Merrill Lynch Beneficiary Designation Form

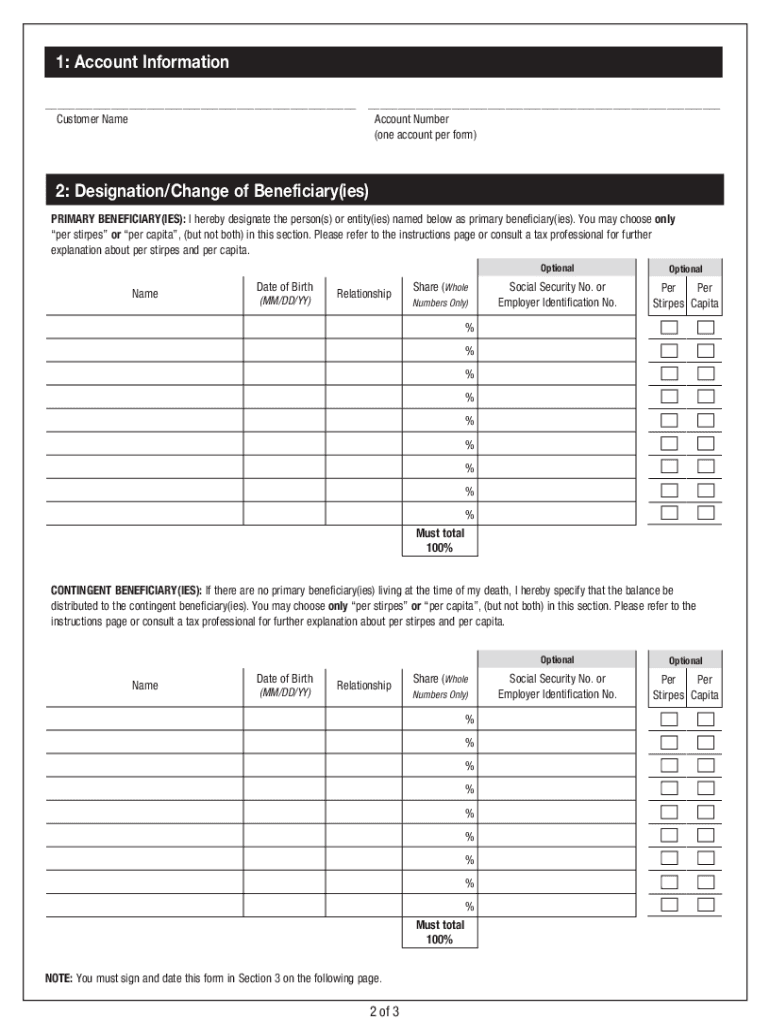

Merrill Lynch Beneficiary Designation Form - Web beneficiary designation form merrill~. Additional clients must use a separate beneficiary designation form. Web beneficiary designation form this form is to be used to designate beneficiaries or to replace all prior beneficiary designations at merrill lynch for the accounts listed below. Including an inherited account of which you are the beneficial owner: Web this form is to be used to designate beneficiaries or to replace all prior beneficiary designations at merrill for the accounts listed below. Account and beneficiary information decedent’s merrill account number (required): Web this form is to be used to designate beneficiaries or to replace all prior beneficiary designations for merrill lynch for the accounts listed below. Web please use this form to designate individual(s) or trust(s) that you would like to receive assets in your merrill lynch brokerage account upon your death without going through probate. If your form is incomplete, a letter will be mailed to you explaining why your request was rejected. Aa aa aa dealing with the death of a loved one can be difficult enough without the additional responsibilities of settling the deceased's estate, particularly when it comes to bills, taxes, and other outstanding debt.

Please review this information prior to executing this agreement. Included in this document are definitions, important terms and disclosures starting on page 5. Additional clients must use a separate beneficiary designation form. Web you must complete a new beneficiary designation form if your marital status changes. Use one form per client. Web beneficiary designation form this form is to be used to designate beneficiaries or to replace all prior beneficiary designations at merrill lynch for the accounts listed below. Web settling an estate after a loved one passes what to know when a loved one passes text size: Including an inherited account of which you are the beneficial owner: Web please use this form to designate individual(s) or trust(s) that you would like to receive assets in your merrill lynch brokerage account upon your death without going through probate. 1 individual retirement account (ira) irra® (rollover ira) roth ira

Ira n basictm n retirement selector account® 403(b)(7) irra® n sep ira n archer medical savings account (msa) roth ira n simple ira n health savings account (hsa) Web beneficiary designation form merrill~. If your form is incomplete, a letter will be mailed to you explaining why your request was rejected. Including an inherited account of which you are the beneficial owner: Included in this document are definitions, important terms and disclosures starting on page 5. Aa aa aa dealing with the death of a loved one can be difficult enough without the additional responsibilities of settling the deceased's estate, particularly when it comes to bills, taxes, and other outstanding debt. Web settling an estate after a loved one passes what to know when a loved one passes text size: Ira irra® roth ira mlesa® basicsm sep ira simple ira retirement selector accountsm archer msa (medical savings account) health savings account instructions use one form per account. Web you must complete a new beneficiary designation form if your marital status changes. Use one form per client.

Don't to check your beneficiary designations every year Wood law

Web this form is to be used to designate beneficiaries or to replace all prior beneficiary designations at merrill for the accounts listed below. Ira • sep ira irra® • simple ira roth ira • retirement selector account® 403(b)(7) basictm instructions: 1 individual retirement account (ira) irra® (rollover ira) roth ira If your form is incomplete, a letter will be.

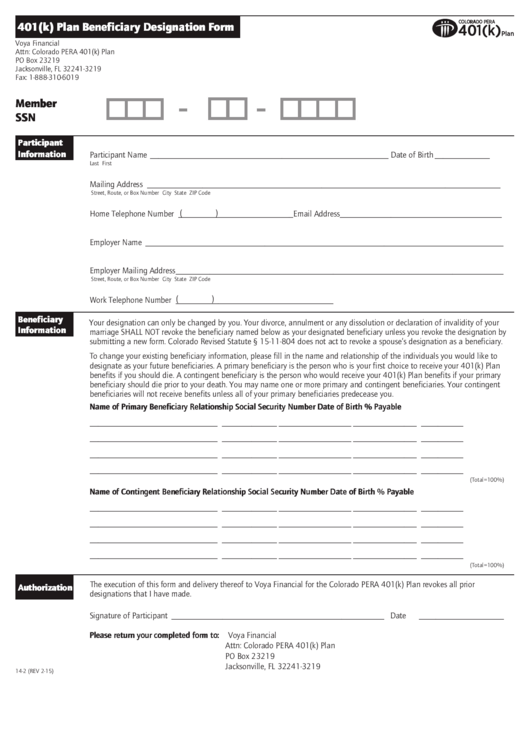

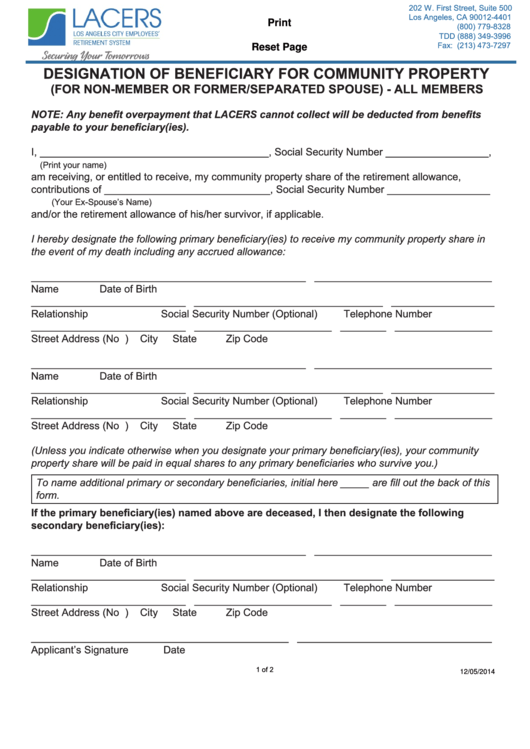

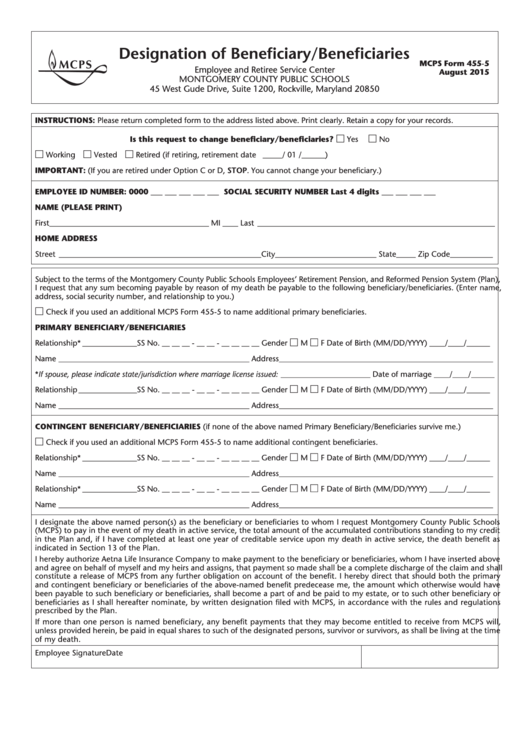

76 Beneficiary Form Templates free to download in PDF

Web you must complete a new beneficiary designation form if your marital status changes. Bank of america company use this form to take a beneficiary distribution from any of the following merrill account types from which you have inherited assets; Aa aa aa dealing with the death of a loved one can be difficult enough without the additional responsibilities of.

76 Beneficiary Form Templates free to download in PDF

Web this form is to be used to designate beneficiaries or to replace all prior beneficiary designations for merrill lynch for the accounts listed below. Aa aa aa dealing with the death of a loved one can be difficult enough without the additional responsibilities of settling the deceased's estate, particularly when it comes to bills, taxes, and other outstanding debt..

Bank Of America Beneficiary Designation Form

Included in this document are definitions, important terms and disclosures starting on page 5. Web you must complete a new beneficiary designation form if your marital status changes. Account and beneficiary information decedent’s merrill account number (required): Ira irra® roth ira mlesa® basicsm sep ira simple ira retirement selector accountsm archer msa (medical savings account) health savings account instructions use.

Top 38 Beneficiary Designation Form Templates free to download in PDF

1 individual retirement account (ira) irra® (rollover ira) roth ira Web beneficiary distribution form merrill~. Ira irra® roth ira mlesa® basicsm sep ira simple ira retirement selector accountsm archer msa (medical savings account) health savings account instructions use one form per account. Web settling an estate after a loved one passes what to know when a loved one passes text.

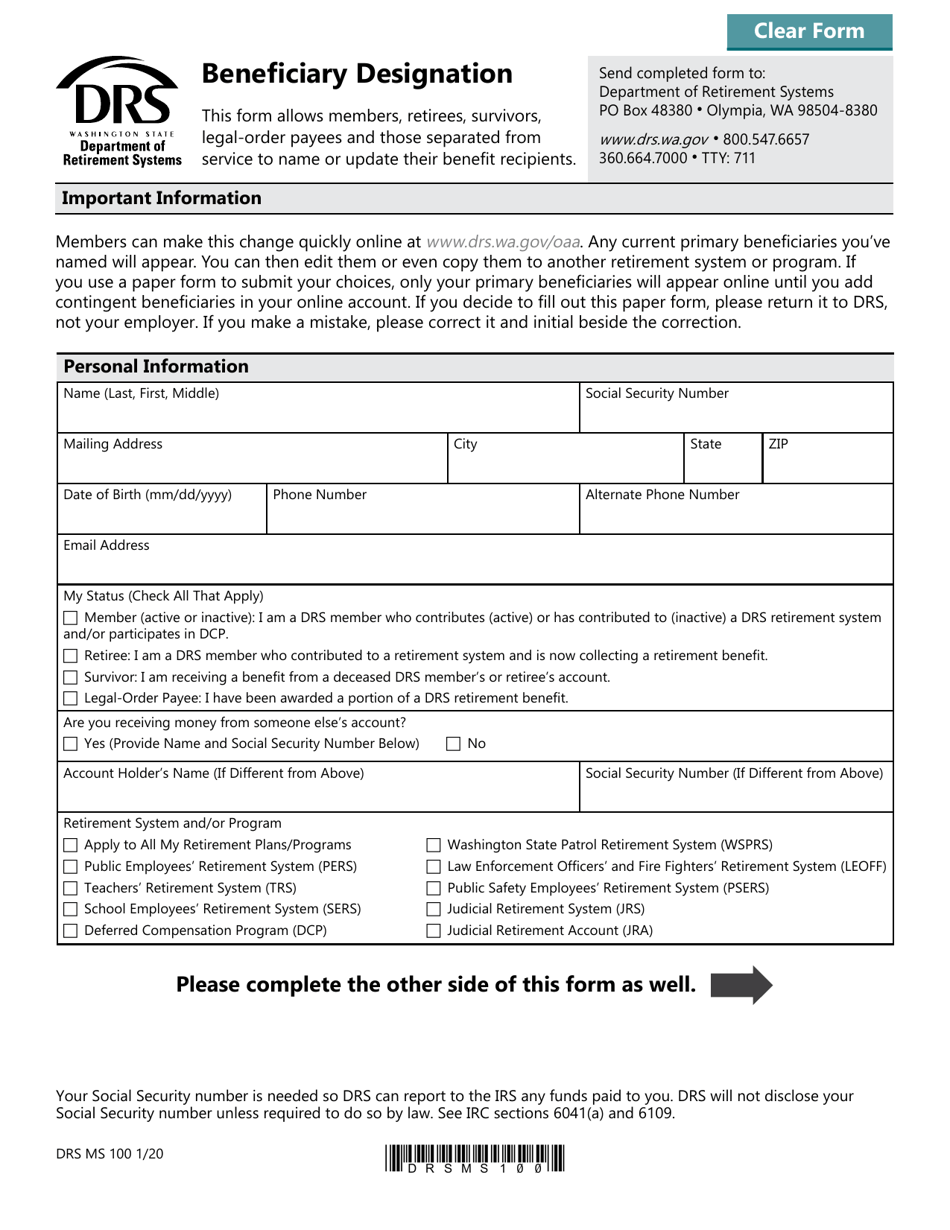

Form DRS MS100 Download Fillable PDF or Fill Online Beneficiary

If your form is incomplete, a letter will be mailed to you explaining why your request was rejected. Additional clients must use a separate beneficiary designation form. Included in this document are definitions, important terms and disclosures starting on page 5. Please review this information prior to executing this agreement. 1 individual retirement account (ira) irra® (rollover ira) roth ira

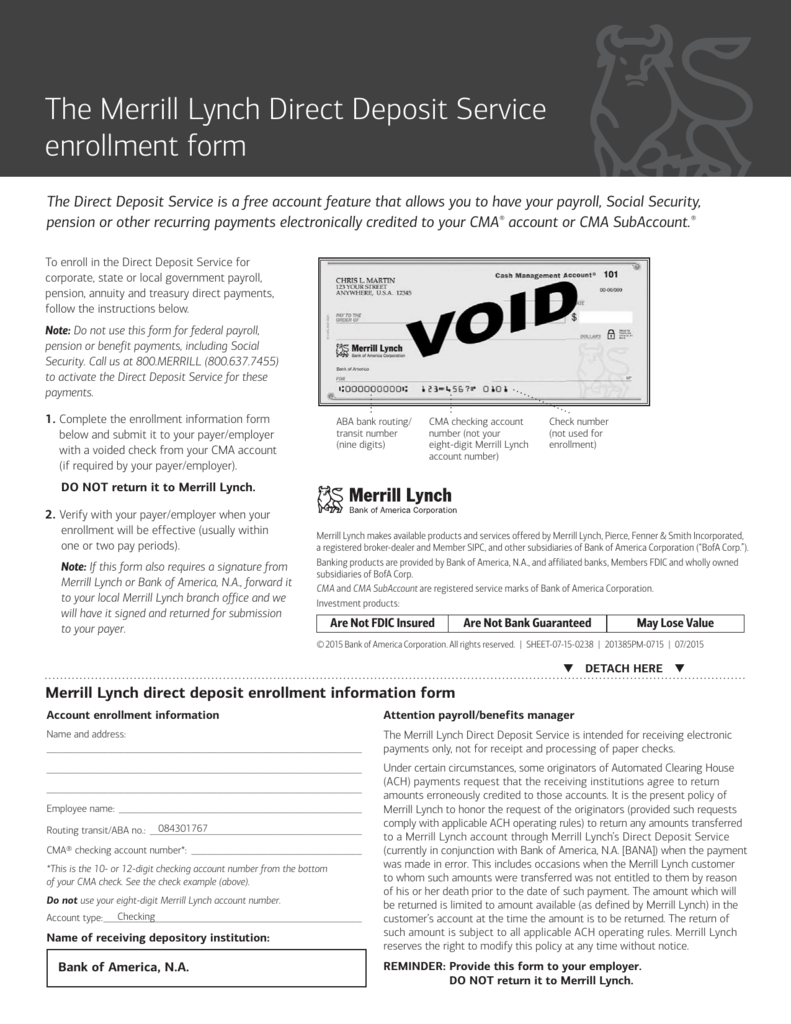

The Merrill Lynch Direct Deposit Service enrollment form

Bank of america company this form is to be used to designate beneficiaries or to replace all prior beneficiary designations at merrill for the accounts listed below. Aa aa aa dealing with the death of a loved one can be difficult enough without the additional responsibilities of settling the deceased's estate, particularly when it comes to bills, taxes, and other.

Merrill lynch beneficiary designation form Fill out & sign online DocHub

Ira • sep ira irra® • simple ira roth ira • retirement selector account® 403(b)(7) basictm instructions: Please review this information prior to executing this agreement. Ira n basictm n retirement selector account® 403(b)(7) irra® n sep ira n archer medical savings account (msa) roth ira n simple ira n health savings account (hsa) 1 individual retirement account (ira) irra®.

Beneficiary Designation Nielsen Law Austin Estate Planning Lawyer

Please review this information prior to executing this agreement. Included in this document are definitions, important terms and disclosures starting on page 5. Ira • sep ira irra® • simple ira roth ira • retirement selector account® 403(b)(7) basictm instructions: Account and beneficiary information decedent’s merrill account number (required): Web beneficiary designation form merrill~.

Merrill Lynch Financial Advisor Paula Sabbagha Earns the Certified

Web beneficiary distribution form merrill~. Bank of america company use this form to take a beneficiary distribution from any of the following merrill account types from which you have inherited assets; Ira irra® roth ira mlesa® basicsm sep ira simple ira retirement selector accountsm archer msa (medical savings account) health savings account instructions use one form per account. Web beneficiary.

Web You Must Complete A New Beneficiary Designation Form If Your Marital Status Changes.

Ira irra® roth ira mlesa® basicsm sep ira simple ira retirement selector accountsm archer msa (medical savings account) health savings account instructions use one form per account. Web beneficiary designation form merrill~. Instructions please complete all applicable sections of the attached beneficiary designation form. If your form is incomplete, a letter will be mailed to you explaining why your request was rejected.

Web Settling An Estate After A Loved One Passes What To Know When A Loved One Passes Text Size:

Included in this document are definitions, important terms and disclosures starting on page 5. Ira n basictm n retirement selector account® 403(b)(7) irra® n sep ira n archer medical savings account (msa) roth ira n simple ira n health savings account (hsa) Bank of america company use this form to take a beneficiary distribution from any of the following merrill account types from which you have inherited assets; Use one form per client.

Web This Form Is To Be Used To Designate Beneficiaries Or To Replace All Prior Beneficiary Designations At Merrill For The Accounts Listed Below.

Account and beneficiary information decedent’s merrill account number (required): Additional clients must use a separate beneficiary designation form. Web this form is to be used to designate beneficiaries or to replace all prior beneficiary designations for merrill lynch for the accounts listed below. Please review this information prior to executing this agreement.

Web Beneficiary Designation Form This Form Is To Be Used To Designate Beneficiaries Or To Replace All Prior Beneficiary Designations At Merrill Lynch For The Accounts Listed Below.

1 individual retirement account (ira) irra® (rollover ira) roth ira Bank of america company this form is to be used to designate beneficiaries or to replace all prior beneficiary designations at merrill for the accounts listed below. Web please use this form to designate individual(s) or trust(s) that you would like to receive assets in your merrill lynch brokerage account upon your death without going through probate. Aa aa aa dealing with the death of a loved one can be difficult enough without the additional responsibilities of settling the deceased's estate, particularly when it comes to bills, taxes, and other outstanding debt.

/https://specials-images.forbesimg.com/imageserve/5d8bfaf56de3150009a52202/0x0.jpg%3FcropX1%3D0%26cropX2%3D6593%26cropY1%3D334%26cropY2%3D4043)