Ohio Homestead Exemption Form

Ohio Homestead Exemption Form - Web disabled applicants must complete form dte 105e, certificate of disability for the homestead exemption, and attach it or a separate certification of disability status from. You can also download the. Web homestead exemption if you are a homeowner who meets one of the requirements below, you may be eligible for a valuable tax reduction: Web the homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year's household income that does. Web any information regarding the homestead exemption program may be obtained from the lake county auditor’s office by mail, by phone or in person. Web homestead exemption application form for military veterans evaluated at 100% disability from a service homeowners, already receiving homestead exemption, who have. Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. Web what is ohio’s homestead exemption? Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status. A homeowner is entitled the reduction on only one home.

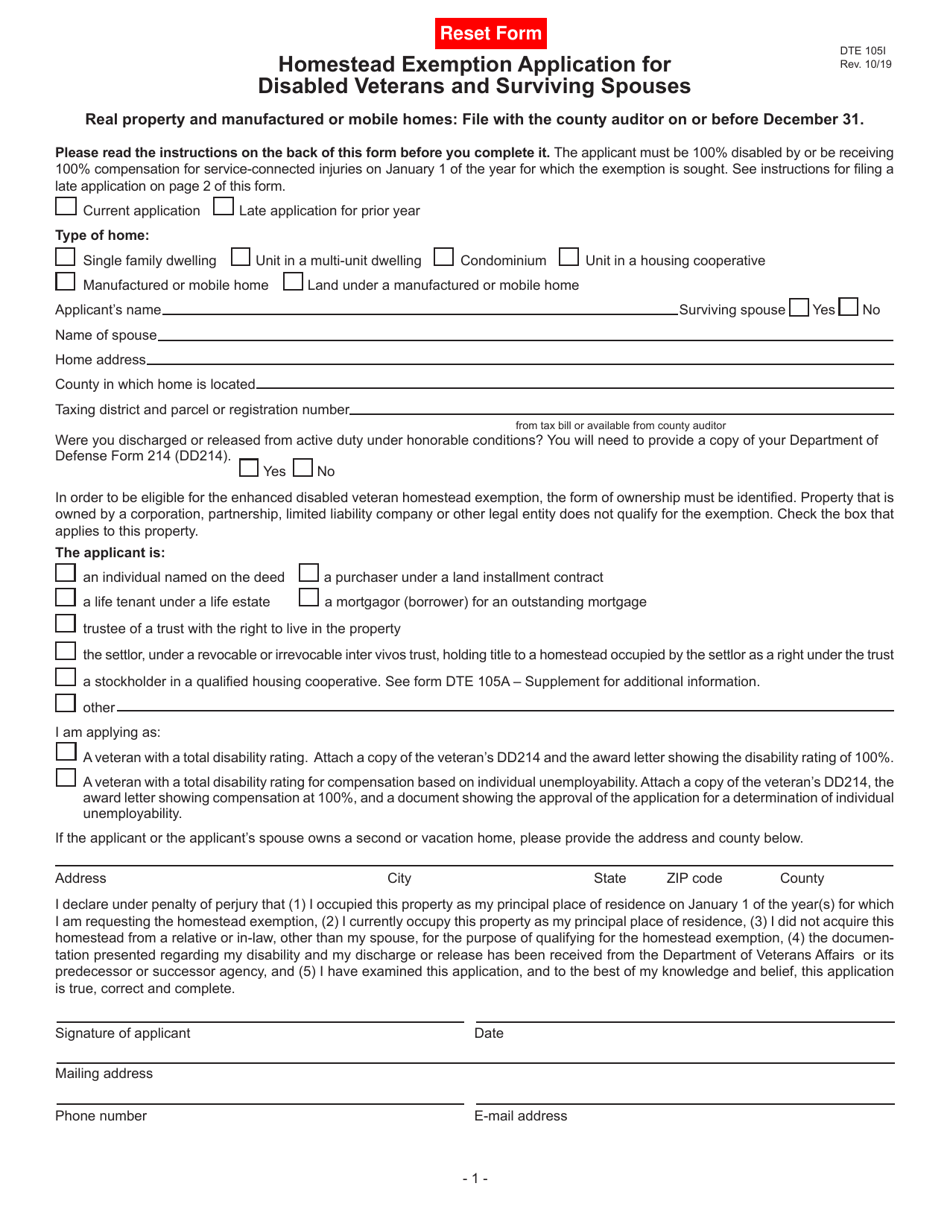

Web homestead exemption application form for military veterans evaluated at 100% disability from a service homeowners, already receiving homestead exemption, who have. Web dte 105i homestead exemption application for rev. If you are under 65 and disabled, you also have to download form dte 105e. Web the exemption takes the form of a credit on property tax bills. 10/19 disabled veterans and surviving spouses real property and manufactured or mobile homes: Web the purpose of this bulletin is to assist ohio’s county auditors in administering the homestead exemption program for both real property and manufactured homes. Web visit the ohio department of taxation website and download form dte 105a. Web the homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year's household income that does. Web disabled applicants must complete form dte 105e, certificate of disability for the homestead exemption, and attach it or a separate certification of disability status from. The homestead exemption for senior and disabled persons allows eligible homeowners to exempt the first $25,000.

10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the. A homeowner is entitled the reduction on only one home. Homestead exemption form email the auditor's office regarding homestead exemption Web homestead exemption if you are a homeowner who meets one of the requirements below, you may be eligible for a valuable tax reduction: Web any information regarding the homestead exemption program may be obtained from the lake county auditor’s office by mail, by phone or in person. House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. Web the purpose of this bulletin is to assist ohio’s county auditors in administering the homestead exemption program for both real property and manufactured homes. Web the exemption takes the form of a credit on property tax bills. Ohio has two types of homestead exemption: Web what is ohio’s homestead exemption?

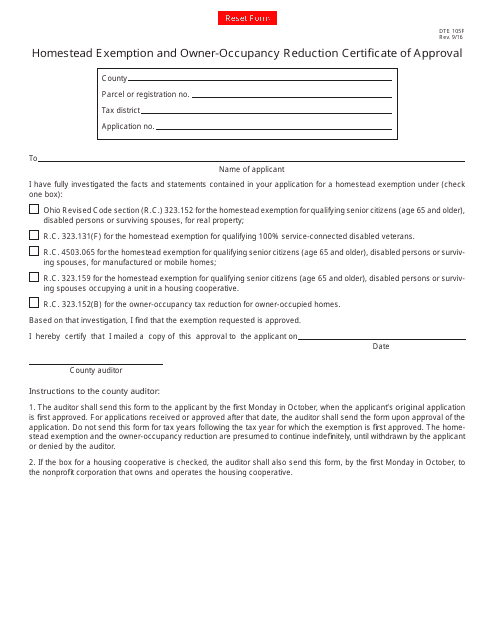

Form DTE105F Download Fillable PDF or Fill Online Homestead Exemption

Web dteaddendum to the homestead exemption application for 105h rev. 10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the. Web homestead exemption application form for military veterans evaluated at 100% disability from a service homeowners, already receiving homestead exemption, who have. 10/19 disabled veterans and surviving spouses real property and manufactured or mobile.

How To Apply For Homestead Tax Credit In Ohio PRORFETY

A homeowner is entitled the reduction on only one home. Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. Web homestead exemption department auditor homestead exemption department home property search appraisal and revaluation agricultural district cauv documents and. If you are under 65 and.

What Is Ohio's Homestead Exemption? Richard P. Arthur Attorney at Law

Web any information regarding the homestead exemption program may be obtained from the lake county auditor’s office by mail, by phone or in person. Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status. Web dteaddendum to the homestead exemption application for 105h rev. A homeowner.

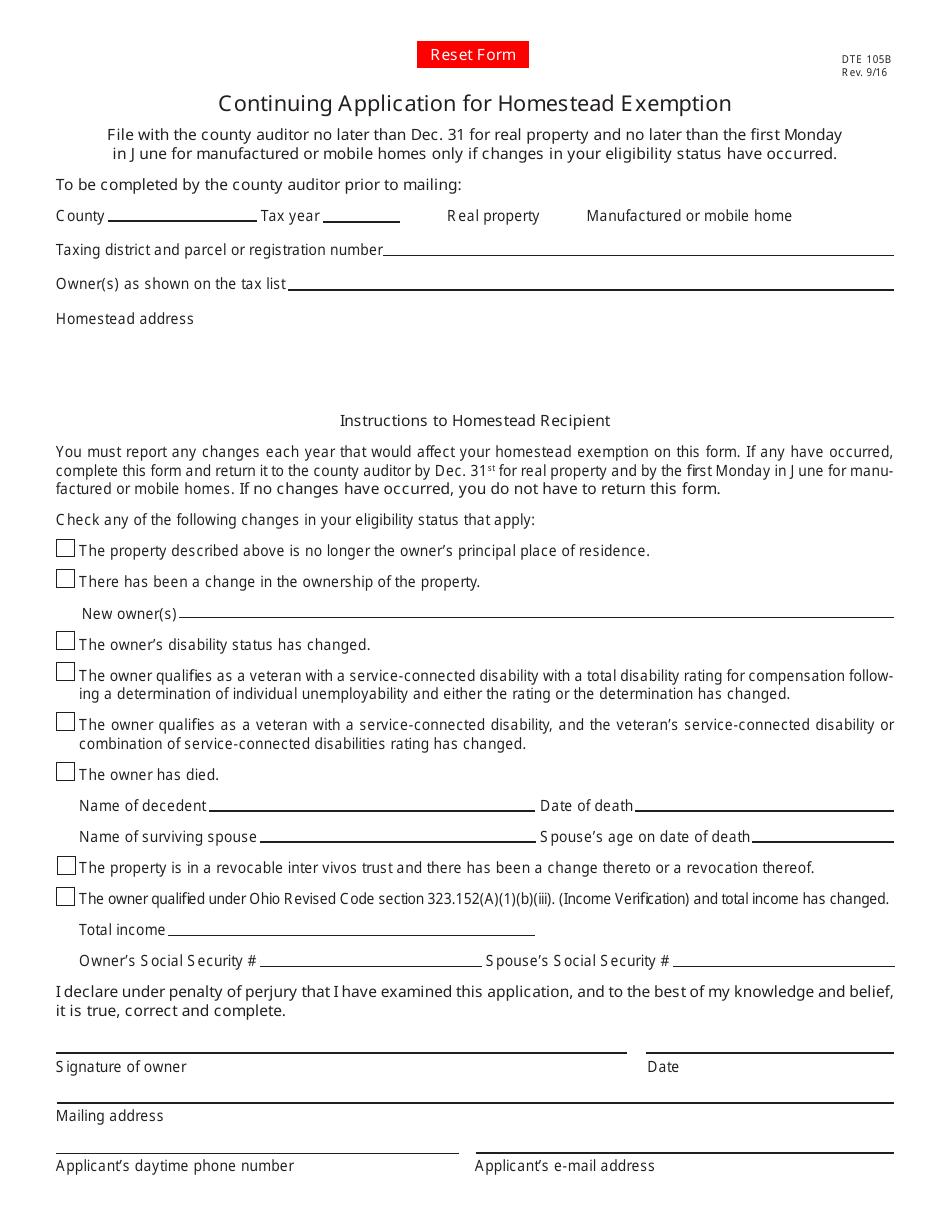

Form DTE105B Download Fillable PDF or Fill Online Continuing

Web homestead exemption if you are a homeowner who meets one of the requirements below, you may be eligible for a valuable tax reduction: Web what is ohio’s homestead exemption? To apply for the homestead exemption: Web homestead exemption 2022 requirements qualifying income homestead exemption 2022 requirements 1. House bill 17 became effective, allowing a homestead exemption for a surviving.

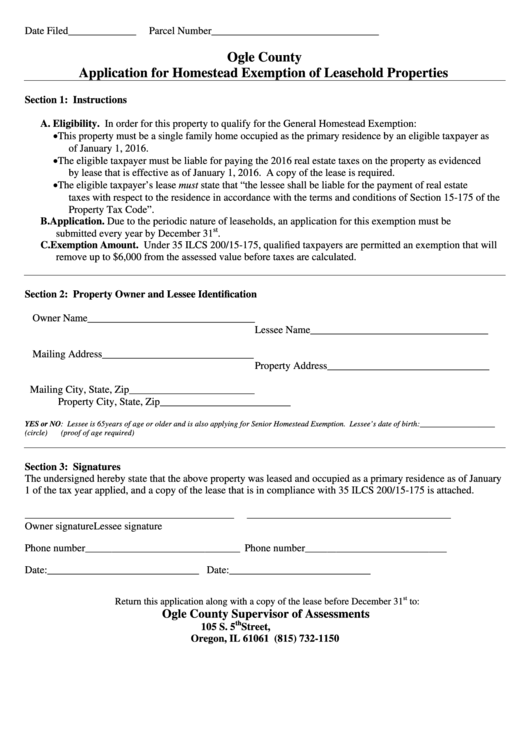

Fillable Application For Homestead Exemption Of Leasehold Properties

Web disability exemptions must include a certificate of disability form (dte105e) or other available certifications. Web disabled applicants must complete form dte 105e, certificate of disability for the homestead exemption, and attach it or a separate certification of disability status from. (1) senior and disabled persons homestead exemption and (2) disabled veterans. Web what is ohio’s homestead exemption? 10/19 disabled.

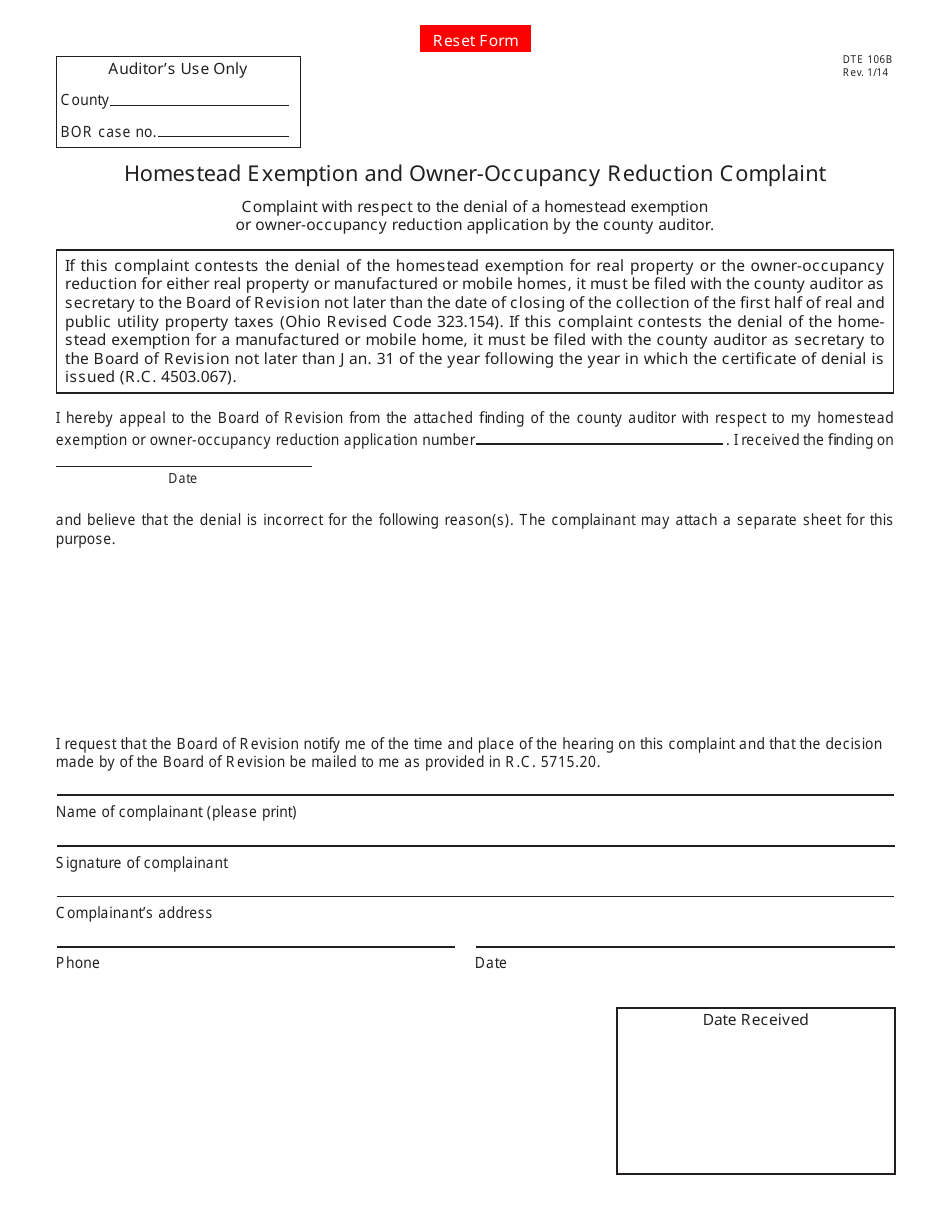

Form DTE106A Download Fillable PDF or Fill Online Homestead Exemption

Web dteaddendum to the homestead exemption application for 105h rev. Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status. Homestead exemption form email the auditor's office regarding homestead exemption Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens,.

How To Apply For Homestead Tax Credit In Ohio PRORFETY

If you are under 65 and disabled, you also have to download form dte 105e. Web any information regarding the homestead exemption program may be obtained from the lake county auditor’s office by mail, by phone or in person. Web dte 105i homestead exemption application for rev. Web the exemption takes the form of a credit on property tax bills..

Form DTE105I Download Fillable PDF or Fill Online Homestead Exemption

Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status. To apply for the homestead exemption: Web homestead exemption if you are a homeowner who meets one of the requirements below, you may be eligible for a valuable tax reduction: A homeowner is entitled the reduction.

Homestead exemption to rise The Blade

Web what is ohio’s homestead exemption? Web visit the ohio department of taxation website and download form dte 105a. If you are under 65 and disabled, you also have to download form dte 105e. (1) senior and disabled persons homestead exemption and (2) disabled veterans. A homeowner is entitled the reduction on only one home.

Homestead Exemption (Explained) YouTube

(1) senior and disabled persons homestead exemption and (2) disabled veterans. Web homestead exemption 2022 requirements qualifying income homestead exemption 2022 requirements 1. To apply for the homestead exemption: Own your home as your principal place of residence. Ohio has two types of homestead exemption:

Web Disability Exemptions Must Include A Certificate Of Disability Form (Dte105E) Or Other Available Certifications.

Web what is ohio’s homestead exemption? Web homestead exemption department auditor homestead exemption department home property search appraisal and revaluation agricultural district cauv documents and. A homestead exemption application form (“dte 105a) (link is external) is available from. Web any information regarding the homestead exemption program may be obtained from the lake county auditor’s office by mail, by phone or in person.

(1) Senior And Disabled Persons Homestead Exemption And (2) Disabled Veterans.

Web the homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year's household income that does. Web dteaddendum to the homestead exemption application for 105h rev. To apply for the homestead exemption: Web visit the ohio department of taxation website and download form dte 105a.

Web To Apply, Complete The Application Form (Dte 105A, Homestead Exemption Application Form For Senior Citizens, Disabled Persons, And Surviving Spouses), Then File It With.

10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the. Web the exemption takes the form of a credit on property tax bills. Web homestead exemption if you are a homeowner who meets one of the requirements below, you may be eligible for a valuable tax reduction: Web homestead exemption 2022 requirements qualifying income homestead exemption 2022 requirements 1.

A Homeowner Is Entitled The Reduction On Only One Home.

You can also download the. Ohio has two types of homestead exemption: Web the purpose of this bulletin is to assist ohio’s county auditors in administering the homestead exemption program for both real property and manufactured homes. Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status.