Late 1099 Form

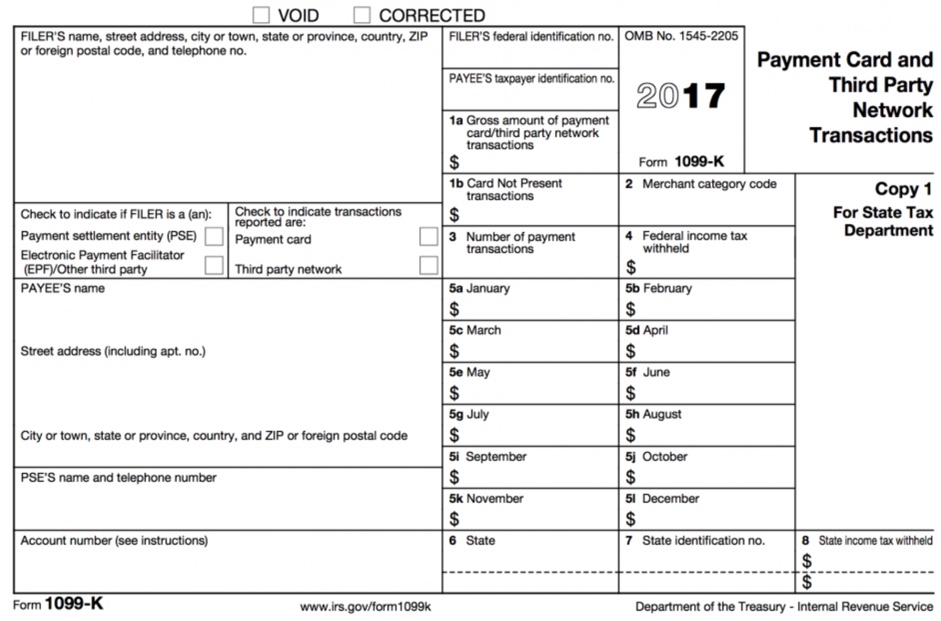

Late 1099 Form - After 30 days and before august 1 $110 /form $1,669,500 per year ($556,500 for small businesses) You can access the system at irs fire. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. This form should be filed with the irs, on paper or electronically, and sent to recipients by february 1, 2021. Web while balancing multiple deadlines and different forms to file, you may miss a deadline or submit an inaccurate return. The irs also charges interest on the penalties it levies. Send out a 1099 form by that date to the person or company that you paid for their services. Web in general, though, if you call or write the payer and ask for a form 1099, you may end up with two forms 1099, one issued in the ordinary course (even if you never received it), and one. Your all inclusive payroll suite! You can mail in documentation, or use the irs filing information returns electronically system (fire) to expedite the process.

1099 filing deadlines 1099 late filing and reporting penalties penalty for failing to report 1099 income frequently asked questions (faqs) photo: You can access the system at irs fire. The irs also charges interest on the penalties it levies. Web one possible exception: The major deadline to put down on your calendar is jan. After 30 days and before august 1 $110 /form $1,669,500 per year ($556,500 for small businesses) See your tax return instructions for where to report. The different penalty levels are determined by the size. If you are late, be sure to file within 30 days to avoid receiving a larger penalty. If you own a business, no matter its size, you will likely need to prepare a 1099.

Web while balancing multiple deadlines and different forms to file, you may miss a deadline or submit an inaccurate return. Your all inclusive payroll suite! Web there are penalties on companies that issue forms 1099 late, but some come as late as april or may when you may have already filed your return. If you are late, be sure to file within 30 days to avoid receiving a larger penalty. If they can't get the forms, they must still file their tax return on time. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. What happens if you submit a late 1099? However, if you paper file your 1099 forms you may be penalized for failing to include your 1096. Send out a 1099 form by that date to the person or company that you paid for their services. Web what happens if a 1099 is late?

Late IRS Form 1099? Don’t Request It, Here’s Why

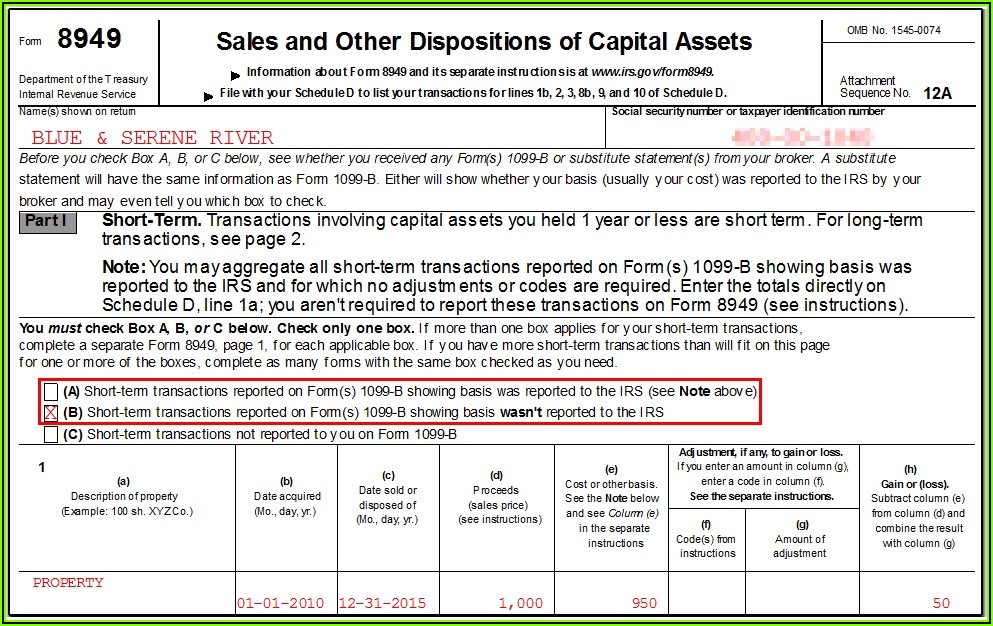

See your tax return instructions for where to report. There are maximum fines per year for small businesses. Web the penalty rate for late filing form 1099 misc will vary based on the time you filed the return. There are more independent contractors working now than ever before. Web if you issue 1099s just a little late — within 30.

It’s time to file 1099s Avoid 50100 plus late penalties per form

Web the penalty rate for late filing form 1099 misc will vary based on the time you filed the return. The major deadline to put down on your calendar is jan. When that happens, the irs will send you a notice of a 1099 late filing penalty (or penalties) detailing what you owe to correct the situation. You can instantly.

1099NEC Software to Create, Print & EFile IRS Form 1099NEC

Even if you never receive a form 1099, if you. You can report a late 1099 to the irs directly by speaking with one of their representatives over the phone. The different penalty levels are determined by the size. You can instantly download a printable copy of the tax form by logging in to or creating a free my social.

When is tax form 1099MISC due to contractors? GoDaddy Blog

This form should be filed with the irs, on paper or electronically, and sent to recipients by february 1, 2021. Web in general, though, if you call or write the payer and ask for a form 1099, you may end up with two forms 1099, one issued in the ordinary course (even if you never received it), and one. Web.

Filing Form 1099 Misc Late Form Resume Examples e79Q7ZgVkQ

You can access the system at irs fire. If you are late, be sure to file within 30 days to avoid receiving a larger penalty. Web what happens if a 1099 is late? Penalties for filing 1099 forms late. What happens if you submit a late 1099?

How Not To Deal With A Bad 1099

The major deadline to put down on your calendar is jan. Send out a 1099 form by that date to the person or company that you paid for their services. Web what happens if a 1099 is late? If they can't get the forms, they must still file their tax return on time. There are maximum fines per year for.

Free Printable 1099 Misc Forms Free Printable

If you are late, be sure to file within 30 days to avoid receiving a larger penalty. Prepare to pay some type of penalty if you file a late 1099 form. When that happens, the irs will send you a notice of a 1099 late filing penalty (or penalties) detailing what you owe to correct the situation. Web the penalty.

Filing 1099 Forms Late Universal Network

If they can't get the forms, they must still file their tax return on time. However, if you paper file your 1099 forms you may be penalized for failing to include your 1096. The major deadline to put down on your calendar is jan. Web what happens if a 1099 is late? After 30 days and before august 1 $110.

How To File Form 1099NEC For Contractors You Employ VacationLord

Penalties for filing 1099 forms late. Even if you never receive a form 1099, if you. There are more independent contractors working now than ever before. Web what happens if you submit a late 1099? 1099 filing deadlines 1099 late filing and reporting penalties penalty for failing to report 1099 income frequently asked questions (faqs) photo:

Irs Form 1099 Late Filing Penalty Form Resume Examples

Web what happens if you submit a late 1099? If you own a business, no matter its size, you will likely need to prepare a 1099. The irs also charges interest on the penalties it levies. Web how much is the 1099 late filing penalty? Web while balancing multiple deadlines and different forms to file, you may miss a deadline.

Web The Penalty For Filing Form 1099 Less Than 30 Days Late Is $50 Per Form With A Maximum Penalty Of $194,500 For Small Businesses And $556,500 For Large Businesses.

There are more independent contractors working now than ever before. Send out a 1099 form by that date to the person or company that you paid for their services. See the instructions for form 8938. This form should be filed with the irs, on paper or electronically, and sent to recipients by february 1, 2021.

If You Are Late, Be Sure To File Within 30 Days To Avoid Receiving A Larger Penalty.

Web one possible exception: Web what happens if you submit a late 1099? If they can't get the forms, they must still file their tax return on time. There are maximum fines per year for small businesses.

The Major Deadline To Put Down On Your Calendar Is Jan.

Web in general, though, if you call or write the payer and ask for a form 1099, you may end up with two forms 1099, one issued in the ordinary course (even if you never received it), and one. Web while balancing multiple deadlines and different forms to file, you may miss a deadline or submit an inaccurate return. When that happens, the irs will send you a notice of a 1099 late filing penalty (or penalties) detailing what you owe to correct the situation. Penalties for filing 1099 forms late.

Web On This Form 1099 To Satisfy Its Account Reporting Requirement Under Chapter 4 Of The Internal Revenue Code.

Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Web what happens if a 1099 is late? You can access the system at irs fire. See your tax return instructions for where to report.