Louisiana Farm Tax Exemption Form

Louisiana Farm Tax Exemption Form - A good example is the certificate of exemption,. Web act 464 of the regular session of the 2009 louisiana legislature amended the sales tax exemption for farm equipment authorized by louisiana revised statute 47:305.25 to. Web all schedule f (form 1040) revisions. Web louisiana revised statue 47:301(30) was passed in 2018 which allows commercial farmers to be exempt from sales tax on feed purchases. Web how do i get a farm tax exempt in louisiana? Web when purchasing merchandise, it must be noted that there are many exemption certificates which can be utilized. Web louisiana revised statute 47:305.25 provides a sales tax exemption for the purchase of certain farm equipment. Use this publication as a guide to figure your taxes and complete your farm tax return. Web louisiana revised statute 47:305.25 provides a sales tax exemption for the purchase of certain farm equipment. Web the louisiana department of revenue has fixed the problem with the form needed to receive agricultural tax exemptions as a commercial farmer.

Use this publication as a guide to figure your taxes and complete your farm tax return. Web louisiana revised statute 47:305.25 provides a sales tax exemption for the purchase of certain farm equipment. A good example is the certificate of exemption,. Web how do i get a farm tax exempt number in louisiana? The sales tax exemption covers the first $50,000 of the sales. You must apply to the. A.(1)(a) farm and agricultural vehicles and equipment, except draglines and bulldozers, being operated or transported for bona. Web louisiana revised statute 47:305.25 provides a sales tax exemption for the purchase of certain farm equipment. Web certificate of exemption covering purchases of certain farm equipment to be used exclusively for commercial agricultural purposes, and, therefore, entitled to the partial. About publication 463, travel, entertainment, gift, and car expenses.

About publication 225, farmer's tax guide. Web certificate of exemption covering purchases of certain farm equipment to be used exclusively for commercial agricultural purposes, and, therefore, entitled to the partial. About publication 463, travel, entertainment, gift, and car expenses. Web how do i get a farm tax exempt number in louisiana? Web the louisiana department of revenue has fixed the problem with the form needed to receive agricultural tax exemptions as a commercial farmer. “while this is a renewal of the tax exempt. Web how do i get a farm tax exempt in louisiana? Web louisiana revised statute 47:305.25 provides a sales tax exemption for the purchase of certain farm equipment. The sales tax exemption covers the first $50,000 of the sales. Web louisiana revised statue 47:301(30) was passed in 2018 which allows commercial farmers to be exempt from sales tax on feed purchases.

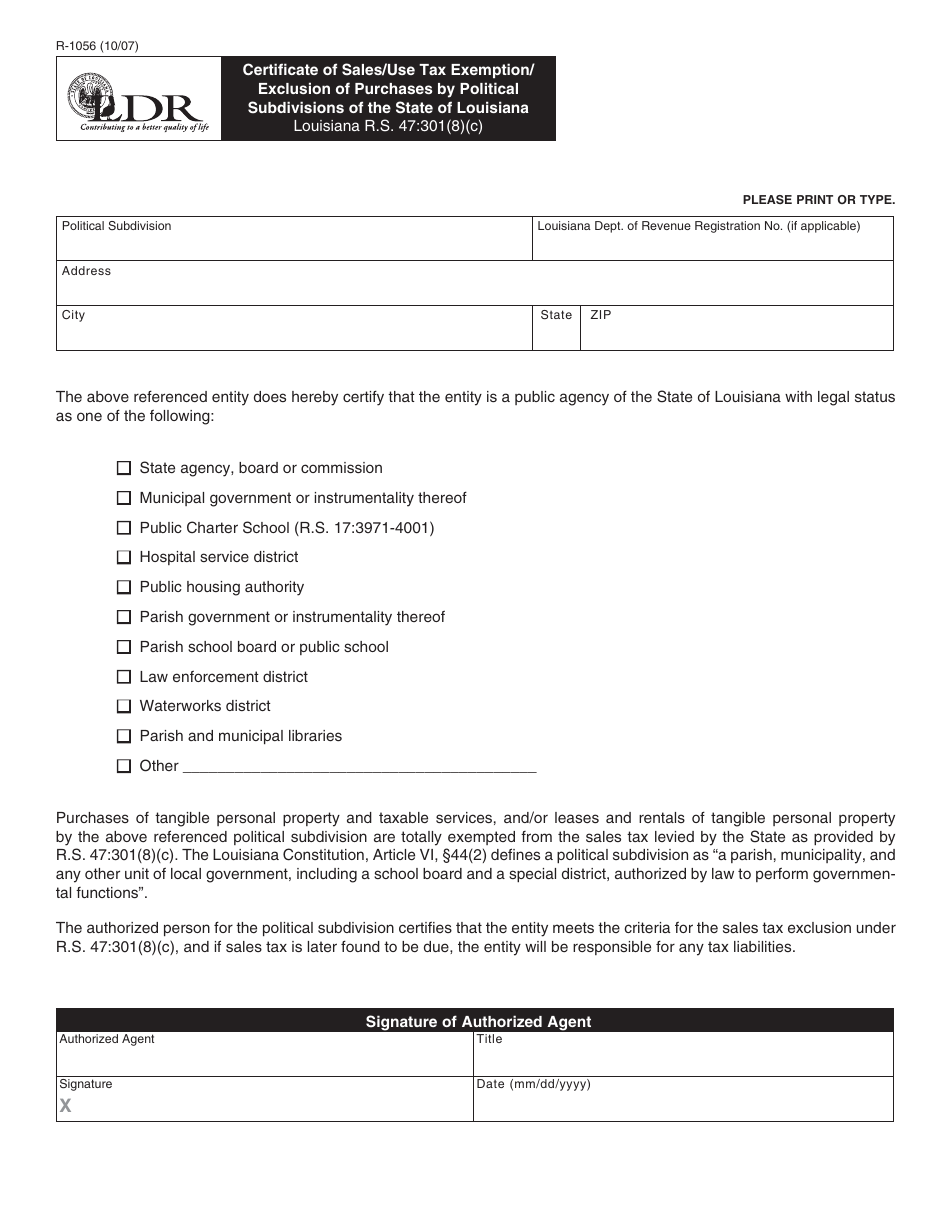

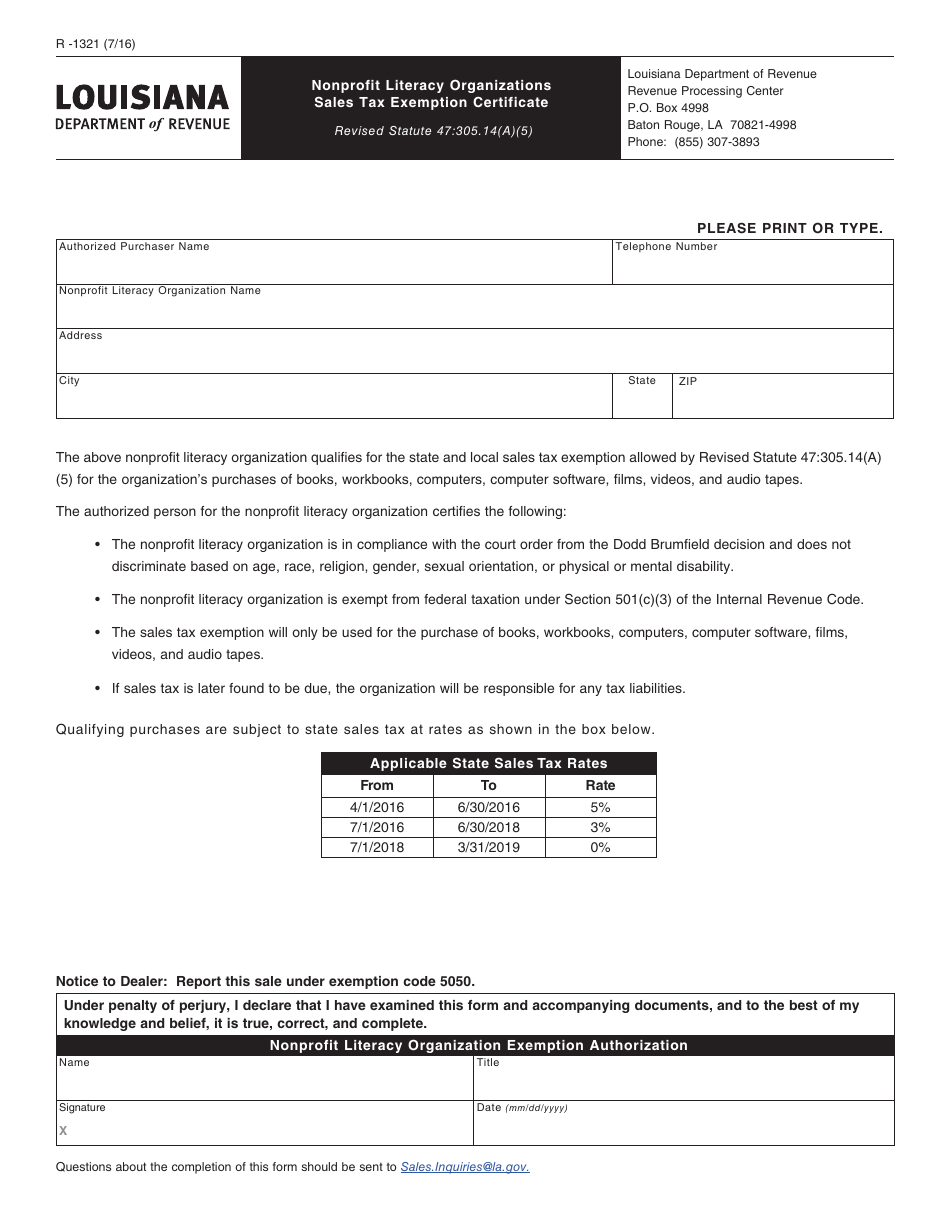

Form R1056 Download Fillable PDF or Fill Online Certificate of Sales

About publication 463, travel, entertainment, gift, and car expenses. Web act 464 of the regular session of the 2009 louisiana legislature amended the sales tax exemption for farm equipment authorized by louisiana revised statute 47:305.25 to. “while this is a renewal of the tax exempt. Web louisiana revised statute 47:305.25 provides a sales tax exemption for the purchase of certain.

Louisiana Hotel Tax Exempt Form Fill Online, Printable, Fillable

Web all schedule f (form 1040) revisions. A good example is the certificate of exemption,. Web when purchasing merchandise, it must be noted that there are many exemption certificates which can be utilized. Web the state sales tax exemption on farm agricultural inputs includes fuel, feed, seed, fertilizer and livestock pharmaceuticals. “while this is a renewal of the tax exempt.

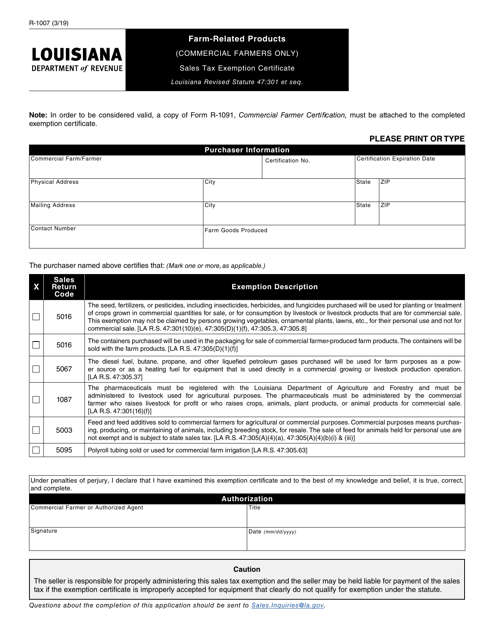

Form R1007 Download Fillable PDF or Fill Online FarmRelated Products

Web certificate of exemption covering purchases of certain farm equipment to be used exclusively for commercial agricultural purposes, and, therefore, entitled to the partial. Web act 464 of the regular session of the 2009 louisiana legislature amended the sales tax exemption for farm equipment authorized by louisiana revised statute 47:305.25 to. Use this publication as a guide to figure your.

Tax Exemption form due Sunday for farmers

Web this publication explains how the federal tax laws apply to farming. The sales tax exemption covers the first $50,000 of the sales. Web the state sales tax exemption on farm agricultural inputs includes fuel, feed, seed, fertilizer and livestock pharmaceuticals. A.(1)(a) farm and agricultural vehicles and equipment, except draglines and bulldozers, being operated or transported for bona. Web how.

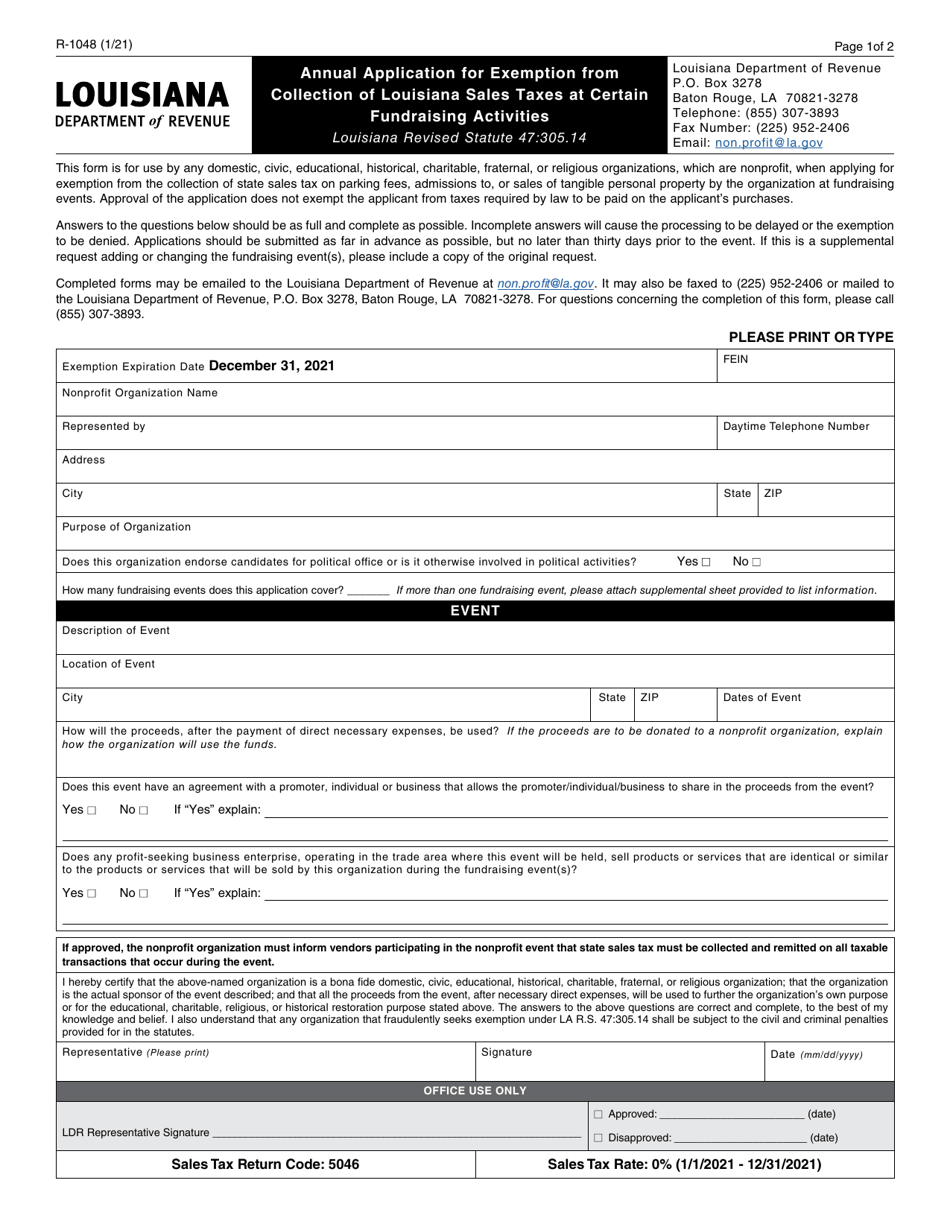

Form R1048 Download Fillable PDF or Fill Online Annual Application for

Web the state sales tax exemption on farm agricultural inputs includes fuel, feed, seed, fertilizer and livestock pharmaceuticals. Use this publication as a guide to figure your taxes and complete your farm tax return. Web how do i get a farm tax exempt in louisiana? Web when purchasing merchandise, it must be noted that there are many exemption certificates which.

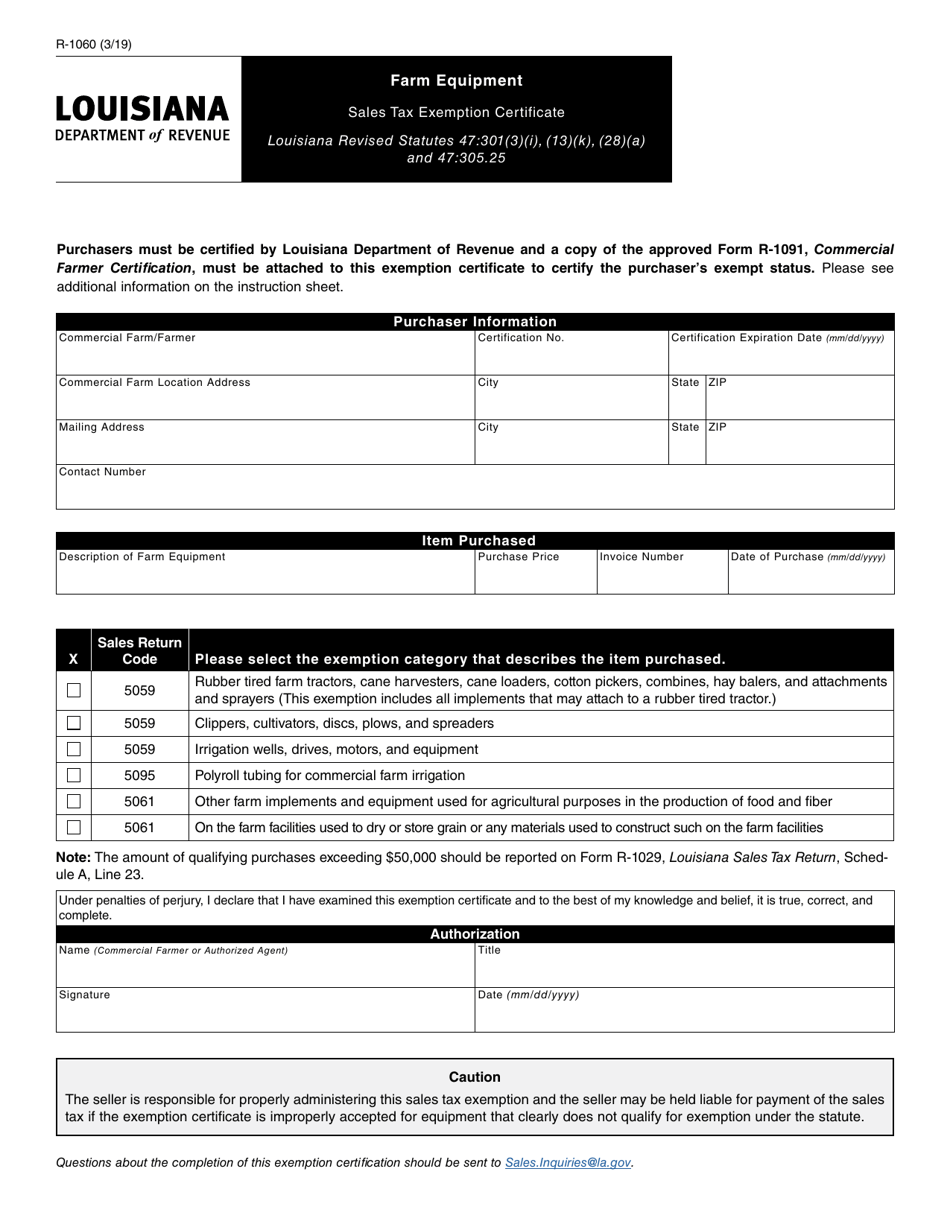

Form R1060 Download Fillable PDF or Fill Online Farm Equipment Sales

You must apply to the. Web act 464 of the regular session of the 2009 louisiana legislature amended the sales tax exemption for farm equipment authorized by louisiana revised statute 47:305.25 to. The sales tax exemption covers the first $50,000 of the sales. The sales tax exemption covers the first $50,000 of the sales. “while this is a renewal of.

baraccadesign Louisiana Farm Tax Exemption

Web how do i get a farm tax exempt in louisiana? Web act 464 of the regular session of the 2009 louisiana legislature amended the sales tax exemption for farm equipment authorized by louisiana revised statute 47:305.25 to. Web certificate of exemption covering purchases of certain farm equipment to be used exclusively for commercial agricultural purposes, and, therefore, entitled to.

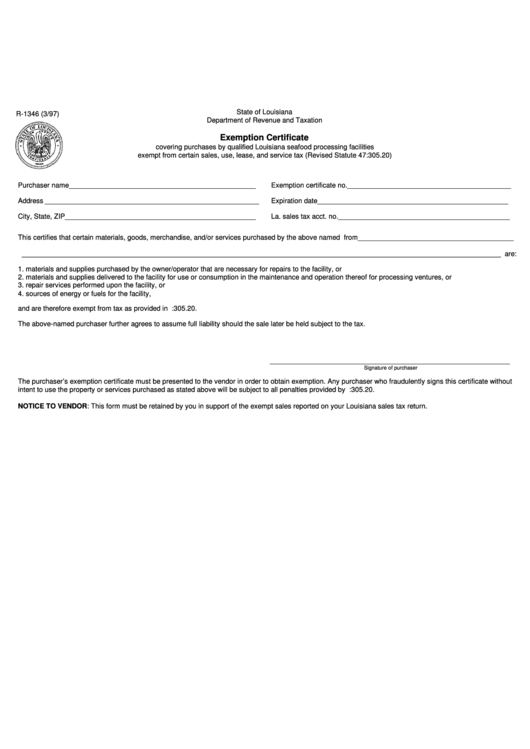

Fillable Form R1346 Exemption Certificate State Of Louisiana

A.(1)(a) farm and agricultural vehicles and equipment, except draglines and bulldozers, being operated or transported for bona. Web the louisiana department of revenue has fixed the problem with the form needed to receive agricultural tax exemptions as a commercial farmer. Web louisiana revised statute 47:305.25 provides a sales tax exemption for the purchase of certain farm equipment. About publication 463,.

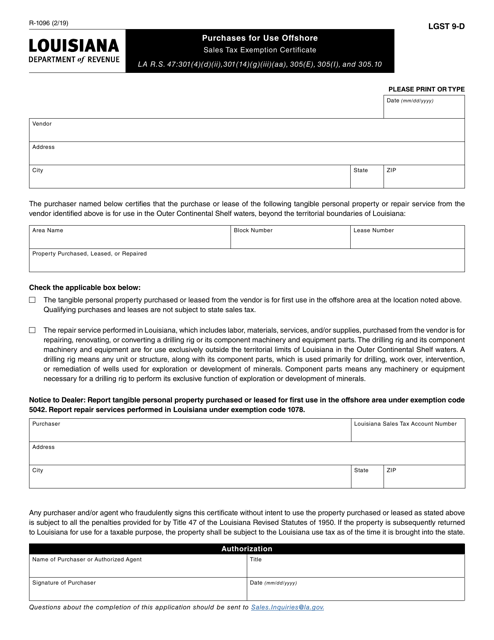

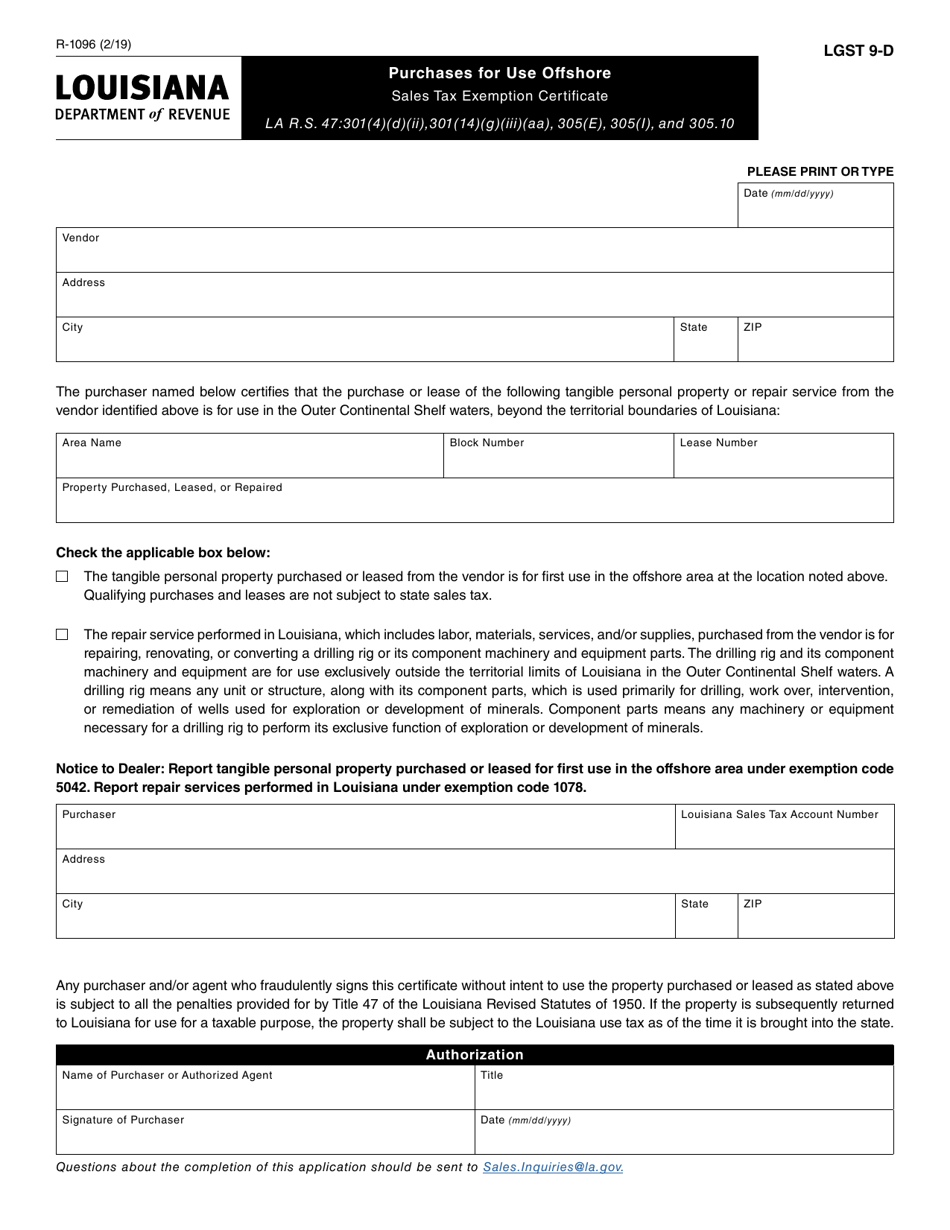

Form R1096 Download Fillable PDF or Fill Online Purchases for Use

About publication 225, farmer's tax guide. Web act 464 of the regular session of the 2009 louisiana legislature amended the sales tax exemption for farm equipment authorized by louisiana revised statute 47:305.25 to. The sales tax exemption covers the first $50,000 of the sales. Web the state sales tax exemption on farm agricultural inputs includes fuel, feed, seed, fertilizer and.

Bupa Tax Exemption Form / Parcel Tax Exemption Forms Now Available

The sales tax exemption covers the first $50,000 of the sales. Web when purchasing merchandise, it must be noted that there are many exemption certificates which can be utilized. Web the state sales tax exemption on farm agricultural inputs includes fuel, feed, seed, fertilizer and livestock pharmaceuticals. A good example is the certificate of exemption,. Web all schedule f (form.

Web This Publication Explains How The Federal Tax Laws Apply To Farming.

You must apply to the. Web louisiana revised statue 47:301(30) was passed in 2018 which allows commercial farmers to be exempt from sales tax on feed purchases. Web all schedule f (form 1040) revisions. The sales tax exemption covers the first $50,000 of the sales.

Web How Do I Get A Farm Tax Exempt Number In Louisiana?

Web certificate of exemption covering purchases of certain farm equipment to be used exclusively for commercial agricultural purposes, and, therefore, entitled to the partial. “while this is a renewal of the tax exempt. Web how do i get a farm tax exempt in louisiana? About publication 225, farmer's tax guide.

Web The Louisiana Department Of Revenue Has Fixed The Problem With The Form Needed To Receive Agricultural Tax Exemptions As A Commercial Farmer.

About publication 463, travel, entertainment, gift, and car expenses. Web act 464 of the regular session of the 2009 louisiana legislature amended the sales tax exemption for farm equipment authorized by louisiana revised statute 47:305.25 to. Use this publication as a guide to figure your taxes and complete your farm tax return. The sales tax exemption covers the first $50,000 of the sales.

A Good Example Is The Certificate Of Exemption,.

Web when purchasing merchandise, it must be noted that there are many exemption certificates which can be utilized. A.(1)(a) farm and agricultural vehicles and equipment, except draglines and bulldozers, being operated or transported for bona. Web the state sales tax exemption on farm agricultural inputs includes fuel, feed, seed, fertilizer and livestock pharmaceuticals. Web louisiana revised statute 47:305.25 provides a sales tax exemption for the purchase of certain farm equipment.