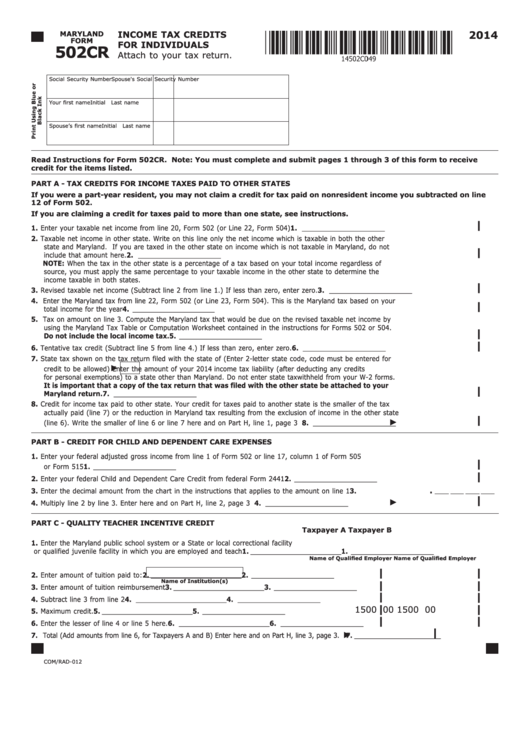

Maryland Form 502Cr

Maryland Form 502Cr - Web a maryland resident having income from one of these states must report the income on the maryland return form 502. You can download or print current or past. Web what is a maryland 502cr form? 2020 tax return resident income maryland (comptroller of maryland) form is 4 pages long and contains: You can download maryland 502cr form from the pdfliner website where you can fill it online. Write on this line only the net. Form 502cr must be attached to. Web on form 502, form 505 or form 515 in the designated area. Web the return of the other state or on the maryland return (line 29 of form 502). To claim a credit for taxes paid to the other state, and/or local jurisdiction in the other state, complete form 502cr and attach it and a copy of the.

To claim a credit for taxes paid to the other state, and/or local jurisdiction in the other state, complete form 502cr and attach it and a copy of the. Web 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Form 502cr must be attached to. For individuals form 502cr must be attached to your maryland tax return. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. Web form 2013 attachment sequence no. Taxable net income in other state. Web we last updated the retirement income form in january 2023, so this is the latest version of form 502r, fully updated for tax year 2022. Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Web read instructions for form 502cr.

Web there is no jump to for maryland form 502cr because the form is used for multiple credits. Web what is a maryland 502cr form? To claim a credit for taxes paid to the other state, and/or local jurisdiction in the other state, complete form 502cr and attach it and a copy of the. You must complete and submit pages 1 through 3 of this form to receive credit for the. Web form 2013 attachment sequence no. Web the return of the other state or on the maryland return (line 29 of form 502). Web read instructions for form 502cr. Web 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Web form 502cr is used to claim the conservation easement tax credit. Web form 502cr must be attached to the annual return (form 502, 504, 505 or 515) and filed with the comptroller of maryland, revenue administration division, 110 carroll street,.

Fill Free fillable forms Comptroller of Maryland

Web we last updated the retirement income form in january 2023, so this is the latest version of form 502r, fully updated for tax year 2022. Web what is maryland form 502cr? Taxable net income in other state. It is issued by the. This form is for income earned in tax year 2022, with tax returns due in april.

Fill Free fillable forms Comptroller of Maryland

Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Web read instructions for form 502cr. You must complete and submit pages 1 through 4 of this form to receive credit for the items listed. Web 2023 individual income tax forms 2023 individual income tax forms for additional information,.

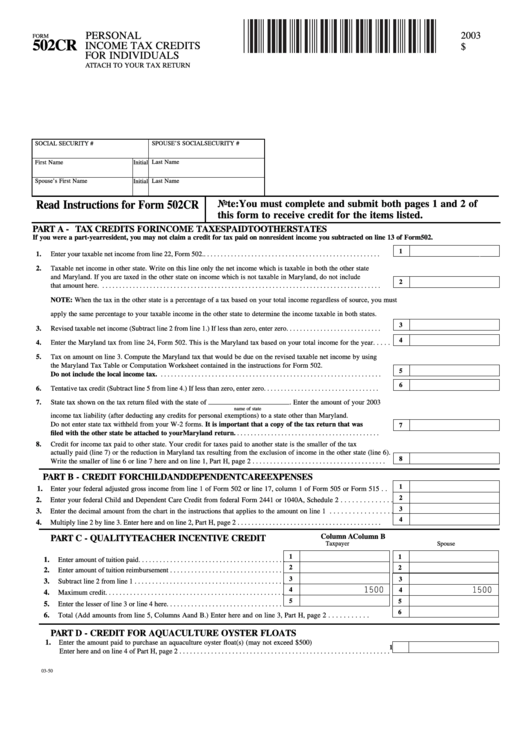

Fillable Form 502cr Personal Tax Credits For Individuals

Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Web on form 502, form 505 or form 515 in the designated area. When and where to file. This form is for income earned in tax year 2022, with tax returns due in april. Web form 502cr is used.

Fill Free fillable forms Comptroller of Maryland

Write on this line only the net. It is issued by the. This form is for income earned in tax year 2022, with tax returns due in april. Web form 502cr is used to claim the conservation easement tax credit. Web what is a maryland 502cr form?

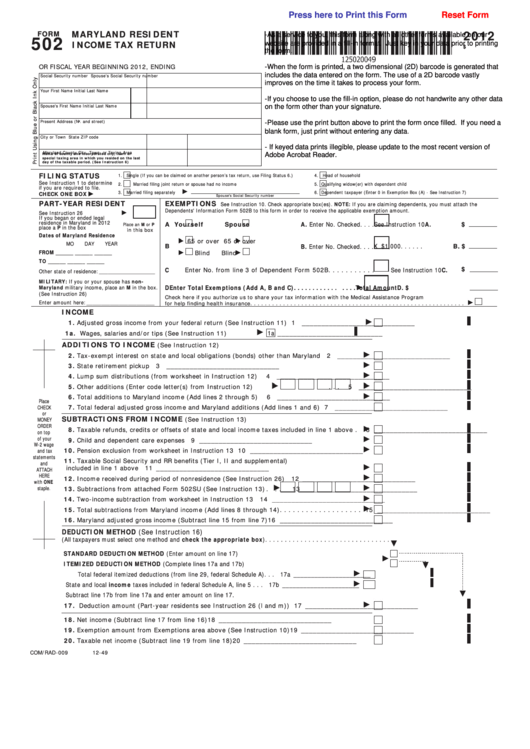

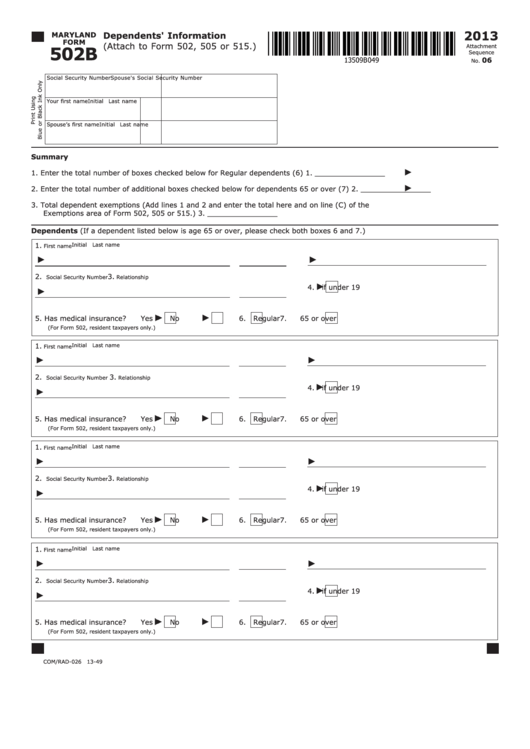

Fillable Form 502 Maryland Resident Tax Return, Form 502b

Web form 502cr must be attached to the annual return (form 502, 504, 505 or 515) and filed with the comptroller of maryland, revenue administration division, 110 carroll street,. This form is for income earned in tax year 2022, with tax returns due in april. Most of these credits are on the screen take a look at maryland. Write on.

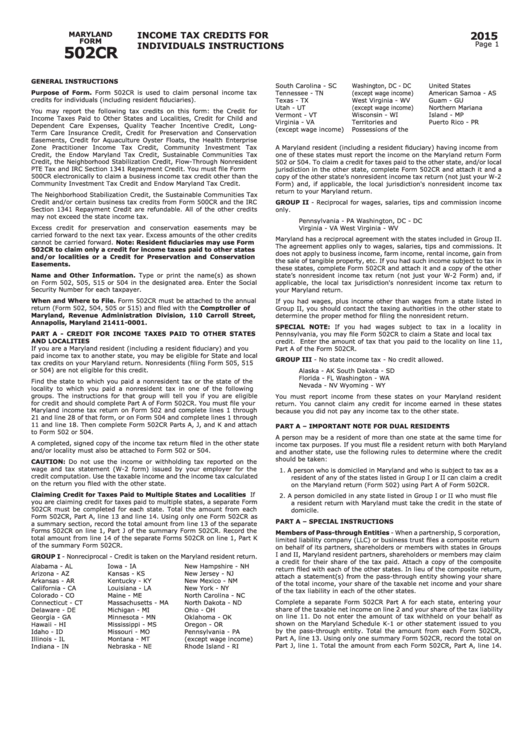

Instructions For Maryland Form 502cr Tax Credits For

Web what is maryland form 502cr? Write on this line only the net. Web the return of the other state or on the maryland return (line 29 of form 502). Enter your taxable net income from line 20, form 502 (or line 10, form 504). You must complete and submit pages 1 through 3 of this form to receive credit.

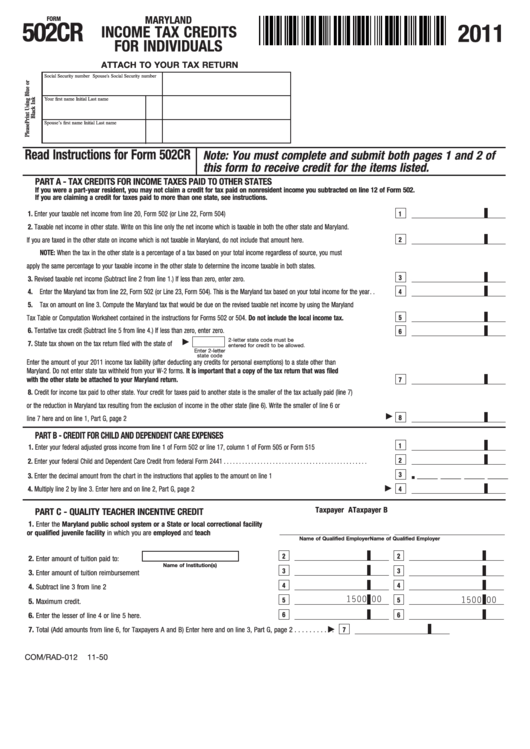

Fillable Form 502cr Maryland Tax Credits For Individuals

To claim a credit for taxes paid to the other state, and/or local jurisdiction in the other state, complete form 502cr and attach it and a copy of the. Web on form 502, form 505 or form 515 in the designated area. Web form 502cr must be attached to the annual return (form 502, 504, 505 or 515) and filed.

Fillable Maryland Form 502b Dependents' Information 2013 printable

Web form 502cr is used to claim the conservation easement tax credit. Enter the social security number for each taxpayer. To claim a credit for taxes paid to the other state, and/or. Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Taxable net income in other state.

Fillable Maryland Form 502cr Tax Credits For Individuals

Web 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Web on form 502, form 505 or form 515 in the designated area. Web we last updated the maryland personal income tax credits for individuals in january 2023, so this is the latest version of form 502cr,.

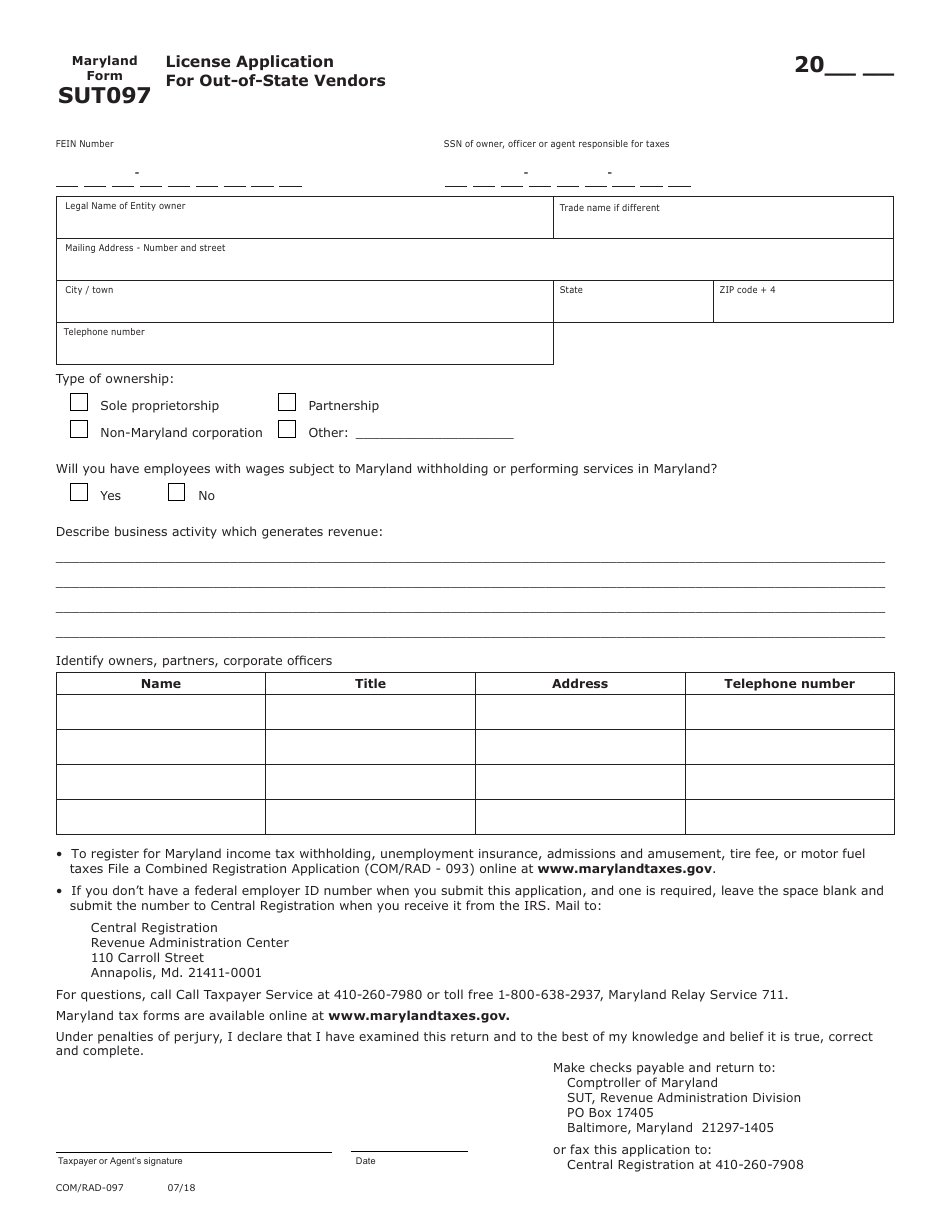

Form COM/RAD097 (Maryland Form SUT097) Download Fillable PDF or Fill

Web form 502cr is used to claim the conservation easement tax credit. It is issued by the. Web we last updated the retirement income form in january 2023, so this is the latest version of form 502r, fully updated for tax year 2022. This is an income tax credit for individuals. Enter your taxable net income from line 20, form.

When And Where To File.

Web what is a maryland 502cr form? The form is estimated to. It is issued by the. Taxable net income in other state.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web we last updated maryland form 502r in january 2023 from the maryland comptroller of maryland. You must complete and submit pages 1 through 3 of this form to receive credit for the. Web read instructions for form 502cr. Most of these credits are on the screen take a look at maryland.

Web On Form 502, Form 505 Or Form 515 In The Designated Area.

You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. Web there is no jump to for maryland form 502cr because the form is used for multiple credits. You must complete and submit pages 1 through 4 of this form to receive credit for the items listed. Write on this line only the net.

2020 Tax Return Resident Income Maryland (Comptroller Of Maryland) Form Is 4 Pages Long And Contains:

Web form 502cr must be attached to the annual return (form 502, 504, 505 or 515) and filed with the comptroller of maryland, revenue administration division, 110 carroll street,. To claim a credit for taxes paid to the other state, and/or local jurisdiction in the other state, complete form 502cr and attach it and a copy of the. This form is for income earned in tax year 2022, with tax returns due in april. Enter the social security number for each taxpayer.