Oklahoma Withholding Tax Form

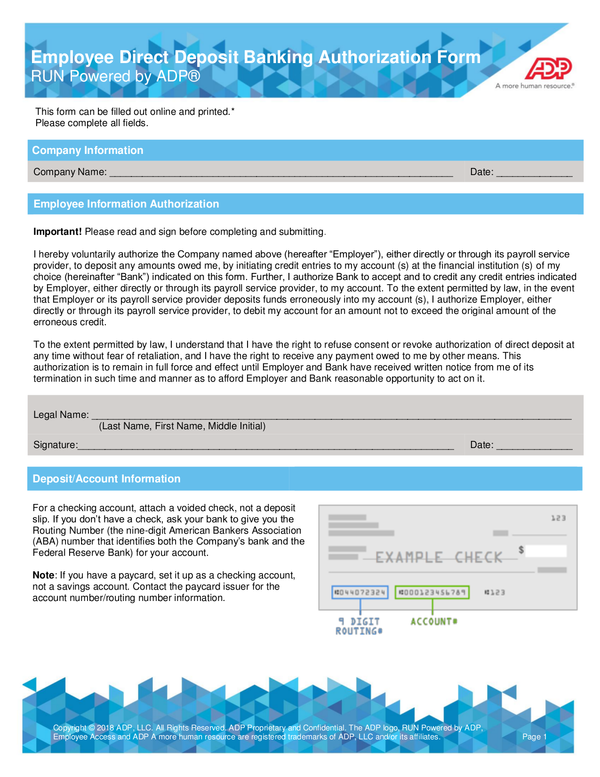

Oklahoma Withholding Tax Form - Web oklahoma taxable income and tax withheld. Your first name and middle initial. After registration with the oklahoma tax commission (otc) employers will be assigned. Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov. Web this form is to change oklahoma withholding allowances. Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. Employee's withholding certificate form 941; You can download blank forms from the business forms. Oklahoma nonresident distributed income withholding tax annual return: Web oklahoma taxpayer access point complete a withholding application request 4 2.

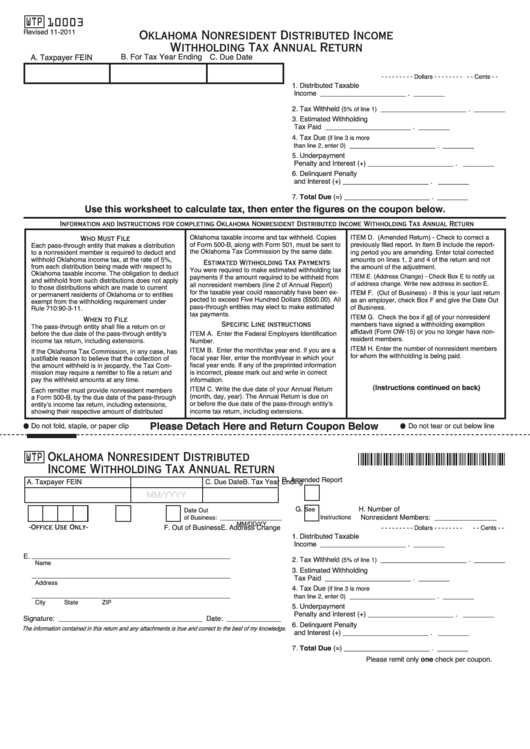

Oklahoma nonresident distributed income withholding tax annual return: Web opers has two forms to provide tax withholding preferences for federal and state taxes. Employee's withholding certificate form 941; Web oklahoma taxpayer access point complete a withholding application request 4 2. Employee’s signature (form is not valid unless you sign it)date. Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. Non resident royalty withholding tax : Complete the required fields and click the ok button to save the information. Web any oklahoma income tax withheld from your pension. Pass through withholding tax :

Employee's withholding certificate form 941; Pass through withholding tax : Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. No action on the part of the. You can download blank forms from the business forms. Complete the required fields and click the ok button to save the information. The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Web this form is to change oklahoma withholding allowances. Web oklahoma taxable income and tax withheld. Oklahoma nonresident distributed income withholding tax annual return:

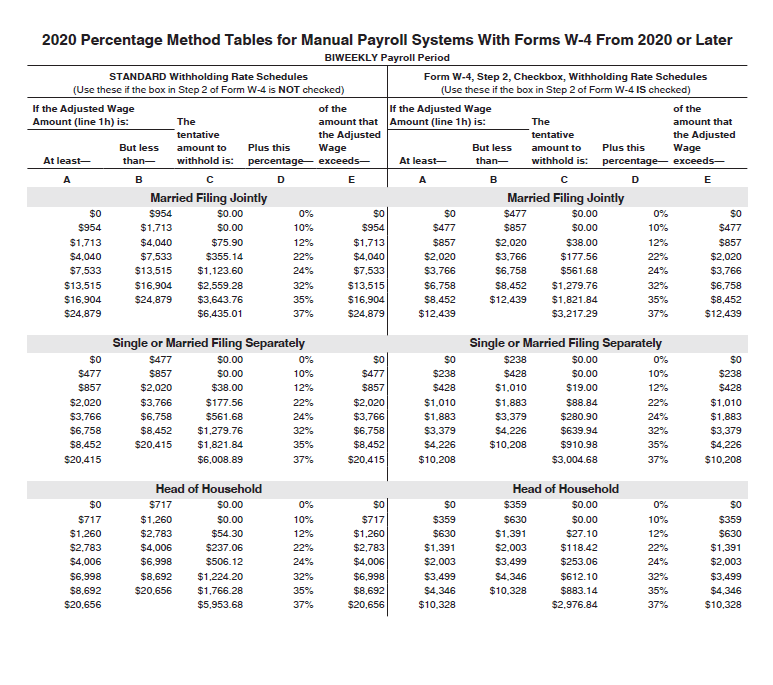

Oklahoma Withholding Tables 2021 Federal Withholding Tables 2021

No action on the part of the. Web oklahoma taxable income and tax withheld. The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. You can download blank forms from the business forms. Pass through withholding tax :

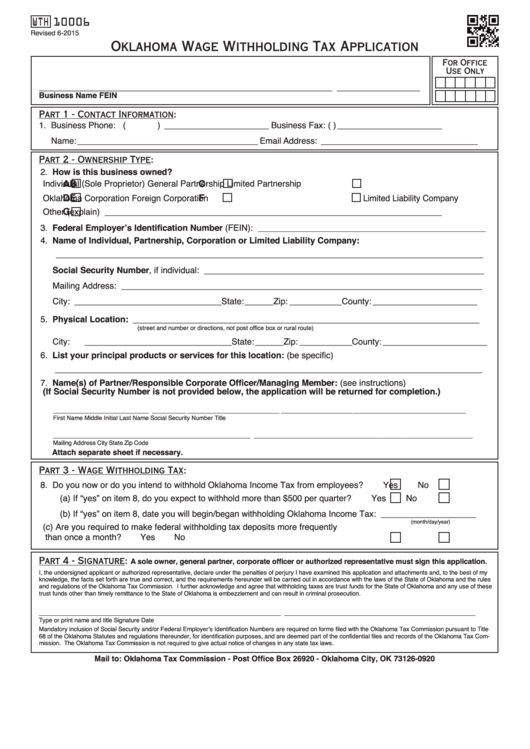

Fillable Form Wth 10006 Oklahoma Wage Withholding Tax Application

The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Pass through withholding tax : Web any oklahoma income tax withheld from your pension. Instructions for completing the withholding. Web opers has two forms to provide tax withholding preferences for federal and state taxes.

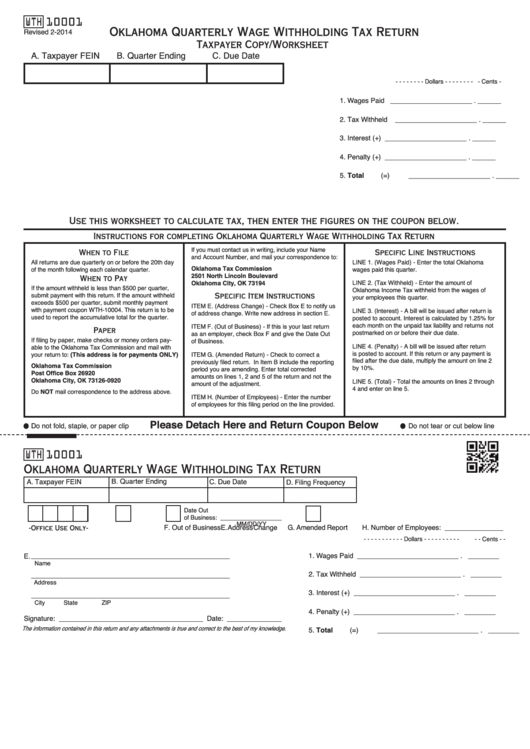

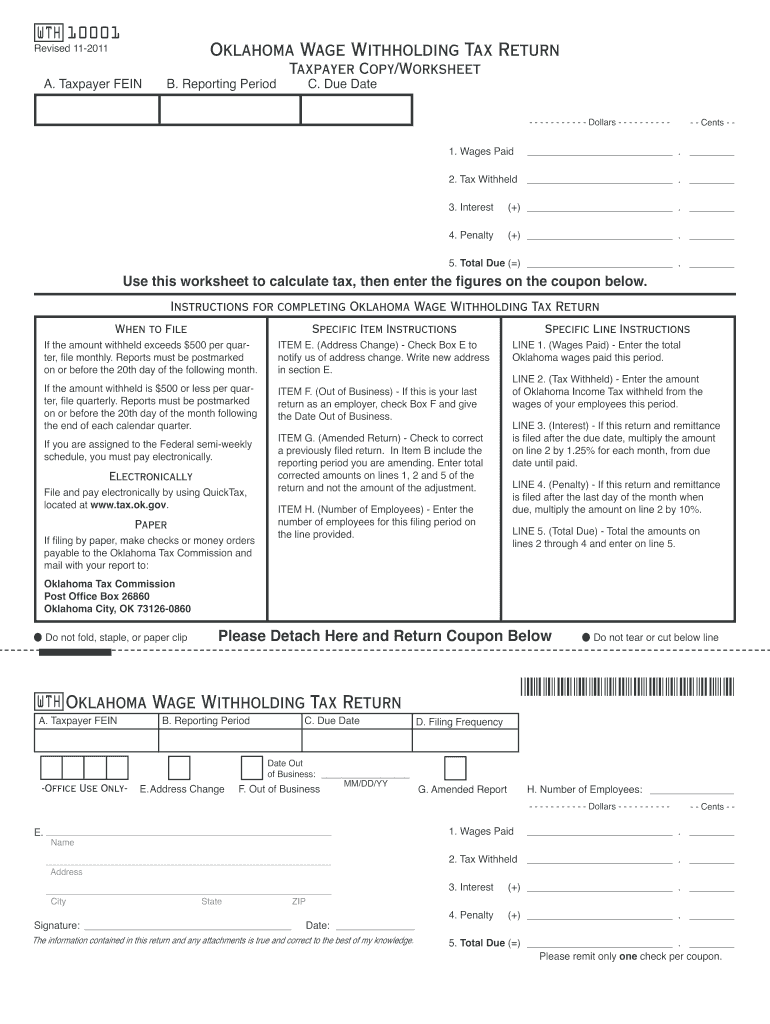

Fillable Form Wth 10001 Oklahoma Quarterly Wage Withholding Tax

The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Employee’s signature (form is not valid unless you sign it)date. Web any oklahoma income tax withheld from your pension. Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov. Web oklahoma taxable income and tax withheld.

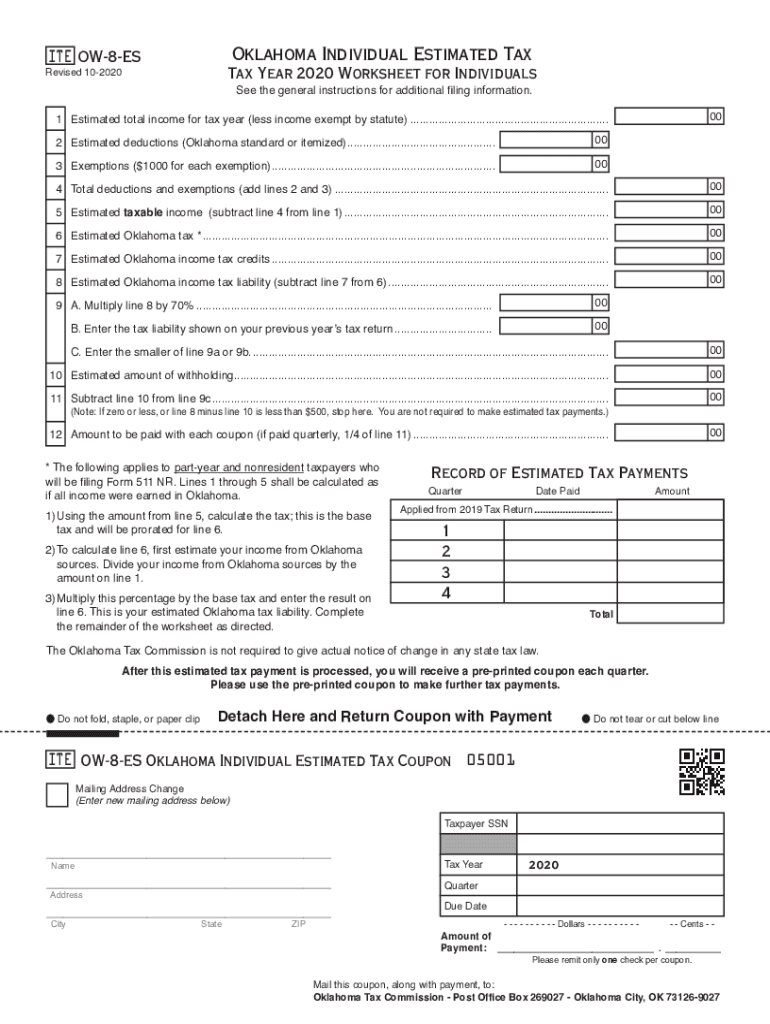

Form Ow 8 Es Tax Fill Out and Sign Printable PDF Template signNow

Agency code '695' form title: Pass through withholding tax : Non resident royalty withholding tax : The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. What are the requirements for oklahoma payroll tax withholding?.

2011 Form OK OTC WTH 10001 Fill Online, Printable, Fillable, Blank

Pass through withholding tax : Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov. Instructions for completing the withholding. Oklahoma nonresident distributed income withholding tax annual return: What are the requirements for oklahoma payroll tax withholding?.

How To Fill Out Oklahoma Employers Withholding Tax Return Form

Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. After registration with the oklahoma tax commission (otc) employers will be assigned. Your first name and middle initial. Employee's withholding certificate form 941; You can download blank forms from the business forms.

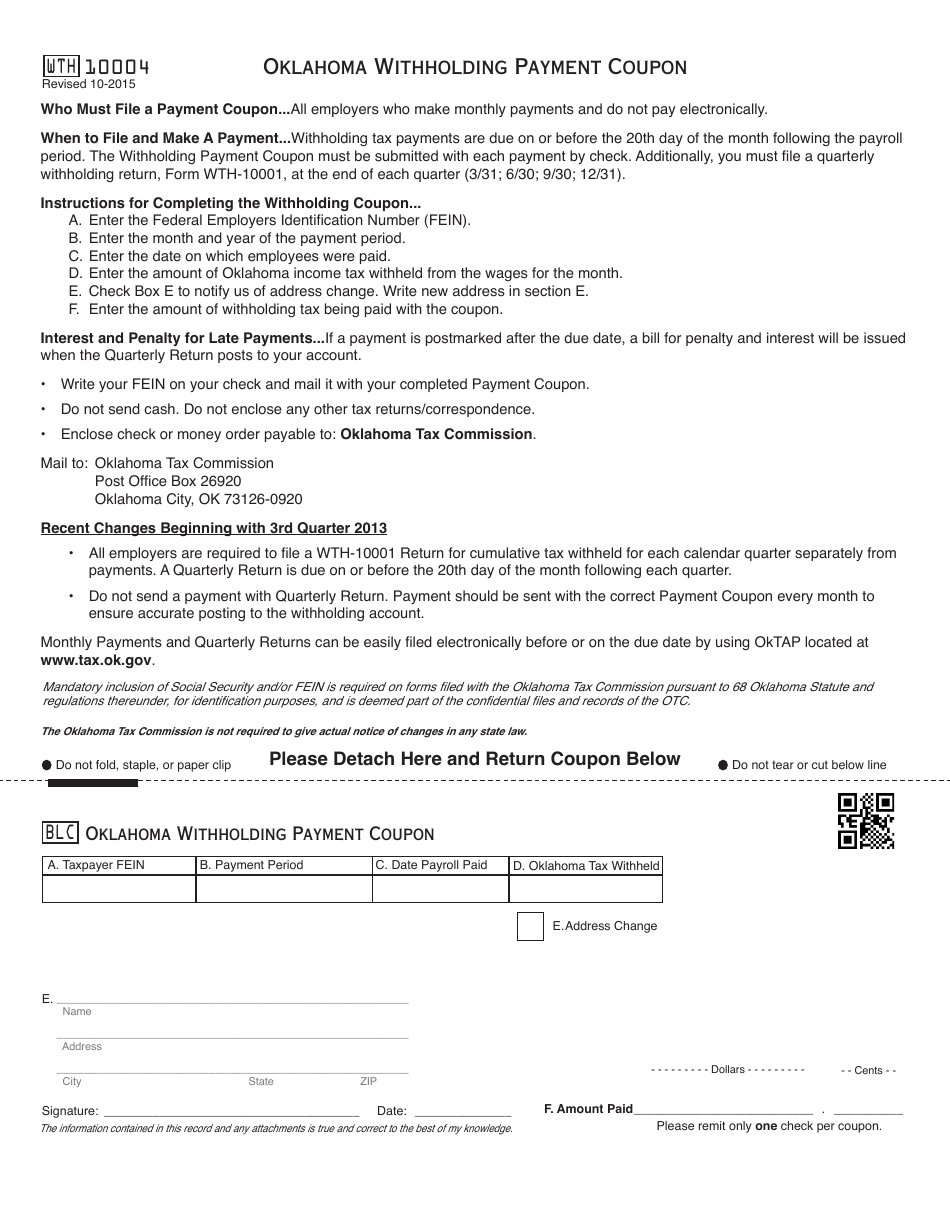

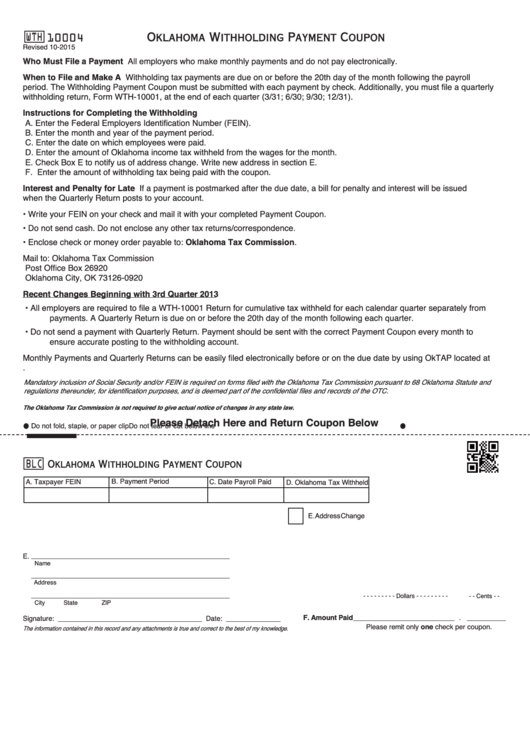

OTC Form WTH10004 Download Fillable PDF or Fill Online Oklahoma

Employee’s signature (form is not valid unless you sign it)date. Web withholding tax : Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. Employee's withholding certificate form 941; Web any oklahoma income tax withheld from your pension.

2014 Form OK OTC STS20002 Fill Online, Printable, Fillable, Blank

Pass through withholding tax : Web oklahoma taxable income and tax withheld. Complete the required fields and click the ok button to save the information. Web up to 25% cash back to apply on paper, use form wth10006, oklahoma wage withholding tax application. After registration with the oklahoma tax commission (otc) employers will be assigned.

Fillable Oklahoma Nonresident Distributed Withholding Tax Annual

Oklahoma city — lizbeth saenz longoria of guymon, oklahoma, was sentenced to serve 15 months in. The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Instructions for completing the withholding. Oklahoma nonresident distributed income withholding tax annual return: Complete the required fields and click the ok button to.

Web Withholding Tax :

After registration with the oklahoma tax commission (otc) employers will be assigned. No action on the part of the. Instructions for completing the withholding. Oklahoma nonresident distributed income withholding tax annual return:

Web Up To 25% Cash Back To Apply On Paper, Use Form Wth10006, Oklahoma Wage Withholding Tax Application.

Web oklahoma taxpayer access point complete a withholding application request 4 2. Pass through withholding tax : Web oklahoma employer’s withholding tax accounts can be established online at tax.ok.gov. Complete the required fields and click the ok button to save the information.

Employee’s Signature (Form Is Not Valid Unless You Sign It)Date.

The single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Non resident royalty withholding tax : Web opers has two forms to provide tax withholding preferences for federal and state taxes. Agency code '695' form title:

Oklahoma City — Lizbeth Saenz Longoria Of Guymon, Oklahoma, Was Sentenced To Serve 15 Months In.

Web this form is to change oklahoma withholding allowances. You can download blank forms from the business forms. Employers engaged in a trade or business who. What are the requirements for oklahoma payroll tax withholding?.