Mo Property Tax Credit Form

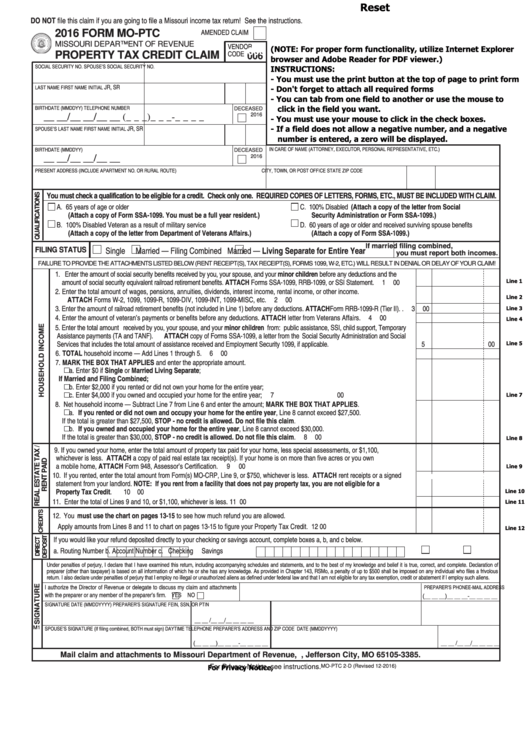

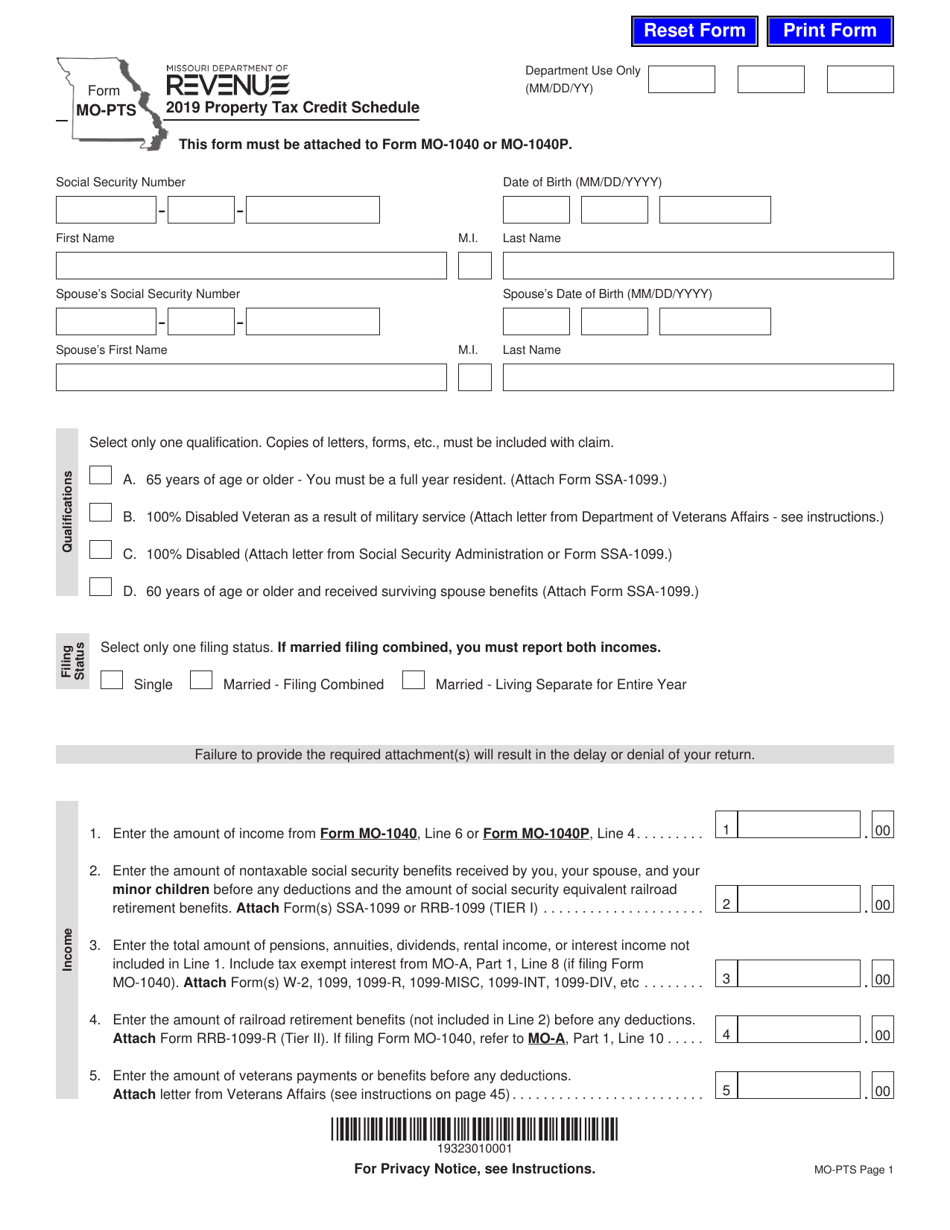

Mo Property Tax Credit Form - Ink only and do not staple. Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. • detailed instructions, forms, and charts can be found at: For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2022. Web 2022 property tax credit claim. Web download or print the 2022 missouri (property tax credit claim) (2022) and other income tax forms from the missouri department of revenue. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. Ink only and do not staple. Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. • specific questions can be sent to:

Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Ink only and do not staple. Ink only and do not staple. • specific questions can be sent to: Web 2022 property tax credit claim. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. Web • specific questions can be sent to: Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2022. Please note, direct deposit of a property tax credit refund claim is not an option with this filing method.

Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Ink only and do not staple. Web 2021 property tax credit claim. Web • specific questions can be sent to: The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. • specific questions can be sent to: Web download or print the 2022 missouri (property tax credit claim) (2022) and other income tax forms from the missouri department of revenue. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Web 2022 property tax credit claim.

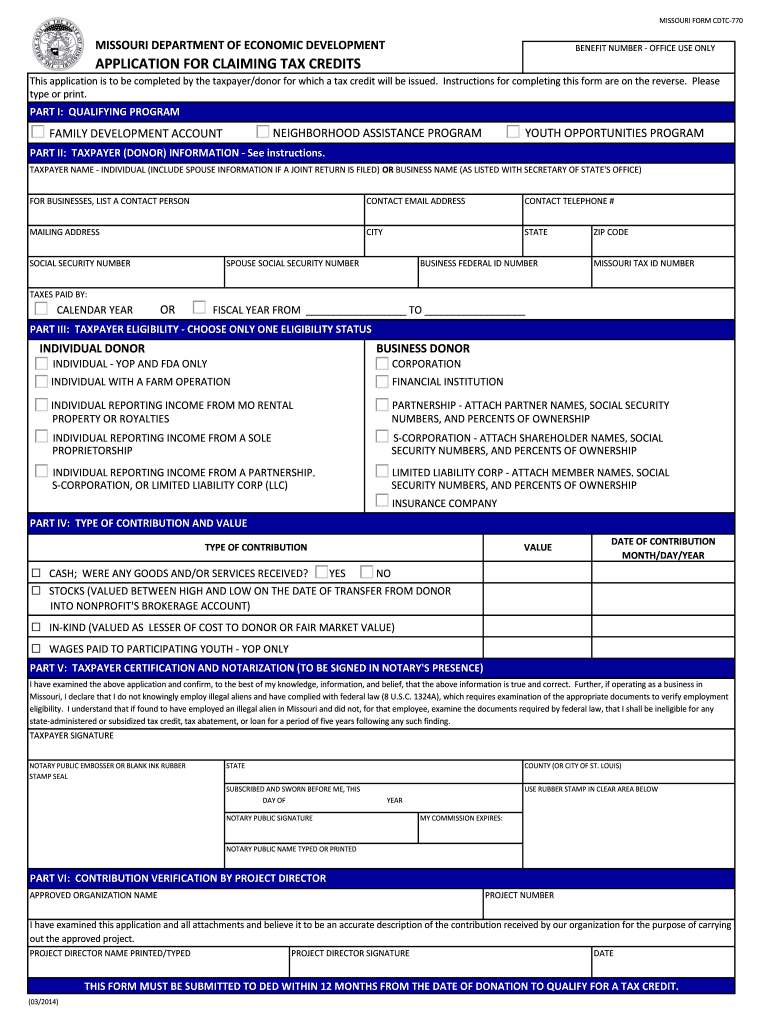

20142022 Form MO CDTC770 Fill Online, Printable, Fillable, Blank

Ink only and do not staple. Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2022. Web 2021 property tax credit claim. • detailed instructions, forms, and charts can be found at:

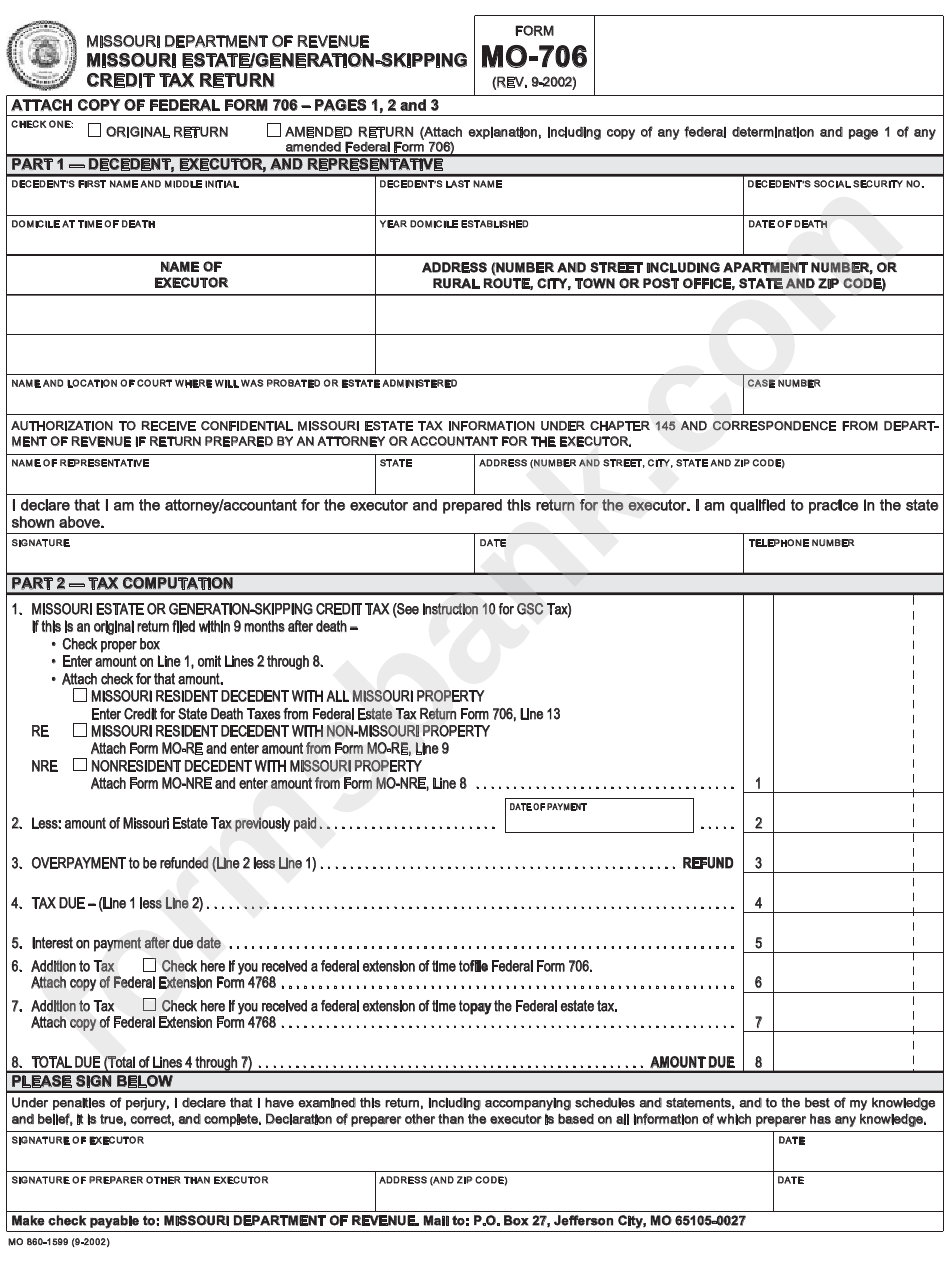

Form Mo706 Missouri Estate/generationSkipping Credit Tax Return

• detailed instructions, forms, and charts can be found at: Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. The credit is for a maximum of $750 for renters and $1,100.

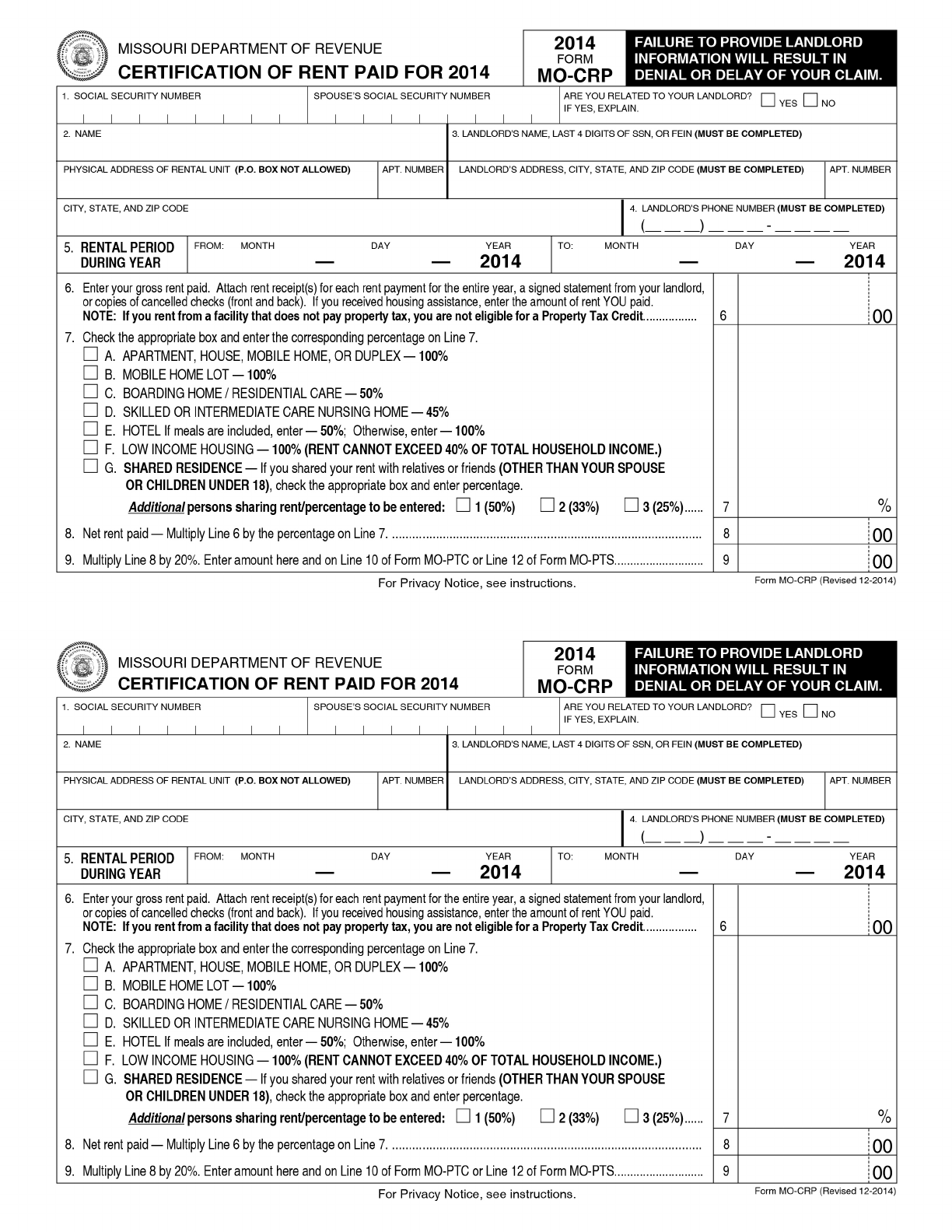

2014 Form MoPtc, Property Tax Credit Claim Edit, Fill, Sign Online

Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Ink only and do not staple. Web • specific questions can be sent to: • specific questions can be sent to: Web 2022 property tax credit.

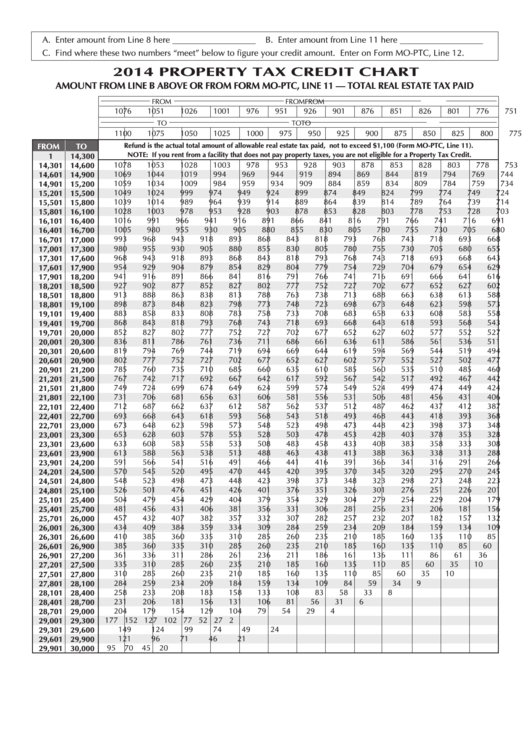

Form MoPtc Property Tax Credit Chart 2014 printable pdf download

Ink only and do not staple. Web • specific questions can be sent to: The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. Ink only and do not staple.

Fillable Form MoPtc Property Tax Credit Claim 2016 printable pdf

Ink only and do not staple. • specific questions can be sent to: Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent.

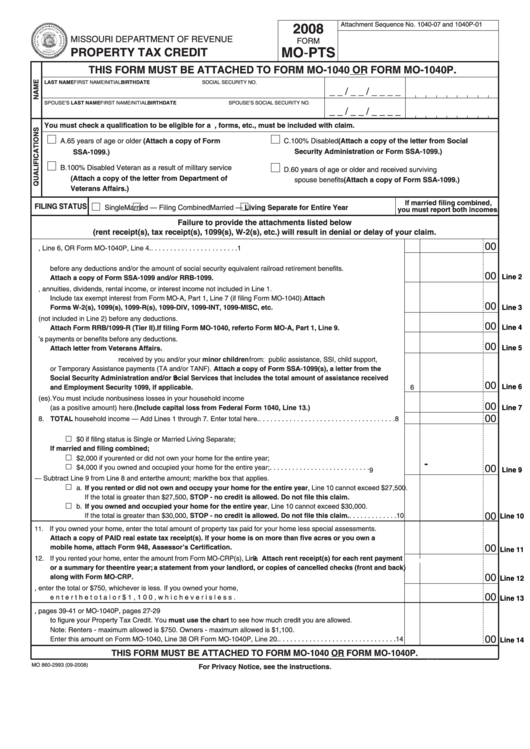

Fillable Form MoPts Property Tax Credit 2008 printable pdf download

Ink only and do not staple. • detailed instructions, forms, and charts can be found at: Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate.

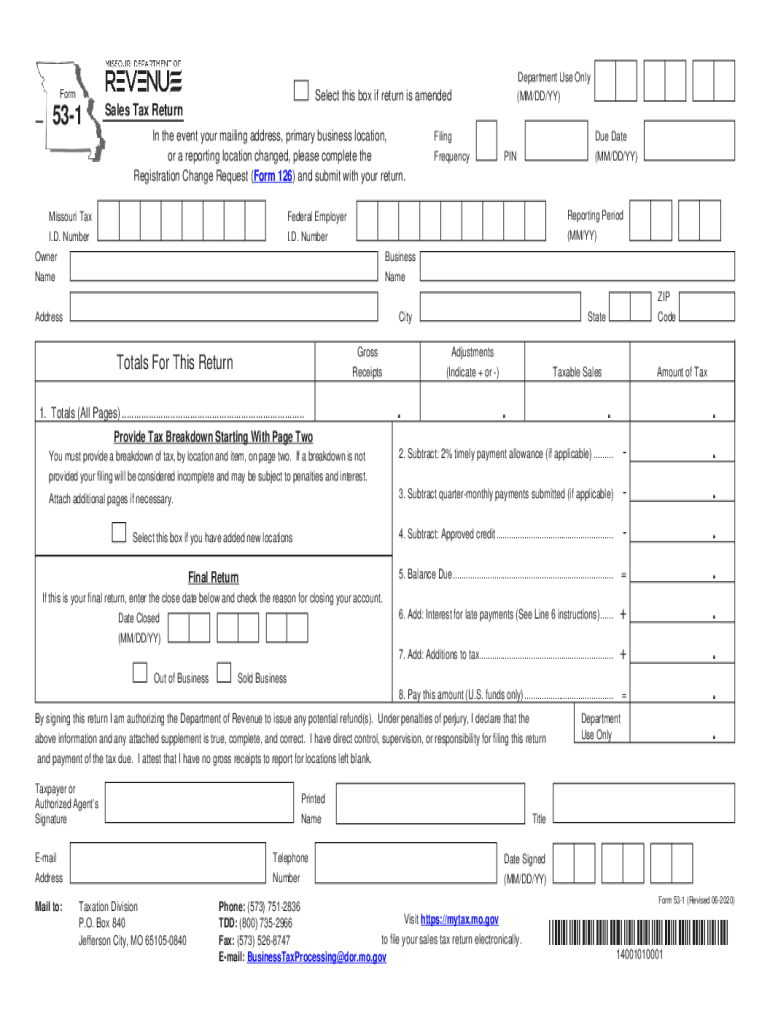

20202022 MO DoR Form 531 Fill Online, Printable, Fillable, Blank

Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Web the credit is for a maximum.

Form MOPTS Download Fillable PDF or Fill Online Property Tax Credit

Web download or print the 2022 missouri (property tax credit claim) (2022) and other income tax forms from the missouri department of revenue. Web 2021 property tax credit claim. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid.

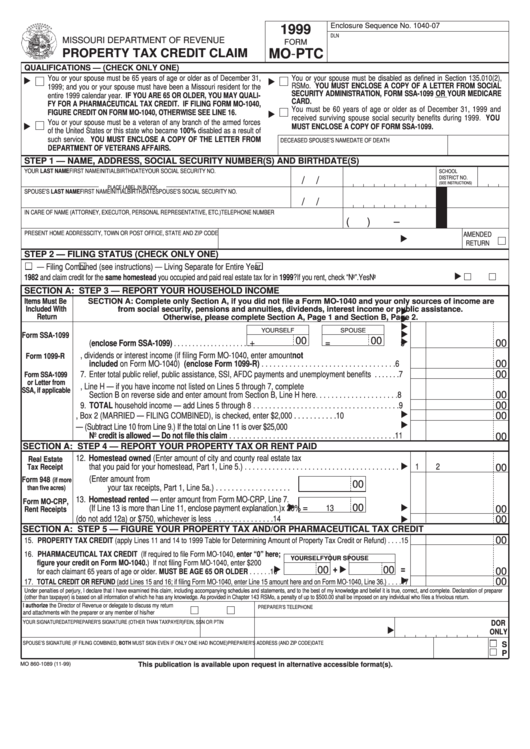

Form MoPtc Property Tax Credit Claim 1999 printable pdf download

Web 2021 property tax credit claim. For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2022. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion.

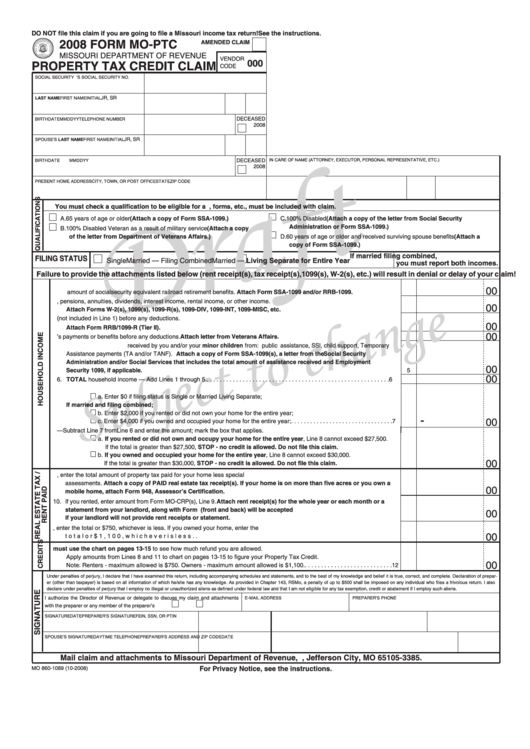

Form MoPtc Draft Property Tax Credit Claim 2008 printable pdf download

Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. • specific questions can be sent to: • detailed instructions, forms, and charts can be found at: Ink only and do not staple. Web 2021 property tax credit claim.

Web 2022 Property Tax Credit Claim.

Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. Web 2021 property tax credit claim. Web • specific questions can be sent to: Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit.

• Specific Questions Can Be Sent To:

Web download or print the 2022 missouri (property tax credit claim) (2022) and other income tax forms from the missouri department of revenue. Ink only and do not staple. Ink only and do not staple. For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2022.

Web The Missouri Property Tax Credit Claim Gives Credit To Certain Senior Citizens And 100 Percent Disabled Individuals For A Portion Of The Real Estate Taxes Or Rent They Have Paid For The Year.

• detailed instructions, forms, and charts can be found at: The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable.