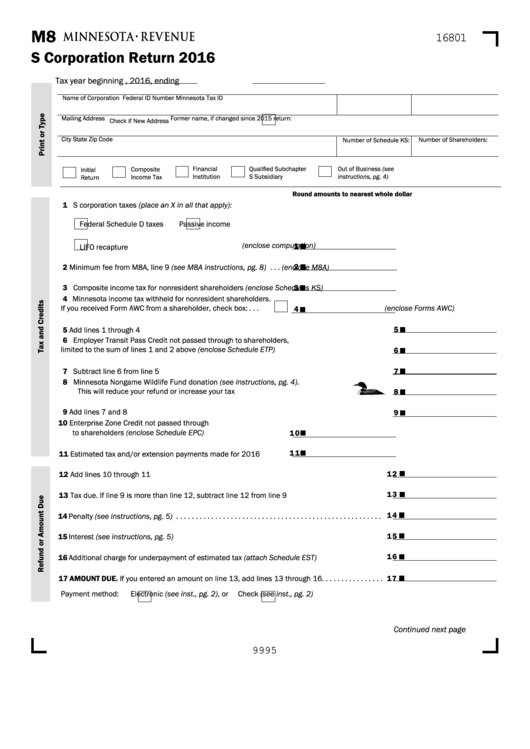

Minnesota Form M8

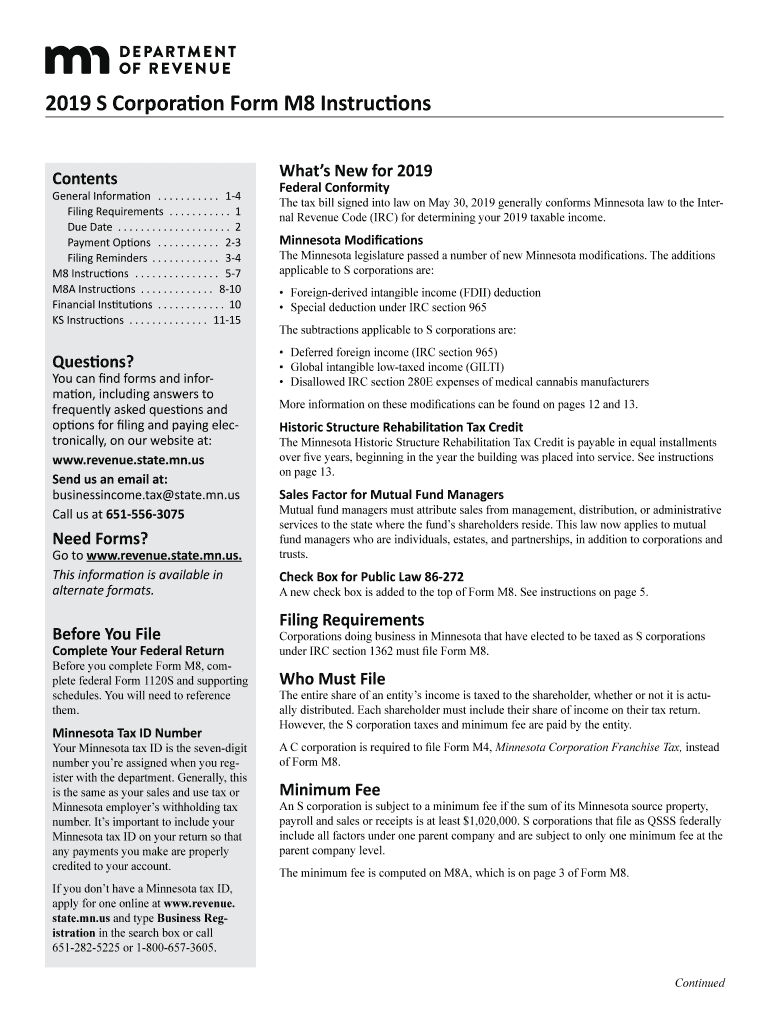

Minnesota Form M8 - Minnesota s corporation income tax mail station 1770 st. To amend your return, use form m1x, amended minnesota income tax return. If you checked the s election termination box on your federal form 1120s you must attach a copy of your federal return to your form m8. Once completed you can sign your. Web name of corporation federal id number minnesota tax id mailing address. City number of shareholders:state zip code. Any amount not claimed on line 7 of form m8 may be passed through to. Now it requires at most thirty minutes, and you can accomplish it from any location. If the schedule is not included, the department will. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8.

Ad register and subscribe now to work on your mn dor m8 instructions & more fillable forms. City number of shareholders:state zip code. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Web fill online, printable, fillable, blank 2020 m8, s corporaon return (minnesota department of revenue) form. The entire share of an entity's income is taxed to the shareholder, whether or not it is actually. If you make a claim for a refund and we do not act on it within six months of the date filed, you may bring an action in the district court or the tax court. Form m8—s corporation return form m8a—apportionment and minimum fee schedule. In addition, the s corporation may have to pay a minimum fee based on property, payroll, and sales attributable to. If you checked the s election termination box on your federal form 1120s you must attach a copy of your federal return to your form m8. Web you will need this information to complete form m4, corporation franchise tax return, form m8, s corporation return, or form m3, partnership return, and you must include this schedule when you file your return.

In addition, the s corporation may have to pay a minimum fee based on property, payroll, and sales attributable to. Now it requires at most thirty minutes, and you can accomplish it from any location. Web fill online, printable, fillable, blank 2020 m8, s corporaon return (minnesota department of revenue) form. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Use fill to complete blank online minnesota department of revenue pdf forms for free. How you can finish mn dor m8 instructions easy. The entire share of an entitys income is taxed to the shareholder, whether or not it is actually. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Or form m2x, amended income tax return for estates and trusts. Web we last updated the s corporation return (m8 and m8a) in february 2023, so this is the latest version of form m8, fully updated for tax year 2022.

Fillable Form M8 S Corporation Return 2016 printable pdf download

The entire share of an entity's income is taxed to the shareholder, whether or not it is actually. .9 enter this amount on line 2 of your form m8. Web what is the minnesota m8 form? Minnesota s corporation income tax mail station 1770 st. Web you will need this information to complete form m4, corporation franchise tax return, form.

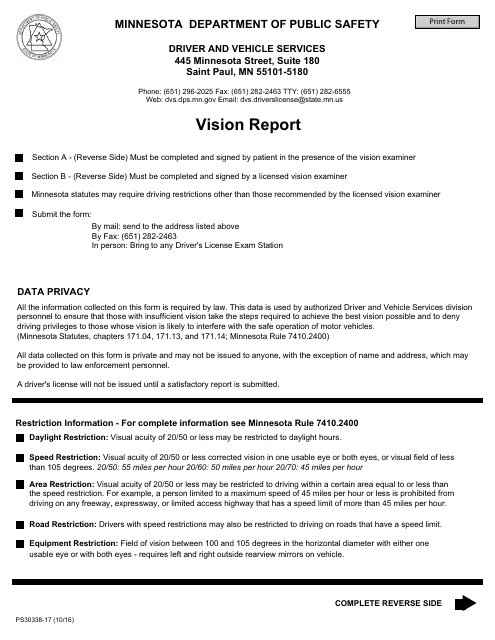

Form PS3033817 Download Fillable PDF or Fill Online Vision Report

Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022. Check if new address former name, if changed since 2018 return: How you can finish mn dor m8 instructions easy. City number of shareholders:state zip code. .9 enter this amount on.

Fill Free fillable 2020 M8, S Corporaon Return (Minnesota Department

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. The entire share of an entity's income is taxed to the shareholder, whether or not it is actually. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362.

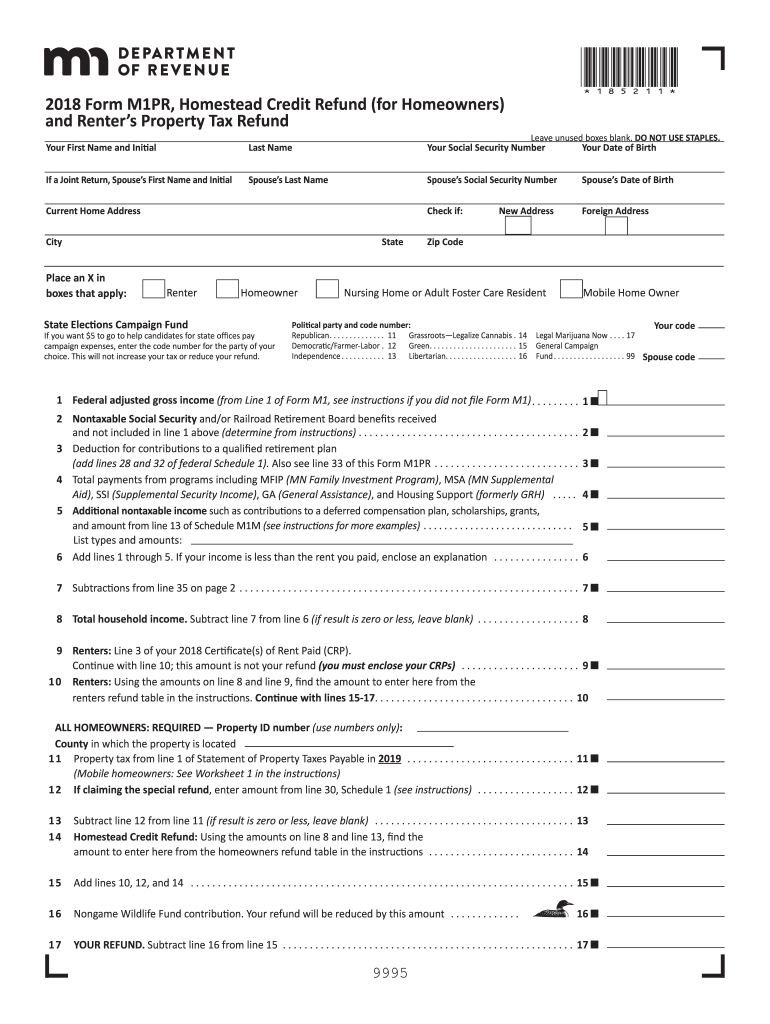

How To File Minnesota Property Tax Refund

If the schedule is not included, the department will. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022..

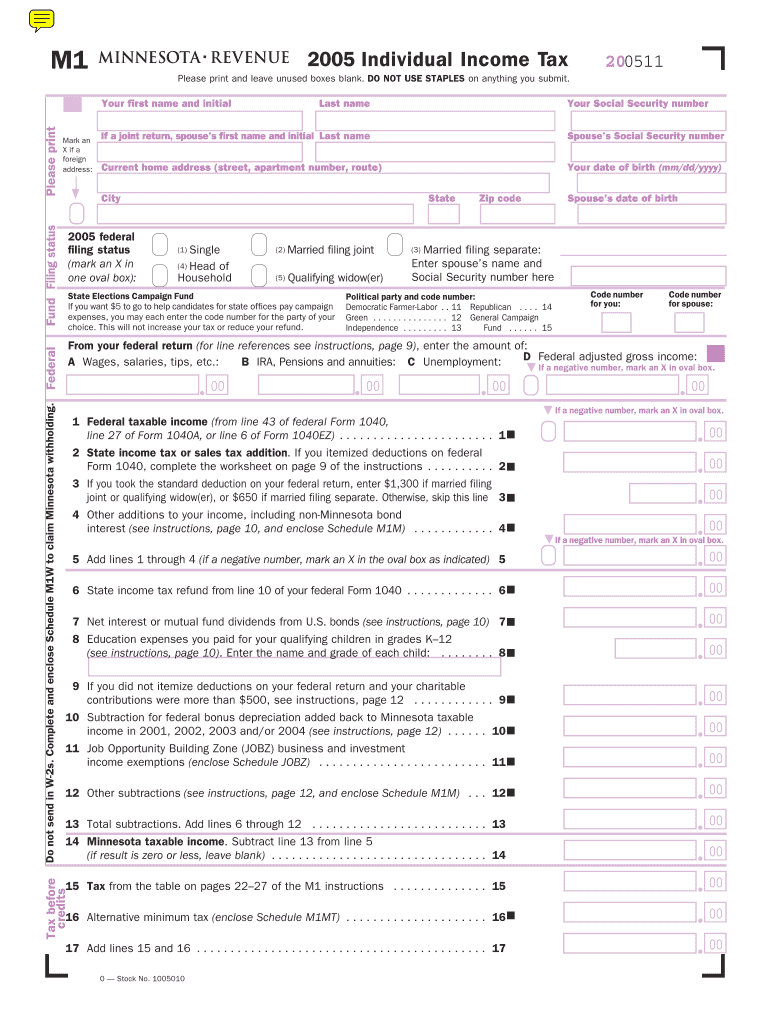

M1 Mn State Tax Form Fill Out and Sign Printable PDF Template signNow

If you checked the s election termination box on your federal form 1120s you must attach a copy of your federal return to your form m8. Use fill to complete blank online minnesota department of revenue pdf forms for free. Check if new address former name, if changed since 2018 return: Ad register and subscribe now to work on your.

Buy M8 Form C Flat Washers (BS4320) Marine Stainless Steel (A4

Form m8—s corporation return form m8a—apportionment and minimum fee schedule. Web you will need this information to complete form m4, corporation franchise tax return, form m8, s corporation return, or form m3, partnership return, and you must include this schedule when you file your return. Edit your form m8 online type text, add images, blackout confidential details, add comments, highlights.

ANM8 Flare Pistol Commemorative Air Force Minnesota Wing

Once completed you can sign your. .9 enter this amount on line 2 of your form m8. Complete, edit or print tax forms instantly. Web what is the minnesota m8 form? The entire share of an entity's income is taxed to the shareholder, whether or not it is actually.

Alena Skalova

Web what is the minnesota m8 form? Web what is the minnesota m8 form? Download or email m8 instr & more fillable forms, register and subscribe now! If you make a claim for a refund and we do not act on it within six months of the date filed, you may bring an action in the district court or the.

Minnesota Certification Preapplication Information Form Download

Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Partnerships receiving schedules kpc with positive values on lines 10a. Any amount not claimed on line 7 of form m8 may be passed through to. How you can finish mn dor m8 instructions easy. If you make a.

2019 Minnesota Instructions Fill Out and Sign Printable PDF Template

Complete, edit or print tax forms instantly. Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Now it requires at most thirty.

Web Corporations Doing Business In Minnesota That Have Elected To Be Taxed As S Corporations Under Irc Section 1362 Must File Form M8.

Edit your form m8 online type text, add images, blackout confidential details, add comments, highlights and more. .9 enter this amount on line 2 of your form m8. Ad register and subscribe now to work on your mn dor m8 instructions & more fillable forms. Web you will need this information to complete form m4, corporation franchise tax return, form m8, s corporation return, or form m3, partnership return, and you must include this schedule when you file your return.

In Addition, The S Corporation May Have To Pay A Minimum Fee Based On Property, Payroll, And Sales Attributable To.

Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022. Web what is the minnesota m8 form? Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. Web we last updated the s corporation return (m8 and m8a) in february 2023, so this is the latest version of form m8, fully updated for tax year 2022.

Web Name Of Corporation Federal Id Number Minnesota Tax Id Mailing Address.

Federal schedule d taxes passive income / / federal id number minnesota tax id former name, if changed since 2021. Or form m2x, amended income tax return for estates and trusts. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Who must file the entire share of an entity’s income is taxed to the shareholder, whether or not it is actually distributed.

City Number Of Shareholders:state Zip Code.

Complete, edit or print tax forms instantly. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Partnerships receiving schedules kpc with positive values on lines 10a. Who must file the entire share of an entity’s income is taxed to the shareholder, whether or not it is actually distributed.