Ohio Pte Registration Form

Ohio Pte Registration Form - Web new pte filers should send in the registration form prior to or along with your first estimated payment and universal payment coupon (upc). For taxable year 2022, the due. Web ohio governor dewine on june 14 signed into law s.b. If you are a new pte filer, but. Entities filing the pte tax in ohio for the first time in 2022 must send in a separate registration form with any payments being made.) simply filing the. Web this form contains information necessary to create a pte account with the department. Web as enacted, ohio’s pte tax rate is 5% for 2022 and 3% for those years after 2022. A fully refundable ohio pte tax credit is also permitted for pte owners for their. Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. Web more about the ohio form pte reg corporate income tax ty 2022.

Web this form contains information necessary to create a pte account with the department. Web ohio governor dewine on june 14 signed into law s.b. A fully refundable ohio pte tax credit is also permitted for pte owners for their. Web july 22, 2022 article 6 min read authors: Web more about the ohio form pte reg corporate income tax ty 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. If you are a new pte filer, but. Entities filing the pte tax in ohio for the first time in 2022 must send in a separate registration form with any payments being made.) simply filing the. Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. More guidance will likely be forthcoming from the.

We last updated the pass through entity & fiduciary income tax registration in february 2023, so this is. Web ohio governor dewine on june 14 signed into law s.b. Web new ohio pte registration process (pdf) 08/05/2019: A fully refundable ohio pte tax credit is also permitted for pte owners for their. Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. Web as enacted, ohio’s pte tax rate is 5% for 2022 and 3% for those years after 2022. Here’s how you know the due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Web new pte filers should send in the registration form prior to or along with your first estimated payment and universal payment coupon (upc). Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. More guidance will likely be forthcoming from the.

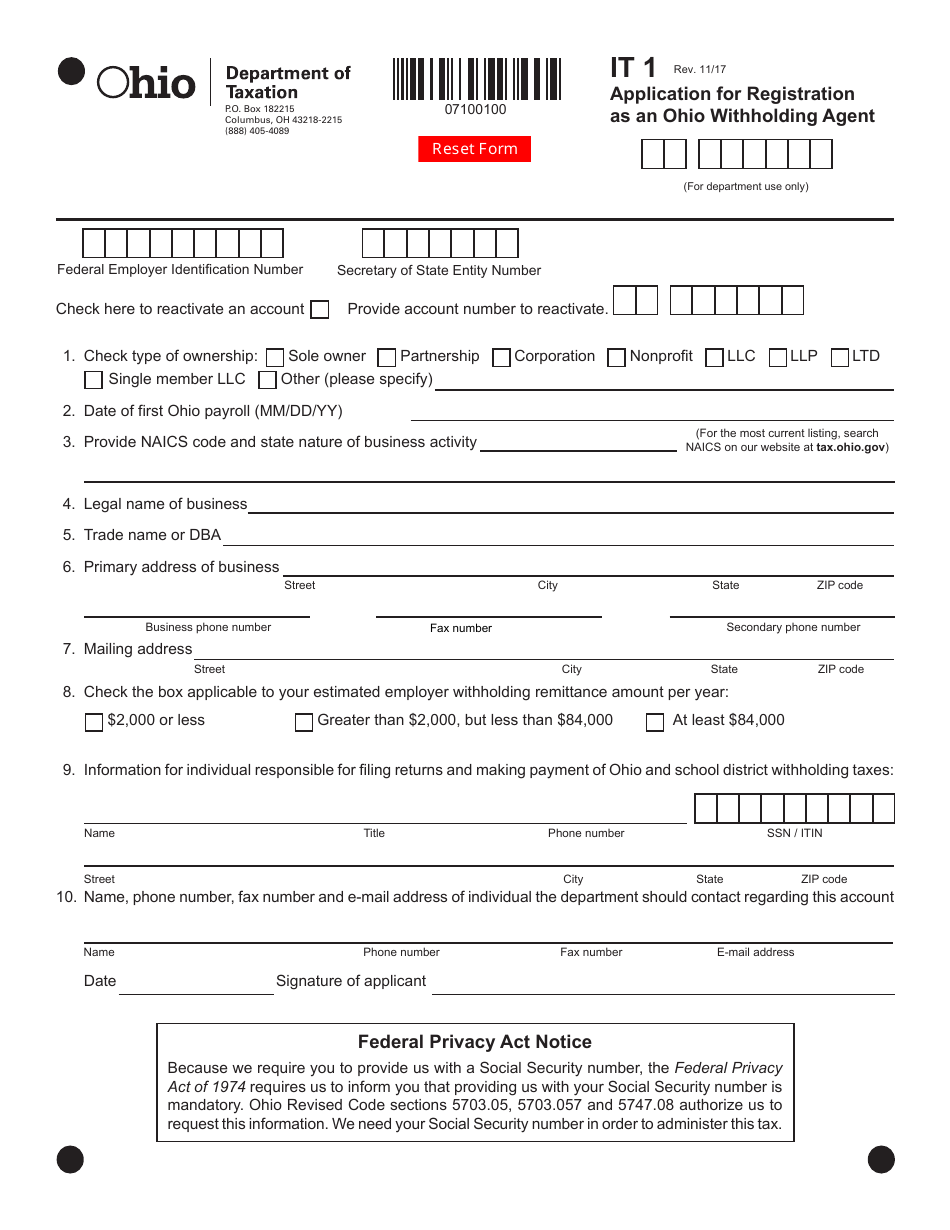

Ohio Withholding Business Registration Subisness

Web more about the ohio form pte reg corporate income tax ty 2022. You can send the form by:. Web july 22, 2022 article 6 min read authors: Ron cook julie corrigan stephen palmer adam garn significant tax changes are in store for ohio after its governor signed. If you are a new pte filer, but.

How to Register a Car in Ohio BMV Registration Guide DMV Connect

Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. You can send the form by:. Entities filing the pte tax in ohio for the first time in 2022 must send in a separate registration form with any payments being made.) simply filing the. Web ohio.

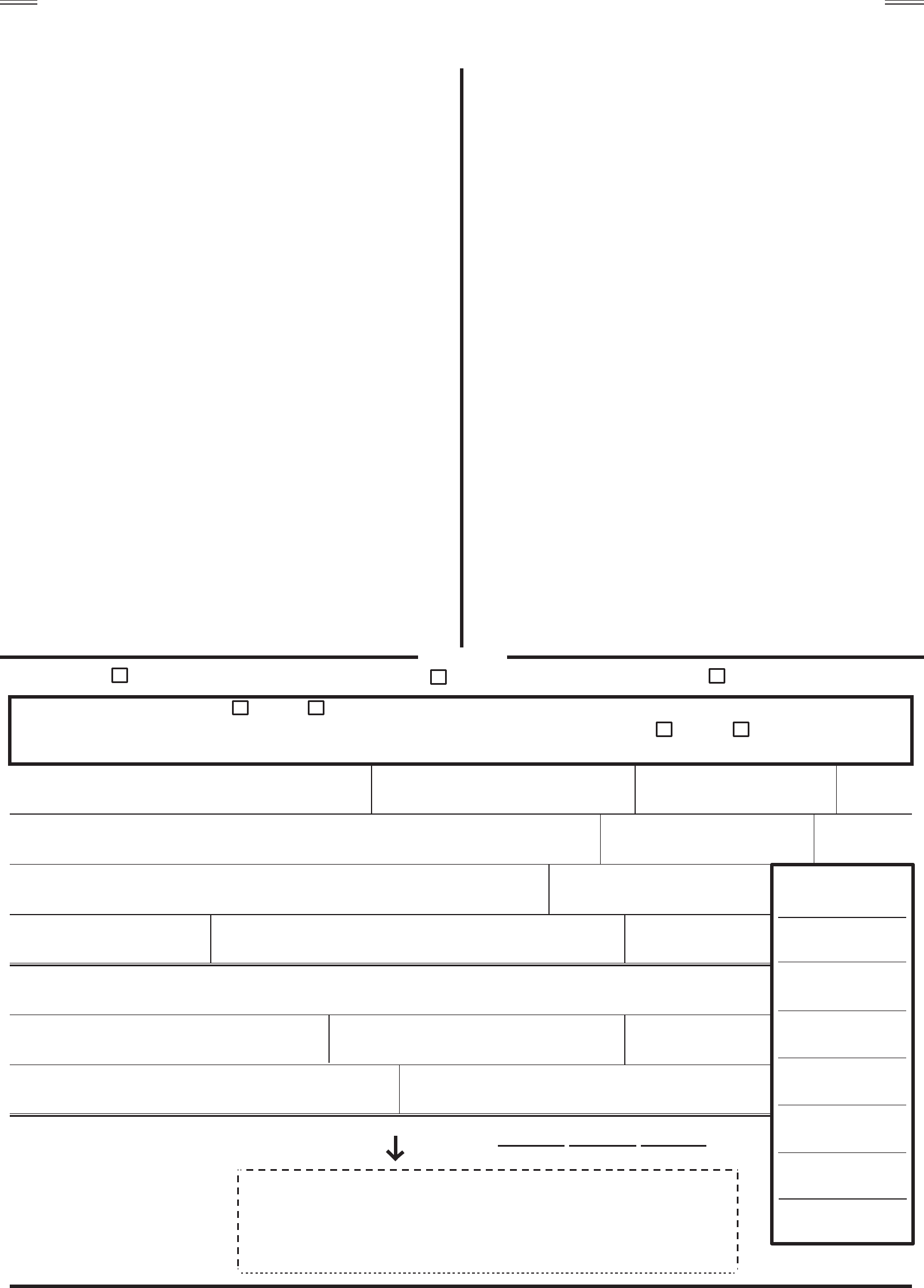

Ohio Voter Registration Information Update Form Edit, Fill, Sign

Web an official state of ohio site. Web new ohio pte registration process (pdf) 08/05/2019: Web as enacted, ohio’s pte tax rate is 5% for 2022 and 3% for those years after 2022. We last updated the pass through entity & fiduciary income tax registration in february 2023, so this is. Web july 22, 2022 article 6 min read authors:

Ohio LLC and Corporation Registration and Formation IncParadise

Web more about the ohio form pte reg corporate income tax ty 2022. Web july 22, 2022 article 6 min read authors: Ron cook julie corrigan stephen palmer adam garn significant tax changes are in store for ohio after its governor signed. This form is for income earned in tax year 2022, with tax returns due in april 2023. If.

Download Ohio Power of Attorney for Vehicle Registration Form for Free

Web an official state of ohio site. We last updated the pass through entity & fiduciary income tax registration in february 2023, so this is. If you are a new pte filer, but. More guidance will likely be forthcoming from the. Ron cook julie corrigan stephen palmer adam garn significant tax changes are in store for ohio after its governor.

ITI Registration Form 2 Free Templates in PDF, Word, Excel Download

Web ohio governor dewine on june 14 signed into law s.b. Web this form contains information necessary to create a pte account with the department. Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. Entities filing the pte tax in ohio for the first time in 2022 must send in a separate.

Free Ohio Voter Registration Form Register to Vote in OH PDF eForms

Web new pte filers should send in the registration form prior to or along with your first estimated payment and universal payment coupon (upc). Web ohio governor dewine on june 14 signed into law s.b. For taxable year 2022, the due. Here’s how you know the due date for filing the it 4738 is april 15th after the year in.

Free Ohio Voter Registration Form Register to Vote in OH PDF eForms

Web more about the ohio form pte reg corporate income tax ty 2022. Web this form contains information necessary to create a pte account with the department. Web an official state of ohio site. If you are a new pte filer, but. This form is for income earned in tax year 2022, with tax returns due in april 2023.

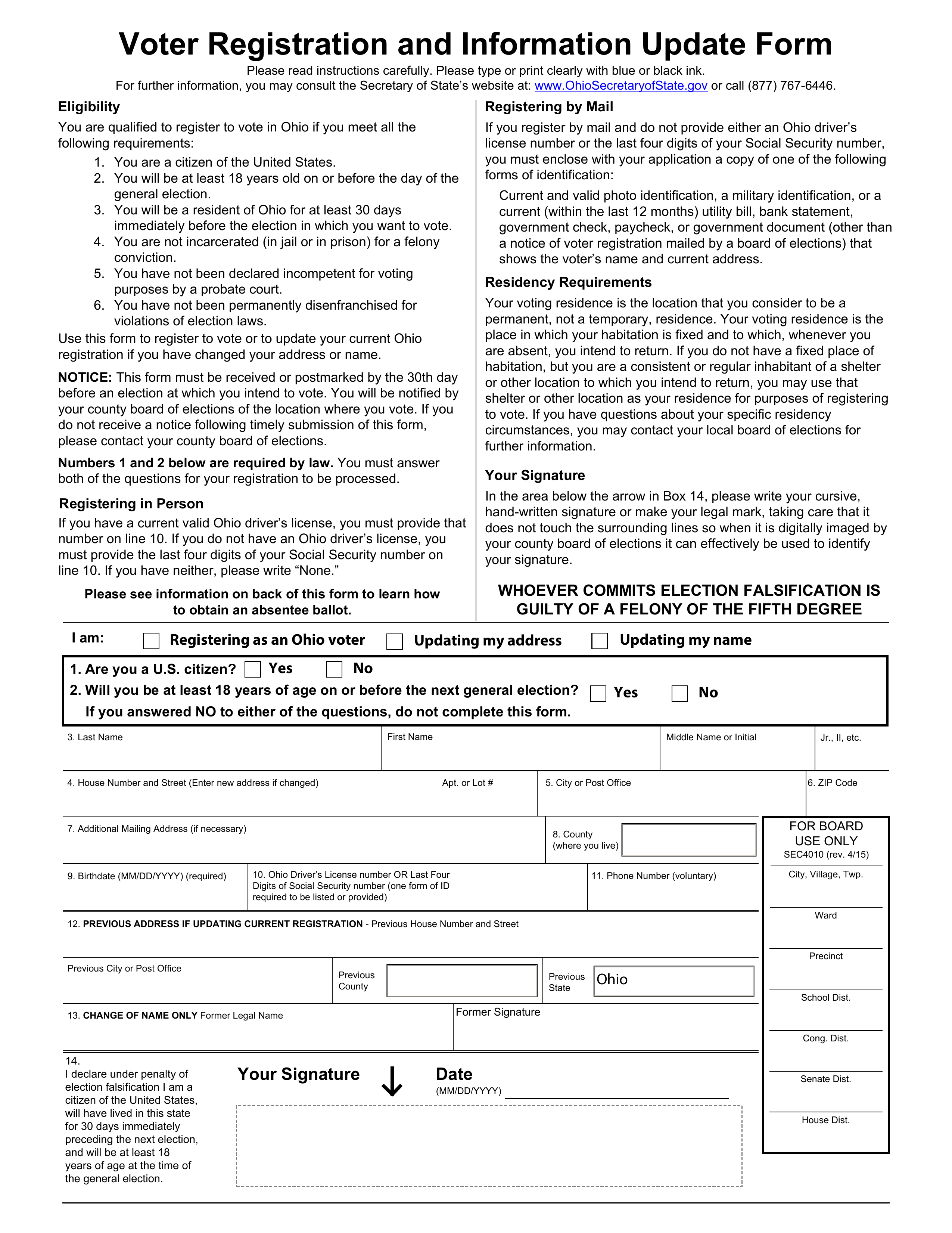

Form Pte Virginia PassThrough Credit Allocation printable pdf download

More guidance will likely be forthcoming from the. Web new pte filers should send in the registration form prior to or along with your first estimated payment and universal payment coupon (upc). Web more about the ohio form pte reg corporate income tax ty 2022. Web this form contains information necessary to create a pte account with the department. Ron.

PTE Registration 2021 Check Registration Process & Test Centers

Ron cook julie corrigan stephen palmer adam garn significant tax changes are in store for ohio after its governor signed. Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. We last updated the pass through entity & fiduciary income tax registration in february 2023, so this is. Web ohio becomes the latest.

Web New Ohio Pte Registration Process (Pdf) 08/05/2019:

Entities filing the pte tax in ohio for the first time in 2022 must send in a separate registration form with any payments being made.) simply filing the. Ron cook julie corrigan stephen palmer adam garn significant tax changes are in store for ohio after its governor signed. Web ohio becomes the latest state to adopt an elective pte tax as a workaround for individual pte owners to the federal salt cap. For taxable year 2022, the due.

Here’s How You Know The Due Date For Filing The It 4738 Is April 15Th After The Year In Which The Entity’s Fiscal Year Ends.

Web this form contains information necessary to create a pte account with the department. If you are a new pte filer, but. Web we last updated ohio form pte ref in may 2021 from the ohio department of taxation. You can send the form by:.

Web Ohio Governor Dewine On June 14 Signed Into Law S.b.

A fully refundable ohio pte tax credit is also permitted for pte owners for their. We last updated the pass through entity & fiduciary income tax registration in february 2023, so this is. Web new pte filers should send in the registration form prior to or along with your first estimated payment and universal payment coupon (upc). More guidance will likely be forthcoming from the.

Web An Official State Of Ohio Site.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web as enacted, ohio’s pte tax rate is 5% for 2022 and 3% for those years after 2022. Web more about the ohio form pte reg corporate income tax ty 2022. Web july 22, 2022 article 6 min read authors: