Oklahoma Firefighter Tax Credit Form

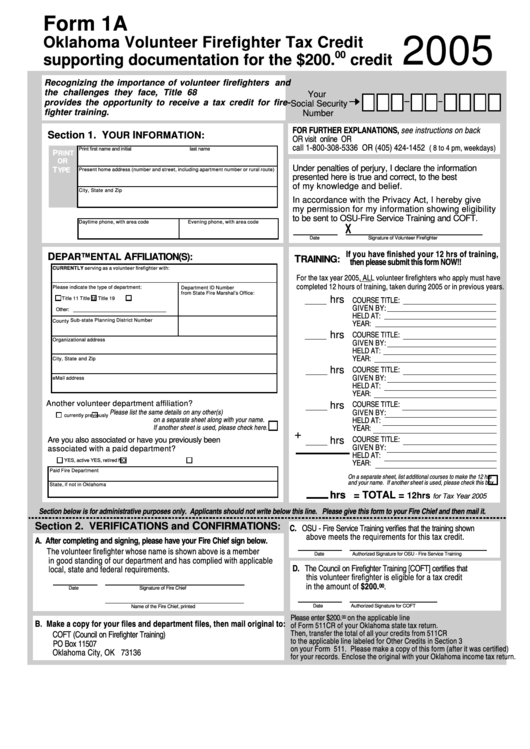

Oklahoma Firefighter Tax Credit Form - Web the council on firefighter training [coft] certifies that this volunteer firefighter is eligible for a tax incentive in the amount of $400. The credit has an overall cap. Application of firefighter for disability pension form 3: Web the council on firefighter training [coft] certifies that this volunteer firefighter is eligible for a tax credit in the amount of $200.00. Web in some cases, volunteer firefighters receive benefits in the form of state or local tax credits or rebates. This volunteer firefighter is eligible for a tax incentive. Application for surviving spouse for pension form 4: For taxpayers who qualify for the $200 or $400 oklahoma volunteer firefighter tax credit, the completed and signed council on. Through direct application to the ftac. Web in order to claim the tax credit authorized by paragraph 1 of subsection a of this section, a volunteer firefighter shall be required to provide adequate documentation to the.

Web the council on firefighter training [coft] certifies that. This volunteer firefighter is eligible for a tax incentive. Web (c) a fire department organized pursuant to section 592 of title 18 of the oklahoma statutes may obtain one card, the size and design of which shall be prescribed by the. For taxable years beginning after december 31, 2004, there shall be allowed as a credit. Through direct application to the ftac. An income tax credit of two hundred dollars ($200.00) is available for a volunteer firefighter who has completed at least twelve (12). Application for retirement pension form 2: Web the council on firefighter training [coft] certifies that this volunteer firefighter is eligible for a tax incentive in the amount of $400. ♦ prescribe a reporting form for the use by volunteer fire departments and by volunteer firefighters. No more than $20 million of credit may be allowed to offset tax in a taxable year.

An income tax credit of two hundred dollars ($200.00) is available for a volunteer firefighter who has completed at least twelve (12). Application for surviving spouse for pension form 4: Web the council on firefighter training [coft] certifies that. For the forms and filing information, follow this link: Web the council on firefighter training [coft] certifies that this volunteer firefighter is eligible for a tax incentive in the amount of $400. Through direct application to the ftac. 68 ok stat § 2358.7 (2022) a. 00 for tax year 2007. ♦ prescribe a reporting form for the use by volunteer fire departments and by volunteer firefighters. Application for retirement pension form 2:

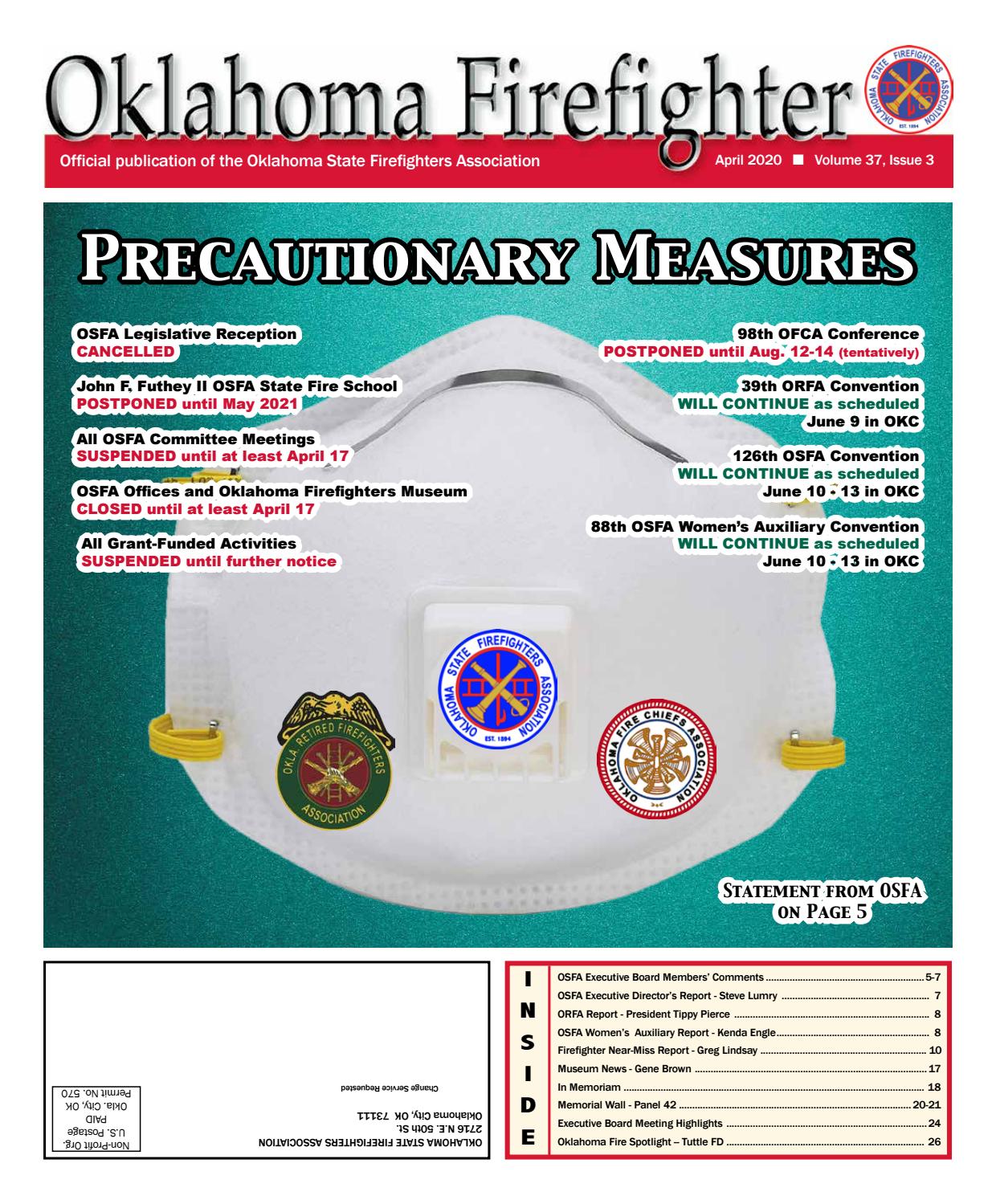

Oklahoma Firefighter newspaper February 2020 by Oklahoma State

Web the council on firefighter training [coft] certifies that this volunteer firefighter is eligible for a tax credit in the amount of $200.00. Application for surviving spouse for pension form 4: Web how do i file my oklahoma volunteer firefighter tax credit? Date authorized signature for coft please. Through direct application to the ftac.

OKC Fire Department Fire department, Ems unit, Firefighter

Through direct application to the ftac. This volunteer firefighter is eligible for a tax incentive. 00 for tax year 2007. For the forms and filing information, follow this link: An income tax credit of two hundred dollars ($200.00) is available for a volunteer firefighter who has completed at least twelve (12).

N.S. volunteer firefighter tax credit allows for 500 refundable tax

Through direct application to the ftac. Web the council on firefighter training [coft] certifies that. Web how do i file my oklahoma volunteer firefighter tax credit? Web the council on firefighter training [coft] certifies that this volunteer firefighter is eligible for a tax incentive in the amount of $400. Web (c) a fire department organized pursuant to section 592 of.

Oklahoma Firefighter August 2018 by Oklahoma State Firefighters Assoc

$400.00 for tax year 2008. Web statutory duties of the oklahoma state fire marshal commission are: Web (c) a fire department organized pursuant to section 592 of title 18 of the oklahoma statutes may obtain one card, the size and design of which shall be prescribed by the. If these benefits are offered in return for services performed, their value..

Oklahoma Firefighter April 2020 newspaper by Oklahoma State

Application for retirement pension form 2: 00 for tax year 2007. Web the council on firefighter training [coft] certifies that this volunteer firefighter is eligible for a tax incentive in the amount of $400. The credit has an overall cap. Web statutory duties of the oklahoma state fire marshal commission are:

The Volunteer Firefighter’s Tax Credit and Search and the Rescue

For taxable years beginning after december 31, 2004, there shall be allowed as a credit. Web oklahoma volunteer firefighter tax credit forms: If these benefits are offered in return for services performed, their value. Web the council on firefighter training [coft] certifies that this volunteer firefighter is eligible for a tax credit in the amount of $200.00. This volunteer firefighter.

Oklahoma Firefighter May 2020 by Oklahoma State Firefighters Assoc Issuu

There is hereby established the oklahoma council on firefighter training. Web in some cases, volunteer firefighters receive benefits in the form of state or local tax credits or rebates. Web statutory duties of the oklahoma state fire marshal commission are: 68 ok stat § 2358.7 (2022) a. Web the council on firefighter training [coft] certifies that.

New tax credit supports search and rescue and firefighter … Flickr

Web volunteer firefighter credit. 68 ok stat § 2358.7 (2022) a. Application for retirement pension form 2: This volunteer firefighter is eligible for a tax incentive. 00 for tax year 2007.

Form 1a Oklahoma Volunteer Firefighter Tax Credit 2005 printable

Web in order to claim the tax credit authorized by paragraph 1 of subsection a of this section, a volunteer firefighter shall be required to provide adequate documentation to the. Application for surviving spouse for pension form 4: $400.00 for tax year 2008. For taxable years beginning after december 31, 2004, there shall be allowed as a credit. No more.

Senate Bill 3224 Gives Volunteer Firefighters Tax Credit

This volunteer firefighter is eligible for a tax incentive. Application for surviving spouse for pension form 4: No more than $20 million of credit may be allowed to offset tax in a taxable year. Date authorized signature for coft please. For the forms and filing information, follow this link:

Web (C) A Fire Department Organized Pursuant To Section 592 Of Title 18 Of The Oklahoma Statutes May Obtain One Card, The Size And Design Of Which Shall Be Prescribed By The.

Application for retirement pension form 2: $400.00 for tax year 2008. Web oklahoma volunteer firefighter tax credit forms: An income tax credit of two hundred dollars ($200.00) is available for a volunteer firefighter who has completed at least twelve (12).

Web The Council On Firefighter Training [Coft] Certifies That This Volunteer Firefighter Is Eligible For A Tax Credit In The Amount Of $200.00.

Web in some cases, volunteer firefighters receive benefits in the form of state or local tax credits or rebates. Web statutory duties of the oklahoma state fire marshal commission are: 68 ok stat § 2358.7 (2022) a. If these benefits are offered in return for services performed, their value.

Through Direct Application To The Ftac.

Application for surviving spouse for pension form 4: Application of firefighter for disability pension form 3: 00 for tax year 2007. ♦ prescribe a reporting form for the use by volunteer fire departments and by volunteer firefighters.

Include Any Oklahoma Statements Containing.

No more than $20 million of credit may be allowed to offset tax in a taxable year. Web how do i file my oklahoma volunteer firefighter tax credit? Web the council on firefighter training [coft] certifies that. For taxable years beginning after december 31, 2004, there shall be allowed as a credit.