Oklahoma State Tax Form 2020

Oklahoma State Tax Form 2020 - Web 1 next printed all of your oklahoma income tax forms? Use this table if your taxable income is less than $100,000. Oklahoma tax commission oklahoma city, ok 73194 a new check will be issued. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Does oklahoma require a 1099 form? Be sure to verify that the form. Web oklahoma has a state income tax that ranges between 0.5% and 5%. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Web popular forms & instructions; Web we would like to show you a description here but the site won’t allow us.

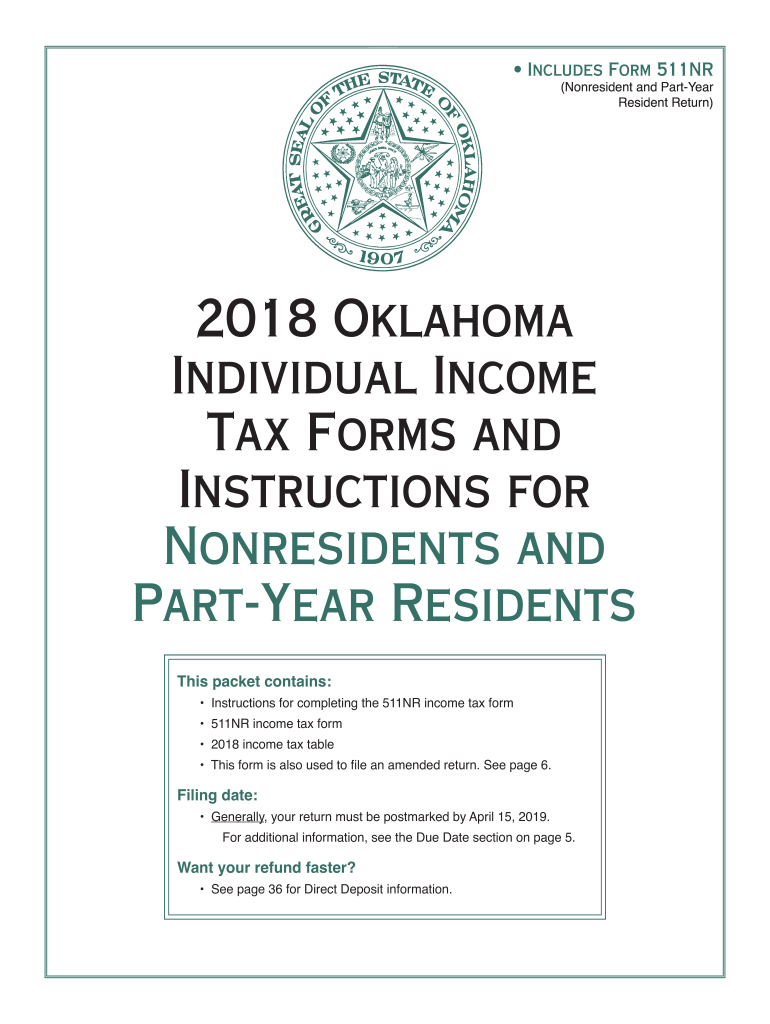

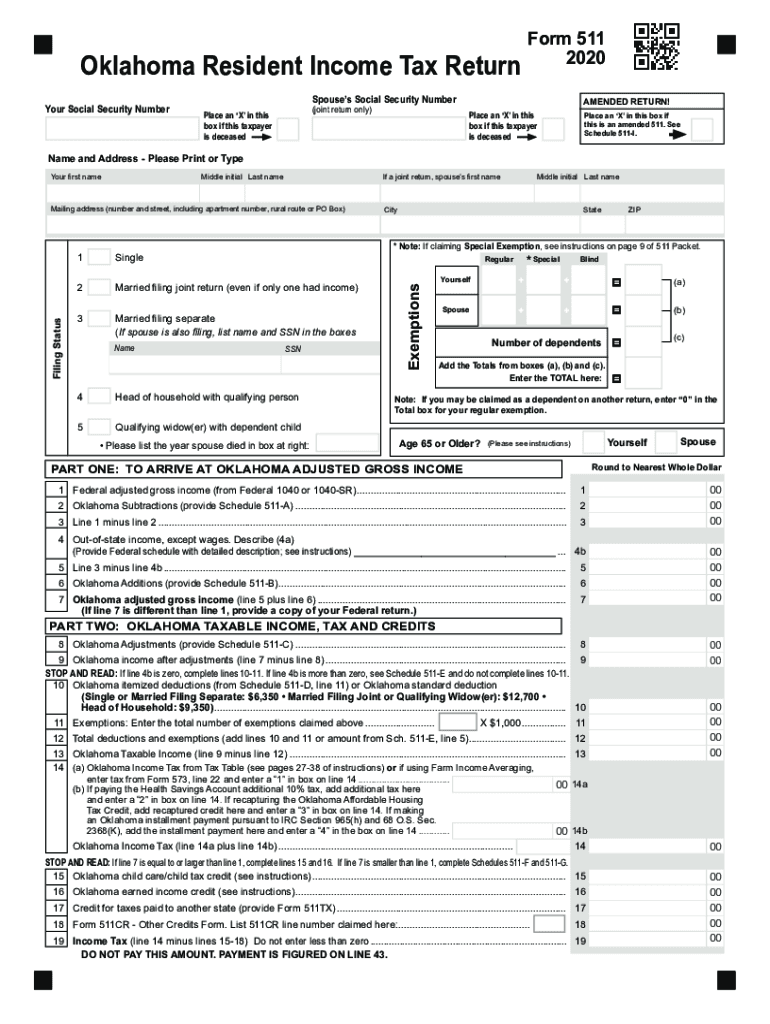

Web form 511nr 2020 your social security number spouse’s social security number (joint return only) name and address please print or typemailing address (number and street,. Web oklahoma has a state income tax that ranges between 0.5% and 5%. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Oklahoma resident income tax return • form 511: Use this table if your taxable income is less than $100,000. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Web oklahoma tax forms for 2022 and 2023. Does oklahoma require a 1099 form? Individual tax return form 1040 instructions; Ad register and subscribe now to work on ok resident individual income tax forms and instr.

Web popular forms & instructions; Oklahoma resident income tax return form • form. Find forms for your industry in minutes. Oklahoma doesn’t require you to attach 1099 forms to fill out. Head over to the federal income tax forms page to get any forms you need for completing your federal income tax. Streamlined document workflows for any industry. Individual tax return form 1040 instructions; Web 2020 oklahoma resident individual income tax forms and instructions. Web where’s your ok tax refund? You can complete the forms with the help of.

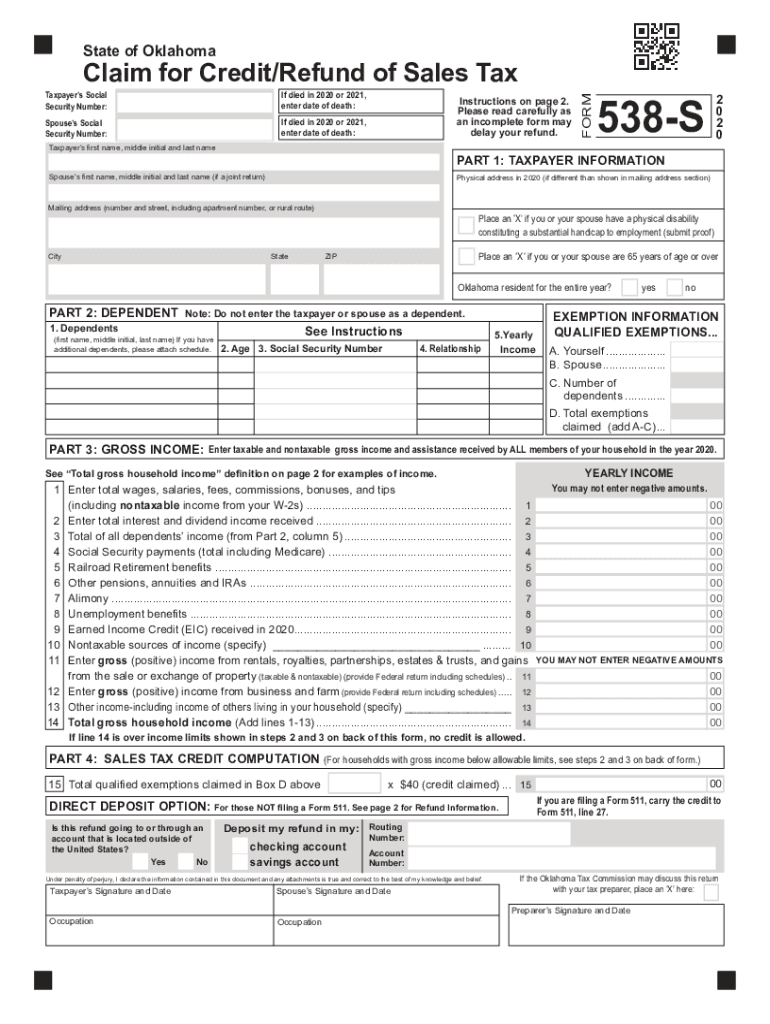

OK 538S 20202022 Fill out Tax Template Online US Legal Forms

Individual tax return form 1040 instructions; Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Name(s) shown on form 511: Web we would like to show you a description here but the site won’t allow us. Oklahoma doesn’t require you to attach 1099 forms.

IRS 1040X 2020 Fill and Sign Printable Template Online US Legal Forms

Web popular forms & instructions; Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Web oklahoma has a state income tax that ranges between 0.5% and 5%. Oklahoma resident income tax return • form 511: Find forms for your industry in minutes.

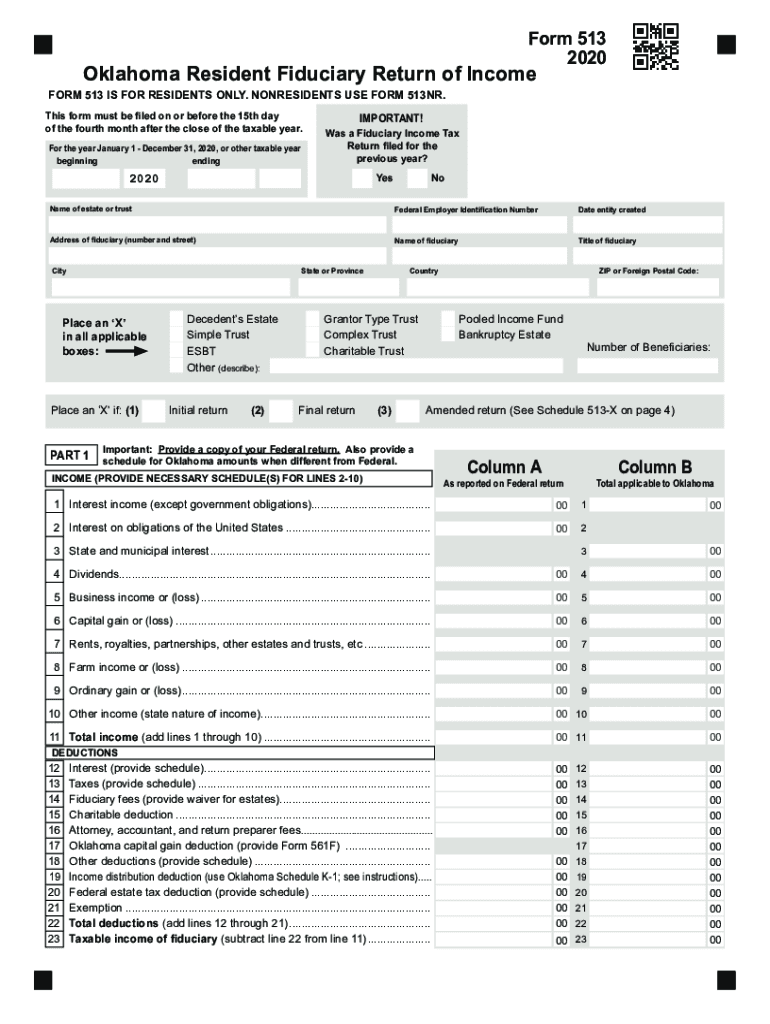

2020 OK Resident Fiduciary Tax Forms and Instructions Fill

Learn more about ok tax refunds here. Web oklahoma has a state income tax that ranges between 0.5% and 5%. Find forms for your industry in minutes. Head over to the federal income tax forms page to get any forms you need for completing your federal income tax. Web 1 next printed all of your oklahoma income tax forms?

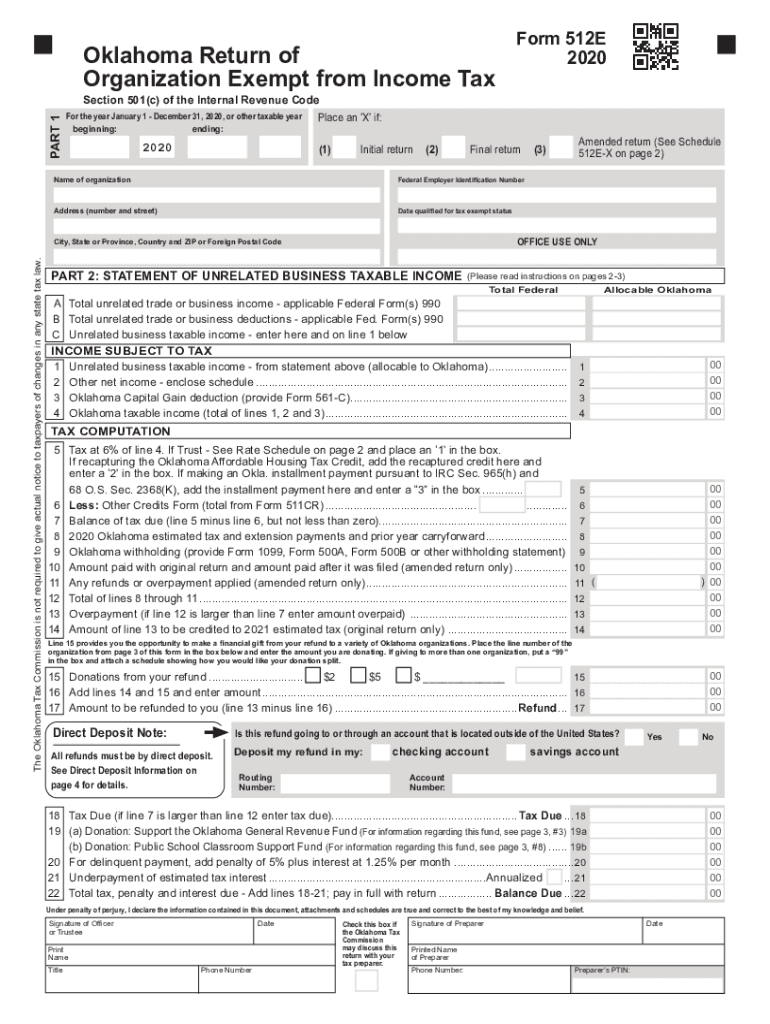

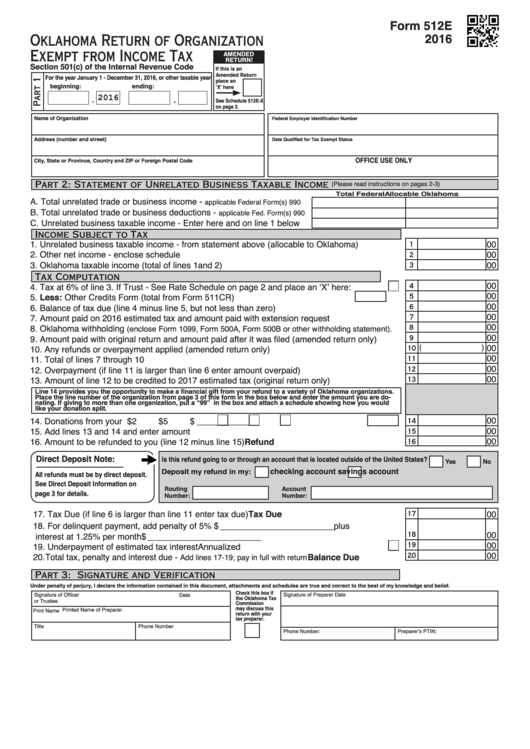

Oklahoma Form 512 Instructions 2020 Fill Out and Sign Printable PDF

Web 1 next printed all of your oklahoma income tax forms? Head over to the federal income tax forms page to get any forms you need for completing your federal income tax. You can complete the forms with the help of. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state.

2020 Form OK OTC 994 Fill Online, Printable, Fillable, Blank pdfFiller

• instructions for completing the form 511: Streamlined document workflows for any industry. Oklahoma doesn’t require you to attach 1099 forms to fill out. Ad register and subscribe now to work on ok resident individual income tax forms and instr. Does oklahoma require a 1099 form?

2018 Form OK 511NR Packet Fill Online, Printable, Fillable, Blank

Find forms for your industry in minutes. Oklahoma doesn’t require you to attach 1099 forms to fill out. • instructions for completing the form 511: Streamlined document workflows for any industry. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law.

2019 Form OK 511NR Packet Fill Online, Printable, Fillable, Blank

Ad register and subscribe now to work on ok resident individual income tax forms and instr. Web popular forms & instructions; Individual tax return form 1040 instructions; Web form 511nr 2020 your social security number spouse’s social security number (joint return only) name and address please print or typemailing address (number and street,. Web oklahoma tax forms for 2022 and.

Fillable Form 512e Oklahoma Return Of Organization Exempt From

Streamlined document workflows for any industry. Find forms for your industry in minutes. Web popular forms & instructions; You can complete the forms with the help of. • instructions for completing the form 511:

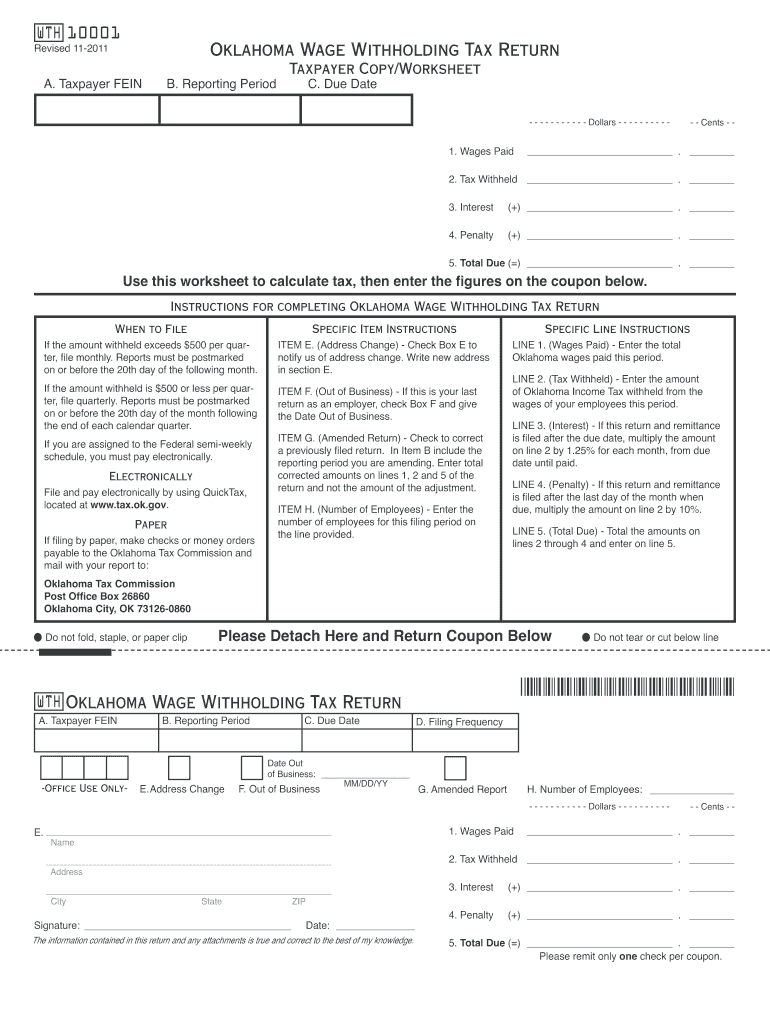

Oklahoma Withholding Tax Fill Out and Sign Printable PDF Template

Web mail form 507, the original refund check and any required documentation to: You can complete the forms with the help of. Web 2020 oklahoma resident individual income tax forms and instructions. Web where’s your ok tax refund? Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law.

Oklahoma State Tax Form Fill Out and Sign Printable PDF Template

Web mail form 507, the original refund check and any required documentation to: Web popular forms & instructions; Streamlined document workflows for any industry. Web 2020 oklahoma resident individual income tax forms and instructions. Web oklahoma tax forms for 2022 and 2023.

Streamlined Document Workflows For Any Industry.

Web if you are required to file an oklahoma income tax return, claim the sales tax refund as a credit on your tax return, form 511, and provide this signed form. Web oklahoma tax forms for 2022 and 2023. Oklahoma doesn’t require you to attach 1099 forms to fill out. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law.

Web Popular Forms & Instructions;

Oklahoma resident income tax return form • form. Learn more about ok tax refunds here. Web where’s your ok tax refund? • instructions for completing the form 511:

Head Over To The Federal Income Tax Forms Page To Get Any Forms You Need For Completing Your Federal Income Tax.

Web 2020 511 packet instructions. Use this table if your taxable income is less than $100,000. Oklahoma resident income tax return • form 511: Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in.

Find Forms For Your Industry In Minutes.

Individual tax return form 1040 instructions; Web 1 next printed all of your oklahoma income tax forms? Oklahoma tax commission oklahoma city, ok 73194 a new check will be issued. Name(s) shown on form 511: