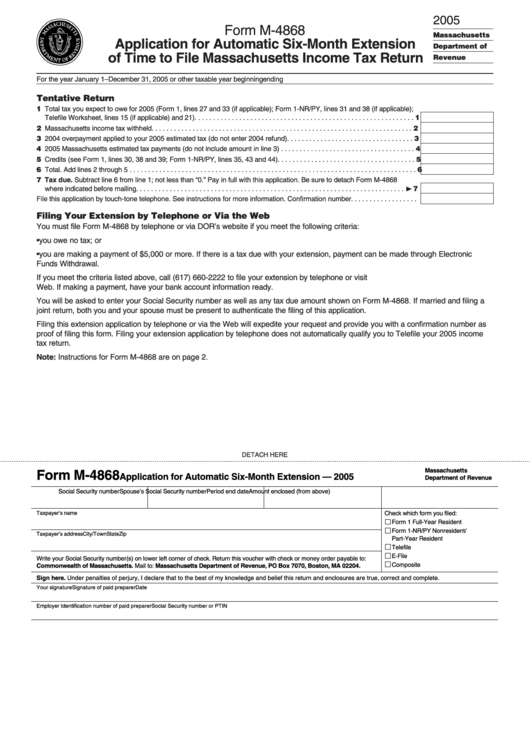

Ma Form 4868

Ma Form 4868 - Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Underpayment of massachusetts estimated income tax for fiduciaries. Interest rates on lines 21 and 23 updated. Web revised march 5, 2021; Web form 4868 (2019) page. See page 1 for more information. 2 when to file form 4868 file form 4868 by april 15, 2021. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Web there are several ways to submit form 4868. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return.

Ad get ready for tax season deadlines by completing any required tax forms today. Explore more file form 4868 and extend your 1040 deadline up to 6. Web revised march 5, 2021; Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Your state extension pdf is free. This form is for income earned in tax year 2022, with tax returns. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Web there are several ways to submit form 4868. If line 7 is “0” or you are making a payment of $5,000 or more,. Fiscal year taxpayers file form.

Web massachusetts tax extension form m 4868 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 40 votes how to fill out and sign m 4868 online? Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Your state extension pdf is free. Underpayment of massachusetts estimated income tax for fiduciaries. Web form 4868 (2018) page. Web revised march 5, 2021; 2 when to file form 4868 file form 4868 by april 15, 2020. Citizen or resident files this form to request. This form is for income earned in tax year 2022, with tax returns. Web 2021 form efo:

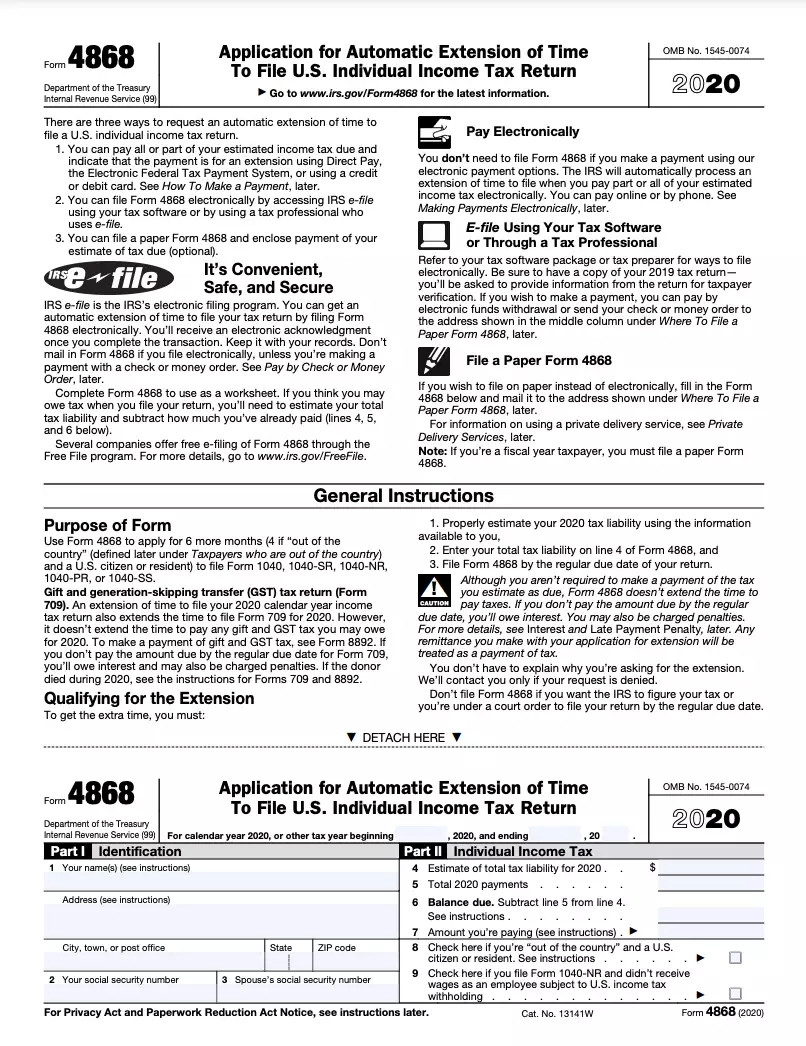

Form 4868 Application for Automatic Extension of Time to File U.S

2 when to file form 4868 file form 4868 by april 15, 2019 (april 17, 2019, if you live in maine or massachusetts). This form is for income earned in tax year 2022, with tax returns. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Web you can file a paper form 4868.

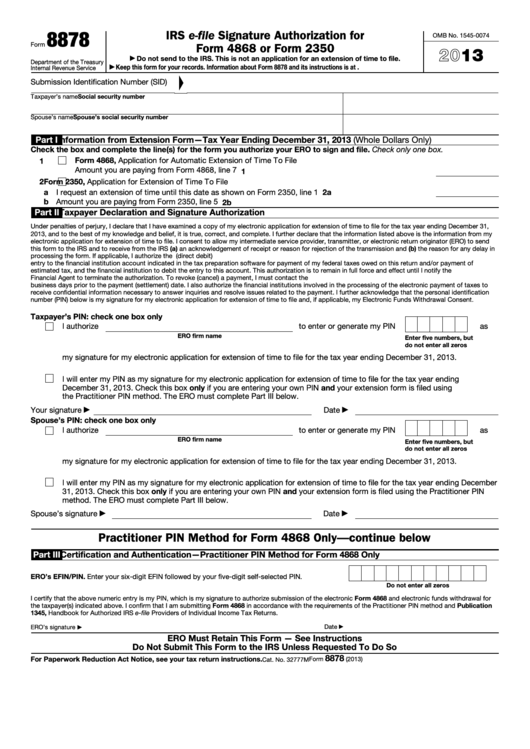

Fillable Form 8878 Irs EFile Signature Authorization For Form 4868

Citizen or resident files this form to request. Web form 4868 (2018) page. Web 2021 form efo: Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. 2 when to file form 4868 file form 4868 by april 15, 2020.

Top 10 Us Tax Forms In 2022 Explained Pdf Co Gambaran

Interest rates on lines 21 and 23 updated. This form is for income earned in tax year 2022, with tax returns. Web form 4868 (2020) page. Explore more file form 4868 and extend your 1040 deadline up to 6. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return.

Form M4868 Application For Automatic SixMonth Extension Of Time To

Fiscal year taxpayers file form. This form is for income earned in tax year 2022, with tax returns. Interest rates on lines 21 and 23 updated. Web form 4868 (2018) page. Ad get ready for tax season deadlines by completing any required tax forms today.

How to File a 2016 Tax Extension (IRS Form 4868) on iPhone, iPad or

2 when to file form 4868 file form 4868 by april 15, 2019 (april 17, 2019, if you live in maine or massachusetts). Web form 4868 (2019) page. Fiscal year taxpayers file form. Underpayment of massachusetts estimated income tax for fiduciaries. Interest rates on lines 21 and 23 updated.

Form 4868 Application for Automatic Extension of Time to File U.S

Your state extension pdf is free. This form is for income earned in tax year 2022, with tax returns. 2 when to file form 4868 file form 4868 by april 15, 2019 (april 17, 2019, if you live in maine or massachusetts). Web revised march 5, 2021; Web form 4868 (2019) page.

Form 4868 Application for Automatic Extension of Time to File U.S

2 when to file form 4868 file form 4868 by april 15, 2021. Anyone that misses the deadline to file should make payment of any tax due via a return payment. Explore more file form 4868 and extend your 1040 deadline up to 6. Web form 4868 (2020) page. Web 8 rows these where to file addresses are to be.

Know about IRS tax extension Form 4868 TaxEz

Web form 4868 (2018) page. See page 1 for more information. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Ad get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns.

E File Tax Form 4868 Online Universal Network

Interest rates on lines 21 and 23 updated. Anyone that misses the deadline to file should make payment of any tax due via a return payment. Web form 4868 (2019) page. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). This form is for income earned in tax year 2022, with.

Fiscal Year Taxpayers File Form 4868 By The Original Due Date Of The Fiscal Year Return.

Ad get ready for tax season deadlines by completing any required tax forms today. Anyone that misses the deadline to file should make payment of any tax due via a return payment. If line 7 is “0” or you are making a payment of $5,000 or more,. Explore more file form 4868 and extend your 1040 deadline up to 6.

Interest Rates On Lines 21 And 23 Updated.

Web massachusetts tax extension form m 4868 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 40 votes how to fill out and sign m 4868 online? You must file form 4868 by. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Your state extension pdf is free.

Fiscal Year Taxpayers File Form.

Web form 4868 (2018) page. This form is for income earned in tax year 2022, with tax returns. Web form 4868 (2020) page. See page 1 for more information.

Web There Are Several Ways To Submit Form 4868.

2 when to file form 4868 file form 4868 by april 15, 2019 (april 17, 2019, if you live in maine or massachusetts). Underpayment of massachusetts estimated income tax for fiduciaries. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Web 8 rows these where to file addresses are to be used only by taxpayers and tax professionals filing form 4868 during calendar year 2022 to 2023.