Payment Plan Bankruptcy Chapter 7

Payment Plan Bankruptcy Chapter 7 - Web liquidation under chapter 7 is a common form of bankruptcy. Businesses choosing to terminate their. There is a little bit more to it than that, however. Other options include an irs payment plan or an offer in compromise. For individuals, the most common type of. Everyone seeking debt relief in the form of. It is available to individuals who cannot make regular, monthly, payments toward their debts. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code.

There is a little bit more to it than that, however. Other options include an irs payment plan or an offer in compromise. Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code. Businesses choosing to terminate their. For individuals, the most common type of. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web liquidation under chapter 7 is a common form of bankruptcy. Everyone seeking debt relief in the form of.

Other options include an irs payment plan or an offer in compromise. For individuals, the most common type of. There is a little bit more to it than that, however. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code. It is available to individuals who cannot make regular, monthly, payments toward their debts. Web liquidation under chapter 7 is a common form of bankruptcy. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Businesses choosing to terminate their. Everyone seeking debt relief in the form of.

What You Need to Know About Bankruptcy

Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code. Everyone seeking debt relief in the form of. For individuals, the most common type of. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. Web liquidation under chapter 7 is a common.

Chapter 13 Bankruptcy Payments How To Calculate Yours

Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web liquidation under chapter 7 is a common form of bankruptcy. It is available to individuals who cannot make regular,.

What Is Chapter 7 Bankruptcy? Bankruptcy, Filing bankruptcy, Personal

Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. Businesses choosing to terminate their. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in.

NEW Payment Plan Available for Chapter 7 Bankruptcy YouTube

Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Web liquidation under chapter 7 is a common form of bankruptcy. Businesses choosing to terminate their. Everyone seeking debt relief in the form of. Other options include an irs payment plan or an offer in compromise.

The Bankruptcy Payment Plan

Everyone seeking debt relief in the form of. It is available to individuals who cannot make regular, monthly, payments toward their debts. Businesses choosing to terminate their. For individuals, the most common type of. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option.

Chapter 7 vs Chapter 13 Bankruptcy Sheppard Law Office

For individuals, the most common type of. Businesses choosing to terminate their. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Other options include an irs payment plan or an offer in compromise. There is a little bit more to it than that, however.

Bradley’s Bankruptcy Basics Chapter 13 Bankruptcy — Consumer

Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. For individuals, the most common type.

Filing for bankruptcy Chapter 13 2022 guide by NY lawyer Ortiz&Ortiz

Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Other options include.

Fighting Legal Complexity How Sen. Warren’s Bankruptcy Plan Defends

There is a little bit more to it than that, however. For individuals, the most common type of. It is available to individuals who cannot make regular, monthly, payments toward their debts. Everyone seeking debt relief in the form of. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay.

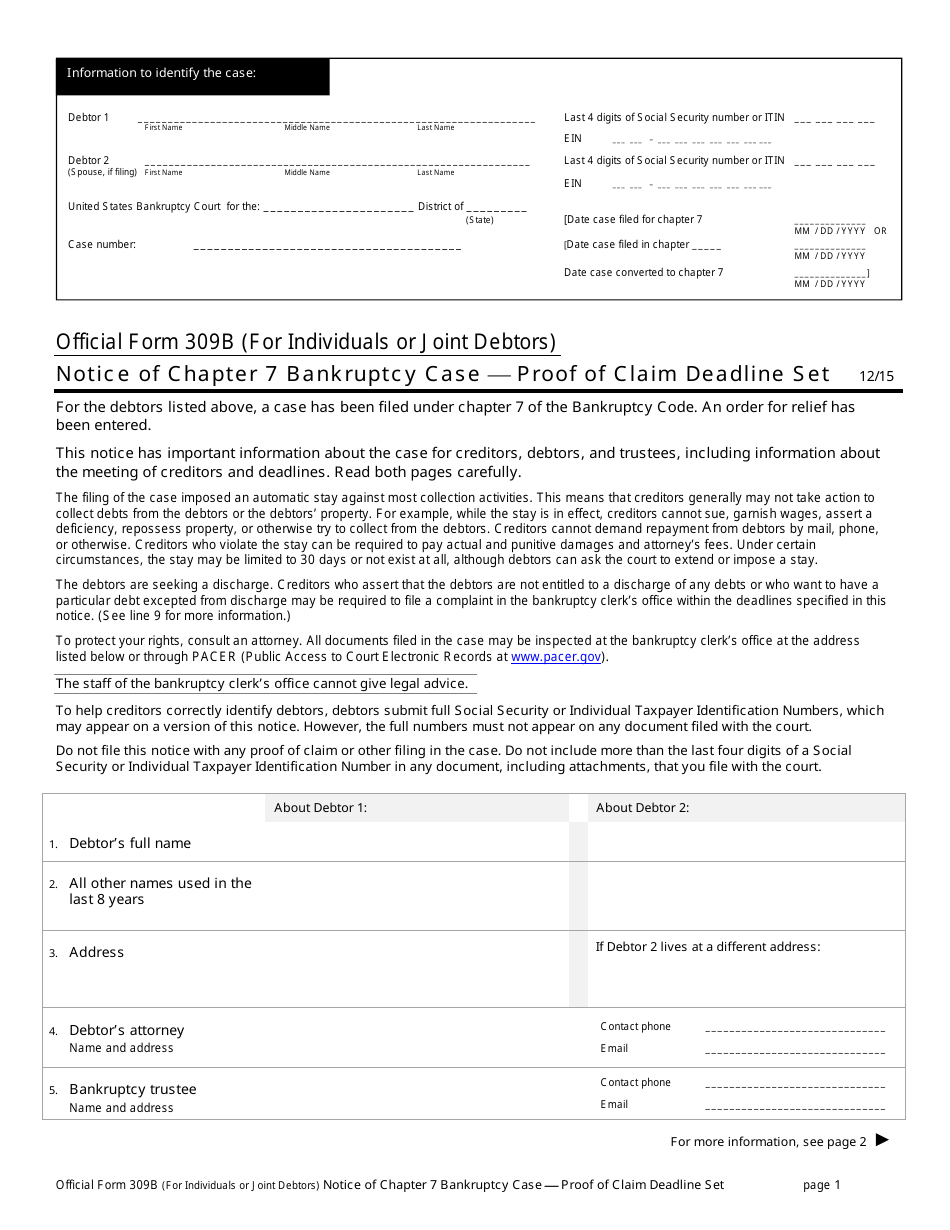

Proof Of Claim Chapter 13 eformsdesigner

Web if you owe past due federal taxes that you cannot pay, bankruptcy may be an option. For individuals, the most common type of. Businesses choosing to terminate their. Web liquidation under chapter 7 is a common form of bankruptcy. Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code.

Web If You Owe Past Due Federal Taxes That You Cannot Pay, Bankruptcy May Be An Option.

Web individuals, spouses, and business entities can qualify for relief under chapter 7 of the bankruptcy code. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay. It is available to individuals who cannot make regular, monthly, payments toward their debts. Web liquidation under chapter 7 is a common form of bankruptcy.

For Individuals, The Most Common Type Of.

There is a little bit more to it than that, however. Everyone seeking debt relief in the form of. Other options include an irs payment plan or an offer in compromise. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13.

:max_bytes(150000):strip_icc()/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)