Ohio Withholding Form 2022

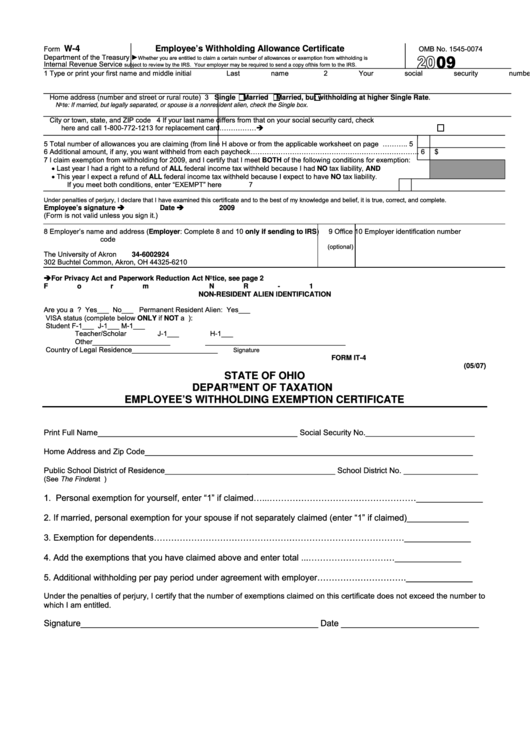

Ohio Withholding Form 2022 - School district of residence (see the finderat tax.ohio.gov): Web ohio income tax forms ohio printable income tax forms 83 pdfs ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio. Web 2022 annual withholding reconciliation form; Ohio employer and school district withholding tax filing guidelines (2021) school district tax rates (2021). 12/20 submit form it 4 to your employer on or before the start date of employment so your. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022. Web ohio online w4 form 2022: Web tax forms access the forms you need to file taxes or do business in ohio. Web department of taxation employee’s withholding exemption certificate it 4 rev.

Web filing due date for employee withholding. Ach remittance of employer withholding tax. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web 2022 annual withholding reconciliation form; Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. 12/20 submit form it 4 to your employer on or before the start date of employment so your. Web what are ohio’s municipal withholding rules for 2022? Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Web ohio online w4 form 2022:

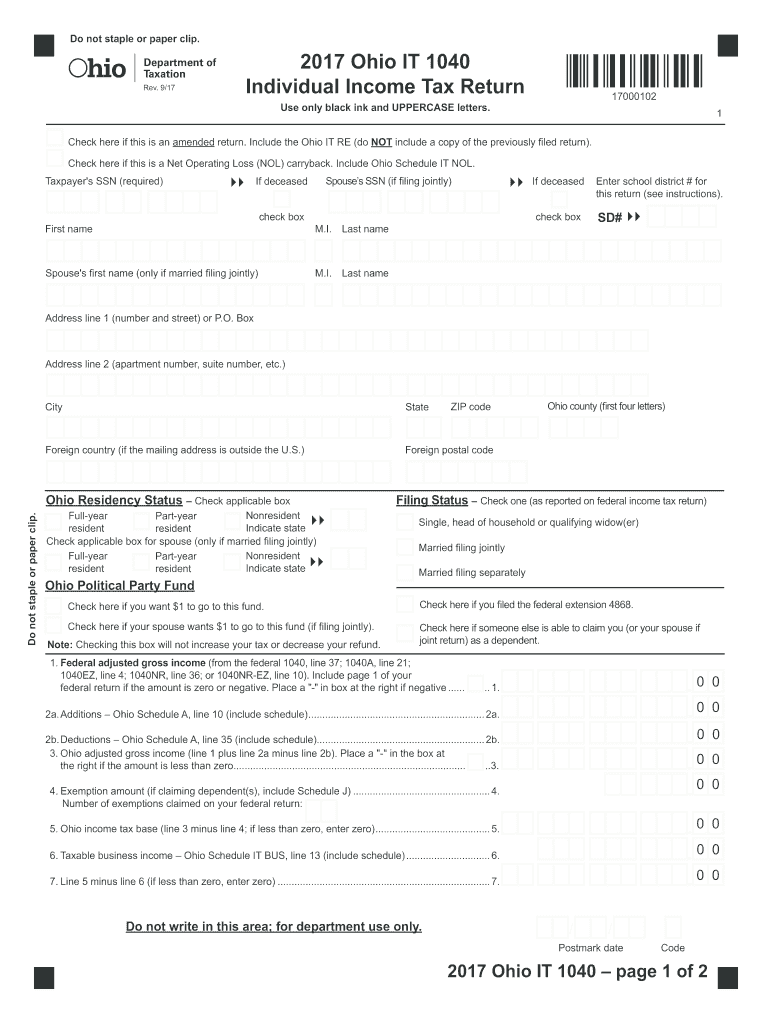

Web tax forms access the forms you need to file taxes or do business in ohio. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web ohio income tax forms ohio printable income tax forms 83 pdfs ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio. Enter “p” in the “p/s” box if the form is the primary taxpayer’s and. Web due dates and payment schedule (2022) 2021 withholding resources: Ach remittance of employer withholding tax. Ohio employer and school district withholding tax filing guidelines (2021) school district tax rates (2021). Web filing due date for employee withholding. The ohio department of taxation provides a searchable repository of individual tax.

Ohio State Tax Forms Printable Printable World Holiday

Previous years downloadable tax forms. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Address, city, state, zip code: 2022 1040 for 2022 directional guide 1040 for 2022 2022 reconciliation withheld. Web filing due date for employee withholding.

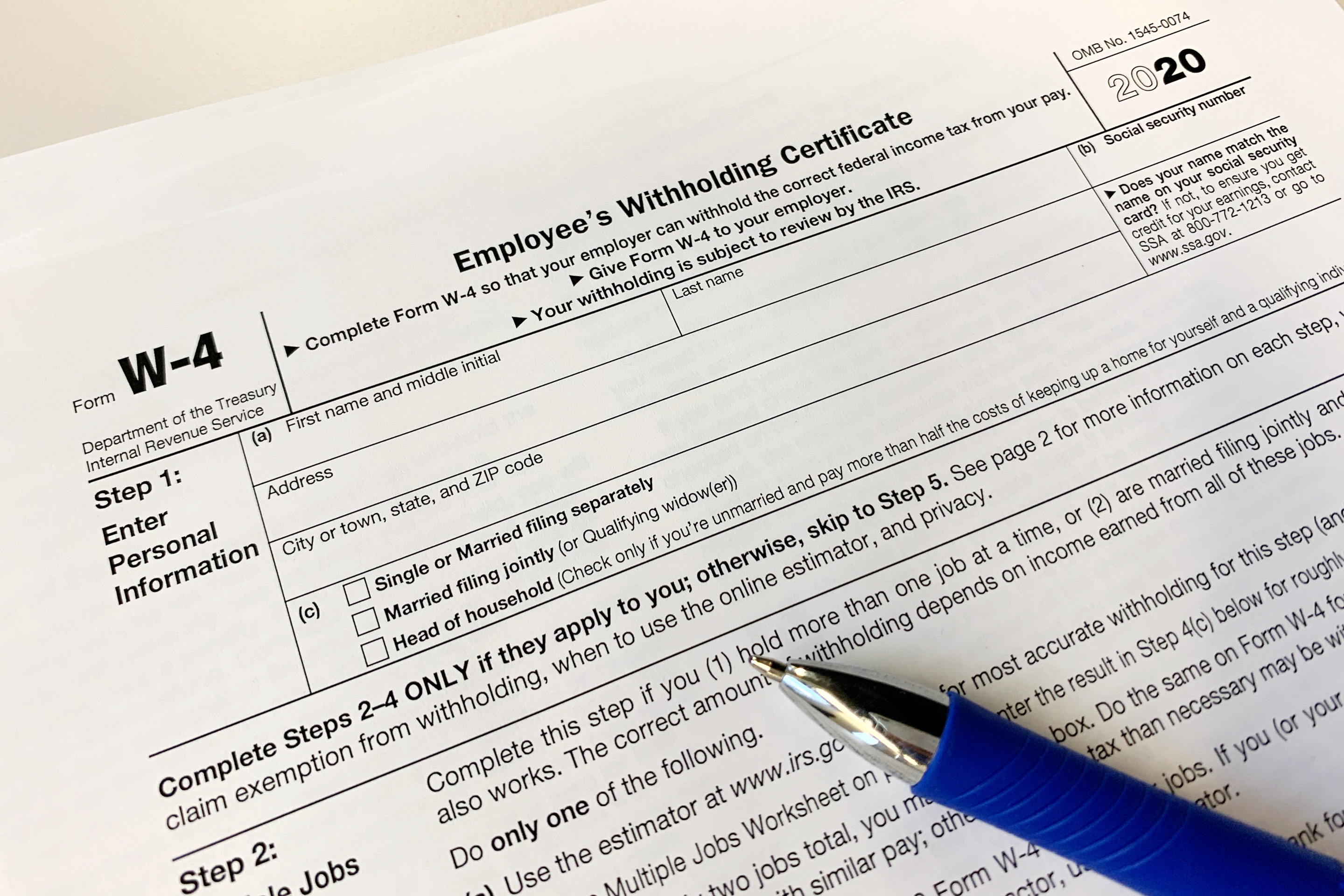

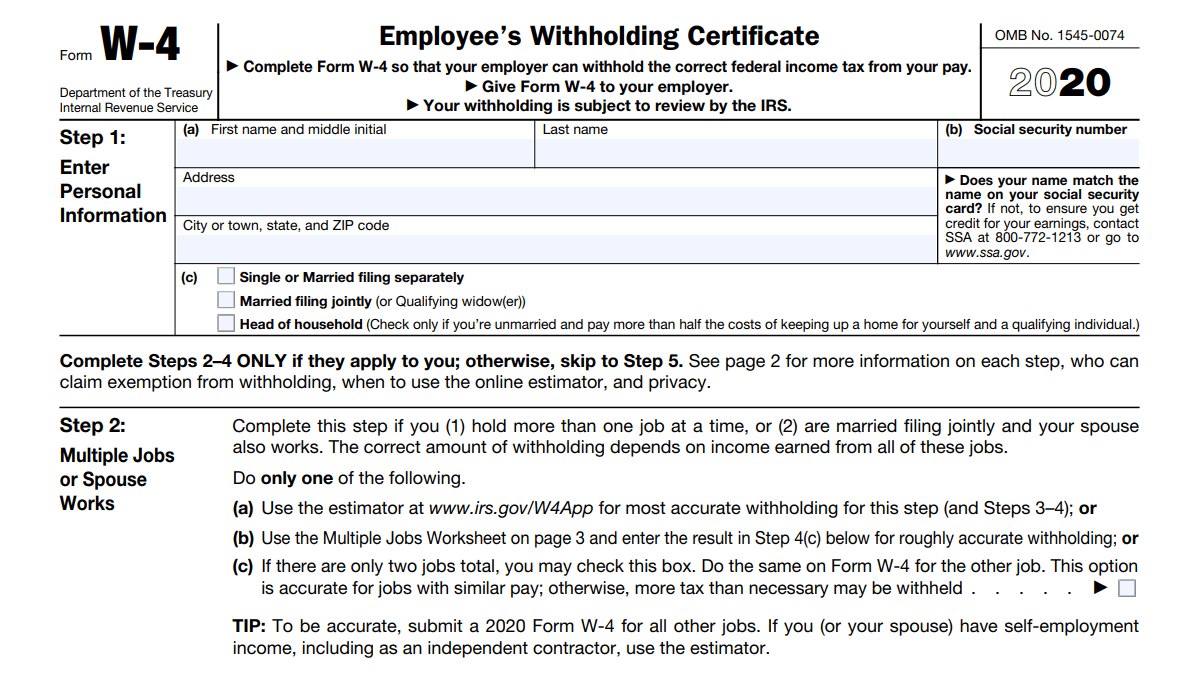

The IRS Has a New 'Easier' W4 for Withholding Taxes in 2020 Money

Web filing due date for employee withholding. 2022 1040 for 2022 directional guide 1040 for 2022 2022 reconciliation withheld. Ohio employer and school district withholding tax filing guidelines (2021) school district tax rates (2021). This form is for income earned in tax year 2022, with tax returns due in april 2023. Web this form is for income earned in tax.

Ohio State Withholding Form 2021 2022 W4 Form

Ohio withholding filing reminder (pdf) 02/25/2022. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Ohio employer and school district withholding tax filing guidelines (2021) school district tax rates (2021). Web we last updated the employee's withholding.

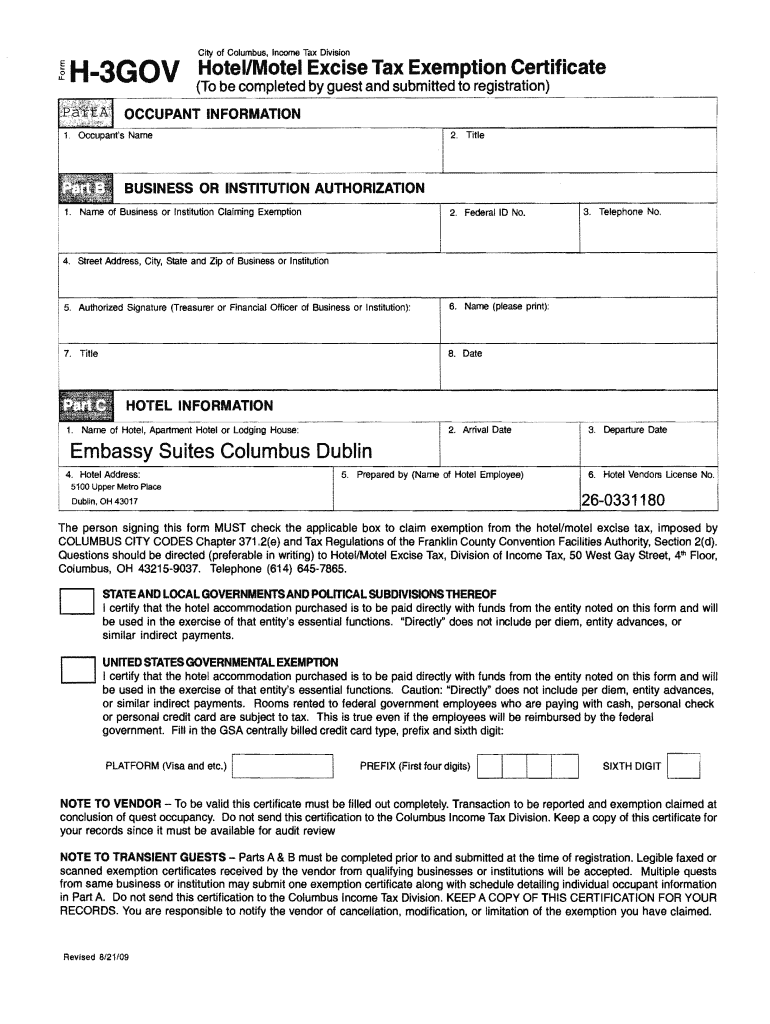

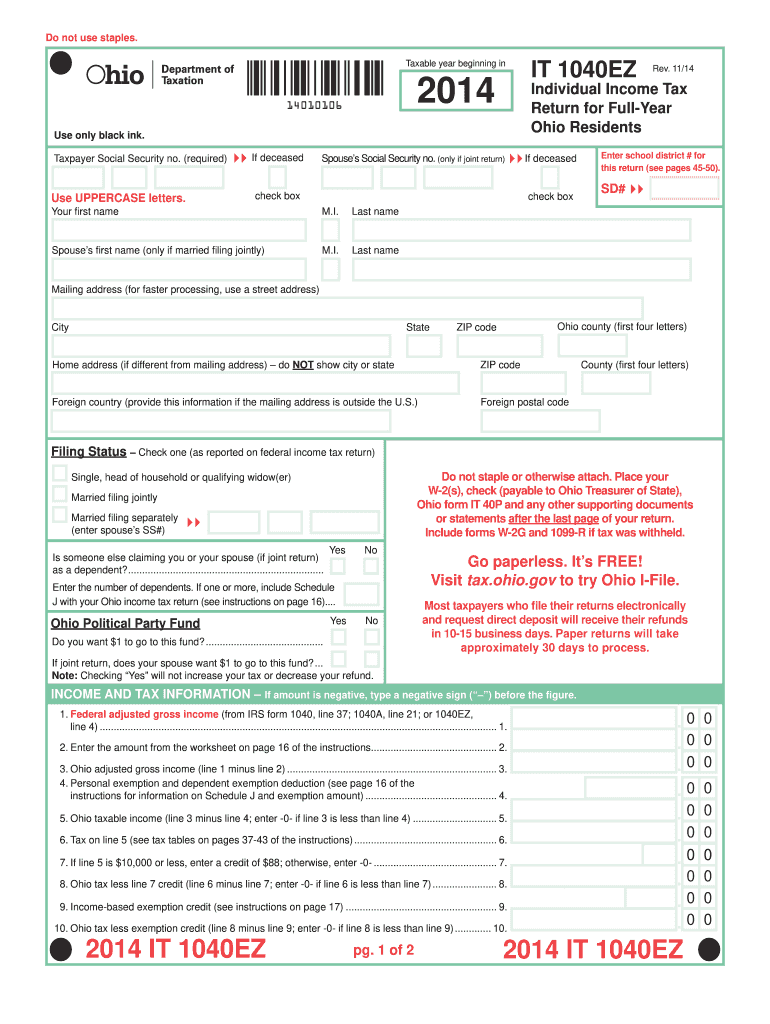

Ohio Tax Forms Fill Out and Sign Printable PDF Template signNow

Web we last updated the income tax estimated payment vouchers and instructions in february 2023, so this is the latest version of form it 1040es, fully updated for tax year 2022. Web tax forms access the forms you need to file taxes or do business in ohio. Web 2022 annual withholding reconciliation form; 2022 ohio w2 upload specifications for reporting.

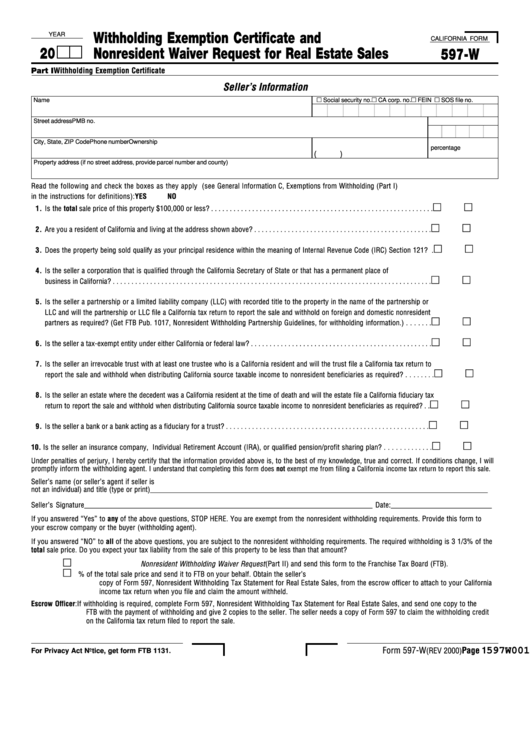

Top Ohio Withholding Form Templates Free To Download In PDF Format

12/20 submit form it 4 to your employer on or before the start date of employment so your. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. The ohio department of taxation provides a searchable repository of.

Tax Brackets 2020 North Carolina TAXP

Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022. Web tax forms access the forms you need to file taxes or do business in ohio. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Web we last updated the income.

Ohio Department Of Taxation Employee Withholding Form

Previous years downloadable tax forms. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web what are ohio’s municipal withholding rules for 2022? The ohio department of taxation provides a searchable repository of individual tax. Web department of taxation employee’s withholding exemption certificate it 4 rev.

Ms Printable W4 Forms 2021 2022 W4 Form

Ohio employer and school district withholding tax filing guidelines (2021) school district tax rates (2021). Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Ohio withholding filing reminder (pdf) 02/25/2022. Web we last updated ohio form it wh in february 2023.

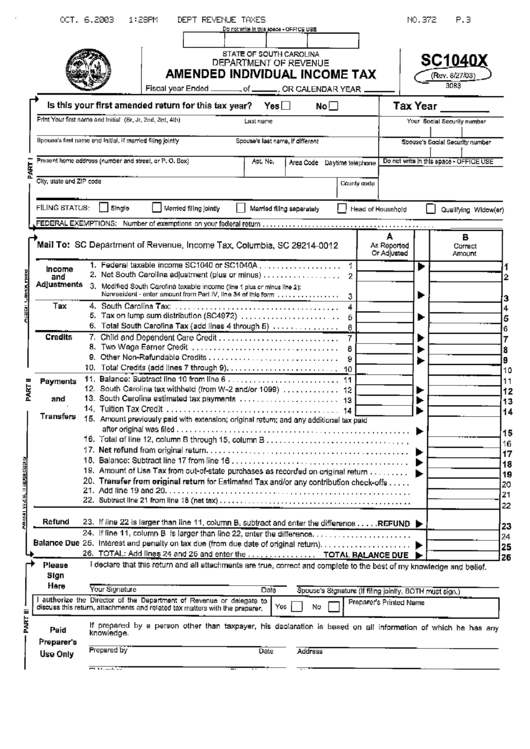

Ohio form 2012 it 1040ez Fill out & sign online DocHub

Ohio employer and school district withholding tax filing guidelines (2021) school district tax rates (2021). Web we last updated ohio form it wh in february 2023 from the ohio department of taxation. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your.

Fillable Heap Form Printable Forms Free Online

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the income tax estimated payment vouchers and instructions in february 2023, so this is the latest version of form it 1040es, fully updated for tax year 2022. Ohio withholding filing reminder (pdf) 02/25/2022. Web ohio income tax forms.

Web Filing Due Date For Employee Withholding.

Ohio withholding filing reminder (pdf) 02/25/2022. 2022 ohio w2 upload specifications for reporting efw2 files by cd, flash drive, or filing online; This form is for income earned in tax year 2022, with tax returns due in april 2023. Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022.

Web We Last Updated Ohio Form It Wh In February 2023 From The Ohio Department Of Taxation.

Web department of taxation employee’s withholding exemption certificate it 4 rev. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Web 2022 annual withholding reconciliation form; Ach remittance of employer withholding tax.

Web Due Dates And Payment Schedule (2022) 2021 Withholding Resources:

Address, city, state, zip code: Enter “p” in the “p/s” box if the form is the primary taxpayer’s and. Web ohio income tax forms ohio printable income tax forms 83 pdfs ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio. Web what are ohio’s municipal withholding rules for 2022?

Web We Last Updated The Employee's Withholding Exemption Certificate In February 2023, So This Is The Latest Version Of Form It 4, Fully Updated For Tax Year 2022.

Web ohio online w4 form 2022: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. We will update this page with a new version of the form for 2024 as soon as it is made available. 12/20 submit form it 4 to your employer on or before the start date of employment so your.