Montana Withholding Form

Montana Withholding Form - Web approved wage withholding and payroll tax software; See “employee instructions” on back of this form before beginning. Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year. Web irs withholding certificate for periodic pension or annuity payments: Forms 1099 with no withholding; Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,. For information about montana state tax withholding, contact the montana. Web you may use this form to register your business and create corporate income tax, small business, partnership, disregarded entity, sole proprietorship asset. See employee instructions on back of this form before beginning. Web 505, tax withholding and estimated tax, and irs publication 575, pension and annuity income.

Web mineral royalty withholding tax; Web 505, tax withholding and estimated tax, and irs publication 575, pension and annuity income. (1) for purposes of determining the employee's withholding allowances and withholding. Forms 1099 with no withholding; Transaction portal (tap) services and aidsthe transaction portal (tap) is a free service for individuals, businesses, and. Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year. Web the transaction portal (tap) is a free service for individuals, businesses, and tax professionals to access and manage accounts with the montana department of. Web approved wage withholding and payroll tax software; If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,.

See employee instructions on back of this form before beginning. Web 505, tax withholding and estimated tax, and irs publication 575, pension and annuity income. Web you may use this form to register your business and create corporate income tax, small business, partnership, disregarded entity, sole proprietorship asset. Web december 30, 2021. Web latest version of the adopted rule presented in administrative rules of montana (arm): See “employee instructions” on back of this form before beginning. Web mineral royalty withholding tax; You can pay your withholding tax liability with your paper voucher or by using. The treasure state has a progressive income tax system. Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year.

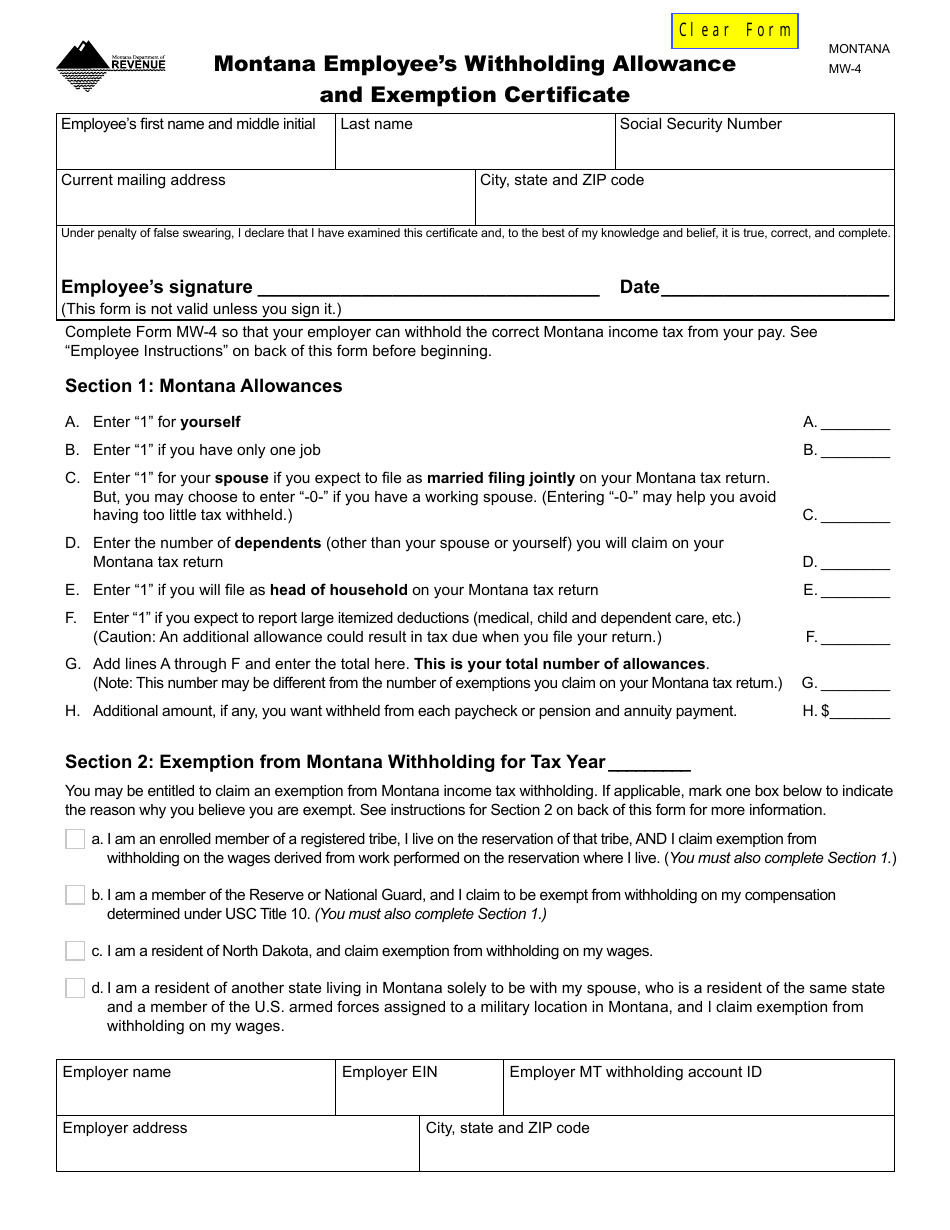

Form MW4 Download Fillable PDF or Fill Online Montana Employee's

You can pay your withholding tax liability with your paper voucher or by using. Web december 30, 2021. Web mineral royalty withholding tax; See “employee instructions” on back of this form before beginning. The treasure state has a progressive income tax system.

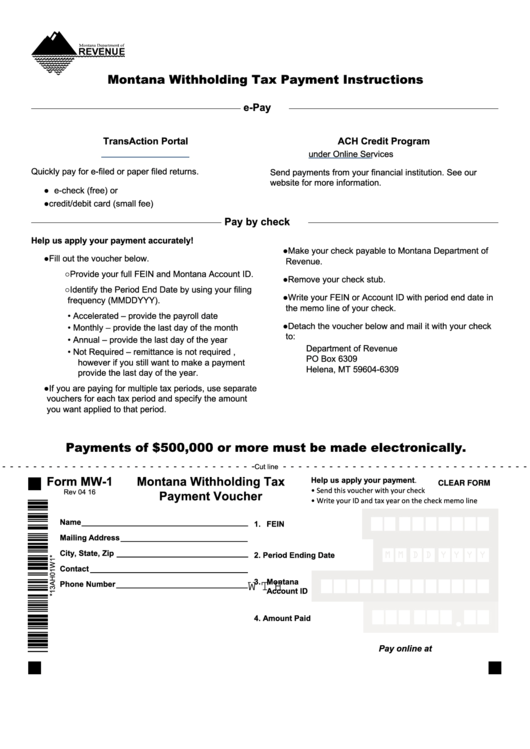

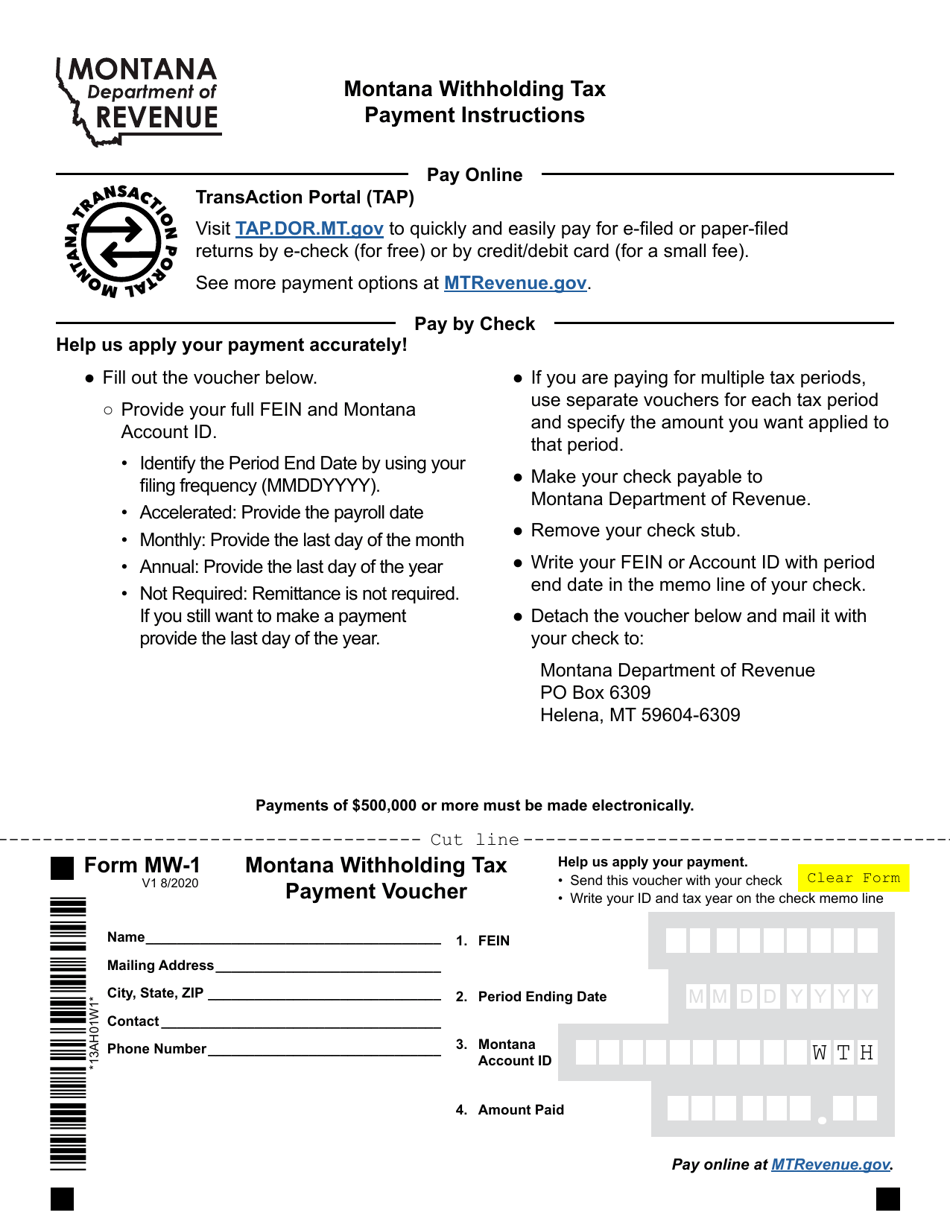

Fillable Form Mw1 Montana Withholding Tax Payment Voucher printable

Forms 1099 with no withholding; The treasure state has a progressive income tax system. You may use this form to make montana withholding tax payments. See “employee instructions” on back of this form before beginning. Web you may use this form to register your business and create corporate income tax, small business, partnership, disregarded entity, sole proprietorship asset.

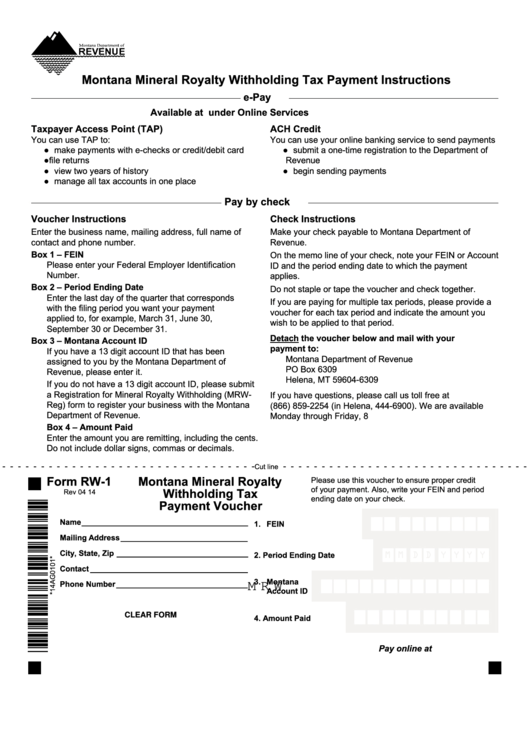

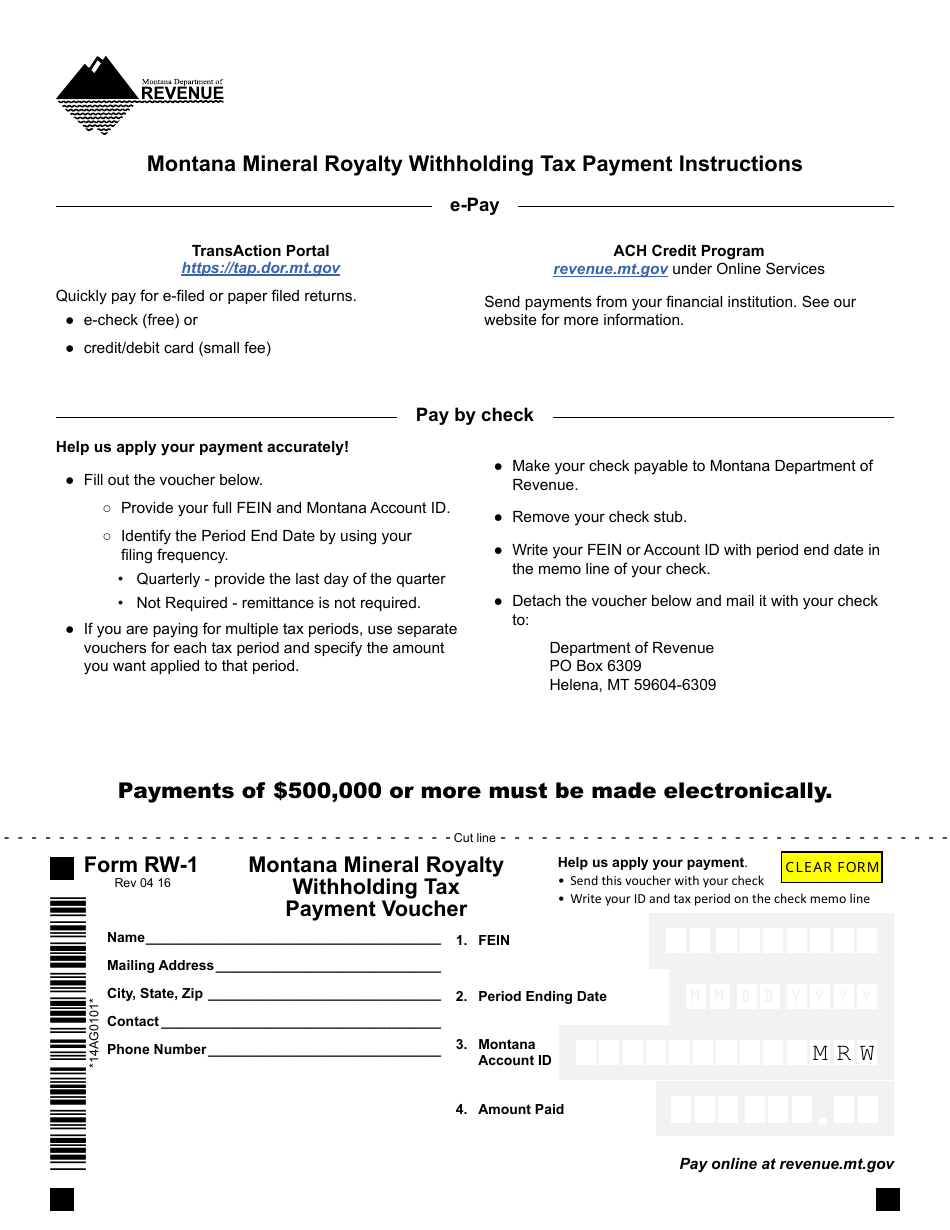

Fillable Form Rw1 Montana Mineral Royalty Withholding Tax Payment

For information about montana state tax withholding, contact the montana. Web latest version of the adopted rule presented in administrative rules of montana (arm): See employee instructions on back of this form before beginning. See “employee instructions” on back of this form before beginning. Web (a) other income (not from jobs).

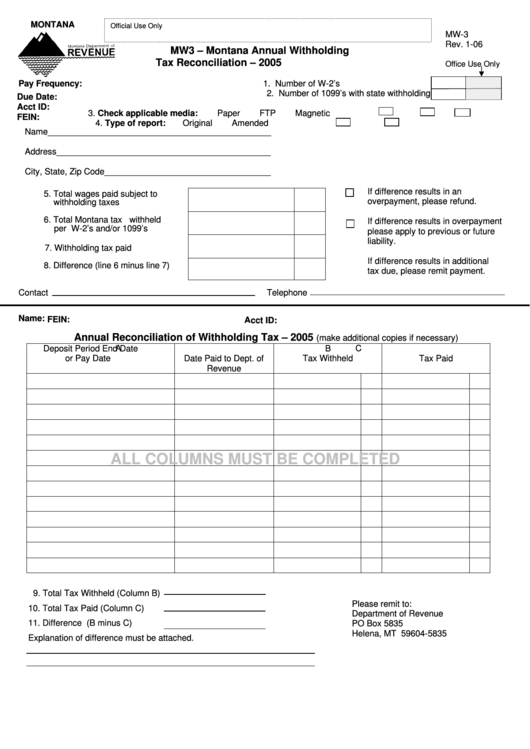

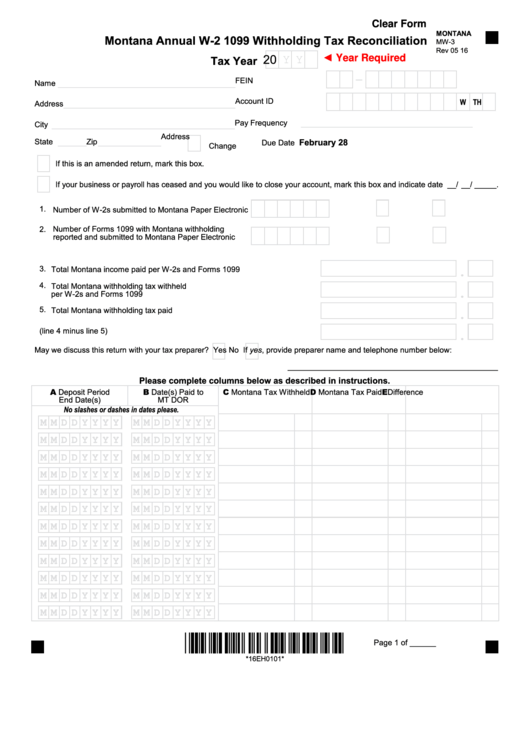

Fillable Form Mw3 Montana Annual Withholding Tax Reconciliation

You can pay your withholding tax liability with your paper voucher or by using. You may use this form to make montana withholding tax payments. Web you may use this form to register your business and create corporate income tax, small business, partnership, disregarded entity, sole proprietorship asset. For information about montana state tax withholding, contact the montana. See employee.

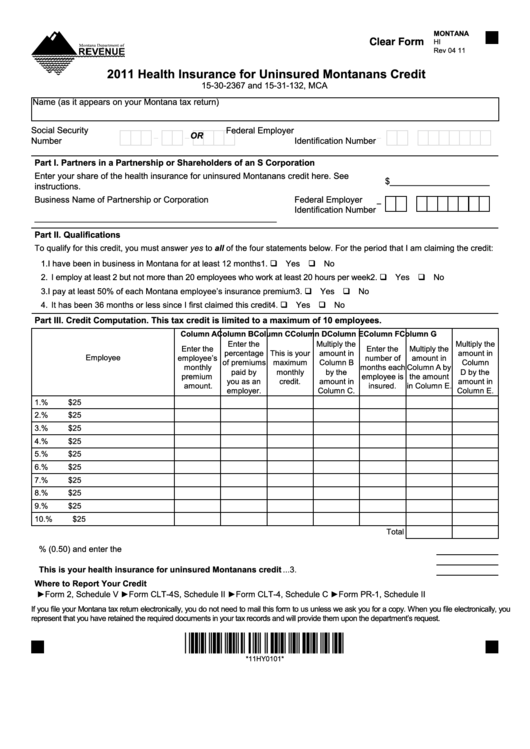

Fillable Montana Form Hi Health Insurance For Uninsured Montanans

Web december 30, 2021. See employee instructions on back of this form before beginning. The treasure state has a progressive income tax system. Forms 1099 with no withholding; For information about montana state tax withholding, contact the montana.

Form RW1 Download Fillable PDF or Fill Online Montana Mineral Royalty

Web latest version of the adopted rule presented in administrative rules of montana (arm): Use the montana paycheck calculators to see the taxes. Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year. If you want tax withheld for other income you expect this year that won’t have withholding,.

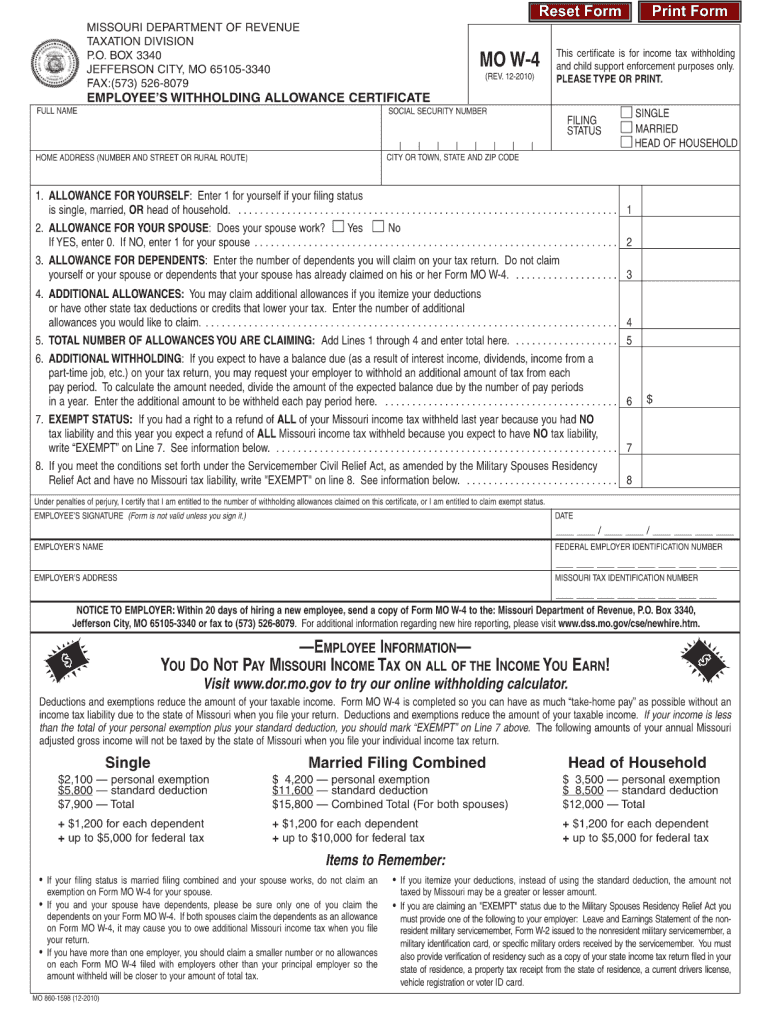

Mo W4 Form 2021 W4 Form 2021

Web latest version of the adopted rule presented in administrative rules of montana (arm): Web (a) other income (not from jobs). Forms 1099 with no withholding; Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,. Web you may use this form to.

Fillable Form Mw3 Montana Annual W2 1099 Withholding Tax

Web december 30, 2021. The treasure state has a progressive income tax system. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. You may use this form to make montana withholding tax payments. For information about montana state tax withholding, contact the montana.

Form MW1 Download Fillable PDF or Fill Online Montana Withholding Tax

Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,. Web mineral royalty withholding tax; Forms 1099 with no withholding; Web approved wage withholding and payroll tax software; Use the montana paycheck calculators to see the taxes.

Monthly Withholding Payments Due Montana Department of Revenue

Transaction portal (tap) services and aidsthe transaction portal (tap) is a free service for individuals, businesses, and. (1) for purposes of determining the employee's withholding allowances and withholding. Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,. Web approved wage withholding and.

You May Use This Form To Make Montana Withholding Tax Payments.

Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,. Web the transaction portal (tap) is a free service for individuals, businesses, and tax professionals to access and manage accounts with the montana department of. Web approved wage withholding and payroll tax software; Web latest version of the adopted rule presented in administrative rules of montana (arm):

(1) For Purposes Of Determining The Employee's Withholding Allowances And Withholding.

For information about montana state tax withholding, contact the montana. See “employee instructions” on back of this form before beginning. Web (a) other income (not from jobs). You can pay your withholding tax liability with your paper voucher or by using.

Web December 30, 2021.

If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Use the montana paycheck calculators to see the taxes. Web 505, tax withholding and estimated tax, and irs publication 575, pension and annuity income. Web mineral royalty withholding tax;

Transaction Portal (Tap) Services And Aidsthe Transaction Portal (Tap) Is A Free Service For Individuals, Businesses, And.

The treasure state has a progressive income tax system. Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year. Web irs withholding certificate for periodic pension or annuity payments: See employee instructions on back of this form before beginning.