Louisiana Extension Form

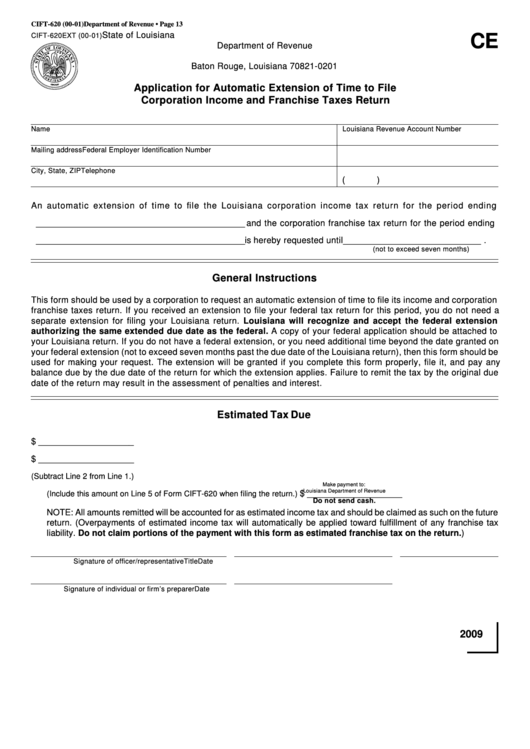

Louisiana Extension Form - If you do not have a federal extension, you. If you do not have a federal extension, you. An emergency extension, which may be requested when a gubernatorially declared disaster or emergency. Web for calendar year filers the extension will be to november 15, 2023. To avoid interest and delinquent payment penalties, individual taxpayers must remit their taxes due by the may. If you know you cannot file your return by the. Web engagement and contact information. Web extended due date as the federal. Attach a copy of your federal application federal form 7004 to your completed louisiana return. • louisiana will recognize and.

If you do not have a federal extension, you. Web your state extension pdf form is free louisiana personal income tax returns are due by the 15th day of the 5th month following the end of the tax year. Web an extension to file your federal tax return for this period, you do not need to apply for a separate extension for your state return. Web irs form 7004 $39.95 now only $34.95 file your tax extension now! Web extended due date as the federal. Web act 410 of the 2022 regular legislative session changed how an extension is granted starting with tax year 2022. Web the secretary of the louisiana department of revenue may grant an extension of time for filing returns not to exceed six months from. No paper or electronic extension form needs to be filed to obtain the automatic extension. If you do not have a federal extension, you. Web anna paltseva, of our school of geosciences, has been named as the recipient of the 2023 soil science education and extension award.

The date the louisiana income tax return is. • louisiana will recognize and. Web extended due date as the federal. Web the secretary of the louisiana department of revenue may grant an extension of time for filing returns not to exceed six months from. Web engagement and contact information. Web the secretary of the louisiana department of revenue may grant an extension of time for filing returns not to exceed six months from the date the louisiana income tax return is. Louisiana business tax forms are due by the 15 th day of the 4 th month after the end of the tax. Web irs form 7004 $39.95 now only $34.95 file your tax extension now! If you know you cannot file your return by the due date, you. Web for calendar year filers the extension will be to november 15, 2023.

Louisiana Cooperative Extension A Journey YouTube

Web extended due date as the federal. Web your state extension pdf form is free louisiana personal income tax returns are due by the 15th day of the 5th month following the end of the tax year. • louisiana will recognize and. Web irs form 7004 $39.95 now only $34.95 file your tax extension now! Web the secretary of the.

BarbecueFrance Extension de Trémie Barbecue à Pellets

If you know you cannot file your return by the. Louisiana will recognize and accept the. Web engagement and contact information. Web anna paltseva, of our school of geosciences, has been named as the recipient of the 2023 soil science education and extension award. An emergency extension, which may be requested when a gubernatorially declared disaster or emergency.

Louisiana Rent and Lease Template Free Templates in PDF, Word, Excel

Individual income tax returns are due by may 15—or by the 15 th day of the 5 th month following the end of the taxable year (for. Web the secretary of the louisiana department of revenue may grant an extension of time for filing returns not to exceed six months from. Web extended due date as the federal. Web if.

OFFICIAL Louisiana Residential Purchase Agreement [2021]

No paper or electronic extension form needs to be filed to obtain the automatic extension. Web there are two types of extensions allowed under louisiana law: If you know you cannot file your return by the. Web how to make an extension payment for individual income tax. Individual income tax returns are due by may 15—or by the 15 th.

Fillable Form Cift620ext Application For Automatic Extension Of Time

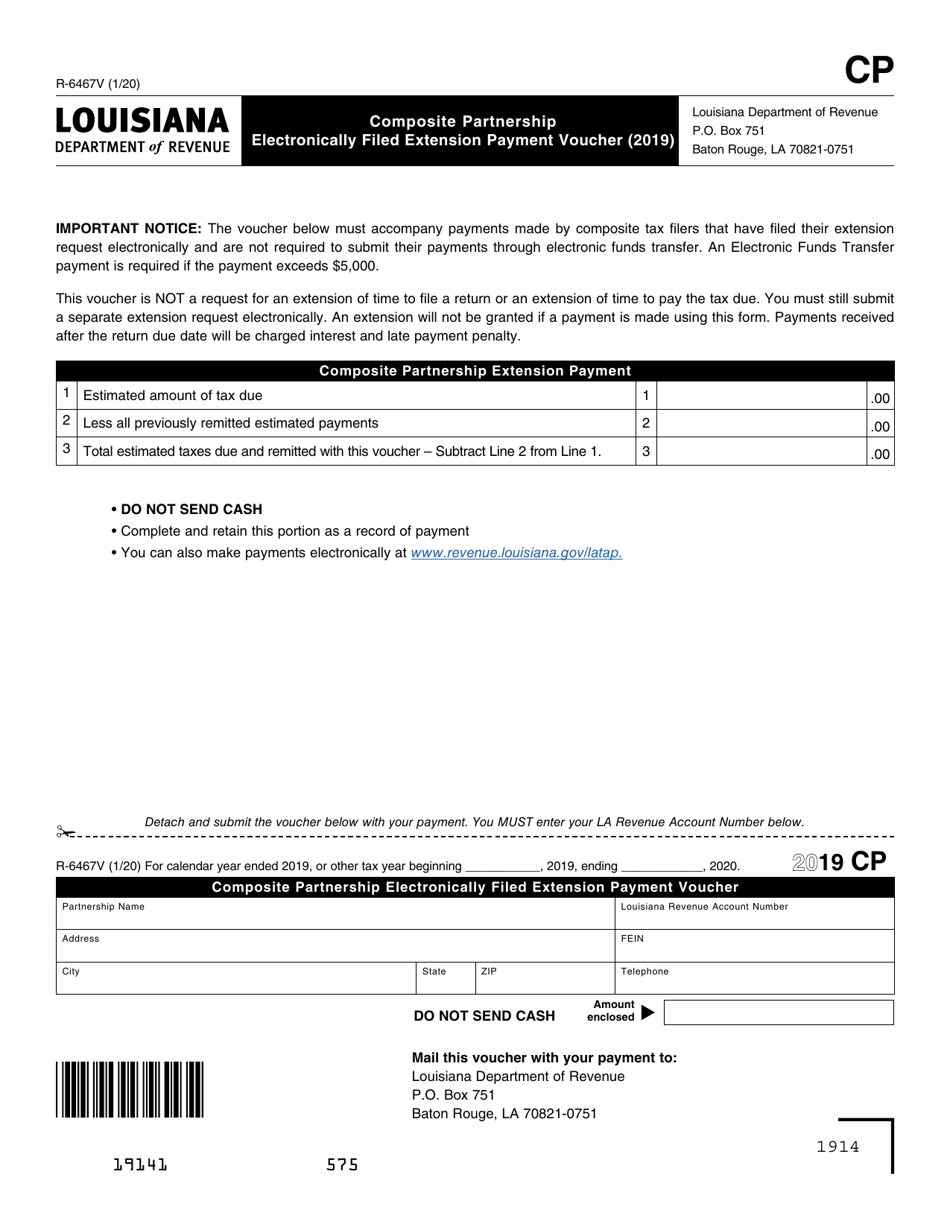

Web how to make an extension payment for individual income tax. To avoid interest and delinquent payment penalties, individual taxpayers must remit their taxes due by the may. If you know you cannot file your return by the due date, you. For fiscal year filers, please indicate. Louisiana will recognize and accept the.

EXTENSION PLOTS IN LOUISIANA Breaux Bridge/LA FIXatioN balansa clover

Web for calendar year filers the extension will be to november 15, 2023. Louisiana will recognize and accept the. If you do not have a federal extension, you. If you do not have a federal extension, you. Web an extension to file your federal tax return for this period, you do not need to apply for a separate extension for.

Louisiana Sublease Agreement Form Free Download

Louisiana business tax forms are due by the 15 th day of the 4 th month after the end of the tax. Web if you received an extension to file your federal tax return for this period, you do not need a separate extension for filing your louisiana return. Individual income tax returns are due by may 15—or by the.

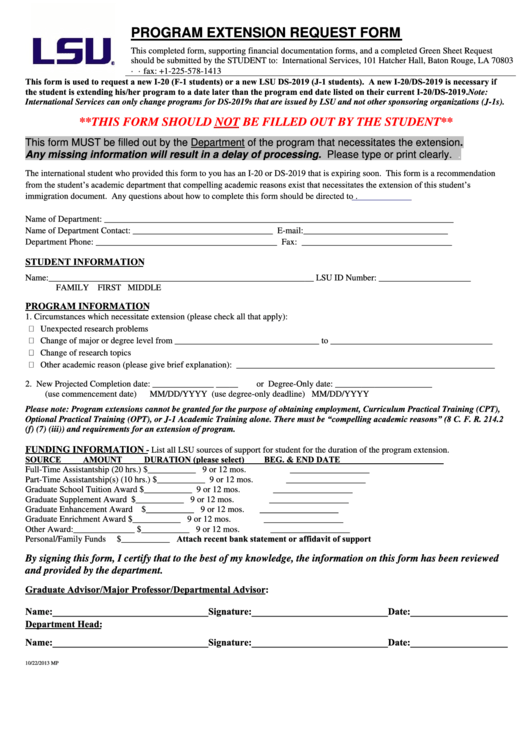

Fillable Program Extension Request Form Louisiana State University

Web if you received an extension to file your federal tax return for this period, you do not need a separate extension for filing your louisiana return. Web extended due date as the federal. • louisiana will recognize and. Web for calendar year filers the extension will be to november 15, 2023. No paper or electronic extension form needs to.

Form R6467V Download Fillable PDF or Fill Online Composite Partnership

Web for calendar year filers the extension will be to november 15, 2023. Web the secretary of the louisiana department of revenue may grant an extension of time for filing returns not to exceed six months from. Attach a copy of your federal application federal form 7004 to your completed louisiana return. No paper or electronic extension form needs to.

W9 Form Louisiana 9 Easy Rules Of W9 Form Louisiana AH STUDIO Blog

Web if you received an extension to file your federal tax return for this period, you do not need a separate extension for filing your louisiana return. To avoid interest and delinquent payment penalties, individual taxpayers must remit their taxes due by the may. • louisiana will recognize and. If you do not have a federal extension, you. Web your.

For Fiscal Year Filers, Please Indicate.

Louisiana business tax forms are due by the 15 th day of the 4 th month after the end of the tax. Louisiana will recognize and accept the. Attach a copy of your federal application federal form 7004 to your completed louisiana return. Individual income tax returns are due by may 15—or by the 15 th day of the 5 th month following the end of the taxable year (for.

Web Extended Due Date As The Federal.

• louisiana will recognize and. Attach a copy of your federal application federal form 7004 to your completed louisiana return. Web the secretary of the louisiana department of revenue may grant an extension of time for filing returns not to exceed six months from the date the louisiana income tax return is. Web the secretary of the louisiana department of revenue may grant an extension of time for filing returns not to exceed six months from.

If You Do Not Have A Federal Extension, You.

An emergency extension, which may be requested when a gubernatorially declared disaster or emergency. Web your state extension pdf form is free louisiana personal income tax returns are due by the 15th day of the 5th month following the end of the tax year. Web by completing and submitting this form by may 15, 2021, you can extend the date to file your louisiana income tax return to november 15, 2021. Web for calendar year filers the extension will be to november 15, 2023.

Web There Are Two Types Of Extensions Allowed Under Louisiana Law:

Web extended due date as the federal. To avoid interest and delinquent payment penalties, individual taxpayers must remit their taxes due by the may. Web how to make an extension payment for individual income tax. Web act 410 of the 2022 regular legislative session changed how an extension is granted starting with tax year 2022.

![OFFICIAL Louisiana Residential Purchase Agreement [2021]](https://ipropertymanagement.com/wp-content/uploads/templates/21140/Louisiana-Real-Estate-Purchase-Agreement-Template_0.jpg)