Nyc Rpie Form

Nyc Rpie Form - Web real property income and expense (rpie) forms. Use the table below to determine the form you need use or visit the rpie forms page for a list of all related forms. Property owners provide this information by completing the real property income and expense (rpie) statement. We use the information you file and/or. Web real property income and expense (rpie) statements. Rpie rent roll addendum frequently asked questions Documents on this page are provided in pdf format. To find out if you can cliam. Rent roll column definitions for information about how to file your rpie statement, visit the real property income and expense page. Rpie information is filed each year for the previous year.

We use the information you file and/or. Documents on this page are provided in pdf format. Web rent roll rpie filers whose properties have an actual assessed value of $750,000 or greater are required to file an addendum containing rent roll information. Use the table below to determine the form you need use or visit the rpie forms page for a list of all related forms. Rpie rent roll addendum frequently asked questions Rpie information is filed each year for the previous year. Dof needs income and expense information each year to value your property accurately. Web real property income and expense (rpie) forms. To find out if you can cliam. Property owners provide this information by completing the real property income and expense (rpie) statement.

To find out if you can cliam. We use the information you file and/or. Documents on this page are provided in pdf format. Use the table below to determine the form you need use or visit the rpie forms page for a list of all related forms. Rent roll column definitions for information about how to file your rpie statement, visit the real property income and expense page. Property owners provide this information by completing the real property income and expense (rpie) statement. Certain properties are excluded from this filing requirement by law. Rpie rent roll addendum frequently asked questions Dof needs income and expense information each year to value your property accurately. Web real property income and expense (rpie) forms.

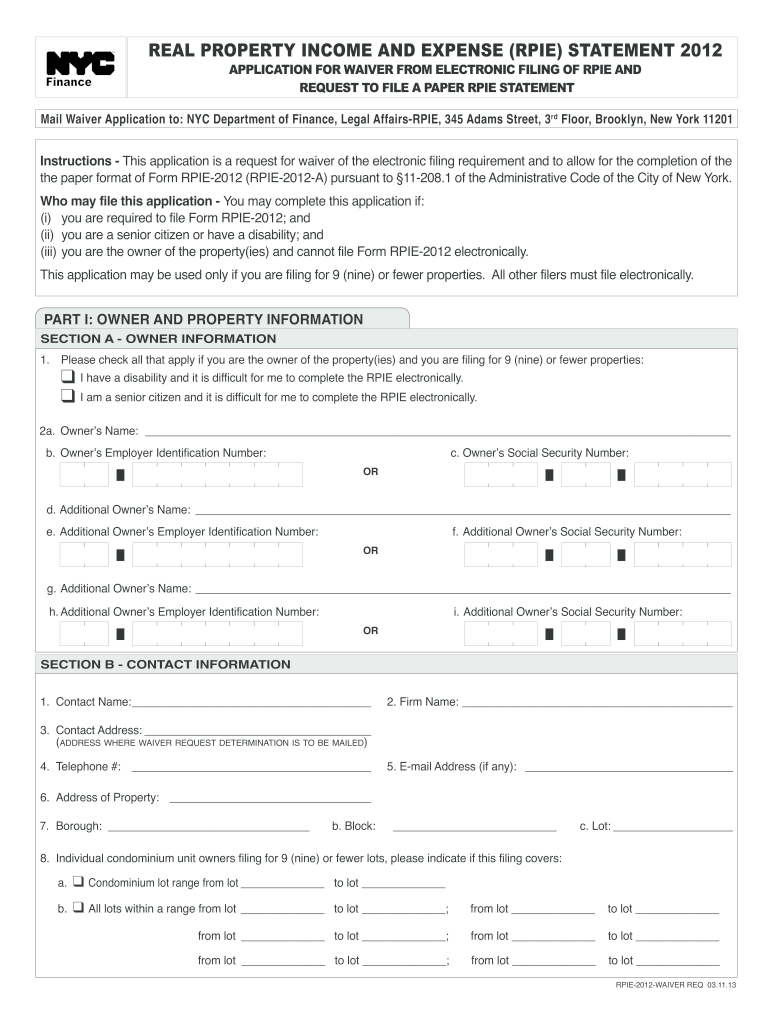

Nyc Rpie Fill Out and Sign Printable PDF Template signNow

Web real property income and expense (rpie) statements. Web rent roll rpie filers whose properties have an actual assessed value of $750,000 or greater are required to file an addendum containing rent roll information. Property owners provide this information by completing the real property income and expense (rpie) statement. Web real property income and expense (rpie) forms. Dof needs income.

NYC RPIE Filing NY Real Estate Tax Reduction Attorneys APFLAW

Certain properties are excluded from this filing requirement by law. Web rent roll rpie filers whose properties have an actual assessed value of $750,000 or greater are required to file an addendum containing rent roll information. Use the table below to determine the form you need use or visit the rpie forms page for a list of all related forms..

brooklynpropertytaxreduction NY Real Estate Tax Reduction

Property owners provide this information by completing the real property income and expense (rpie) statement. Rpie rent roll addendum frequently asked questions Dof needs income and expense information each year to value your property accurately. Rpie information is filed each year for the previous year. Rent roll column definitions for information about how to file your rpie statement, visit the.

Brooklyn Property Tax Reduction NY Real Estate Tax Reduction

Rpie information is filed each year for the previous year. Use the table below to determine the form you need use or visit the rpie forms page for a list of all related forms. Rpie rent roll addendum frequently asked questions Dof needs income and expense information each year to value your property accurately. Property owners provide this information by.

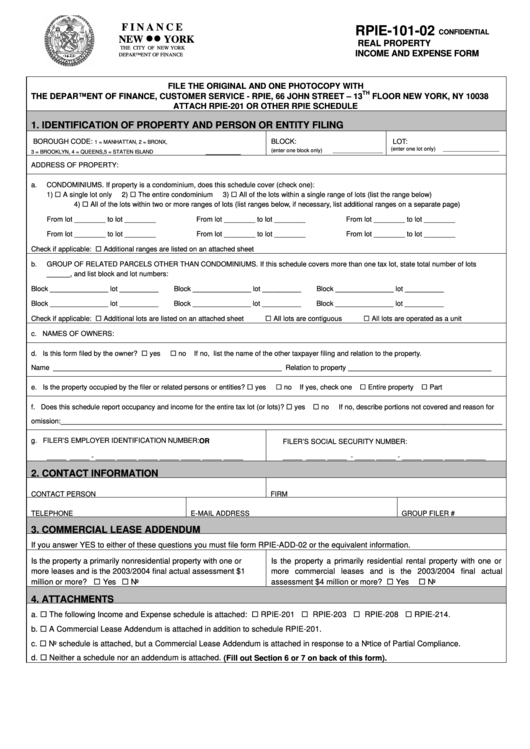

Fillable Form Rpie10102 Real Property And Expense New York

Rpie information is filed each year for the previous year. Rpie rent roll addendum frequently asked questions Documents on this page are provided in pdf format. To find out if you can cliam. We use the information you file and/or.

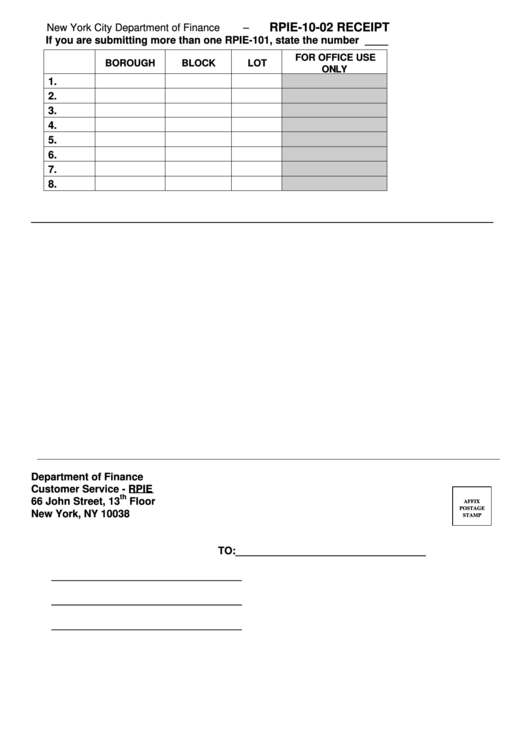

Form Rpie1002 Receipt New York City Department Of Finance

Rpie information is filed each year for the previous year. To find out if you can cliam. Web real property income and expense (rpie) statements. Web rent roll rpie filers whose properties have an actual assessed value of $750,000 or greater are required to file an addendum containing rent roll information. Certain properties are excluded from this filing requirement by.

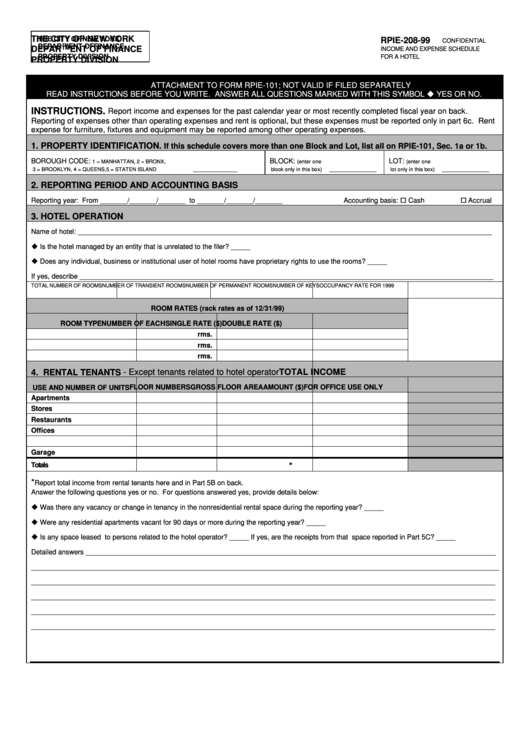

Form Rpie20899 Confidential And Expense Schedule For A Hotel

Documents on this page are provided in pdf format. Rpie rent roll addendum frequently asked questions Property owners provide this information by completing the real property income and expense (rpie) statement. Rpie information is filed each year for the previous year. Certain properties are excluded from this filing requirement by law.

NYC RPIE FAQ 2014 Fill and Sign Printable Template Online US Legal

Web real property income and expense (rpie) forms. Use the table below to determine the form you need use or visit the rpie forms page for a list of all related forms. Rpie rent roll addendum frequently asked questions To find out if you can cliam. Web real property income and expense (rpie) statements.

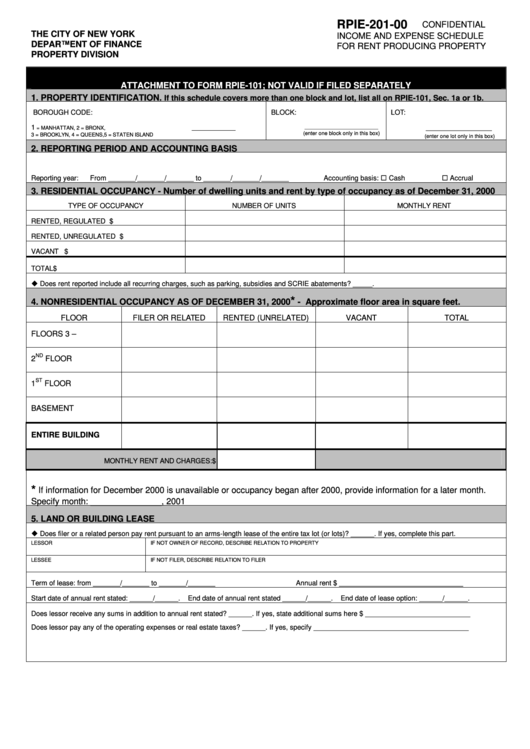

Form Rpie20100 And Expense Schedule For Rent Producing

Property owners provide this information by completing the real property income and expense (rpie) statement. Web rent roll rpie filers whose properties have an actual assessed value of $750,000 or greater are required to file an addendum containing rent roll information. We use the information you file and/or. To find out if you can cliam. Web real property income and.

Preserving Value The Easy Way Do Your RPIE Filing Now The Nowak Group

Rpie rent roll addendum frequently asked questions Dof needs income and expense information each year to value your property accurately. Web real property income and expense (rpie) forms. Documents on this page are provided in pdf format. We use the information you file and/or.

Rpie Rent Roll Addendum Frequently Asked Questions

Web real property income and expense (rpie) forms. Web real property income and expense (rpie) statements. Certain properties are excluded from this filing requirement by law. Property owners provide this information by completing the real property income and expense (rpie) statement.

Rent Roll Column Definitions For Information About How To File Your Rpie Statement, Visit The Real Property Income And Expense Page.

We use the information you file and/or. Web rent roll rpie filers whose properties have an actual assessed value of $750,000 or greater are required to file an addendum containing rent roll information. Documents on this page are provided in pdf format. Dof needs income and expense information each year to value your property accurately.

Rpie Information Is Filed Each Year For The Previous Year.

To find out if you can cliam. Use the table below to determine the form you need use or visit the rpie forms page for a list of all related forms.