Non Foreign Affidavit Form

Non Foreign Affidavit Form - Income taxation (as such term is defined in the internal revenue code and income tax regulations. Web affidavit of support under section 213a of the ina. Our nonforeign person affidavit forms are professionally drafted to comply with federal law. Real property interest must withhold tax if the transferor (seller) is. Under federal law, (the foreign investment in real property tax act (firpta)(26 usc 1445) and the regulations thereunder (26 cfr parts 1 and 602)), a buyer of real estate is required to withhold a tax from the sale of real property to a foreign person unless an exemption applies. To be completed by an attorney or accredited representative (if any). Law summary related legal definitions real estate closings defined This simple form, containing a certification under oath that the seller is not a “foreign person” and disclosing the transferor’s name, u.s. Web in order to avoid withholding, irc §1445 (b) requires that the seller (a) provides an afidavit to the buyer with the seller’s taxpayer identification number (“tin”), or (b) provides a proper afidavit, (such as this form) including seller’s tin, to a “qualified substitute” who furnishes a statement to the buyer under penalty of perjury that the q. Web seller's affidavitof nonforeign status section 1445 of the internal revenue code provides that a transferee of a u.s.

This document must be signed and notarized. The form includes the seller’s name, u.s. To be completed by an attorney or accredited representative (if any). Law summary related legal definitions real estate closings defined Sign online button or tick the preview image of the form. The advanced tools of the editor will lead you through the editable pdf template. Law summary related legal definitions real estate closings defined This simple form, containing a certification under oath that the seller is not a “foreign person” and disclosing the transferor’s name, u.s. Our nonforeign person affidavit forms are professionally drafted to comply with federal law. Web in order to avoid withholding, irc §1445 (b) requires that the seller (a) provides an afidavit to the buyer with the seller’s taxpayer identification number (“tin”), or (b) provides a proper afidavit, (such as this form) including seller’s tin, to a “qualified substitute” who furnishes a statement to the buyer under penalty of perjury that the q.

Web seller's affidavitof nonforeign status section 1445 of the internal revenue code provides that a transferee of a u.s. Under federal law, (the foreign investment in real property tax act (firpta)(26 usc 1445) and the regulations thereunder (26 cfr parts 1 and 602)), a buyer of real estate is required to withhold a tax from the sale of real property to a foreign person unless an exemption applies. This document must be signed and notarized. Web certificate of non foreign status (firpta affidavit) section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. This document must be signed and notarized. Section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Law summary related legal definitions real estate closings defined Property uses to certify under oath that they aren’t a foreign citizen. Real property interest must withhold tax if the transferor (seller) is. To be completed by an attorney or accredited representative (if any).

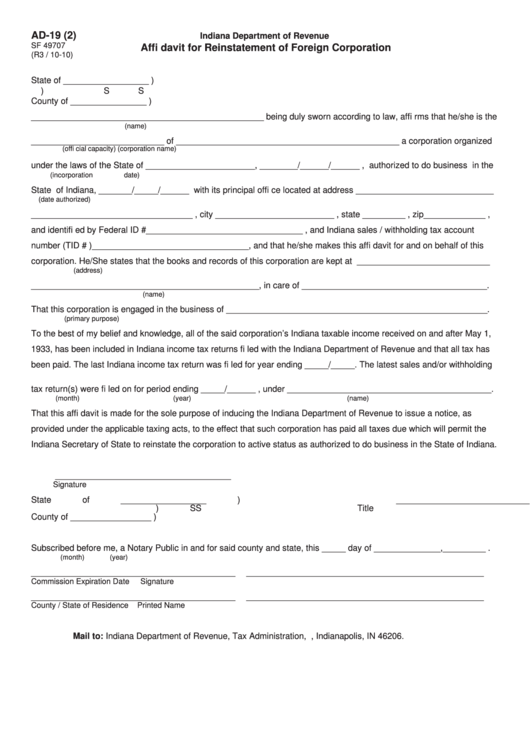

Fillable Ad19 (2) Indiana Affidavit For Reinstatement Of Foreign

Under federal law, (the foreign investment in real property tax act (firpta)(26 usc 1445) and the regulations thereunder (26 cfr parts 1 and 602)), a buyer of real estate is required to withhold a tax from the sale of real property to a foreign person unless an exemption applies. Web certificate of non foreign status (firpta affidavit) section 1445 of.

NonCollusion Affidavit Form Oklahoma Free Download

Law summary related legal definitions real estate closings defined Under federal law, (the foreign investment in real property tax act (firpta)(26 usc 1445) and the regulations thereunder (26 cfr parts 1 and 602)), a buyer of real estate is required to withhold a tax from the sale of real property to a foreign person unless an exemption applies. Web in.

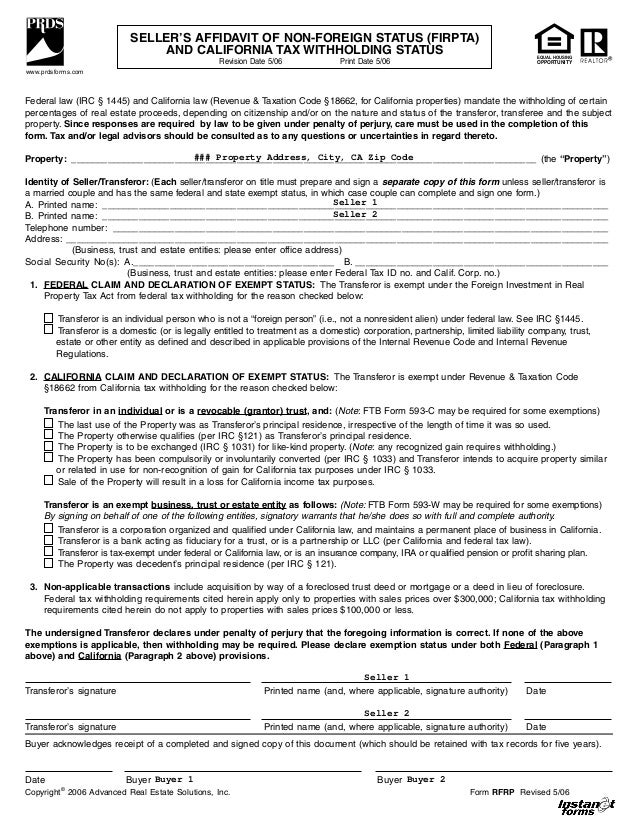

Sellers affidavit of non foreign status (firpta) (rfrp)

Shall be guilty of a felony and, upon conviction thereof, shall be f. Section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Web seller's affidavitof nonforeign status section 1445 of the internal revenue code provides that a transferee of a u.s. Law summary firpta certificate related closing forms Web affidavit of support under section.

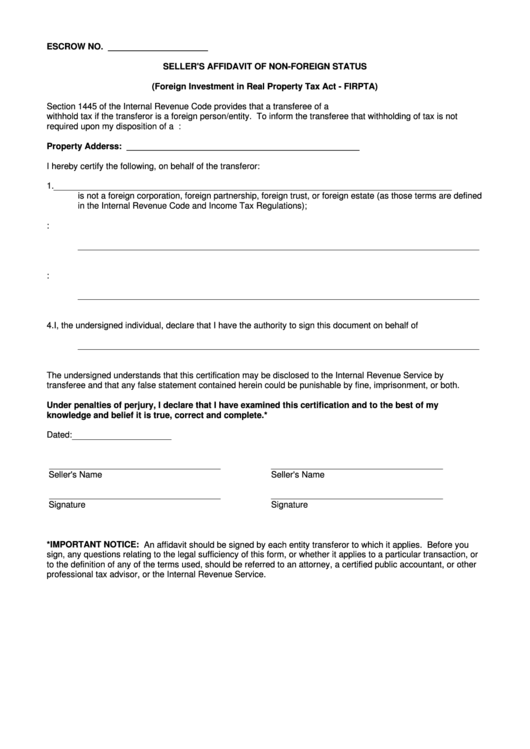

Seller'S Affidavit Of NonForeign Status (Foreign Investment In Real

Real property interest must withhold tax if the transferor (seller) is a foreign person. Basis for filing affidavit of support. This document must be signed and notarized. Willfully makes and subscribes any return, statement, or other document, which contains or is verified by written declaration that it is made under the penalties of perjury, and which he does not believe.

Sample Affidavit UnMarried / Bachelorhood / NonMarriage

Web in order to avoid withholding, irc §1445 (b) requires that the seller (a) provides an afidavit to the buyer with the seller’s taxpayer identification number (“tin”), or (b) provides a proper afidavit, (such as this form) including seller’s tin, to a “qualified substitute” who furnishes a statement to the buyer under penalty of perjury that the q. Real property.

FIRPTA Affidavit

Willfully makes and subscribes any return, statement, or other document, which contains or is verified by written declaration that it is made under the penalties of perjury, and which he does not believe to be true and correct as to every material matter. Under federal law, (the foreign investment in real property tax act (firpta)(26 usc 1445) and the regulations.

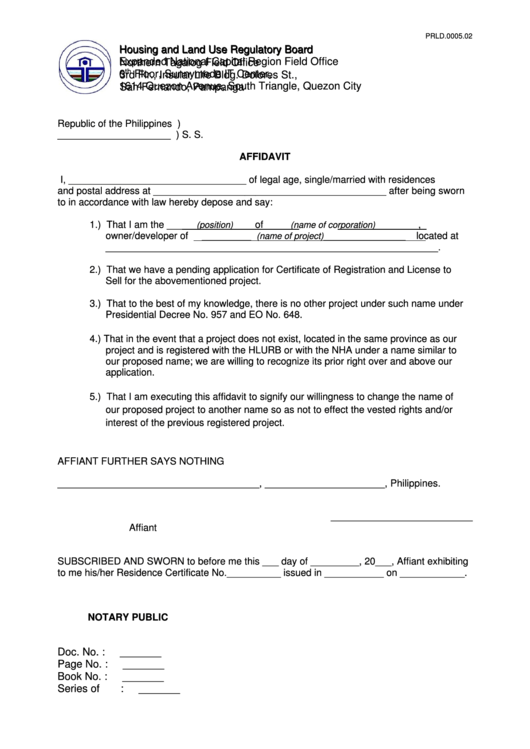

Affidavit Form Republic Of The Philippines printable pdf download

Under federal law, (the foreign investment in real property tax act (firpta)(26 usc 1445) and the regulations thereunder (26 cfr parts 1 and 602)), a buyer of real estate is required to withhold a tax from the sale of real property to a foreign person unless an exemption applies. Income taxation (as such term is defined in the internal revenue.

NY Abstract Company Forms New York Title Insurance Westchester County

Income taxation (as such term is defined in the internal revenue code and income tax regulations. Taxpayer identification number and home address (or office. This document must be signed and notarized. This simple form, containing a certification under oath that the seller is not a “foreign person” and disclosing the transferor’s name, u.s. Our nonforeign person affidavit forms are professionally.

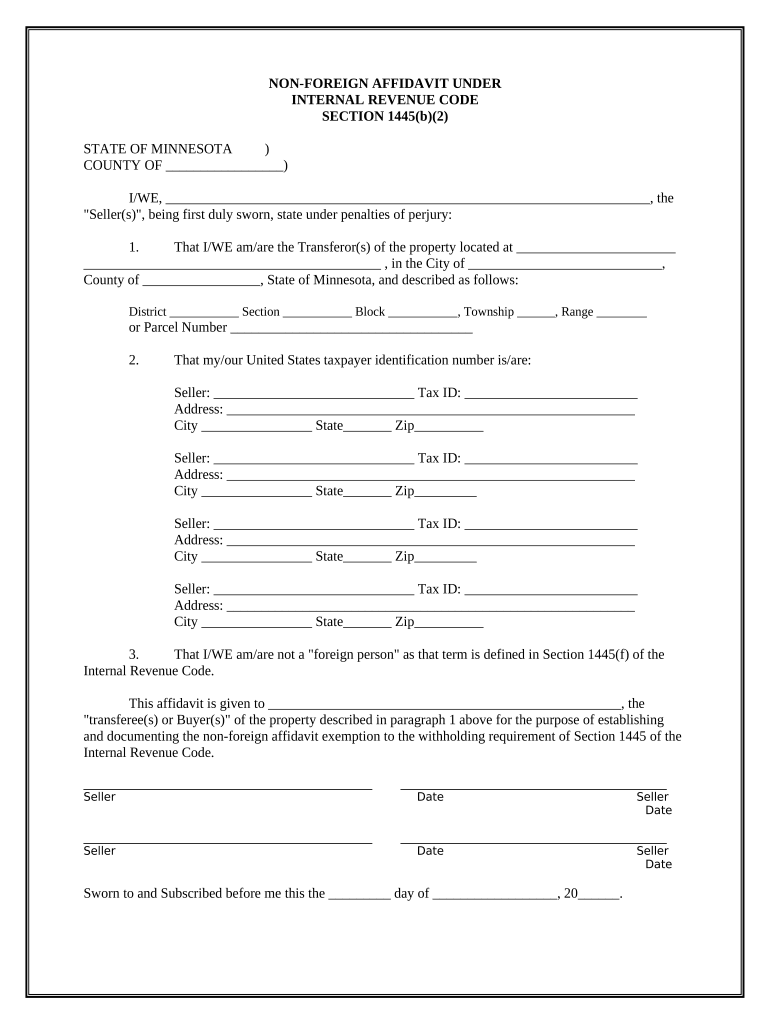

Non Foreign Affidavit under IRC 1445 Minnesota Form Fill Out and Sign

Willfully makes and subscribes any return, statement, or other document, which contains or is verified by written declaration that it is made under the penalties of perjury, and which he does not believe to be true and correct as to every material matter. The advanced tools of the editor will lead you through the editable pdf template. Property uses to.

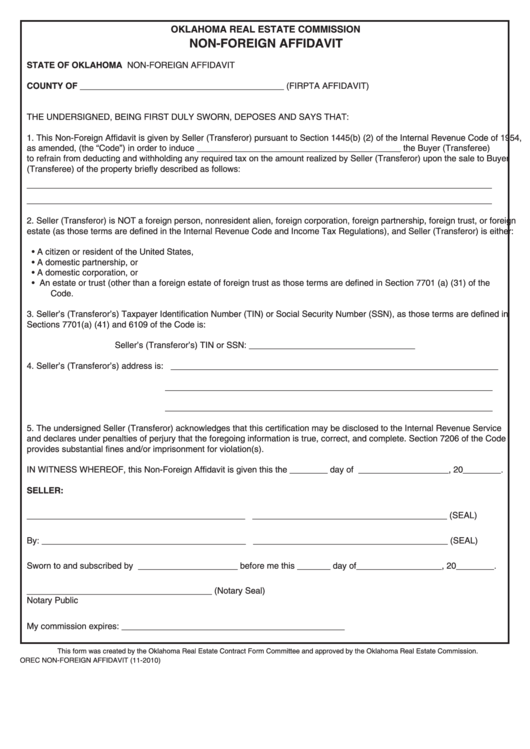

Fillable Oklahoma Real Estate Commission NonForeign Affidavit Form

Law summary firpta certificate related closing forms This document must be signed and notarized. Real property interest must withhold tax if the transferor (seller) is. Our nonforeign person affidavit forms are professionally drafted to comply with federal law. This simple form, containing a certification under oath that the seller is not a “foreign person” and disclosing the transferor’s name, u.s.

The Advanced Tools Of The Editor Will Lead You Through The Editable Pdf Template.

This simple form, containing a certification under oath that the seller is not a “foreign person” and disclosing the transferor’s name, u.s. Income taxation (as such term is defined in the internal revenue code and income tax regulations. To be completed by an attorney or accredited representative (if any). Web seller's affidavitof nonforeign status section 1445 of the internal revenue code provides that a transferee of a u.s.

This Document Must Be Signed And Notarized.

Our nonforeign person affidavit forms are professionally drafted to comply with federal law. This document must be signed and notarized. Web affidavit of support under section 213a of the ina. Real property interest must withhold tax if the transferor (seller) is a foreign person.

Law Summary Related Legal Definitions Real Estate Closings Defined

This document must be signed and notarized. Law summary firpta certificate related closing forms Shall be guilty of a felony and, upon conviction thereof, shall be f. The form includes the seller’s name, u.s.

Real Property Interest Must Withhold Tax If Thetransferor Is A Foreign Person.

Under federal law, (the foreign investment in real property tax act (firpta)(26 usc 1445) and the regulations thereunder (26 cfr parts 1 and 602)), a buyer of real estate is required to withhold a tax from the sale of real property to a foreign person unless an exemption applies. Law summary related legal definitions real estate closings defined Law summary related legal definitions real estate closings defined Sign online button or tick the preview image of the form.