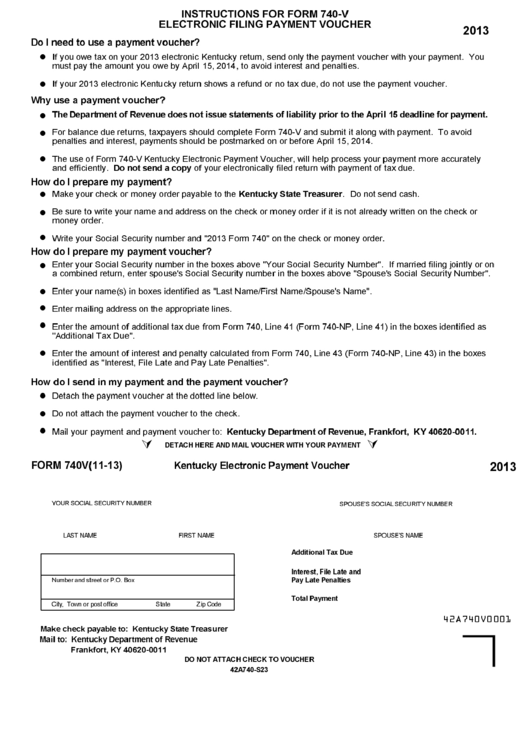

Form 740v Kentucky Electronic Payment Voucher 2013 printable pdf

Web enter the kentucky nonresident income tax withholding (nrwh) account number issued by the department of revenue. Web download the taxpayer bill of rights. Web income for 2022 or 2023 is from farming or fishing, you can do one of the following: This form is for income earned in tax year 2022, with tax returns due in april. If the.

Kentucky Unemployment Back Pay Form NEMPLOY

/ fein spouse's social security no. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated. Web enter the kentucky nonresident income tax withholding (nrwh) account number issued by the department of revenue. Show sources > form 740 is a.

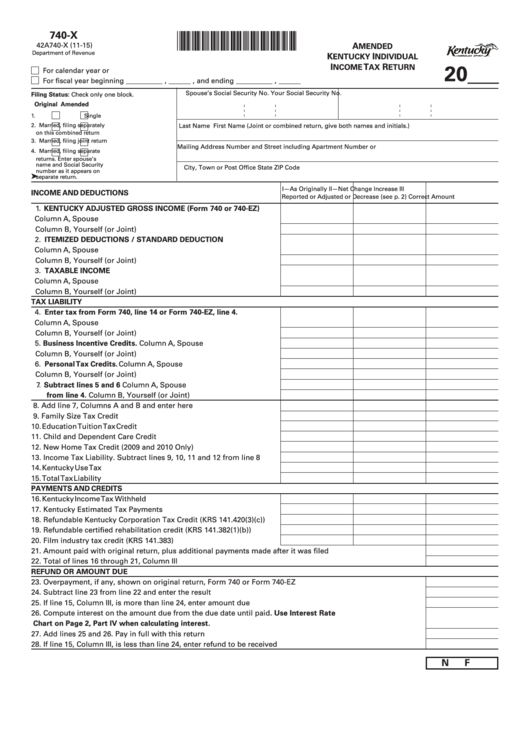

Fillable Form 740X Amended Kentucky Individual Tax Return

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. When completing this form, the following. • pay all of your estimated tax by january 16, 2024. Web income for 2022 or 2023 is from farming or fishing, you can do one of the following: Web enter the kentucky nonresident income tax withholding (nrwh).

Form 740 Kentucky Individual Tax Return Resident YouTube

/ fein spouse's social security no. Web we last updated kentucky form 740 from the department of revenue in february 2023. Form 740 is the kentucky income tax return for use by all taxpayers. Web download the taxpayer bill of rights. Our service gives you a wide selection.

2019 Form KY DoR 740NPWHES Fill Online, Printable, Fillable, Blank

Click on the sign tool and. Indicate the date to the document using the date function. • pay all of your estimated tax by january 16, 2024. This form is for income earned in tax year 2022, with tax returns due in april. Form 740 is the kentucky income tax return for use by all taxpayers.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Form 740 is the kentucky income tax return for use by all taxpayers. Save or instantly send your ready documents. Click on the sign tool and.

Web Download The Taxpayer Bill Of Rights.

Easily fill out pdf blank, edit, and sign them. If the account number is not known, contact registration. Web income for 2022 or 2023 is from farming or fishing, you can do one of the following: Web follow the simple instructions below:

Web Enter The Kentucky Nonresident Income Tax Withholding (Nrwh) Account Number Issued By The Department Of Revenue.

Show sources > form 740 is a kentucky individual income tax form. • pay all of your estimated tax by january 16, 2024. Web fill out each fillable area. Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue.

When Completing This Form, The Following.

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web up to $40 cash back the deadline to file ky 740 in 2023 is april 15, 2024. Indicate the date to the document using the date function. / fein spouse's social security no.