Ky Tax Exempt Form Pdf

Ky Tax Exempt Form Pdf - The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. There are no local sales and use taxes in kentucky. Sign online button or tick the preview image of the form. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now exempt for resale, effective july 1, 2019. Sellers accepting certifi cates for such purchases will be held liable for the sales or use tax. Residential, farm & commercial property; To start the form, use the fill camp; Payment of sales and use tax to the vendor. Web agriculture exemption number faqs (05/0 6/22) a griculture exemption number search. • if the statutory requirements are met, you will be permitted to make purchases of tangible personal property without.

The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. You can find resale certificates for other states here. Web ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Sellers accepting certifi cates for such purchases will be held liable for the sales or use tax. The purchaser is liable for any tax and interest, and possible civil and criminal penalties imposed by the state, if the purchaser is not eligible to claim this exemption. Sales and use tax faqs (09/06 /22) kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. Sign online button or tick the preview image of the form. Web of exemption for materials, machinery and equipment (form 51a159). Check with the state for exemption information and requirements. Payment of sales and use tax to the vendor.

Check with the state for exemption information and requirements. • if the statutory requirements are met, you will be permitted to make purchases of tangible personal property without. The advanced tools of the editor will lead you through the editable pdf template. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now exempt for resale, effective july 1, 2019. Web how you can fill out the tax exempt form ky on the internet: To start the form, use the fill camp; There are no local sales and use taxes in kentucky. __________________________________________________ name of farmer (print) ___________________________________________________ farm location. Web ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Web of exemption for materials, machinery and equipment (form 51a159).

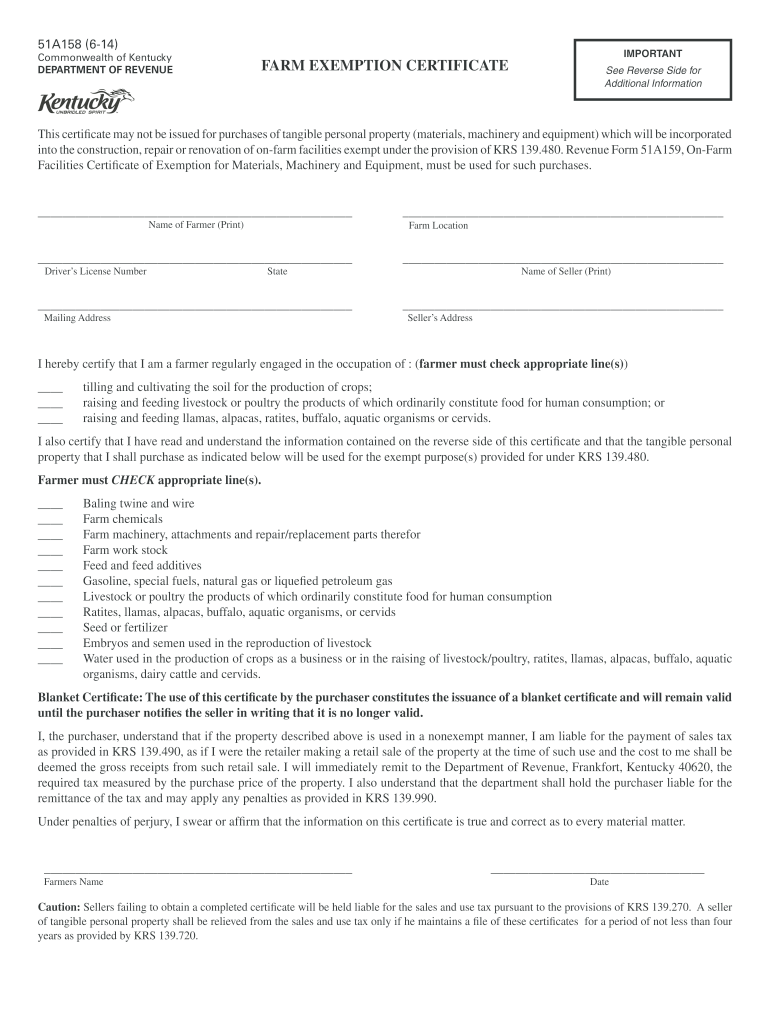

Farm Tax Exemption Kentucky Fill Online, Printable, Fillable, Blank

Sellers accepting certifi cates for such purchases will be held liable for the sales or use tax. The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. Web ensuring it is eligible for.

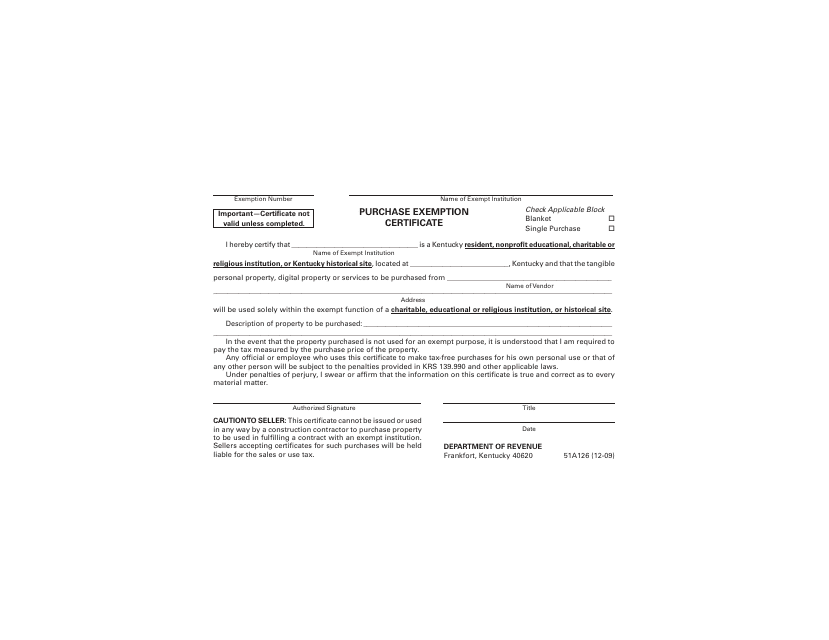

Ky Revenue Form 51a126

__________________________________________________ name of farmer (print) ___________________________________________________ farm location. Web agriculture exemption number faqs (05/0 6/22) a griculture exemption number search. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now exempt for resale, effective july 1, 2019. Web we have five kentucky sales.

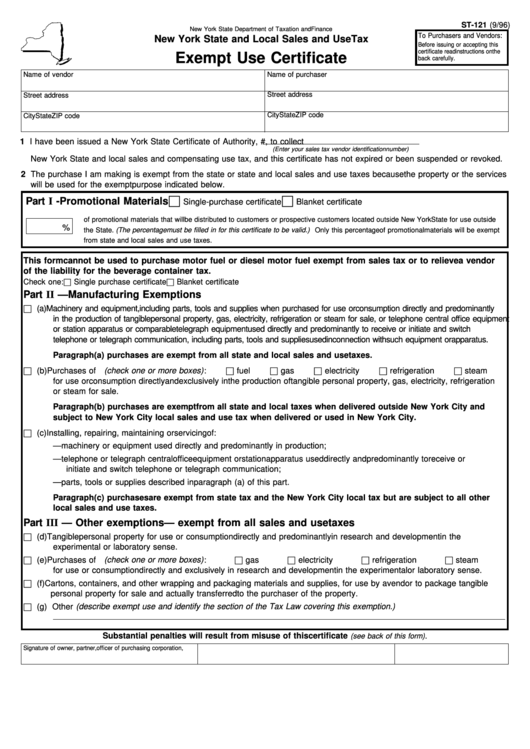

Fillable Form St121 Exempt Use Certificate printable pdf download

Unmined coal & other natural resources; Web agriculture exemption number faqs (05/0 6/22) a griculture exemption number search. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now exempt for resale, effective july 1, 2019. Payment of sales and use tax to the.

Kentucky Sales Tax Exemption For Farmers Farmer Foto Collections

Sign online button or tick the preview image of the form. Web ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Web of exemption for materials, machinery and equipment (form 51a159). To start the form, use the fill camp; Payment of sales and use tax to the vendor.

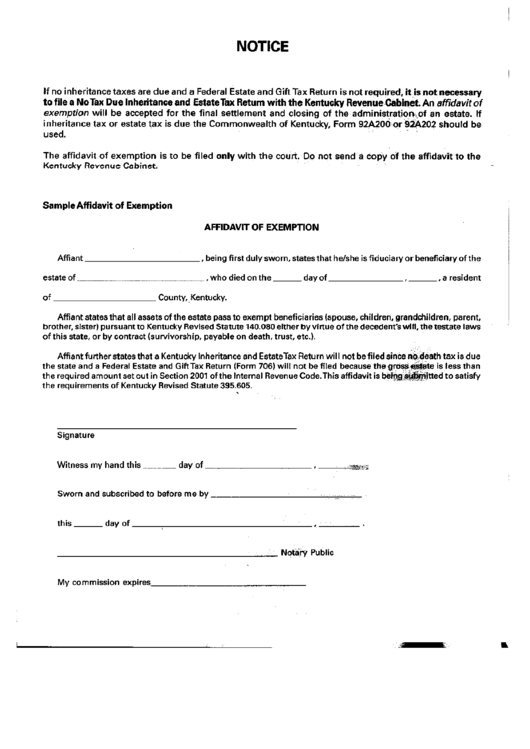

Affidavit Of Exemption Kentucky Tax Exemption printable pdf download

Sales and use tax faqs (09/06 /22) kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. Web agriculture exemption number faqs (05/0 6/22) a griculture exemption number search. The advanced tools of the editor will lead you through the editable pdf template. Web we have five kentucky sales tax exemption.

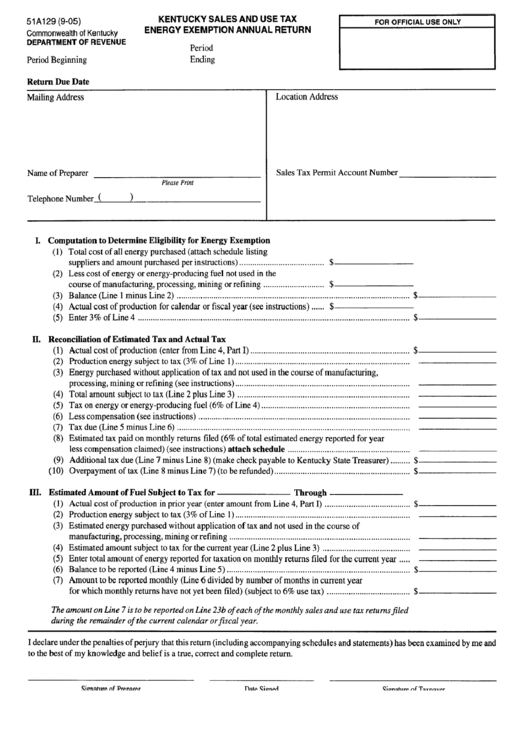

Kentucky Sales And Use Tax Energy Exemption Annual Return Form

Sales and use tax faqs (09/06 /22) kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. Sellers accepting certifi cates for such purchases will be held liable for the sales or use tax. The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the.

Tax Exempt Forms San Patricio Electric Cooperative

Unmined coal & other natural resources; Sales and use tax faqs (09/06 /22) kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. Web we have five kentucky sales tax exemption forms available for you to print or save as a pdf file. Web to be used in fulfi lling a.

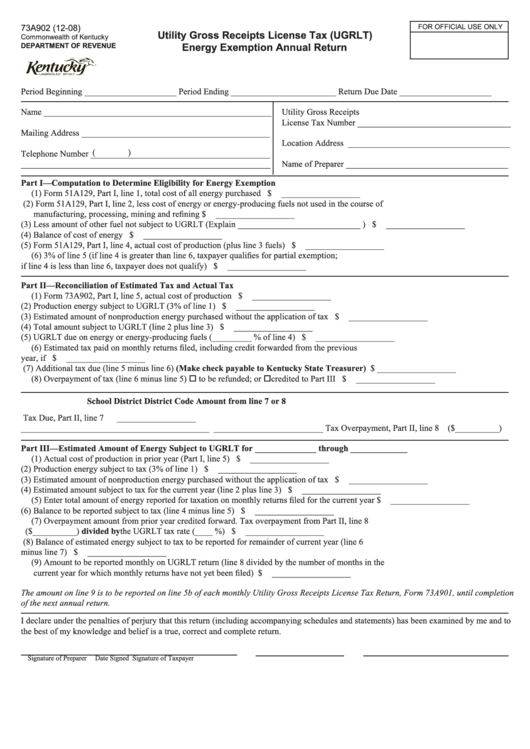

Form 73a902 Utility Gross Receipts License Tax (Ugrlt) Energy

You can find resale certificates for other states here. • if the statutory requirements are met, you will be permitted to make purchases of tangible personal property without. If any of these links are broken, or you can't find the form you need, please let us know. The basis of the residential exemption for utilities shifts from reliance on tariff.

Co Resale Certificate Master of Documents

Web to be used in fulfi lling a contract with an exempt institution. Sales and use tax faqs (09/06 /22) kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. Web ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. The purchaser is.

Ky Revenue Form 51a126

The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. Sellers accepting certifi cates for such purchases will be held liable for the sales or use tax. Residential, farm & commercial property; You.

Sellers Accepting Certifi Cates For Such Purchases Will Be Held Liable For The Sales Or Use Tax.

• if the statutory requirements are met, you will be permitted to make purchases of tangible personal property without. Payment of sales and use tax to the vendor. Web ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Check with the state for exemption information and requirements.

Web How You Can Fill Out The Tax Exempt Form Ky On The Internet:

There are no local sales and use taxes in kentucky. Unmined coal & other natural resources; Residential, farm & commercial property; Sign online button or tick the preview image of the form.

Web To Be Used In Fulfi Lling A Contract With An Exempt Institution.

__________________________________________________ name of farmer (print) ___________________________________________________ farm location. The basis of the residential exemption for utilities shifts from reliance on tariff language filed with the public service commission (psc) to a customer declaration that the services are used at the location as the place of. If any of these links are broken, or you can't find the form you need, please let us know. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now exempt for resale, effective july 1, 2019.

You Can Find Resale Certificates For Other States Here.

Web agriculture exemption number faqs (05/0 6/22) a griculture exemption number search. To start the form, use the fill camp; The purchaser is liable for any tax and interest, and possible civil and criminal penalties imposed by the state, if the purchaser is not eligible to claim this exemption. The advanced tools of the editor will lead you through the editable pdf template.