Nc Farm Tax Exempt Form

Nc Farm Tax Exempt Form - The criteria are set by nc state law, but. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. Web exemption certificate are set out in n.c. Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. This application is to be used to apply for a conditional farmer. Fill out the form with information about. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property. The application form is available from the county tax administration office. Web this is your farm tax id number. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e.

Web for complete details, read this guide. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. The application form is available from the county tax administration office. This application is to be used to apply for a conditional farmer. (2) a copy of the property tax listing showing that the property is eligible for participation in the. Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable. Web (1) a farm sales tax exemption certificate issued by the department of revenue. Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or. Web the north carolina department of revenue has released its official notice and application forms relating to recent revisions to north carolina’s agriculture sales. The criteria are set by nc state law, but.

A “qualifying farmer” is a person who has an annual gross income for the. Sales tax on purchases of farm. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Web (1) a farm sales tax exemption certificate issued by the department of revenue. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. Fill out the form with information about. Web this application is to be used by a qualifying farmer in order to obtain an exemption number for purchases of certain tangible personal property, certain digital property, and. Web exemption certificate are set out in n.c. Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable. The application form is available from the county tax administration office.

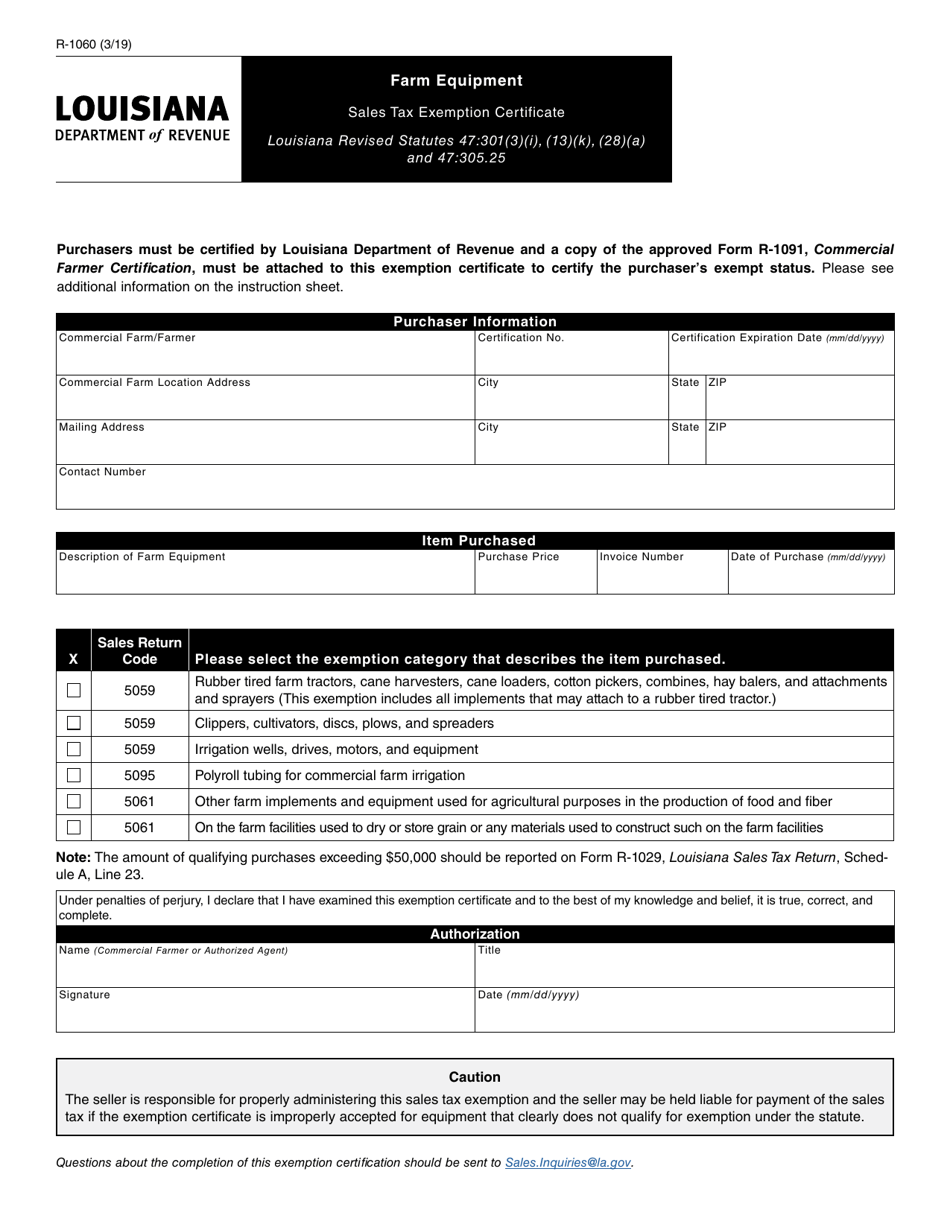

Form R1060 Download Fillable PDF or Fill Online Farm Equipment Sales

This application is to be used to apply for a conditional farmer. Sales tax on purchases of farm. Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. Web this application is to be used by a.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. A “qualifying farmer” is a person who has an annual gross income for the..

Bupa Tax Exemption Form / We do not accept sales tax permits, articles

Web for complete details, read this guide. Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. Sales tax on purchases of farm. Web this is your farm tax id number.

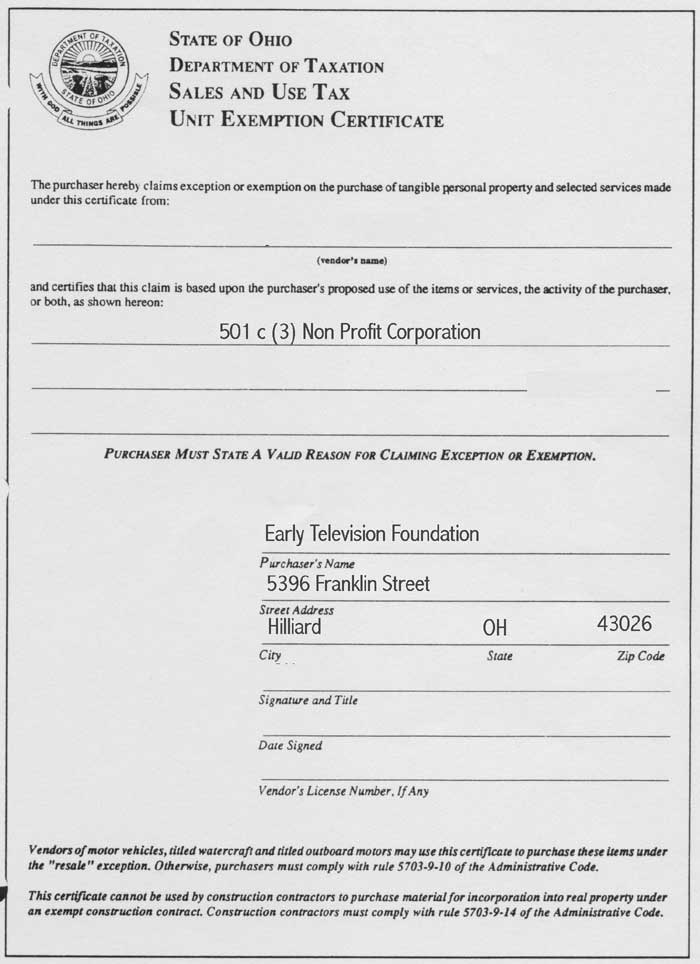

The Early Television Foundation

Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or. This application is to be used to apply for a conditional farmer. Web the north carolina department of revenue has released its official notice and application forms relating to recent revisions.

How To Get A North Carolina Sales Tax Certificate of Exemption (Resale

Web this is your farm tax id number. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property. Web for complete details, read this guide. Web the term farmer means any person engaged in the raising, growing and producing of farm.

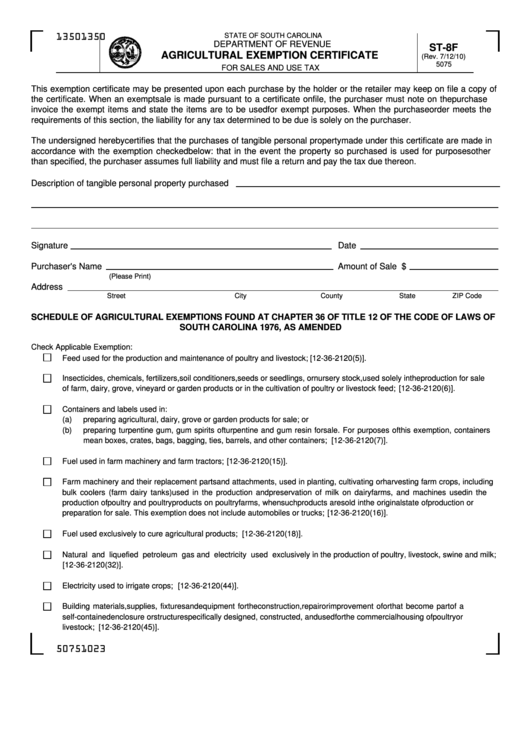

Form St8f Agricultural Exemption Certificate printable pdf download

Web this application is to be used by a qualifying farmer in order to obtain an exemption number for purchases of certain tangible personal property, certain digital property, and. Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north.

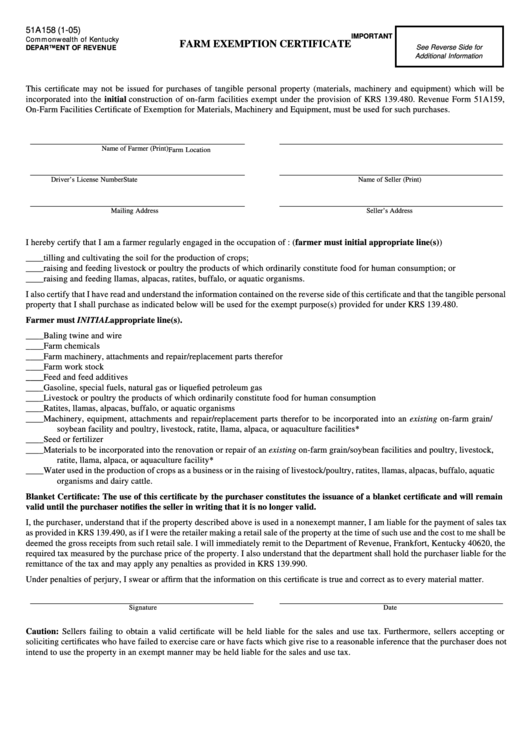

Farm Tax Exempt Form Tn

Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. The application form is available from the county tax administration office. Web this document serves as notice that effective july 1, 2014, n.c. Web for complete details, read this guide. (2) a copy of the property tax listing showing that the property is.

How to get a Sales Tax Exemption Certificate in Missouri

Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property. A “qualifying farmer” is a person who has an annual gross income for the. Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases.

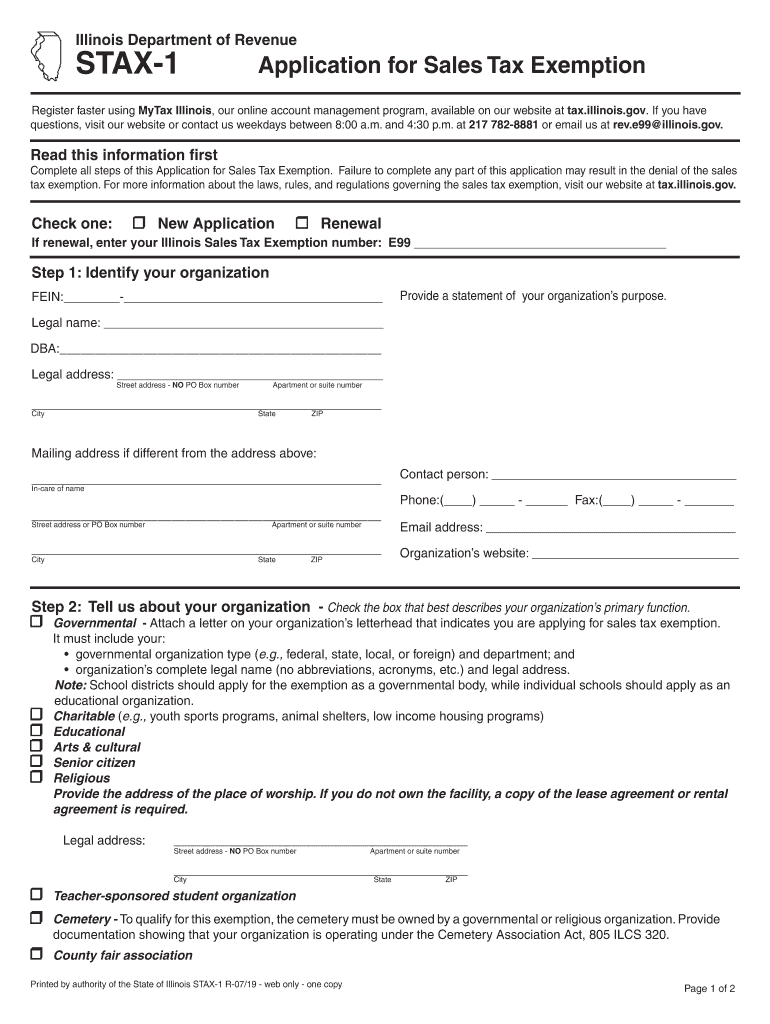

20192022 Form IL STAX1 Fill Online, Printable, Fillable, Blank

Web for complete details, read this guide. This application is to be used to apply for a conditional farmer. A “qualifying farmer” is a person who has an annual gross income for the. (2) a copy of the property tax listing showing that the property is eligible for participation in the. Web a qualifying farmer is allowed an exemption from.

Bupa Tax Exemption Form Bupa Tax Exemption Form Increased Homestead

(2) a copy of the property tax listing showing that the property is eligible for participation in the. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Fill out the form with information about. Web this is your farm tax id number. Web enter agricultural exemption certificate number issued to applicant prior.

Web This Application Is To Be Used By A Qualifying Farmer In Order To Obtain An Exemption Number For Purchases Of Certain Tangible Personal Property, Certain Digital Property, And.

Web (1) a farm sales tax exemption certificate issued by the department of revenue. Web exemption certificate are set out in n.c. (2) a copy of the property tax listing showing that the property is eligible for participation in the. Web for complete details, read this guide.

The Application Form Is Available From The County Tax Administration Office.

Web this document serves as notice that effective july 1, 2014, n.c. Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. A “qualifying farmer” is a person who has an annual gross income for the. Fill out the form with information about.

This Application Is To Be Used To Apply For A Conditional Farmer.

Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable. Web this is your farm tax id number. Web the north carolina department of revenue has released its official notice and application forms relating to recent revisions to north carolina’s agriculture sales. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property.

The Criteria Are Set By Nc State Law, But.

Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or. To apply for a conditional farmer exemption certificate number, complete and submit to the department form e. Sales tax on purchases of farm. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes.