Nj Pa Reciprocity Form

Nj Pa Reciprocity Form - Web tax reciprocal agreement with new jersey will continue the tax reciprocal agreement between pennsylvania and new jersey will continue in 2017. Web pennsylvania has reciprocal agreements with indiana, maryland, new jersey, ohio, virginia, and west virginia. On september 2, 2016, new jersey governor chris christie (r) notified pennsylvania that new jersey terminated the reciprocity agreement between the. Web nj/pa reciprocal agreement the reciprocal personal income tax agreement between pennsylvania and new jersey means compensation paid to new. Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims. Property except vehicles vehicles state state sales tax. Web kentucky participates in the most agreements with seven, followed by michigan and pennsylvania at six apiece. At the other end of the spectrum, iowa,. Web form mwr reciprocity exemption/affidavit of residency: Under these agreements, one state will not tax.

Web nj/pa reciprocal agreement the reciprocal personal income tax agreement between pennsylvania and new jersey means compensation paid to new. Web tax reciprocal agreement with new jersey will continue the tax reciprocal agreement between pennsylvania and new jersey will continue in 2017. I declare i am a. At the other end of the spectrum, iowa,. Web first, since there is a reciprocal agreement between nj and pa, your pa employer should be withholding nj taxes, not pa. This is the correct method and it will. Web form mwr reciprocity exemption/affidavit of residency: Web in september 2016, the governor of new jersey ended a tax reciprocal agreement with pennsylvania effective jan. Web kentucky participates in the most agreements with seven, followed by michigan and pennsylvania at six apiece. Under these agreements, one state will not tax.

Web pennsylvania has reciprocal agreements with indiana, maryland, new jersey, ohio, virginia, and west virginia. Web form mwr reciprocity exemption/affidavit of residency: Web kentucky participates in the most agreements with seven, followed by michigan and pennsylvania at six apiece. I declare i am a. Web i expect to qualify for tax forgiveness of my pa personal income tax liability this year and expect to have a right to a full refund of all income tax withheld. Web tax reciprocal agreement with new jersey will continue the tax reciprocal agreement between pennsylvania and new jersey will continue in 2017. Under these agreements, one state will not tax. Web first, since there is a reciprocal agreement between nj and pa, your pa employer should be withholding nj taxes, not pa. At the other end of the spectrum, iowa,. Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims.

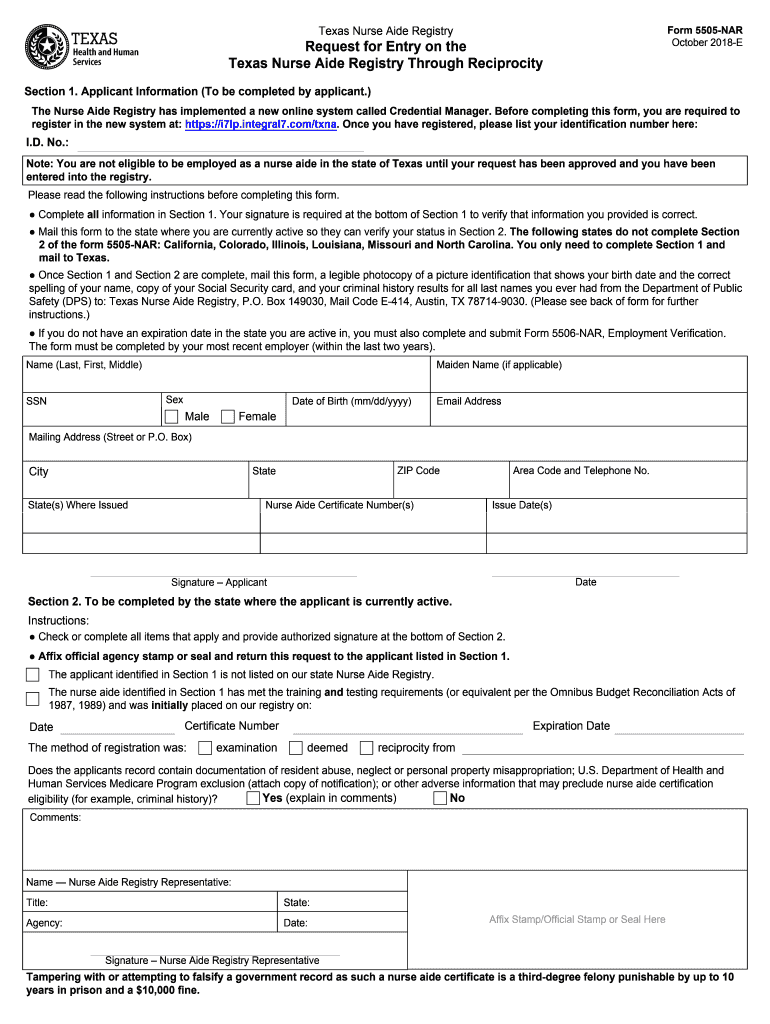

20182021 Form TX 5505NAR Fill Online, Printable, Fillable, Blank

Web in september 2016, the governor of new jersey ended a tax reciprocal agreement with pennsylvania effective jan. I declare i am a. Web i expect to qualify for tax forgiveness of my pa personal income tax liability this year and expect to have a right to a full refund of all income tax withheld. Web you are required to.

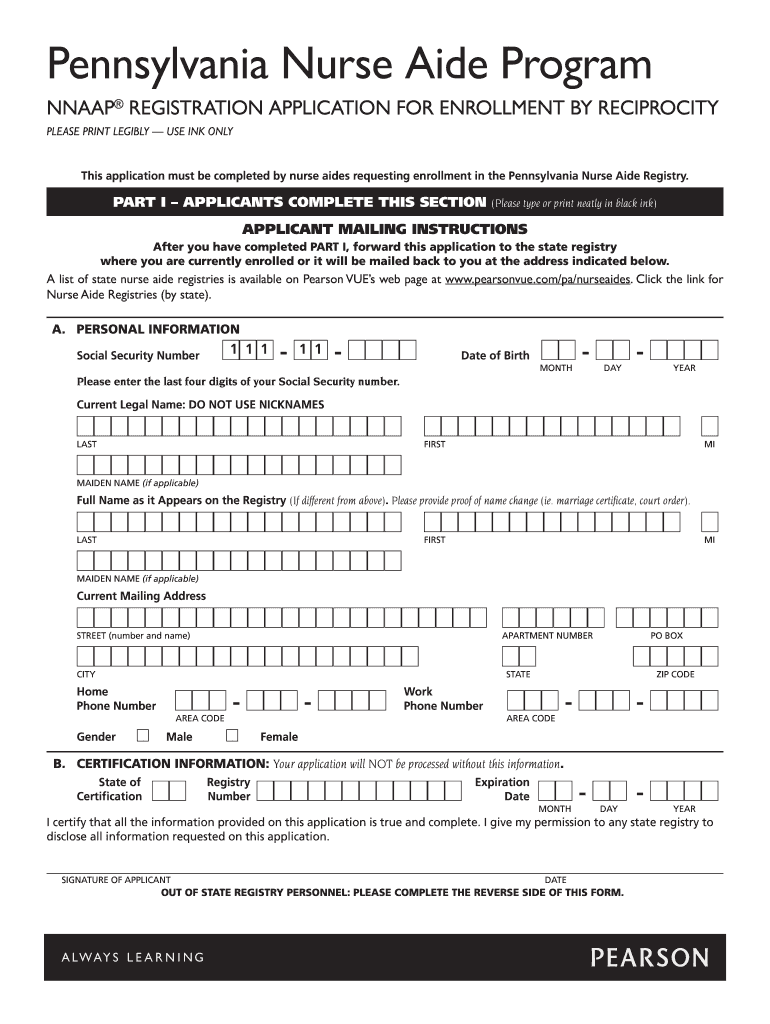

Pennsylvania Cna Reciprocity Online Application Form Fill Out and

Web first, since there is a reciprocal agreement between nj and pa, your pa employer should be withholding nj taxes, not pa. Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims. Property except vehicles vehicles state state sales.

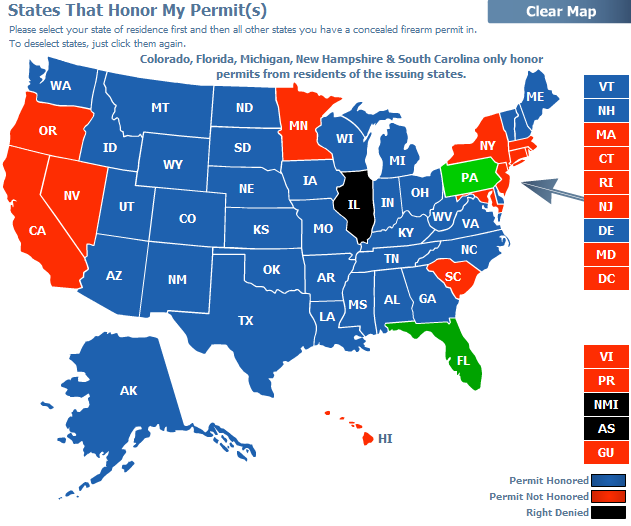

Will the Concealed Carry Reciprocity Act Liberate New Jersey Gun Owners

Under these agreements, one state will not tax. This is the correct method and it will. Web i expect to qualify for tax forgiveness of my pa personal income tax liability this year and expect to have a right to a full refund of all income tax withheld. Web kentucky participates in the most agreements with seven, followed by michigan.

NJPA Tax Reciprocity Chamber of Commerce Southern New Jersey

Web in september 2016, the governor of new jersey ended a tax reciprocal agreement with pennsylvania effective jan. This is the correct method and it will. Web i expect to qualify for tax forgiveness of my pa personal income tax liability this year and expect to have a right to a full refund of all income tax withheld. I declare.

State Tax Reciprocity Agreements What Christies Termination Of The Nj

On september 2, 2016, new jersey governor chris christie (r) notified pennsylvania that new jersey terminated the reciprocity agreement between the. Web first, since there is a reciprocal agreement between nj and pa, your pa employer should be withholding nj taxes, not pa. Web form mwr reciprocity exemption/affidavit of residency: Under these agreements, one state will not tax. I declare.

28 Pa Concealed Carry Reciprocity Map Online Map Around The World

Web pennsylvania has reciprocal agreements with indiana, maryland, new jersey, ohio, virginia, and west virginia. Web tax reciprocal agreement with new jersey will continue the tax reciprocal agreement between pennsylvania and new jersey will continue in 2017. Property except vehicles vehicles state state sales tax. On september 2, 2016, new jersey governor chris christie (r) notified pennsylvania that new jersey.

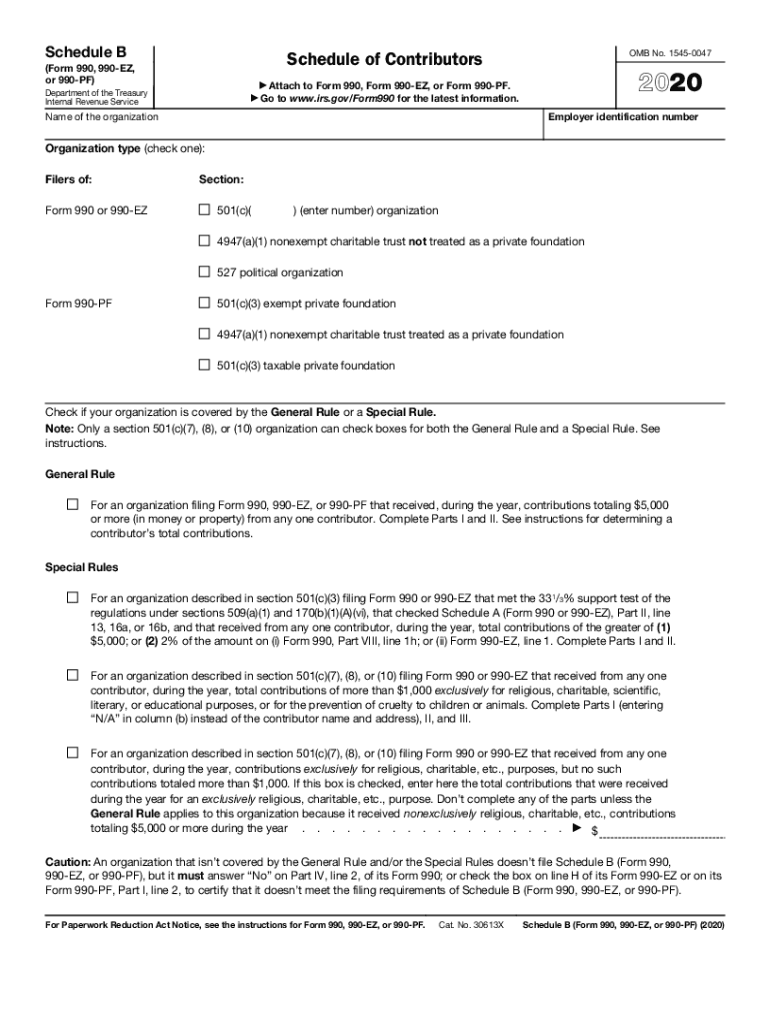

199N E Postcard Fill Out and Sign Printable PDF Template signNow

I declare i am a. Web tax reciprocal agreement with new jersey will continue the tax reciprocal agreement between pennsylvania and new jersey will continue in 2017. Web kentucky participates in the most agreements with seven, followed by michigan and pennsylvania at six apiece. Under these agreements, one state will not tax. At the other end of the spectrum, iowa,.

Reciprocity States Florida Gun Pros

Web form mwr reciprocity exemption/affidavit of residency: Web in september 2016, the governor of new jersey ended a tax reciprocal agreement with pennsylvania effective jan. Web first, since there is a reciprocal agreement between nj and pa, your pa employer should be withholding nj taxes, not pa. I declare i am a. This is the correct method and it will.

Reciprocity Agreement Between New Jersey and Pennsylvania to Remain

Property except vehicles vehicles state state sales tax. This is the correct method and it will. Web kentucky participates in the most agreements with seven, followed by michigan and pennsylvania at six apiece. Under these agreements, one state will not tax. Web form mwr reciprocity exemption/affidavit of residency:

Fill Free fillable Reciprocity Package South Carolina State Board of

Web nj/pa reciprocal agreement the reciprocal personal income tax agreement between pennsylvania and new jersey means compensation paid to new. Property except vehicles vehicles state state sales tax. Web in september 2016, the governor of new jersey ended a tax reciprocal agreement with pennsylvania effective jan. Web i expect to qualify for tax forgiveness of my pa personal income tax.

Web Form Mwr Reciprocity Exemption/Affidavit Of Residency:

Web nj/pa reciprocal agreement the reciprocal personal income tax agreement between pennsylvania and new jersey means compensation paid to new. On september 2, 2016, new jersey governor chris christie (r) notified pennsylvania that new jersey terminated the reciprocity agreement between the. Web in september 2016, the governor of new jersey ended a tax reciprocal agreement with pennsylvania effective jan. Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims.

Web First, Since There Is A Reciprocal Agreement Between Nj And Pa, Your Pa Employer Should Be Withholding Nj Taxes, Not Pa.

Web kentucky participates in the most agreements with seven, followed by michigan and pennsylvania at six apiece. Property except vehicles vehicles state state sales tax. Web tax reciprocal agreement with new jersey will continue the tax reciprocal agreement between pennsylvania and new jersey will continue in 2017. Web pennsylvania has reciprocal agreements with indiana, maryland, new jersey, ohio, virginia, and west virginia.

Web I Expect To Qualify For Tax Forgiveness Of My Pa Personal Income Tax Liability This Year And Expect To Have A Right To A Full Refund Of All Income Tax Withheld.

This is the correct method and it will. I declare i am a. At the other end of the spectrum, iowa,. Under these agreements, one state will not tax.