Maximum Foreign Tax Credit Without Form 1116

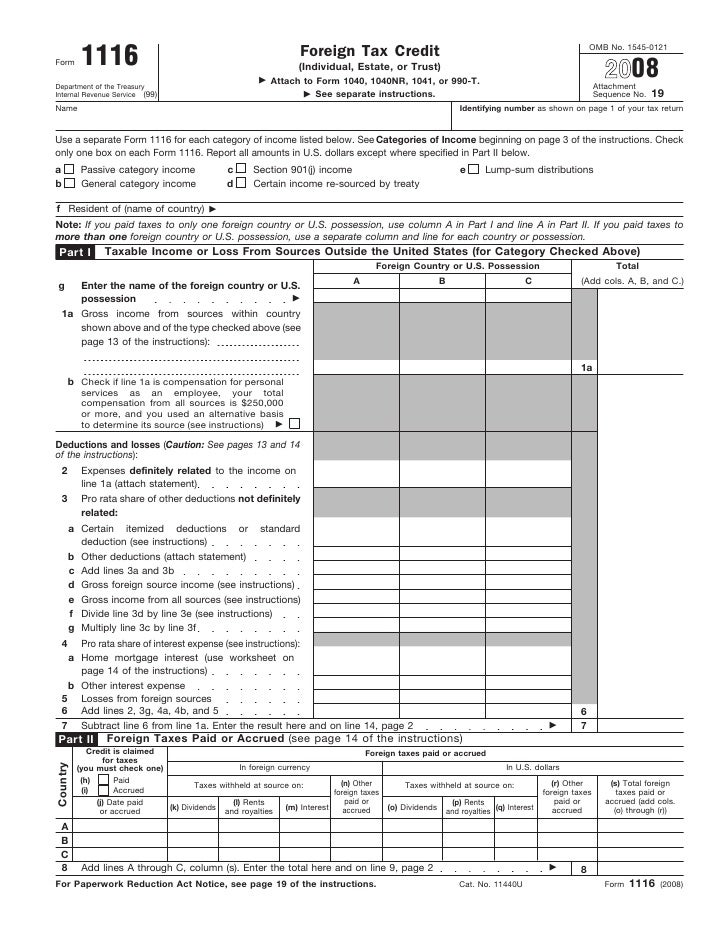

Maximum Foreign Tax Credit Without Form 1116 - By making this election, the foreign tax credit limitation. Limit applied to each income category. Web the $ 7,625 allowable foreign tax is limited to $6,463. Web what category baskets are there? All foreign gross income is passive. Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit. You may be able to claim the foreign tax credit without filing form 1116. All of the gross foreign source income was from. When you paid more than $300/$600 in foreign taxes, the irs doesn’t give the. Web answer a taxpayer may be able to claim the foreign tax credit without filing form 1116 if all of the following apply.

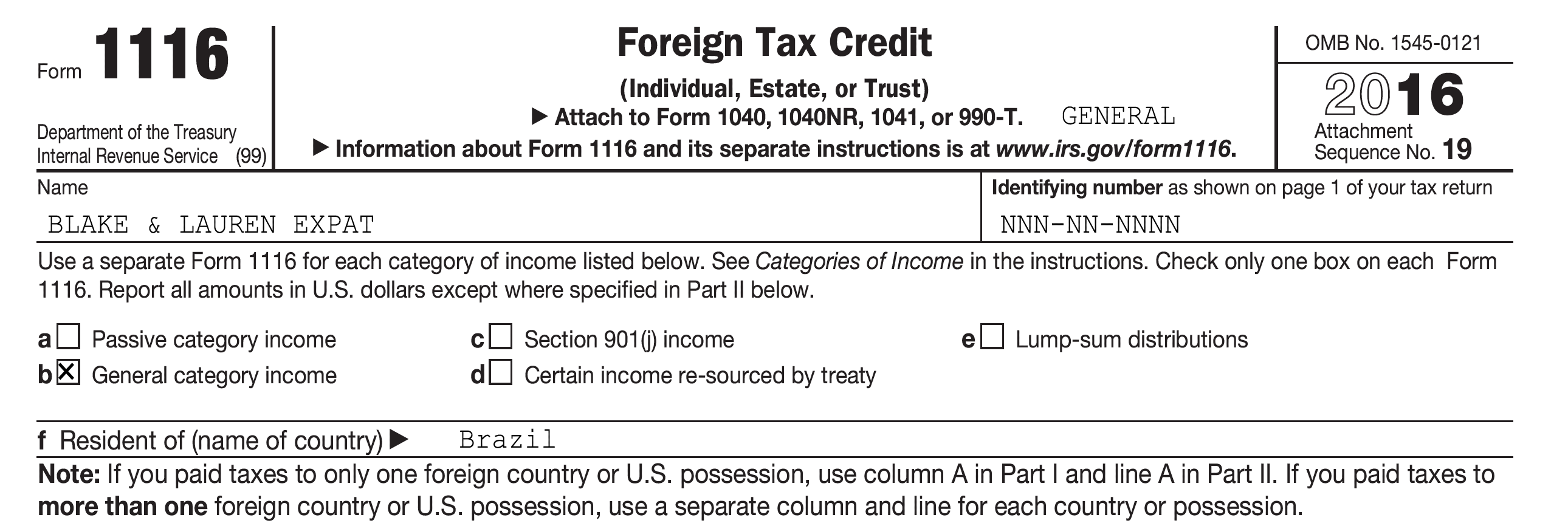

Web what are the rules for claiming the foreign tax credit on form 1116? It’s the form that helps you claim the foreign tax credit (ftc),. You may be able to claim the foreign tax credit without filing form 1116. Web answer a taxpayer may be able to claim the foreign tax credit without filing form 1116 if all of the following apply. By making this election, the foreign tax credit limitation. Web the instructions to form 1116 state: By making this election, the foreign tax credit limitation (lines 15 through 21 of the form) won't apply to. Web the $ 7,625 allowable foreign tax is limited to $6,463. Web what category baskets are there? Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs.

But using the form enables you to. Web the instructions to form 1116 state: Limit applied to each income category. By making this election, the foreign tax credit limitation. You may claim a maximum of $300 ($600) for taxpayers filing a joint return without having to. Web what is the maximum tax credit i can claim without filing form 1116? All of the gross foreign source income was from. Web what category baskets are there? Web to choose the foreign tax credit, you generally must complete form 1116, foreign tax credit and attach it to your u.s. Web the $ 7,625 allowable foreign tax is limited to $6,463.

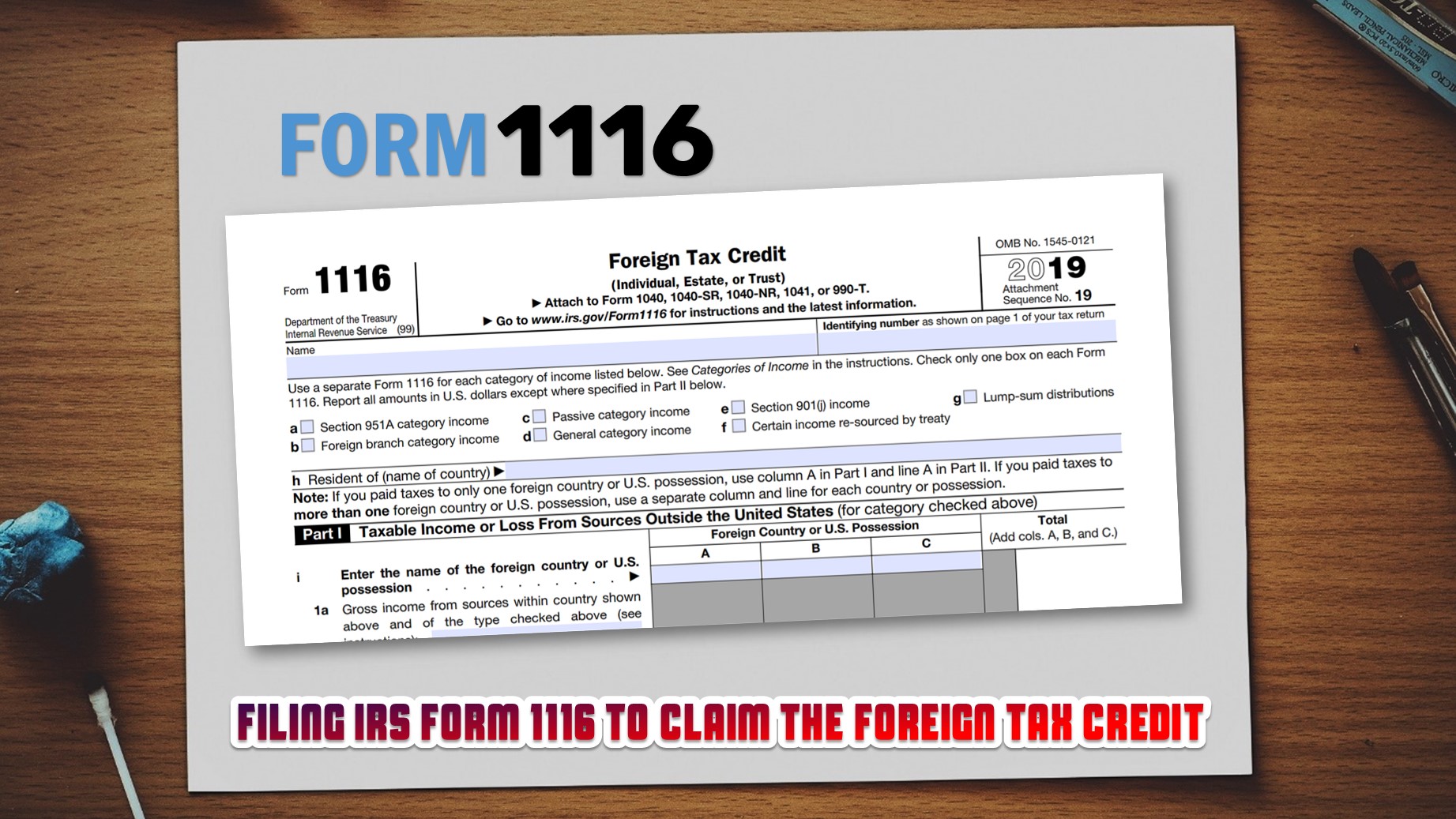

How to fill out form 1116 foreign tax credit Australian manuals

Web note that individuals may be able to claim the foreign tax credit without filing form 1116 if their foreign income was “passive category income,” all the income and any foreign. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes.

How To Claim Foreign Tax Credit On Form 1040 Asbakku

Carryback 1 yr / carryforward 10 yrs. The foreign tax credit cannot be more than the foreign tax credit limit. Web you may be able to claim the foreign tax credit without filing form 1116. Web if you’re an american citizen that lives overseas, then you need to know about irs form 1116. It’s the form that helps you claim.

Foreign Tax Credit Your Guide to the Form 1116 SDG Accountant

The limit is calculated by multiplying your u.s. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Web single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing form 1116..

The Expat's Guide to Form 1116 Foreign Tax Credit

All foreign gross income is passive. Web to choose the foreign tax credit, you generally must complete form 1116, foreign tax credit and attach it to your u.s. Web answer a taxpayer may be able to claim the foreign tax credit without filing form 1116 if all of the following apply. Web if you’re an american citizen that lives overseas,.

U.S. Expatriates Can Claim Foreign Tax Credit Filing Form 1116

All foreign gross income is passive. Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit. However, you may qualify for an. Web what is the maximum tax credit i can claim without filing form 1116? If the foreign tax paid is.

Is From Forex Trading Taxable In Singapore Forex Trend Hunter

The limit is calculated by multiplying your u.s. Web single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing form 1116. You can find the different foreign tax credit baskets at the top of form 1116, which is the form used by individuals to calculate their foreign tax..

Form 1116 Explanation Statement What You Need to File

If the foreign tax paid is more than $300 ($600 for married filing jointly) or they do not meet the other. By making this election, the foreign tax credit limitation. You may be able to claim the foreign tax credit without filing form 1116. All foreign gross income is passive. Web answer a taxpayer may be able to claim the.

Form 1116Foreign Tax Credit

You may be able to claim the foreign tax credit without filing form 1116. Web single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing form 1116. The limit is calculated by multiplying your u.s. Web if you’re an american citizen that lives overseas, then you need to.

edira sudesntrecives a scholarship that is excluded from gros

But using the form enables you to. Web what category baskets are there? You may claim a maximum of $300 ($600) for taxpayers filing a joint return without having to. When you paid more than $300/$600 in foreign taxes, the irs doesn’t give the. However, you may qualify for an.

Demystifying IRS Form 1116 Calculating Foreign Tax Credits SF Tax

Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Web the $ 7,625 allowable foreign tax is limited to $6,463. Web if you’re an american citizen that lives overseas, then you need to know about irs form 1116. Web the instructions to.

Web File Form 1116, Foreign Tax Credit, To Claim The Foreign Tax Credit If You Are An Individual, Estate Or Trust, And You Paid Or Accrued Certain Foreign Taxes To A Foreign.

Web you may be able to claim the foreign tax credit without filing form 1116. Web election to claim the foreign tax credit without filing form 1116; All foreign gross income is passive. Web answer a taxpayer may be able to claim the foreign tax credit without filing form 1116 if all of the following apply.

However, You May Qualify For An.

The limit is calculated by multiplying your u.s. You may claim a maximum of $300 ($600) for taxpayers filing a joint return without having to. Web if you’re an american citizen that lives overseas, then you need to know about irs form 1116. You can find the different foreign tax credit baskets at the top of form 1116, which is the form used by individuals to calculate their foreign tax.

Web Taxpayers May Elect To Report Foreign Tax Without Filing Form 1116 As Long As The Following Conditions Are Met:

Web all the allowable foreign tax credit for different income categories will be summarized on one form 1116, again, the one with the largest allowable foreign tax credit. Web what is the maximum tax credit i can claim without filing form 1116? All of the gross foreign source income was from. Web what are the rules for claiming the foreign tax credit on form 1116?

You May Be Able To Claim The Foreign Tax Credit Without Filing Form 1116.

Web the irs sets that threshold at $300 for single filers and $600 for married filing jointly. By making this election, the foreign tax credit limitation (lines 15 through 21 of the form) won't apply to. Web single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing form 1116. Limit applied to each income category.