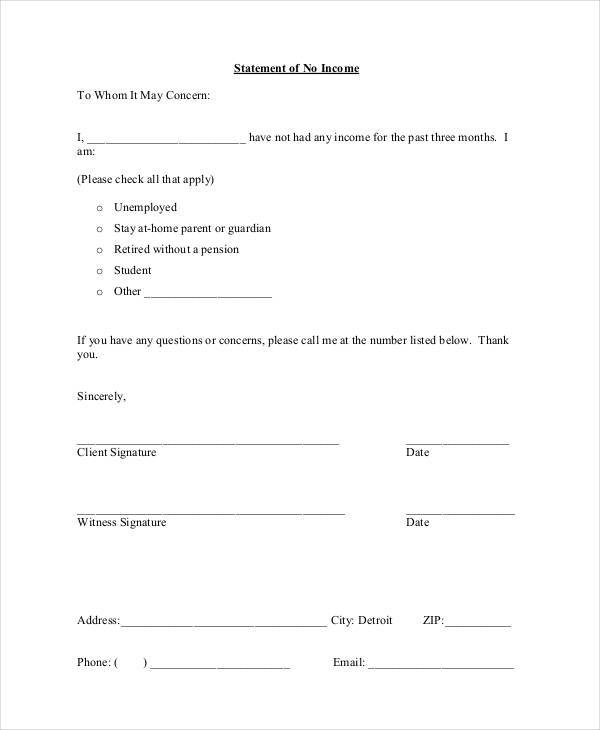

No Income Form

No Income Form - Web how to fill out and sign no income form online? The first step of filing itr is to collect all the documents related to the process. § wages from employment (including commissions, tips, bonuses, fees, etc.) § income from a business i own §. Web fill out no income statement form in a few minutes following the guidelines below: Phfa, certification of zero income form, zero income certificatoin form, zero. Another option would be to file form 1040. Web while people with income under a certain amount aren't required to file a tax return because they won't owe any tax, if you qualify for certain tax credits or already. An individual having salary income should collect. _____ _____, pa _____ i, _____, state that no adult member of my household is currently (print name). Web the no income statement is a word document you can get completed and signed for specific needs.

Find the document template you will need from the library of legal forms. _____ i have lost other sources of income (for. In that case, it is furnished to the exact addressee to provide certain details of. Another option would be to file form 1040. An individual having salary income should collect. Web go to irs.gov/freefile select “choose an irs free file offer” blue button select “browse all offers” and look for a product that has no minimum income. Web no income form name/sender address city zip code telephone number comed account number please describe your current income. Enjoy smart fillable fields and interactivity. Web documents needed to file itr; Web certification of zero income author:

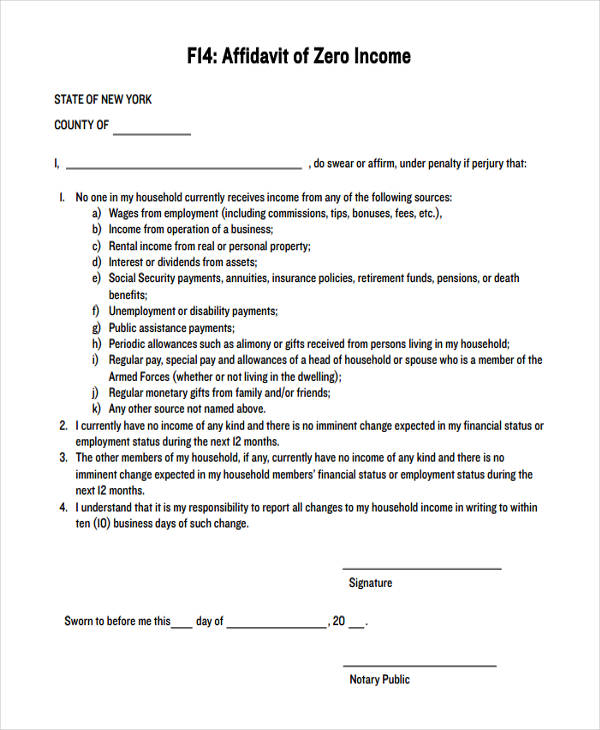

The first step of filing itr is to collect all the documents related to the process. Declaration of no income this form can be used by families who have no income to. Another option would be to file form 1040. To be completed by adult household members who are claiming zero income from any. Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions. § wages from employment (including commissions, tips, bonuses, fees, etc.) § income from a business i own §. _____ i have no job and have no unemployment benefits. Web statement of no income this form should be completed by meck prek staff and not the family child’s name: Web household zero income claim: Web zero income claim form customer name:

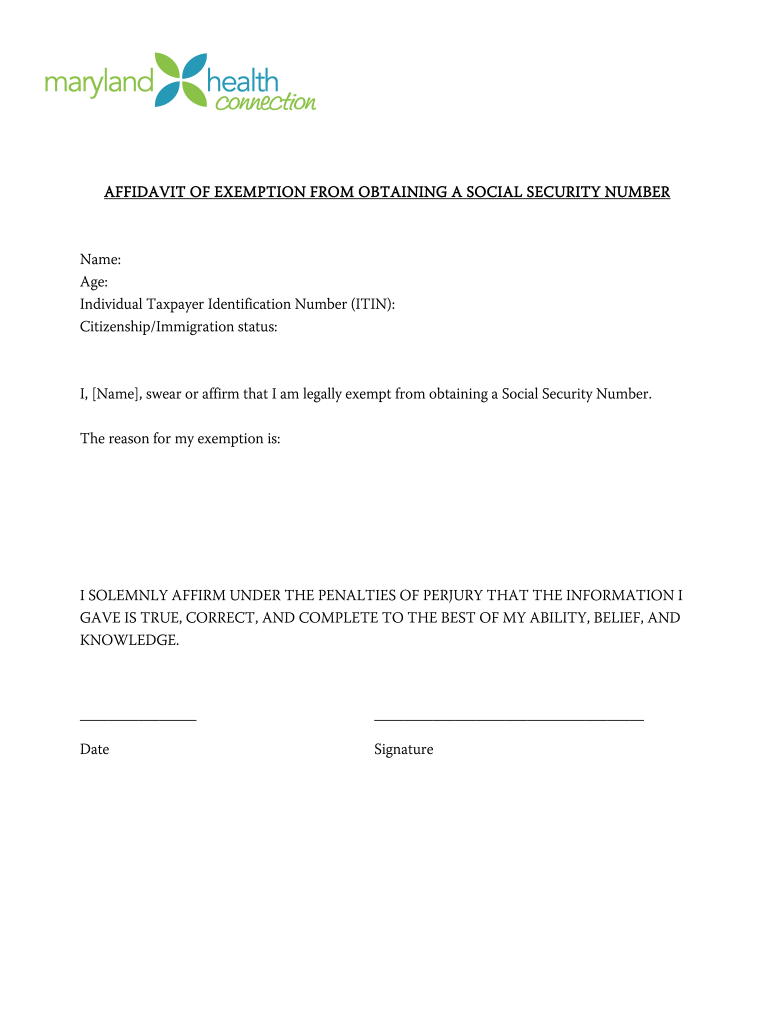

FREE 11+ Affidavit Forms in PDF MS Word

_____ i have no job and have no unemployment benefits. Web zero income claim form customer name: Declaration of no income this form can be used by families who have no income to. Find the document template you will need from the library of legal forms. In that case, it is furnished to the exact addressee to provide certain details.

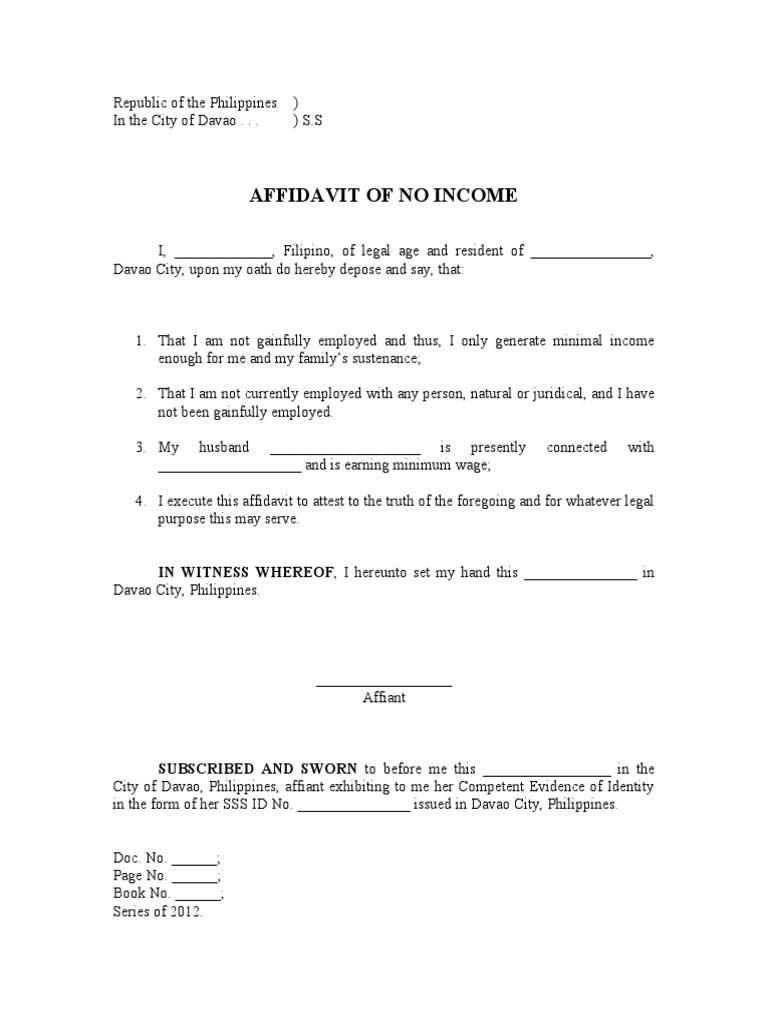

Affidavit of No

Get your online template and fill it in using progressive features. Web i have no income for the following reason(s). Web no income form name/sender address city zip code telephone number comed account number please describe your current income. _____ i have no job and have no unemployment benefits. Web the no income statement is a word document you can.

[PDF] Certificate Form PDF Download PDFfile

Enjoy smart fillable fields and interactivity. In that case, it is furnished to the exact addressee to provide certain details of. Find the document template you will need from the library of legal forms. I, _____ state that no adult member of my household is currently receiving income from any source. Web fill out no income statement form in a.

19+ Proof of Letters PDF, DOC, Google Docs, Outlook , Apple Pages

Web zero income claim form customer name: Web documents needed to file itr; Web how to fill out and sign no income form online? Web go to irs.gov/freefile select “choose an irs free file offer” blue button select “browse all offers” and look for a product that has no minimum income. Web while people with income under a certain amount.

Self Declaration Form For Certificate 20202021 Fill and Sign

Web i have no income for the following reason(s). Web household zero income claim: Find the document template you will need from the library of legal forms. Web certification of zero income author: Web go to irs.gov/freefile select “choose an irs free file offer” blue button select “browse all offers” and look for a product that has no minimum income.

Affidavit of No Form Fill Out and Sign Printable PDF Template

In that case, it is furnished to the exact addressee to provide certain details of. Web go to irs.gov/freefile select “choose an irs free file offer” blue button select “browse all offers” and look for a product that has no minimum income. Web currently, i have no income of any kind and will not be seeking employment at this time..

Free Employment Verification Letter Template PDF Word

Family member) who helps you pay your bills there are four (4) ways to submit your cap. Web statement of no income this form should be completed by meck prek staff and not the family child’s name: Declaration of no income this form can be used by families who have no income to. The first step of filing itr is.

Affidavit of No PDF Affidavit Government Information

Family member) who helps you pay your bills there are four (4) ways to submit your cap. Web no income form name/sender address city zip code telephone number comed account number please describe your current income. _____ _____, pa _____ i, _____, state that no adult member of my household is currently (print name). Enjoy smart fillable fields and interactivity..

Web i have not received income from any of these sources: _____ i have lost other sources of income (for. Users are advised to navigate to 'e. I, _____ state that no adult member of my household is currently receiving income from any source. Web go to irs.gov/freefile select “choose an irs free file offer” blue button select “browse all.

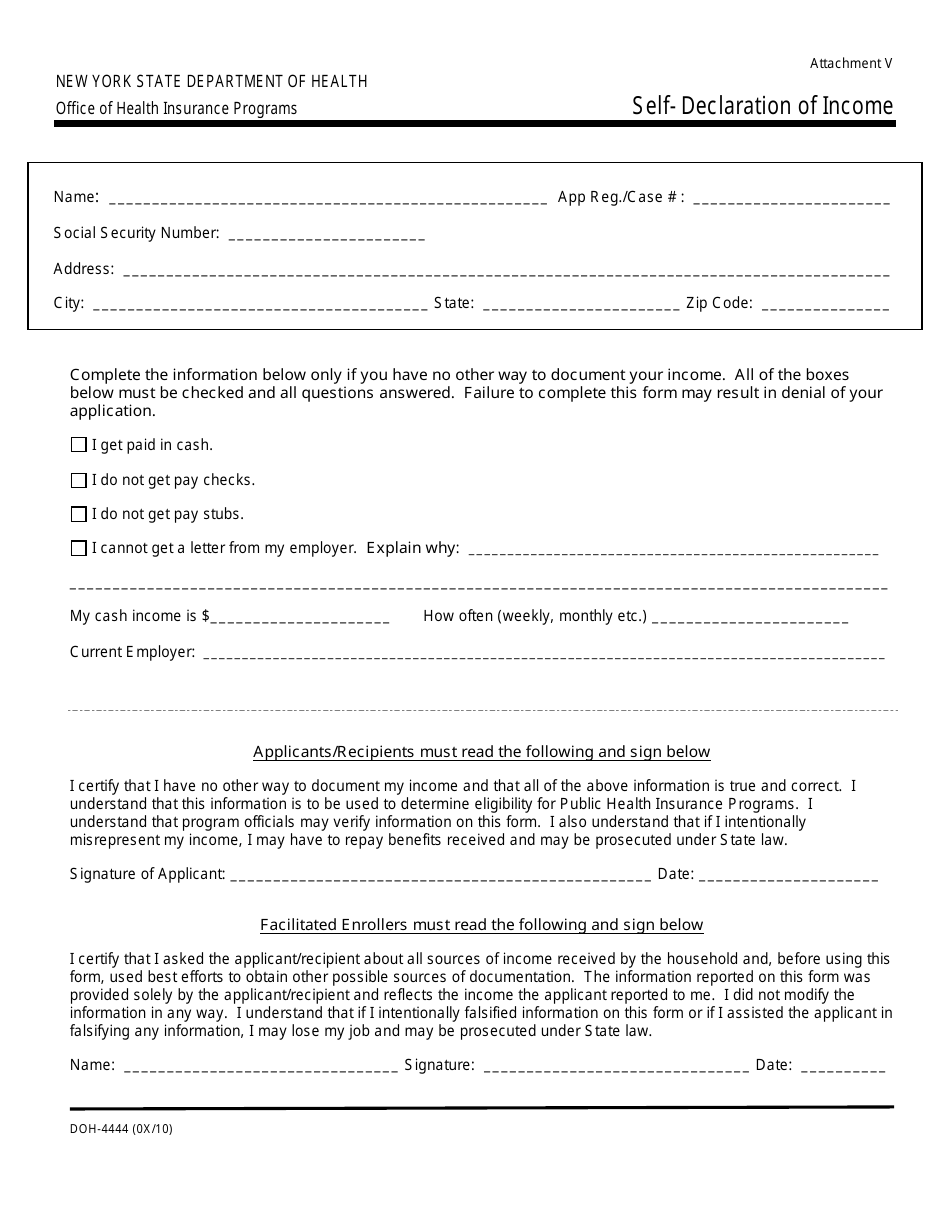

Form DOH4444 Download Printable PDF or Fill Online Selfdeclaration of

Web how to fill out and sign no income form online? An individual having salary income should collect. Web no income form name/sender address city zip code telephone number comed account number please describe your current income. Web go to irs.gov/freefile select “choose an irs free file offer” blue button select “browse all offers” and look for a product that.

Find The Document Template You Will Need From The Library Of Legal Forms.

An individual having salary income should collect. Another option would be to file form 1040. Web certification of zero income author: Web fill out no income statement form in a few minutes following the guidelines below:

Web While People With Income Under A Certain Amount Aren't Required To File A Tax Return Because They Won't Owe Any Tax, If You Qualify For Certain Tax Credits Or Already.

Web how to fill out and sign no income form online? Web zero income claim form customer name: To be used when a family states that. Web i have no income for the following reason(s).

Family Member) Who Helps You Pay Your Bills There Are Four (4) Ways To Submit Your Cap.

Use get form or simply click on the template preview to open it in the editor. _____ _____, pa _____ i, _____, state that no adult member of my household is currently (print name). Users are advised to navigate to 'e. Web documents needed to file itr;

I, _____ State That No Adult Member Of My Household Is Currently Receiving Income From Any Source.

Get your online template and fill it in using progressive features. The first step of filing itr is to collect all the documents related to the process. Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions. In that case, it is furnished to the exact addressee to provide certain details of.

![[PDF] Certificate Form PDF Download PDFfile](https://pdffile.co.in/wp-content/uploads/pdf-thumbnails/2021/07/small/income-certificate-form-825.jpg)