Maine Homestead Exemption Form

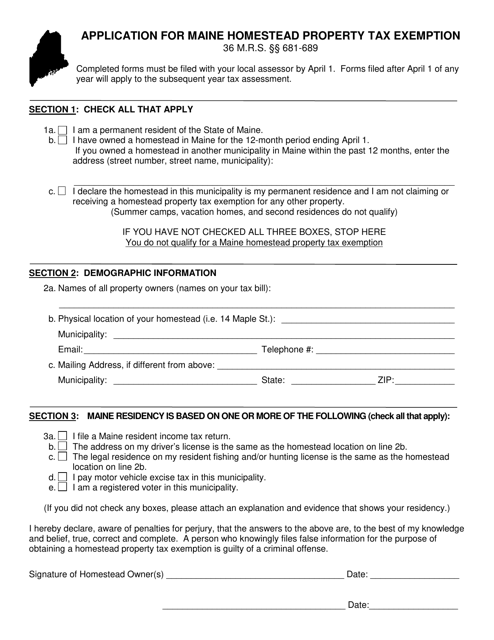

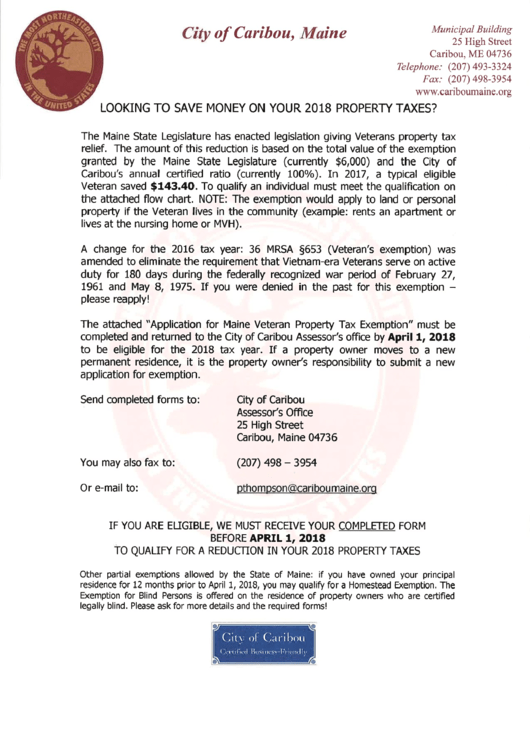

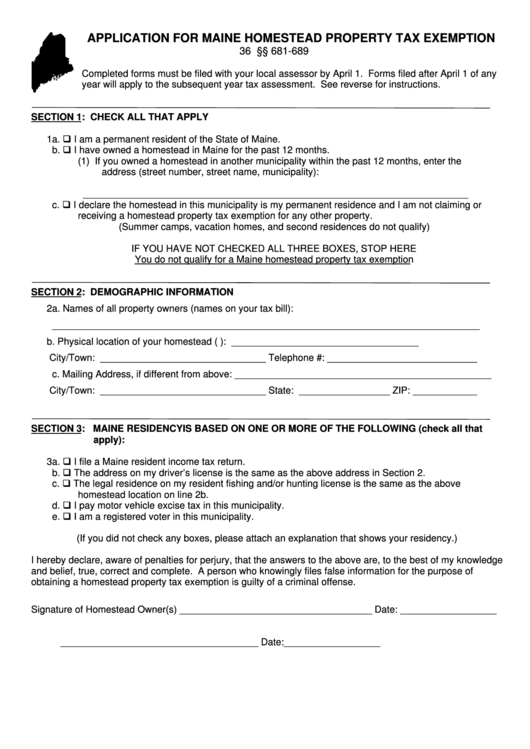

Maine Homestead Exemption Form - This form will be included with the cooperative housing corporation’s homestead exemption application section 1. Web we administer the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and telecommunications business equipment tax and we determine annually the amount of tax reimbursement to each town for veteran, homestead, and animal waste facility exemptions, and tree growth tax loss reimbursement. Forms filed after april 1 of any year will apply to the subsequent year tax assessment. The completed application must be submitted to. Web your cooperative housing corporation must file for the homestead exemption with the municipal assessor no later than april 1. Number of exemptions granted for homesteads valued less than the maximum. Check all that apply 1a. Web how do i apply for the homestead exemption? Check the appropriate box related to each question. You must check all three boxes to qualify for the maine homestead property tax exemption.

Value of homestead exemptions on line 14a (line 14a x $25,000 x line 3) 14b c. The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions page. Property owners would receive an exemption of $25,000. If you have moved during the year and owned a homestead in maine prior to your move, enter the address of the homestead you moved from on line 1b. This is known as the homestead exemption. Web application for maine homestead property tax exemption 36 m.r.s. An applicant must be at least 65 years old, a permanent resident of the state, and must have owned a maine homestead for at least ten years. See reverse for additional instructions section 1: Number of maximum homestead exemptions granted 14a (maximum exemption = $25,000 x line 3 certified ratio) b. Web taxes for individuals 65 years of age or older who own a homestead for at least 10 years.” this new law allows certain senior residents to stabilize, or freeze, the property taxes on their homestead.

The completed application must be submitted to. This is known as the homestead exemption. Web homestead exemptions must be adjusted by the municipality's certified ratio 14. Web we administer the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and telecommunications business equipment tax and we determine annually the amount of tax reimbursement to each town for veteran, homestead, and animal waste facility exemptions, and tree growth tax loss reimbursement. The exemption may not exceed $10,000 even if the title to the homestead is held jointly or in common with others. If you have moved during the year and owned a homestead in maine prior to your move, enter the address of the homestead you moved from on line 1b. Property owners would receive an exemption of $25,000. The homestead exemption application is available at most municipalities or you may download the application on the homestead exemptions page. Check the appropriate box related to each question. Forms filed after april 1 of any year will apply to the subsequent year tax assessment.

Maine Application for Maine Homestead Property Tax Exemption Download

Web homestead exemptions must be adjusted by the municipality's certified ratio 14. Web we administer the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and telecommunications business equipment tax and we determine annually the amount of tax reimbursement to each town for veteran, homestead, and animal waste facility exemptions, and tree growth tax loss reimbursement. Web.

Applicaton For Maine Veteran Property Tax Exemption printable pdf download

You must check all three boxes to qualify for the maine homestead property tax exemption. I am a permanent resident of. Web taxes for individuals 65 years of age or older who own a homestead for at least 10 years.” this new law allows certain senior residents to stabilize, or freeze, the property taxes on their homestead. This form will.

File Homestead Exemption YouTube

Web in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this state for the preceding 12 months is exempt from taxation.”. You must check all three boxes to qualify for the maine homestead property tax exemption. This form will be included with the cooperative housing corporation’s.

California Homestead Declaration Form for single person Legal Forms

Forms filed after april 1 of any year will apply to the subsequent year tax assessment. You must check all three boxes to qualify for the maine homestead property tax exemption. Web how do i apply for the homestead exemption? This is known as the homestead exemption. The exemption may not exceed $10,000 even if the title to the homestead.

An Introduction to the Homestead Exemption Envoy Mortgage

Web application for maine homestead property tax exemption 36 m.r.s. This is known as the homestead exemption. The exemption may not exceed $10,000 even if the title to the homestead is held jointly or in common with others. If you have moved during the year and owned a homestead in maine prior to your move, enter the address of the.

How Do You Qualify For Florida's Homestead Exemption?

Number of exemptions granted for homesteads valued less than the maximum. Web we administer the real estate transfer tax, commercial forestry excise tax, controlling interest transfer tax, and telecommunications business equipment tax and we determine annually the amount of tax reimbursement to each town for veteran, homestead, and animal waste facility exemptions, and tree growth tax loss reimbursement. The exemption.

Fillable Application Form For Maine Homestead Property Tax Exemption

You must check all three boxes to qualify for the maine homestead property tax exemption. The exemption may not exceed $10,000 even if the title to the homestead is held jointly or in common with others. I am a permanent resident of. Forms filed after april 1 of any year will apply to the subsequent year tax assessment. Web homestead.

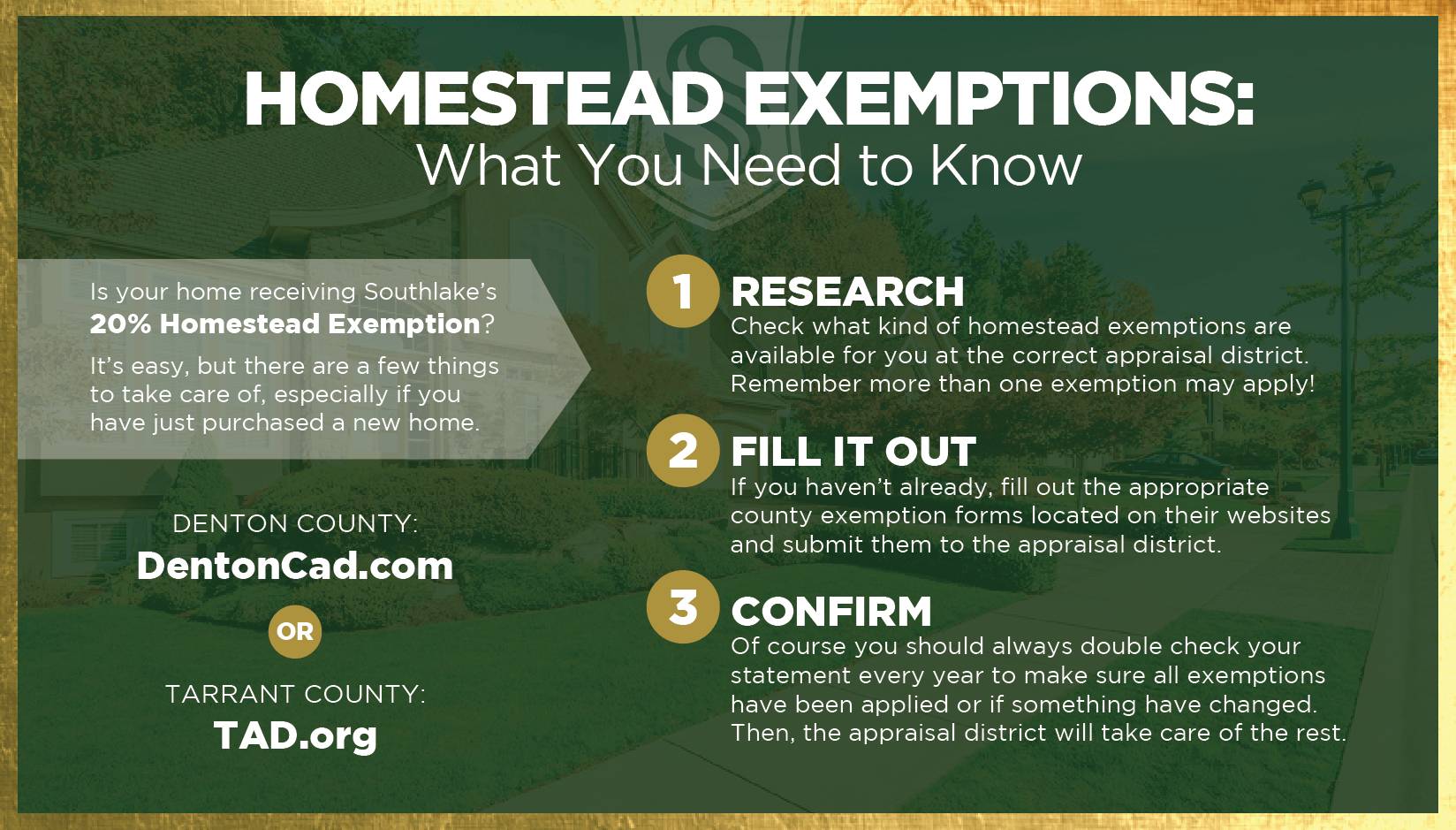

homestead exemption MySouthlakeNews

This is known as the homestead exemption. Web how do i apply for the homestead exemption? Number of maximum homestead exemptions granted 14a (maximum exemption = $25,000 x line 3 certified ratio) b. The exemption may not exceed $10,000 even if the title to the homestead is held jointly or in common with others. I am a permanent resident of.

Montgomery Co Tax Bills Are Coming Are You Receiving the Homestead

Number of exemptions granted for homesteads valued less than the maximum. Web taxes for individuals 65 years of age or older who own a homestead for at least 10 years.” this new law allows certain senior residents to stabilize, or freeze, the property taxes on their homestead. Value of homestead exemptions on line 14a (line 14a x $25,000 x line.

What is Homestead Exemption

See reverse for additional instructions section 1: The completed application must be submitted to. Number of maximum homestead exemptions granted 14a (maximum exemption = $25,000 x line 3 certified ratio) b. Value of homestead exemptions on line 14a (line 14a x $25,000 x line 3) 14b c. Check all that apply 1a.

Number Of Exemptions Granted For Homesteads Valued Less Than The Maximum.

Check all that apply 1a. An applicant must be at least 65 years old, a permanent resident of the state, and must have owned a maine homestead for at least ten years. This form will be included with the cooperative housing corporation’s homestead exemption application section 1. Web in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this state for the preceding 12 months is exempt from taxation.”.

Web We Administer The Real Estate Transfer Tax, Commercial Forestry Excise Tax, Controlling Interest Transfer Tax, And Telecommunications Business Equipment Tax And We Determine Annually The Amount Of Tax Reimbursement To Each Town For Veteran, Homestead, And Animal Waste Facility Exemptions, And Tree Growth Tax Loss Reimbursement.

I am a permanent resident of. Property owners would receive an exemption of $25,000. Web application for maine homestead property tax exemption 36 m.r.s. Completed forms must be filed with your local assessor by april 1.

If You Have Moved During The Year And Owned A Homestead In Maine Prior To Your Move, Enter The Address Of The Homestead You Moved From On Line 1B.

Web how do i apply for the homestead exemption? Forms filed after april 1 of any year will apply to the subsequent year tax assessment. Web your cooperative housing corporation must file for the homestead exemption with the municipal assessor no later than april 1. Web taxes for individuals 65 years of age or older who own a homestead for at least 10 years.” this new law allows certain senior residents to stabilize, or freeze, the property taxes on their homestead.

The Completed Application Must Be Submitted To.

Forms filed after april 1 of any year will apply to the subsequent year tax assessment. Number of maximum homestead exemptions granted 14a (maximum exemption = $25,000 x line 3 certified ratio) b. You must check all three boxes to qualify for the maine homestead property tax exemption. Check the appropriate box related to each question.