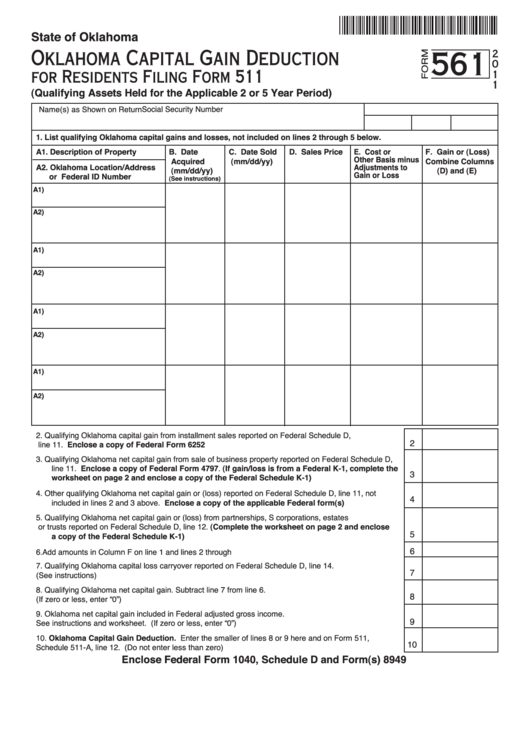

Oklahoma Form 561

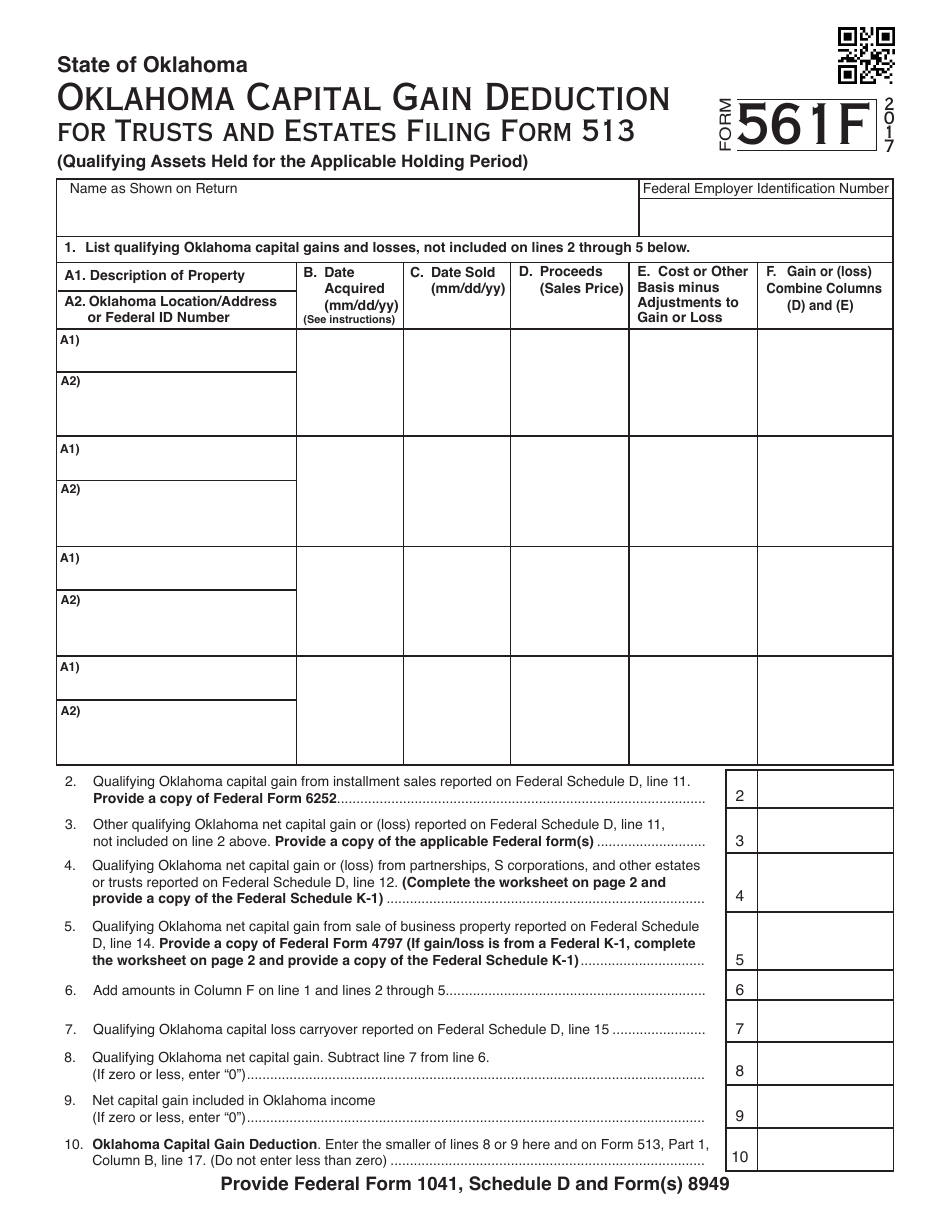

Oklahoma Form 561 - Individual resident income tax return tax return: Web we last updated the capital gain deduction in january 2023, so this is the latest version of form 561s, fully updated for tax year 2022. Web on this form to compute your oklahoma capital gain deduction. Oklahoma location/address or federal id number a1) a2) a1) a2) a1) a2) a1) a2) 1. You can download or print current or past. Web do not include gains and losses reported on form 561 lines 2 through 5. Web corporate taxpayers can deduct qualifying gains receiving capital gain treatment that are included in federal taxable income. Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Web form 561 worksheet for (check one): List qualifying oklahoma capital gains and losses, not.

Web form 561 worksheet for (check one): Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. All of your schedule d. Web 2022 form 561 oklahoma capital gain deduction for residents filing form 511. Web do not include gains and losses reported on form 561 lines 2 through 5. “qualifying gains receiving capital treatment”. Oklahoma location/address or federal id number a1) a2) a1) a2) a1) a2) a1) a2) 1. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain. Web we last updated the capital gain deduction in january 2023, so this is the latest version of form 561s, fully updated for tax year 2022. Do you have to pay taxes when you sell your house in oklahoma?

If you owned and lived in your. All of your schedule d. Web state of oklahoma form 561 a2. Web on this form to compute your oklahoma capital gain deduction. This form is for income earned in tax year 2022, with tax returns due in april 2023. List qualifying oklahoma capital gains and losses, not. Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Web 2022 form 561 oklahoma capital gain deduction for residents filing form 511. Amounts entered on federal screen. Web we last updated the capital gain deduction in january 2023, so this is the latest version of form 561s, fully updated for tax year 2022.

2015 Form SSA561U2 Fill Online, Printable, Fillable, Blank pdfFiller

If federal form 6252 was used to report the installment method for gain on the sale of eligible. Web 2022 form 561 oklahoma capital gain deduction for residents filing form 511. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain. Do you have to.

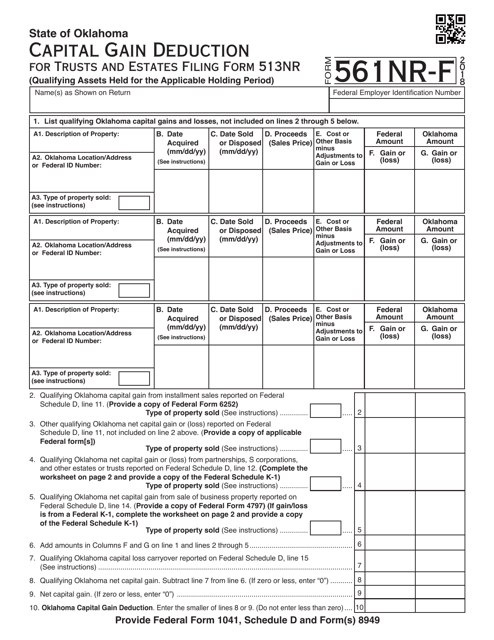

OTC Form 561F Download Fillable PDF or Fill Online Oklahoma Capital

1040 oklahoma frequently asked questions overview. If federal form 6252 was used to report the installment method for gain on the sale of eligible. Web here's a list of some of the most commonly used oklahoma tax forms: Web do not include gains and losses reported on form 561 lines 2 through 5. All of your schedule d.

Oklahoma Form 561 Fill Out and Sign Printable PDF Template signNow

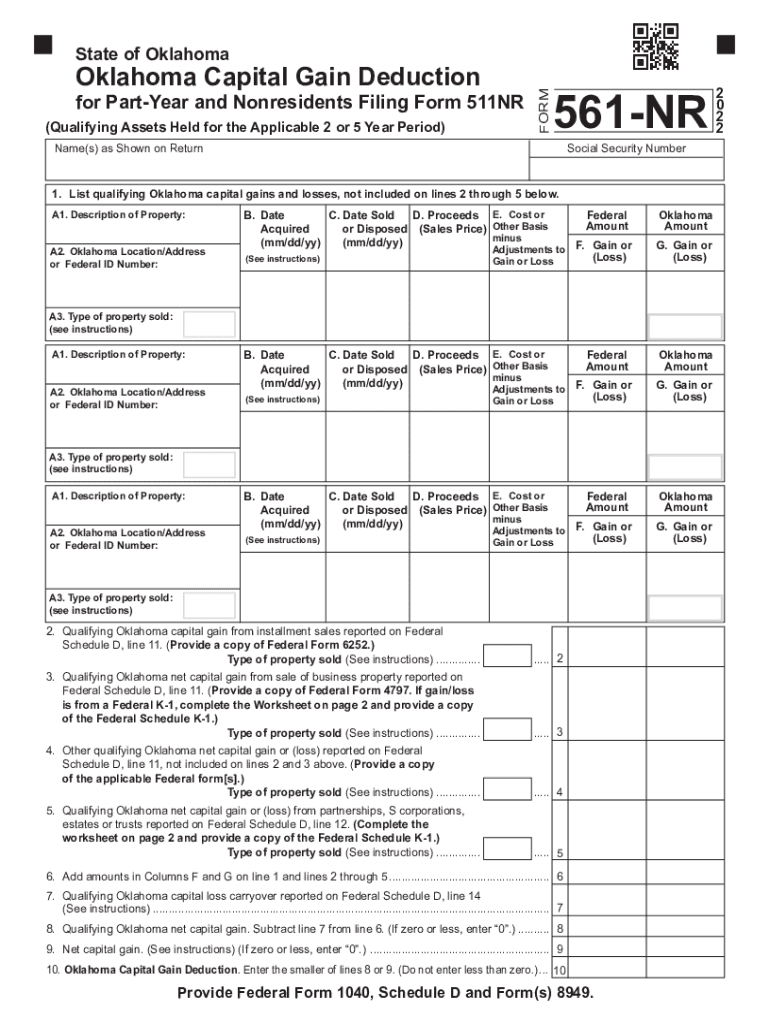

Web a 2021 report prepared for oklahoma’s incentive evaluation commission estimated that the capital gains tax deduction led to an estimated $716.3 million in. 1040 oklahoma frequently asked questions overview. Web here's a list of some of the most commonly used oklahoma tax forms: Web list the nonresident partner’s share of the qualifying oklahoma capital gains and losses from federal.

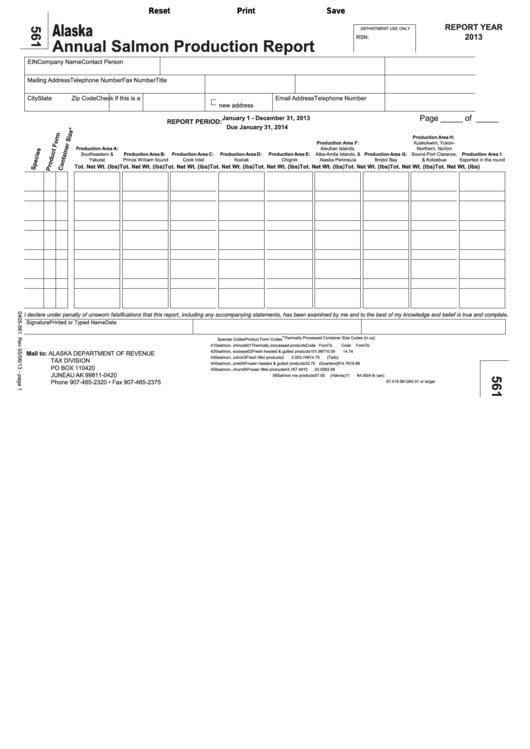

Fillable Form 561 Annual Salmon Production Report 2013 printable

Do you have to pay taxes when you sell your house in oklahoma? Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain. Web on this form to compute your oklahoma capital gain deduction. Web form 561 worksheet for (check one): Web state of oklahoma.

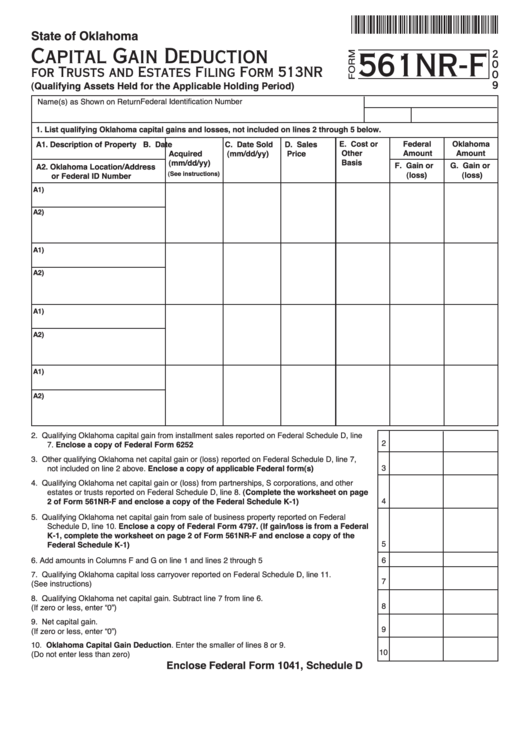

Form 561 NrF Capital Gain Deduction For Trusts And Estates 2009

Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web 2022 form 561 oklahoma capital gain deduction for residents filing form 511. Oklahoma location/address or federal id number a1) a2) a1) a2) a1) a2) a1) a2) 1. Web do not include gains and losses reported on form 561 lines 2.

Fillable Form 561 Oklahoma Capital Gain Deduction For Residents

Web on this form to compute your oklahoma capital gain deduction. List qualifying oklahoma capital gains and losses, not. Web list the nonresident partner’s share of the qualifying oklahoma capital gains and losses from federal form 8949, part ii or from federal schedule d, line 8a. Individual resident income tax return tax return: Amounts entered on federal screen.

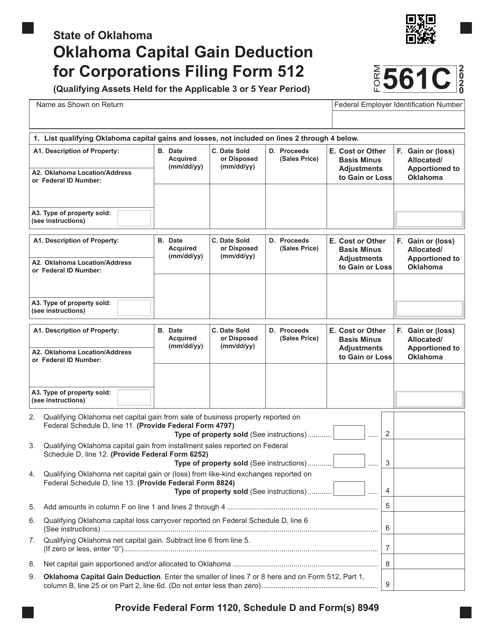

Form 561C Download Fillable PDF or Fill Online Oklahoma Capital Gain

1040 oklahoma frequently asked questions overview. This form is for income earned in tax year 2022, with tax returns due in april 2023. You can download or print current or past. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain. “qualifying gains receiving capital.

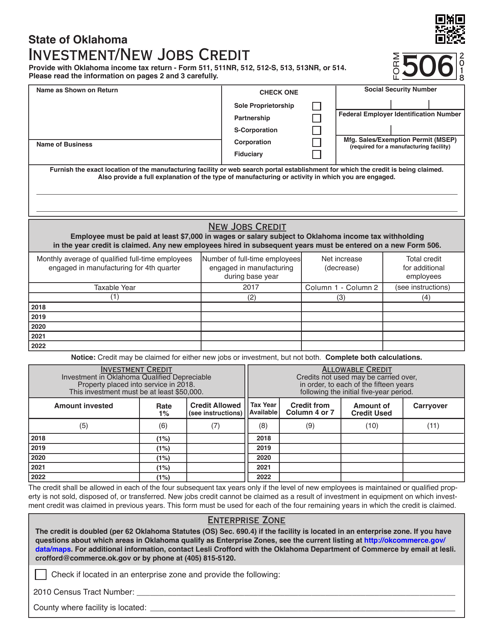

OTC Form 506 Download Fillable PDF 2018, Investment/New Jobs Credit

Qualifying gains included in federal distributable income. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain. Web a 2021 report prepared for oklahoma’s incentive evaluation commission estimated that the capital gains tax deduction led to an estimated $716.3 million in. Web do not include.

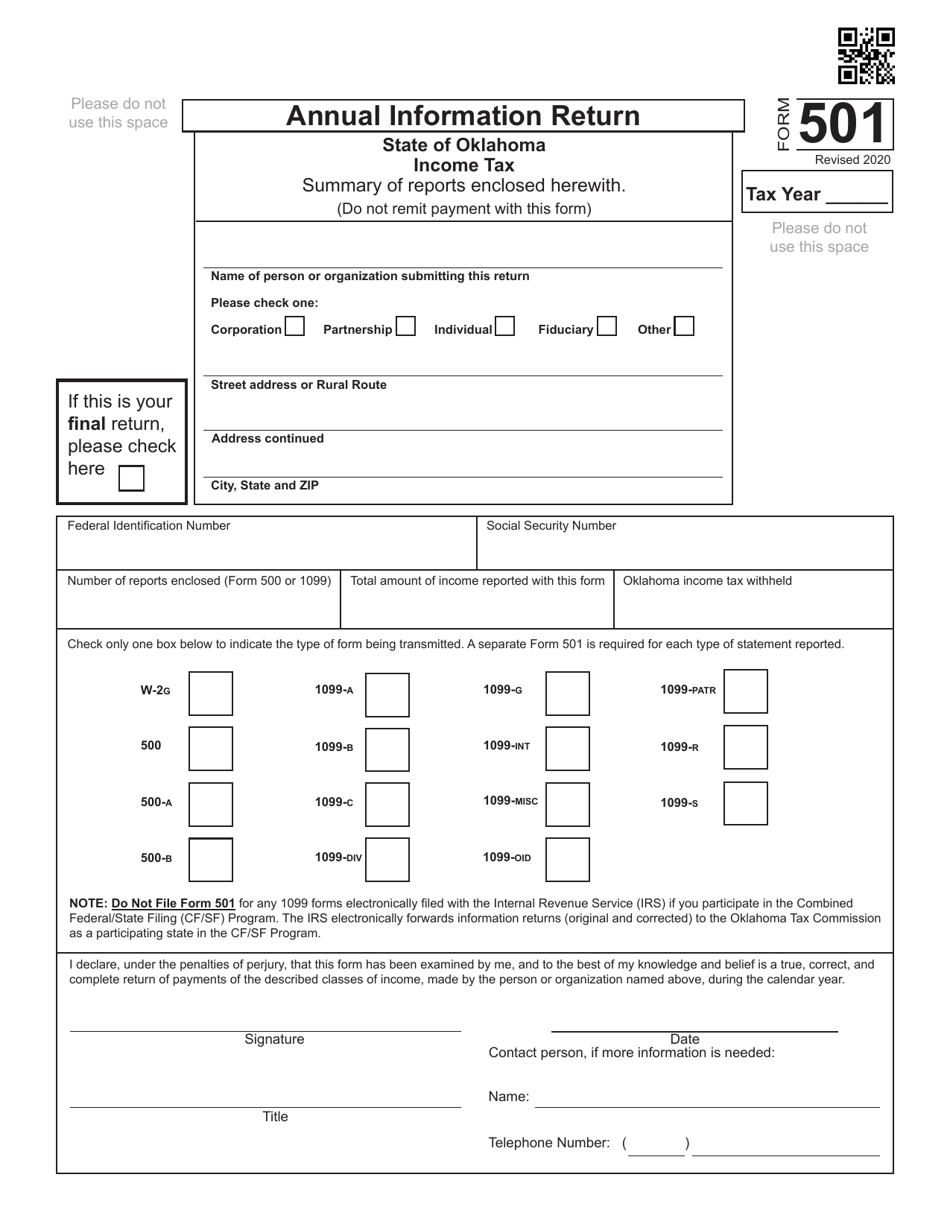

Form 501 Download Fillable PDF or Fill Online Annual Information Return

This form is for income earned in tax year 2022, with tax returns due in april 2023. List qualifying oklahoma capital gains and losses, not. Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax.

OTC Form 561NRF Download Fillable PDF or Fill Online Capital Gain

Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain. Oklahoma location/address or federal id number a1) a2) a1) a2) a1) a2) a1) a2) 1. Web state of oklahoma form 561 a2. Web list the nonresident partner’s share of the qualifying oklahoma capital gains and.

“Qualifying Gains Receiving Capital Treatment”.

If federal form 6252 was used to report the installment method for gain on the sale of eligible. Web do not include gains and losses reported on form 561 lines 2 through 5. Web form 561 worksheet for (check one): Web a 2021 report prepared for oklahoma’s incentive evaluation commission estimated that the capital gains tax deduction led to an estimated $716.3 million in.

Qualifying Gains Included In Federal Distributable Income.

Do you have to pay taxes when you sell your house in oklahoma? Individual resident income tax return tax return: Web we last updated oklahoma form 561 in january 2023 from the oklahoma tax commission. Web state of oklahoma form 561 a2.

1040 Oklahoma Frequently Asked Questions Overview.

List qualifying oklahoma capital gains and losses, not. Web here's a list of some of the most commonly used oklahoma tax forms: Web corporate taxpayers can deduct qualifying gains receiving capital gain treatment that are included in federal taxable income. Amounts entered on federal screen.

Web List The Nonresident Partner’s Share Of The Qualifying Oklahoma Capital Gains And Losses From Federal Form 8949, Part Ii Or From Federal Schedule D, Line 8A.

Oklahoma location/address or federal id number a1) a2) a1) a2) a1) a2) a1) a2) 1. Web on this form to compute your oklahoma capital gain deduction. Line 3 or line 5 oklahoma capital gain deduction for residents filing form 511 68 oklahoma statutes (os) sec. Web form 561 allows you to report qualifying sales of oklahoma assets to get a break on oklahoma state tax on a resulting capital gain.