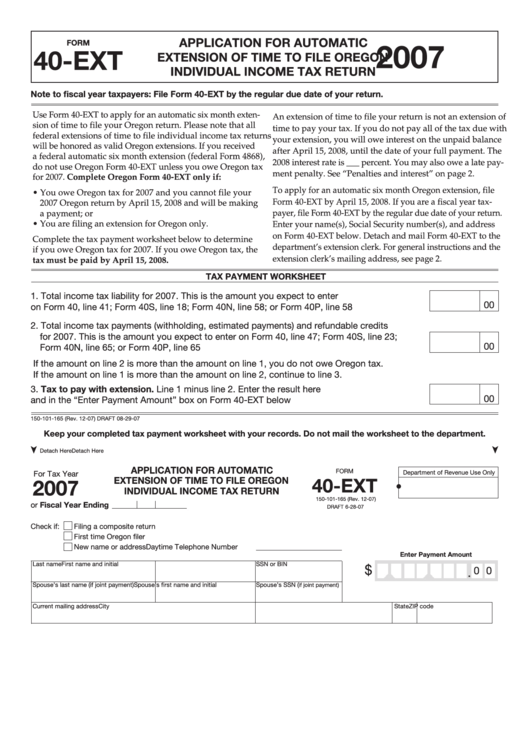

Oregon Tax Extension Form 40 Ext

Oregon Tax Extension Form 40 Ext - Web form 40 is an oregon individual income tax form. Hello, when ensuring a state extension is granted, i am not sure how to interpret the following statement: Get ready for tax season deadlines by completing any required tax forms today. Form 40n or form 40p, line 60. Keep a copy of your oregon extension with your. Web payment on form 40, line 43; Web the state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Don’t attach a copy of the extension to your oregon return. Web application for extension of time to file an oregon corporate activity tax return page 1 of 2 use uppercase letters. Find more information about filing an extension on the estate transfer tax page.

Web form 40 is an oregon individual income tax form. Hello, when ensuring a state extension is granted, i am not sure how to interpret the following statement: Get ready for tax season deadlines by completing any required tax forms today. Web the state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. • print actual size (100%). Web oregon tax extension form: Web application for extension of time to file an oregon corporate activity tax return page 1 of 2 use uppercase letters. Keep a copy of your oregon extension with your. This form is for income earned in tax year 2022, with tax returns due in april. Web you don’t need to request an oregon extension unless you owe oregon tax.

Don’t attach a copy of the extension to your oregon return. This form is for income earned in tax year 2022, with tax returns due in april. Web oregon tax extension form: Web the state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web payment on form 40, line 43; Web form 40 is an oregon individual income tax form. Keep a copy of your oregon extension with your. • print actual size (100%).

Form 40Ext Application For Automatic Extension Of Time To File

Web the state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Keep a copy of your oregon extension with your. This form is for income earned in tax year 2022, with tax returns due in april. Signnow allows users to edit, sign, fill and share all type.

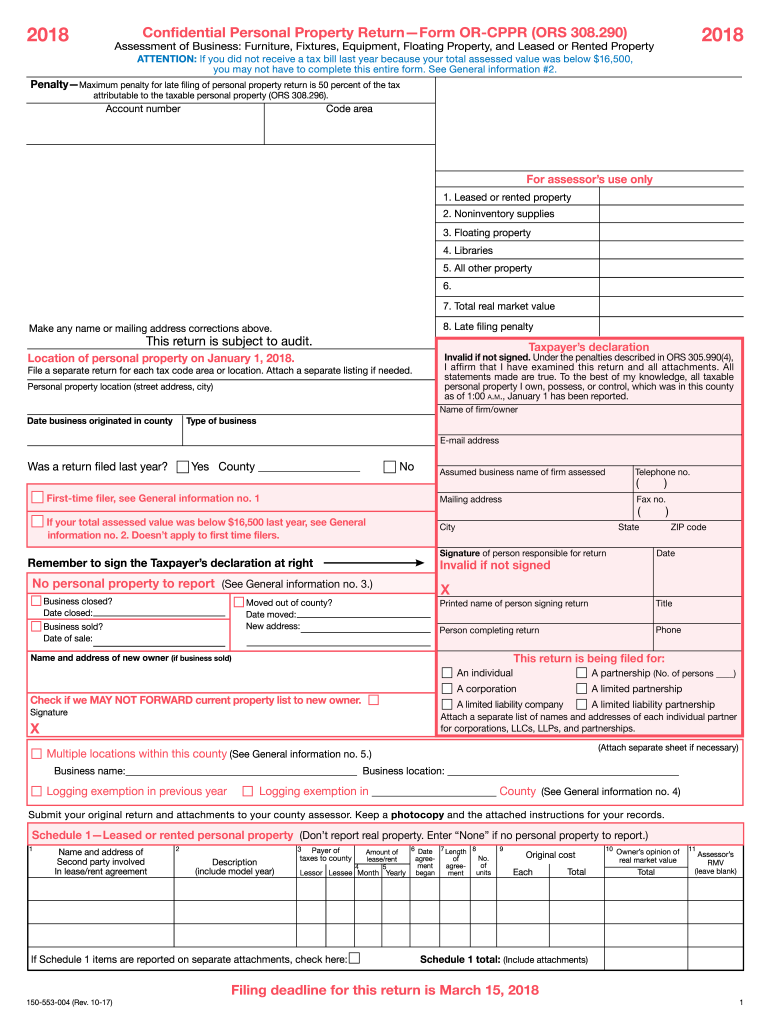

Oregon Form 40 2021 Printable Printable Form 2022

Web oregon tax extension form: Keep a copy of your oregon extension with your. Don’t attach a copy of the extension to your oregon return. Web application for extension of time to file an oregon corporate activity tax return page 1 of 2 use uppercase letters. Web payment on form 40, line 43;

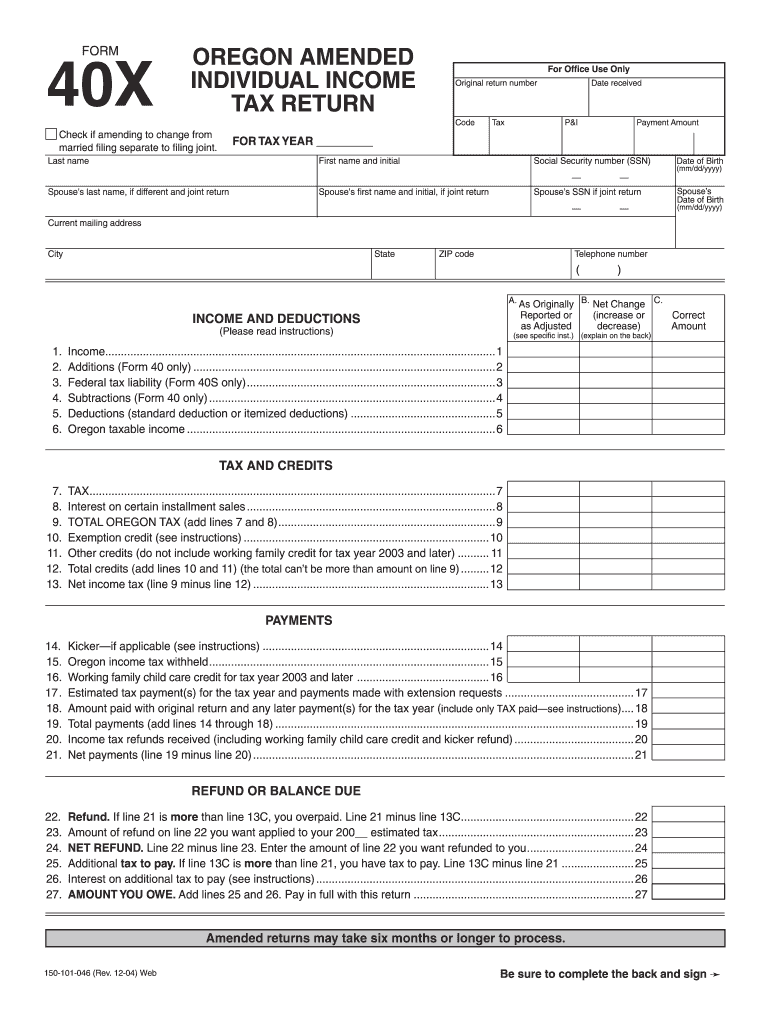

Oregon Form 40X Fill Out and Sign Printable PDF Template signNow

Form 40n or form 40p, line 60. Include your payment with this return. Find more information about filing an extension on the estate transfer tax page. Web oregon tax extension form: Don’t attach a copy of the extension to your oregon return.

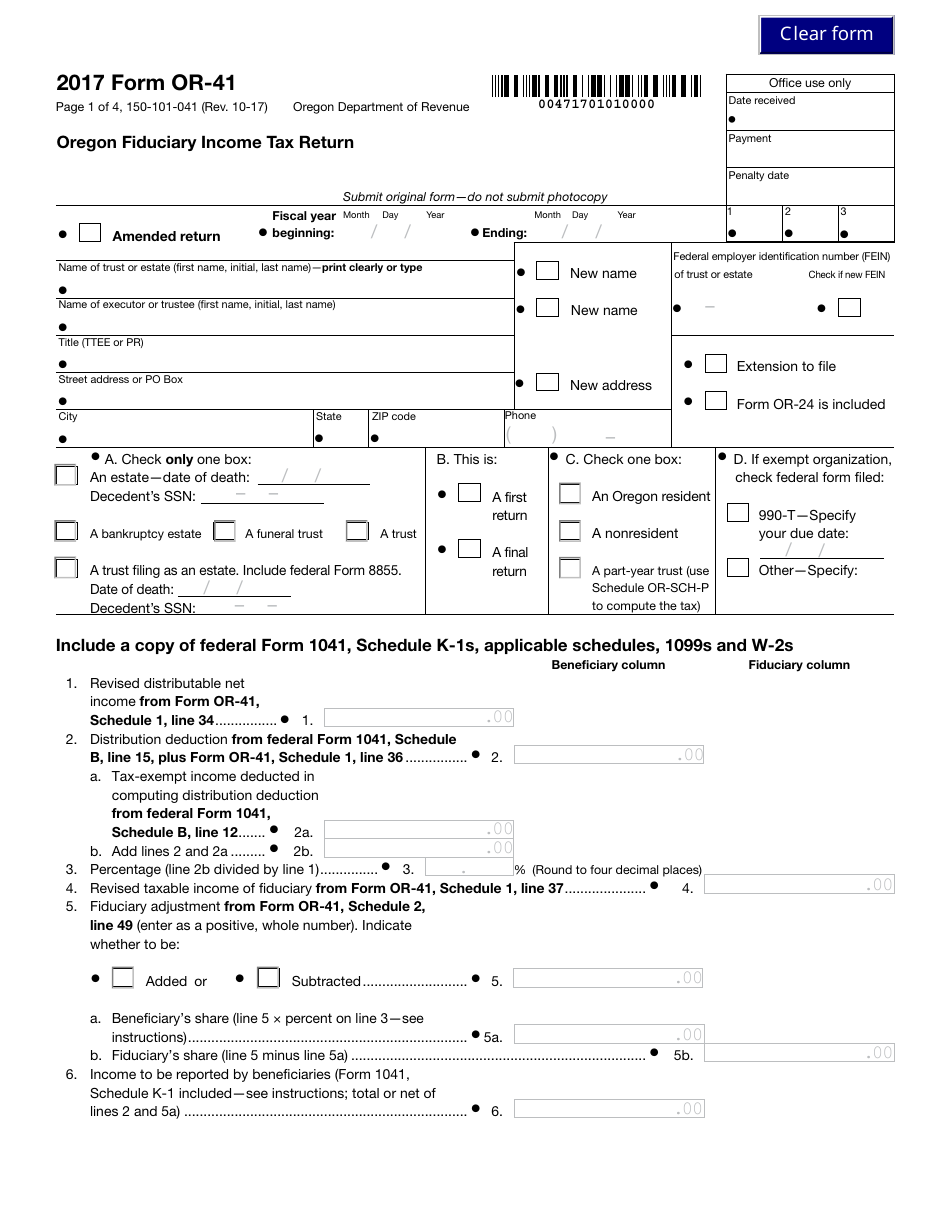

Form OR41 Download Fillable PDF or Fill Online Oregon Fiduciary

• print actual size (100%). Keep a copy of your oregon extension with your. Web payment on form 40, line 43; Hello, when ensuring a state extension is granted, i am not sure how to interpret the following statement: Web application for extension of time to file an oregon corporate activity tax return page 1 of 2 use uppercase letters.

How To File An Oregon Tax Extension

Web payment on form 40, line 43; Web the state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Get ready for tax season deadlines by completing any required tax forms today. Complete the tax payment worksheet below to determine if you owe oregon tax for 2019. Hello,.

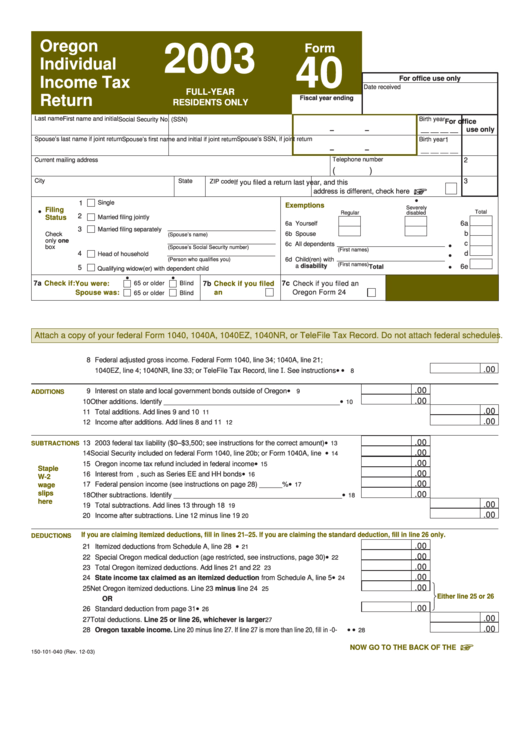

Form 40 Oregon Individual Tax Return (FullYear Residents Only

Signnow allows users to edit, sign, fill and share all type of documents online. • print actual size (100%). Hello, when ensuring a state extension is granted, i am not sure how to interpret the following statement: Complete the tax payment worksheet below to determine if you owe oregon tax for 2019. Form 40n or form 40p, line 60.

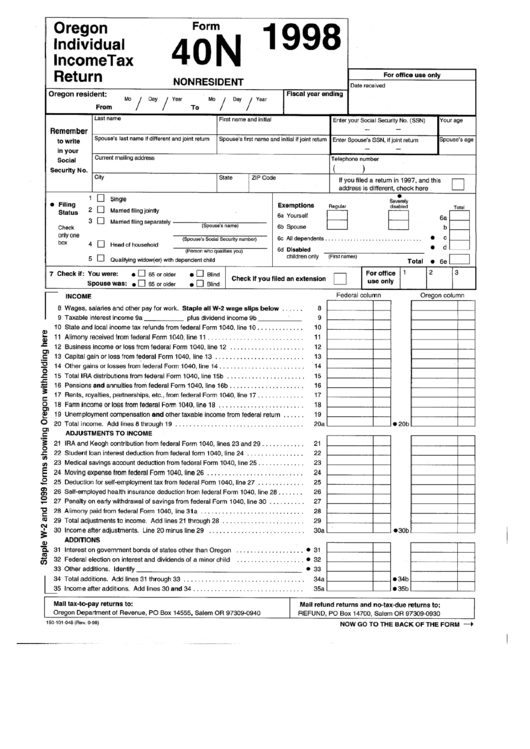

Fillable Form 40n Oregon Individual Tax Return 1998

Get ready for tax season deadlines by completing any required tax forms today. Web you don’t need to request an oregon extension unless you owe oregon tax. Keep a copy of your oregon extension with your. Web payment on form 40, line 43; Web oregon tax extension form:

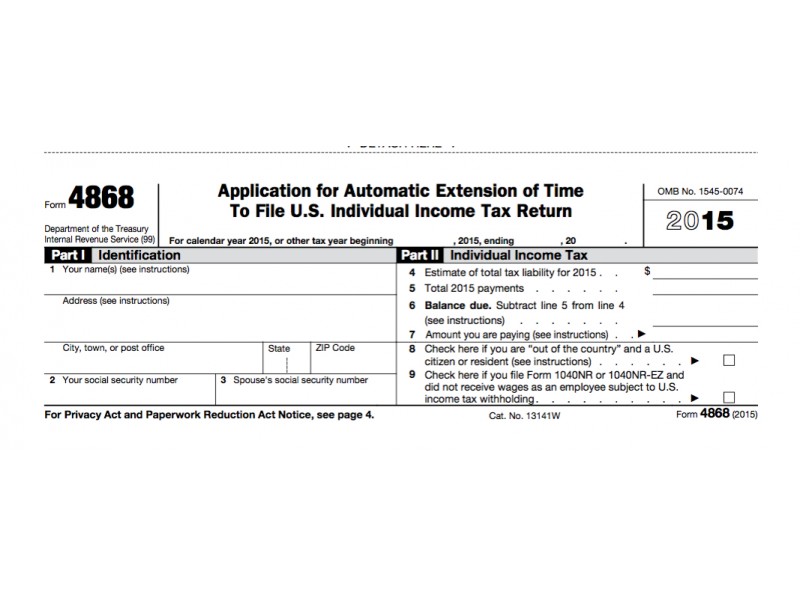

IRS Form 4868 Extension For 2016 Tax Deadline Oregon City, OR Patch

Web you don’t need to request an oregon extension unless you owe oregon tax. Signnow allows users to edit, sign, fill and share all type of documents online. Complete the tax payment worksheet below to determine if you owe oregon tax for 2019. Get ready for tax season deadlines by completing any required tax forms today. Web form 40 is.

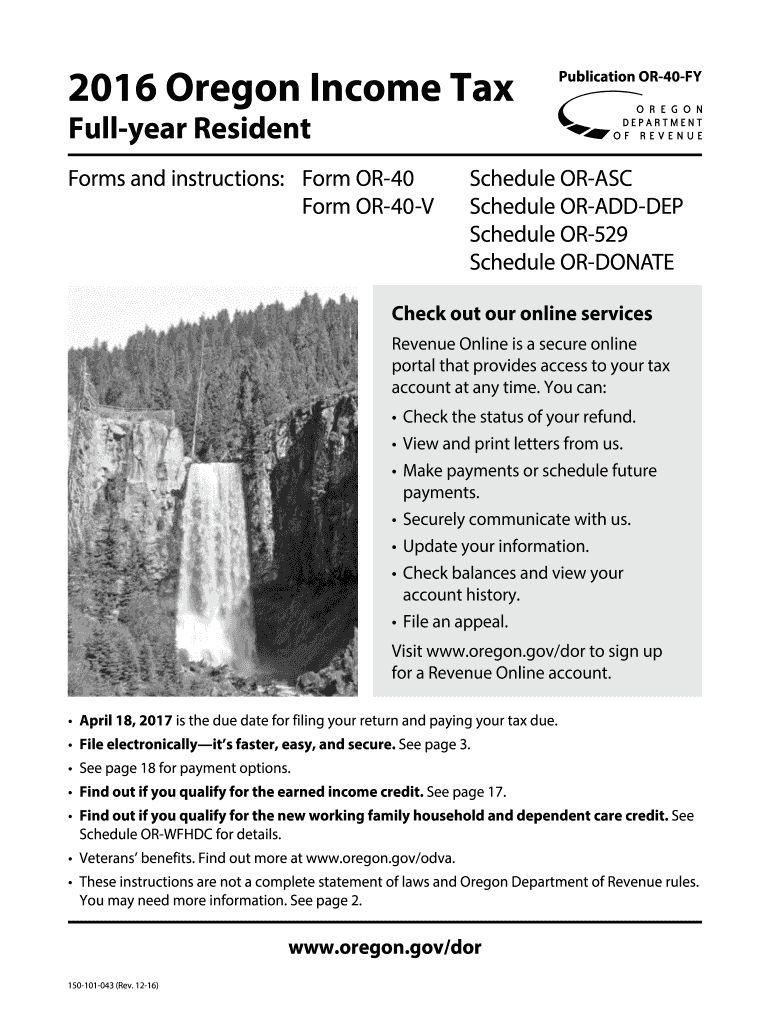

Publication or 40 FY, Oregon Tax Full Oregon Gov Oregon Fill

Get ready for tax season deadlines by completing any required tax forms today. Web application for extension of time to file an oregon corporate activity tax return page 1 of 2 use uppercase letters. Keep a copy of your oregon extension with your. Include your payment with this return. Don’t attach a copy of the extension to your oregon return.

Madonna! 12+ Fatti su Irs Extension? You can file an extension for your

Complete the tax payment worksheet below to determine if you owe oregon tax for 2019. Form 40n or form 40p, line 60. Web the state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Web oregon tax extension form: Web application for extension of time to file an.

Complete The Tax Payment Worksheet Below To Determine If You Owe Oregon Tax For 2019.

Include your payment with this return. Don’t attach a copy of the extension to your oregon return. Find more information about filing an extension on the estate transfer tax page. Web application for extension of time to file an oregon corporate activity tax return page 1 of 2 use uppercase letters.

• Use Blue Or Black Ink.

Get ready for tax season deadlines by completing any required tax forms today. Form 40n or form 40p, line 60. Keep a copy of your oregon extension with your. Signnow allows users to edit, sign, fill and share all type of documents online.

Web Form 40 Is An Oregon Individual Income Tax Form.

Get ready for tax season deadlines by completing any required tax forms today. Web oregon tax extension form: • print actual size (100%). Web the state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form.

Web Payment On Form 40, Line 43;

Web you don’t need to request an oregon extension unless you owe oregon tax. This form is for income earned in tax year 2022, with tax returns due in april. Hello, when ensuring a state extension is granted, i am not sure how to interpret the following statement: