Nys Form It-204-Ll

Nys Form It-204-Ll - 4 enter the amount from line 15, column b, of the new york source gross income worksheet in Skip part 2 and continue with part 3. Prepare tax documents themselves, without the assistance of a tax professional; Web this field is mandatory for new york state. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Regular partnership limited liability company (llc) or limited liability partnership (llp) This form is used to report income, calculate, and pay any taxes owed by the partnership to the state of new york. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Web make check or money order for $25 payable to nys filing fee; Or, • a domestic or foreign llc (including limited liability investment

Skip part 2 and continue with part 3. Regular partnership limited liability company (llc) or limited liability partnership (llp) Web this field is mandatory for new york state. Limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Llcs that are disregarded entities for federal income tax purposes: Prepare tax documents themselves, without the assistance of a tax professional; 4 enter the amount from line 15, column b, of the new york source gross income worksheet in • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; This form is used to report income, calculate, and pay any taxes owed by the partnership to the state of new york. Write your ein or ssn and 2019 filing fee on the remittance and submit it with this form.

Web this field is mandatory for new york state. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Used to report income, deductions, gains, losses and credits from the operation of a partnership. Or, • a domestic or foreign llc (including limited liability investment Llcs that are disregarded entities for federal income tax purposes: Regular partnership limited liability company (llc) or limited liability partnership (llp) This form is used to report income, calculate, and pay any taxes owed by the partnership to the state of new york. Limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Web make check or money order for $25 payable to nys filing fee; Prepare tax documents themselves, without the assistance of a tax professional;

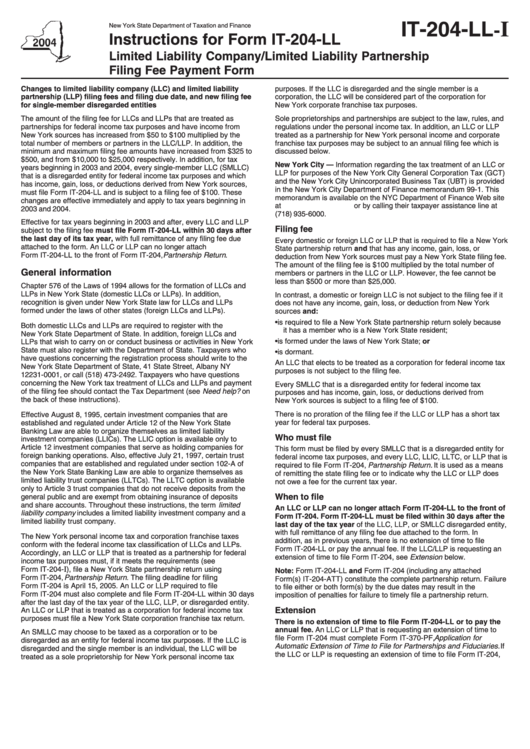

Instructions For Form It204Ll Limited Liability Company/limited

Write your ein or ssn and 2019 filing fee on the remittance and submit it with this form. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Llcs that are disregarded entities for federal income tax purposes: Prepare tax documents themselves, without the assistance of a tax professional; This form is used to report.

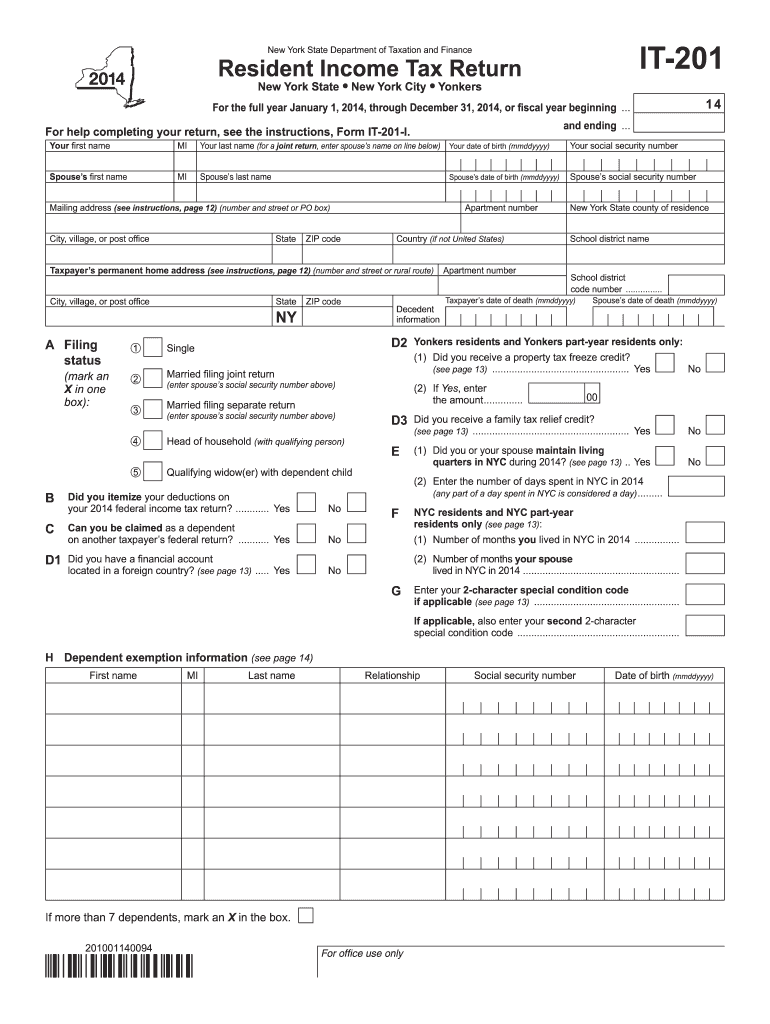

2014 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

• a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; This form is used to report income, calculate, and pay any taxes owed by the partnership to the state of new york. Skip part 2 and continue with part 3. 4 enter.

NY IT204LL 20152021 Fill and Sign Printable Template Online US

Prepare tax documents themselves, without the assistance of a tax professional; Llcs that are disregarded entities for federal income tax purposes: Skip part 2 and continue with part 3. Or, • a domestic or foreign llc (including limited liability investment Limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or.

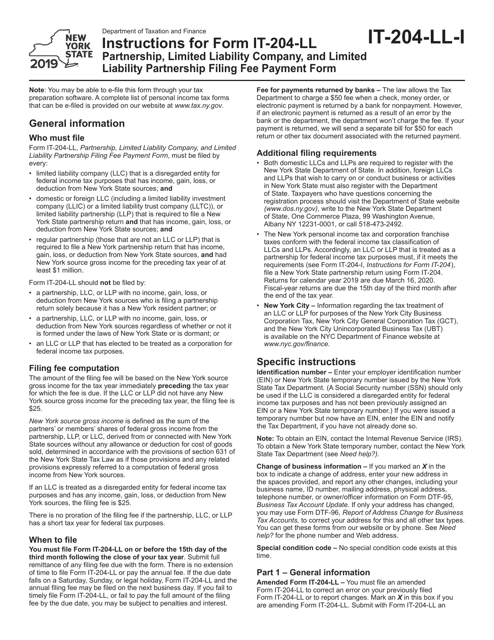

Download Instructions for Form IT204LL Partnership, Limited Liability

• a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Llcs that are disregarded entities for federal income tax purposes: Web make check or money order for $25 payable to nys filing fee; Prepare tax documents themselves, without the assistance of a.

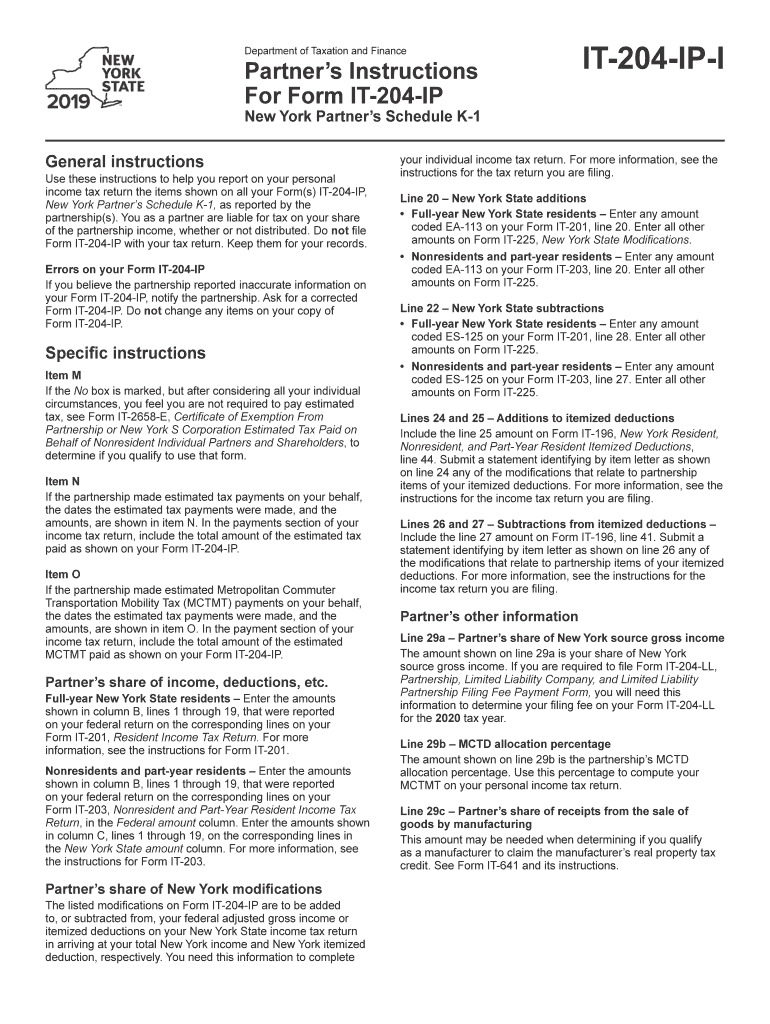

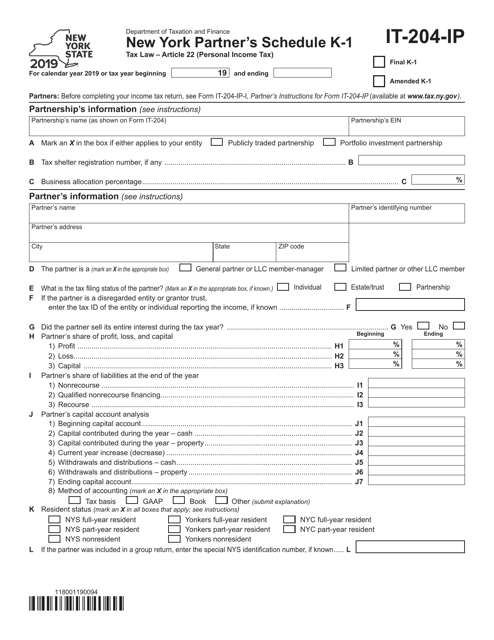

NY IT204IPI 2019 Fill out Tax Template Online US Legal Forms

Llcs that are disregarded entities for federal income tax purposes: Skip part 2 and continue with part 3. Web this field is mandatory for new york state. Prepare tax documents themselves, without the assistance of a tax professional; 4 enter the amount from line 15, column b, of the new york source gross income worksheet in

Fill Free fillable forms for New York State

4 enter the amount from line 15, column b, of the new york source gross income worksheet in Web this field is mandatory for new york state. Regular partnership limited liability company (llc) or limited liability partnership (llp) Or, • a domestic or foreign llc (including limited liability investment This form is used to report income, calculate, and pay any.

Form IT204IP Download Fillable PDF or Fill Online New York Partner's

• a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Prepare tax documents themselves, without the assistance of a tax professional; Web make check or money order for $25 payable to nys filing fee; Llcs that are disregarded entities for federal income.

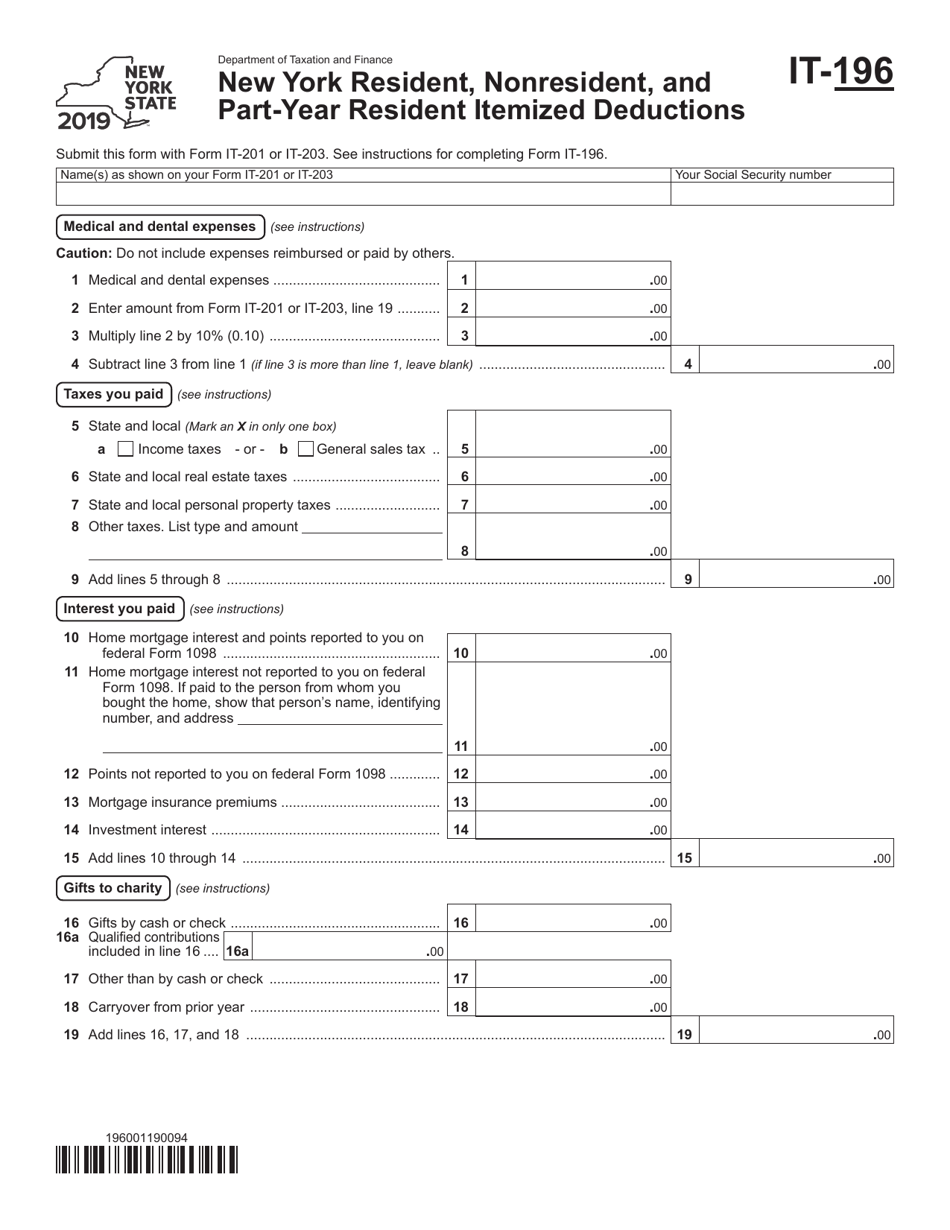

Form IT196 2019 Fill Out, Sign Online and Download Fillable PDF

• a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Write your ein or ssn and 2019 filing fee on the remittance and submit it with this form. Skip part 2 and continue with part 3. Web make check or money order.

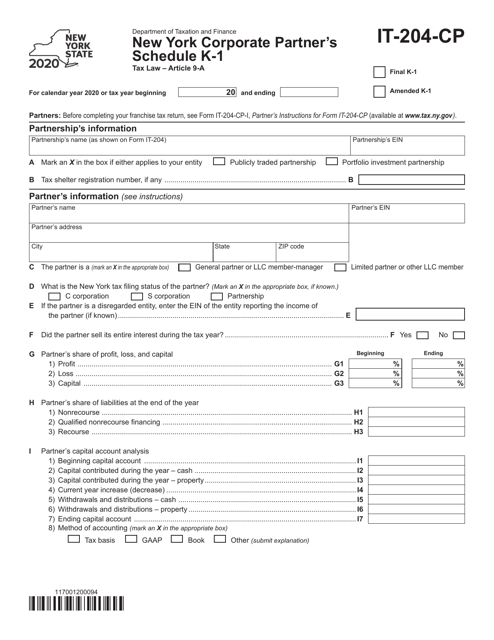

Form IT204CP Download Fillable PDF or Fill Online New York Corporate

Skip part 2 and continue with part 3. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Web make check or money order for $25 payable to nys filing fee; Prepare tax documents themselves, without the assistance of a tax professional;.

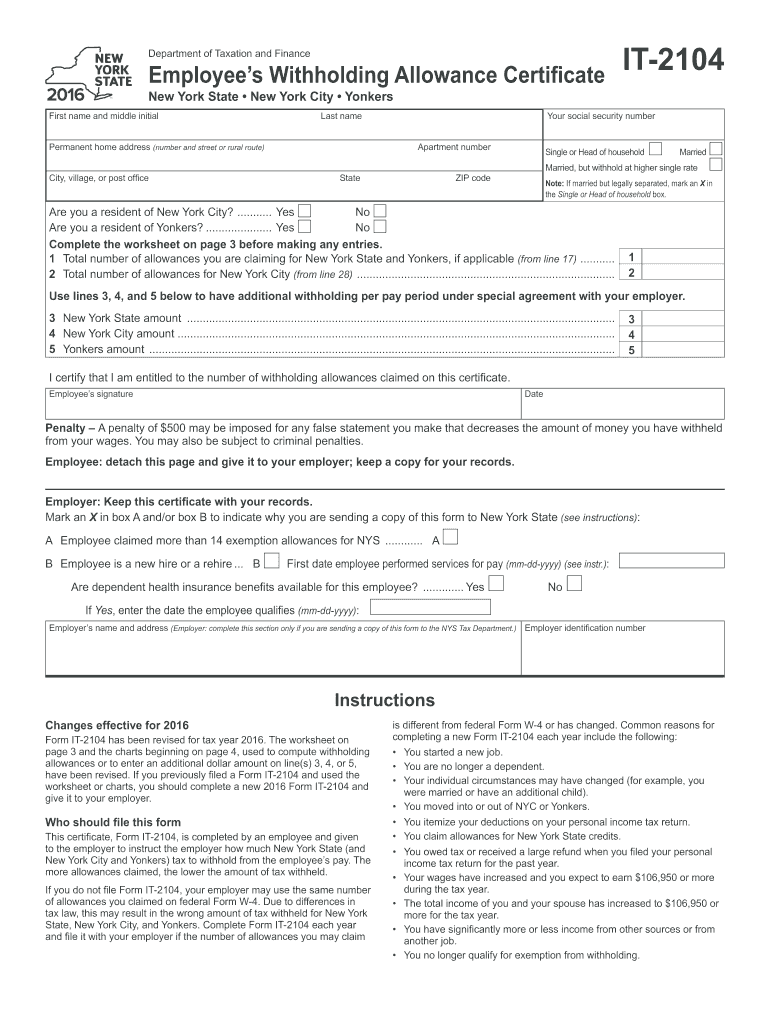

Filling Out It 2104 Fill Out and Sign Printable PDF Template signNow

Limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; This form is used to report income, calculate, and pay any taxes owed by the partnership to the state of new york. Regular partnership limited liability company (llc) or limited liability partnership (llp) Web.

Web This Field Is Mandatory For New York State.

Regular partnership limited liability company (llc) or limited liability partnership (llp) Or, • a domestic or foreign llc (including limited liability investment Llcs that are disregarded entities for federal income tax purposes: Skip part 2 and continue with part 3.

Web Make Check Or Money Order For $25 Payable To Nys Filing Fee;

Limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Write your ein or ssn and 2019 filing fee on the remittance and submit it with this form. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york state sources; Used to report income, deductions, gains, losses and credits from the operation of a partnership.

4 Enter The Amount From Line 15, Column B, Of The New York Source Gross Income Worksheet In

Prepare tax documents themselves, without the assistance of a tax professional; This form is used to report income, calculate, and pay any taxes owed by the partnership to the state of new york.